- Home

- »

- Next Generation Technologies

- »

-

High-frequency Trading Server Market, Industry Report 2030GVR Report cover

![High-frequency Trading Server Market Size, Share & Trends Report]()

High-frequency Trading Server Market (2025 - 2030) Size, Share & Trends Analysis Report By Processor (X-86-based, ARM-based), By Form Factor, By Application (Equity Trading, Forex Markets), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-410-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

HFT Server Market Size & Trends

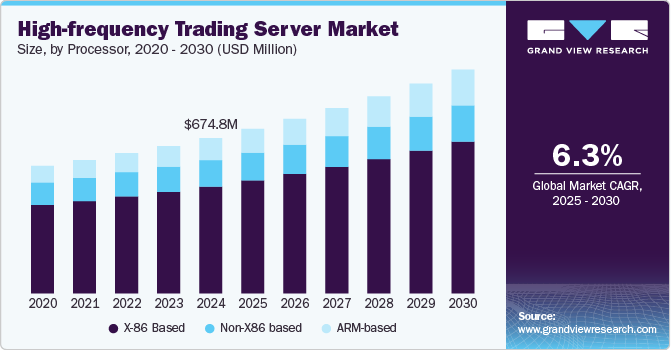

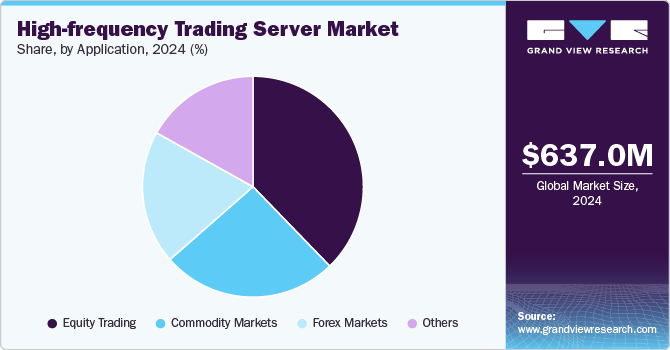

The global high-frequency trading server market size was estimated at USD 637.0 million in 2024 and is projected to grow at a CAGR of 6.3% from 2025 to 2030, owing to the increasing need for high-speed, low-latency systems that enable firms to execute trading strategies in real-time. These specialized servers, designed for ultra-fast transaction processing, are essential for the global financial ecosystem, where milliseconds can determine profitability

The most prominent growth driver in the high-frequency trading (HFT) server industry is the continuous demand for low-latency trading solutions. In the highly competitive landscape of high-frequency trading, speed is a critical factor. Specialized servers, often equipped with custom hardware such as FPGAs (Field Programmable Gate Arrays) and Application-Specific Integrated Circuits (ASICs), provide traders with the ability to execute orders at the highest speeds. The ability to reduce latency by microseconds can significantly improve profitability, prompting financial institutions to invest heavily in low-latency server technologies.

The global financial markets are undergoing significant growth, driven by the expansion of emerging markets and increased participation in trading activities. This growth leads to higher trading volumes, which in turn necessitates advanced trading infrastructures. Financial institutions are investing in high-performance trading servers to manage the increasing demands of global trading operations. Regions such as Asia-Pacific and the Middle East are becoming prominent hubs for financial activity, driving demand for high-frequency trading (HFT) solutions in these regions.

As regulatory frameworks around financial markets become more stringent, there is a growing need for high-performance trading infrastructure that ensures compliance with various financial regulations. For instance, regulations such as MiFID II (Markets in Financial Instruments Directive) in Europe and Dodd-Frank in the U.S. require firms to maintain detailed logs of all trades and monitor market activities in real-time. High-frequency trading (HFT) servers play a crucial role in enabling firms to meet these compliance requirements by offering the necessary data processing, storage, and monitoring capabilities.

Processor Insights

The X-86 segment led the market with the largest revenue share of 68.8% in 2024, due to the increasing adoption of cloud computing and virtualization technologies. As enterprises migrate to cloud-based infrastructures to improve scalability, flexibility, and cost-efficiency, the demand for x86 servers has surged. X86 architecture, known for its compatibility with various virtualization platforms such as VMware and Microsoft Hyper-V, is well-suited for cloud service providers. The ease with which x86 servers can be scaled and integrated into cloud environments makes them an attractive choice for both private and public cloud infrastructures.

The ARM-based segment is expected to grow at the fastest CAGR of 8.5% over the forecast period, owing to the growing emphasis on energy efficiency. ARM processors lower power consumption compared to traditional x86 processors. This makes them highly attractive for data centers and cloud service providers, who are constantly seeking ways to reduce operational costs and minimize their environmental footprint. ARM’s power-efficient design is advantageous in large-scale processors, where energy consumption is a major concern.

Form Factor Insights

Based on form factor, the 2U segment led the market with the largest revenue share of 37.8% in 2024. The continued expansion of data centers and cloud computing services has been a major driver of the segment. Data centers are under constant pressure to increase their computing capacity to handle the growing volumes of data generated by businesses and end-users. The 2U form factor offers a compact and scalable solution for this demand, providing the flexibility to house high-performance components within a smaller footprint. As cloud providers seek to optimize their infrastructure, 2U servers are being increasingly deployed to provide efficient, scalable computing resources.

The 1U segment is expected to grow at a significant CAGR over the forecast period. The increasing adoption of cloud computing and edge computing has accelerated the need for smaller, high-performance servers that can handle a variety of workloads while offering low latency. The 1U form factor is suitable for cloud and edge computing environments, where the demand for high availability and minimal latency is critical. In cloud data centers, 1U servers offer flexibility for cloud service providers to scale their offerings while optimizing the space and energy efficiency of their infrastructure. In edge computing, where computing resources need to be deployed closer to the data source, 1U servers allow businesses to deploy powerful computing resources in remote or distributed locations without sacrificing space or performance.

Application Insights

Based on application, the equity trading segment led the market with the largest revenue share of 37.8% in 2024. The increasing participation of retail investors in equity trading has been a significant growth driver in recent years. The rise of online brokerage platforms, mobile trading apps, and commission-free trading services has democratized access to stock markets, enabling individual investors to trade equities with greater ease. Social media platforms and online communities have also played a role in encouraging retail trading, as they provide a space for sharing tips, strategies, and market insights. This influx of retail investors has increased trading volumes, particularly in popular stocks and ETFs, and has led to a shift in market dynamics, making equity trading more accessible and competitive for a broader audience.

The forex market segment is expected to grow at a significant CAGR over the forecast period. The growth of online trading platforms has significantly increased retail participation in the forex market. The democratization of trading platforms, low-cost access, and availability of educational resources have made it easier for individual traders to enter the market. Retail forex trading is growing exponentially, as traders seek to capitalize on short-term price fluctuations in currency pairs. Moreover, mobile apps and user-friendly interfaces have made it possible for traders to access the market 24/7, creating a more active and liquid forex market. The ease of access for retail investors is an important growth driver of high-frequency trading server industry, as it increases overall market participation and trading volume.

Regional Insights

North America dominated the high-frequency trading server market with the largest revenue share of 39.7% in 2024. Co-location services, where high-frequency trading firms place their servers within the same data centers as the exchange’s infrastructure, continue to be a dominant trend in North America. By colocating their servers in proximity to exchanges, HFT firms can significantly reduce latency, which is crucial for executing trades faster than competitors.

U.S. High-frequency Trading Server Market Trends

The high-frequency trading server market in the U.S. is expected to grow at a significant CAGR of 4.1% from 2025 to 2030. The integration of artificial intelligence (AI) and machine learning (ML) algorithms into high-frequency trading strategies is another emerging trend in the U.S. HFT server industry. Traders and firms are increasingly leveraging AI and ML to develop predictive models and enhance decision-making in real time. These technologies enable HFT systems to process vast quantities of market data, identify patterns, and execute trades autonomously.

Europe High-frequency Trading Server Market Trends

The high-frequency trading server market in Europe is anticipated to grow at a significant CAGR from 2025 to 2030. Regulatory changes are becoming an increasingly important trend influencing the European HFT server industry. Regulatory bodies such as the European Securities and Markets Authority (ESMA) and the Financial Conduct Authority (FCA) are raising oversight of high-frequency trading activities to ensure market fairness, transparency, and stability. New regulations are focusing on areas such as market manipulation, risk management, and algorithmic trading practices. As a result, HFT firms are investing in advanced server solutions capable of tracking, monitoring, and reporting trades in real time to comply with these stringent regulations.

The UK high-frequency trading server market is expected to grow at a rapid CAGR during the forecast period. The high-frequency trading server industry in the UK is being shaped by an increasing focus on regulatory compliance and oversight. Regulators such as the Financial Conduct Authority (FCA) and the Bank of England have introduced tighter regulations to ensure that HFT strategies do not pose a risk to market stability. These regulations address issues like market manipulation, transparency, and the use of algorithms in trading.

The high-frequency trading server market in Germany held a substantial market share in 2024. As the market matures, there is a noticeable trend of consolidation within the German HFT sector. Larger firms are acquiring smaller competitors to strengthen their market position, expand their technological capabilities, and reduce costs. This trend is leading to the development of more integrated trading platforms that combine advanced server technology, algorithmic trading systems, and data analytics into a single offering.

Asia Pacific High-frequency Trading Server Market Trends

The high-frequency trading server market in Asia Pacific is anticipated to grow at a significant CAGR of 8.7% from 2025 to 2030. The Asia Pacific (APAC) region is witnessing rapid growth in its financial markets, particularly in countries such as Japan, China, South Korea, and Singapore. This expansion is driving the demand for high-frequency trading (HFT) servers, as more institutional investors, hedge funds, and proprietary trading firms enter the market. The increased trading volumes and the rise of electronic trading platforms are fueling the need for high-performance server infrastructures capable of processing vast amounts of data and executing trades at ultra-low latencies.

The Japan high-frequency trading server market is expected to grow at a rapid CAGR during the forecast period. Japanese trading firms are increasingly incorporating these technologies into their trading strategies, as AI and ML allow for more sophisticated data analysis, better predictive modeling, and faster decision-making. These technologies can identify trends, optimize algorithms, and improve trading strategies in real time, offering a significant edge in highly competitive markets.

The high-frequency trading server market in China held a substantial market share in 2024. There is a growing trend in China toward the use of cloud computing for non-latency-sensitive tasks, such as data storage, risk management, and analytics. Many HFT firms are adopting hybrid IT architectures, which combine on-premises, high-performance trading servers with cloud infrastructure. The cloud provides scalability, flexibility, and cost-effectiveness, enabling firms to access advanced analytics tools and store large volumes of data without sacrificing trading speed. In China, where cloud adoption is gaining drive across various industries, the integration of cloud computing into HFT strategies is expected to continue, especially for supporting the growing demand for big data analytics and back-office operations.

Key High-frequency Trading Server Company Insights

Key players operating in the high-frequency trading server industry include Super Micro Computer, Inc., Toshiba Corporation, Orthogone Technologies, andHypershark. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

Key High-frequency Trading Server Companies:

The following are the leading companies in the high-frequency trading server market. These companies collectively hold the largest market share and dictate industry trends.

- ASA Computers, Inc.

- Dell Inc.

- Exacta Technologies

- Hewlett Packard Enterprise Development LP

- HyperShark Technologies Corp.

- Hypertec Group Inc.

- Lenovo

- SMART Global Holdings, Inc.

- Super Micro Computer, Inc.

- Tyrone Systems

- XENON Systems Pty Ltd.

Recent Developments

-

In September 2024, Shenzhen Gooxi Digital Intelligence Technology Co., Ltd. introduced a liquid-cooled HFT server optimized for maximum CPU operation at 5.7GHz. This server is designed to enhance trading speeds and stability, utilizing advanced liquid cooling to improve energy efficiency and reduce noise. It also supports FPGA acceleration cards for improved data transmission efficiency, making it suitable for various trading applications, including electronic trading and algorithmic trading.

-

In April 2023, Orthogone Technologies and Napatech announced a strategic partnership to develop a cutting-edge SmartNIC platform for high-frequency trading (HFT) applications. This collaboration caters to financial technology enterprises that require HFT applications capable of processing large volumes of transaction data with high throughput and ultra-low latency. By combining Orthogone's development environment and IP cores with Napatech's programmable SmartNIC, developers can create HFT applications with exceptional ultra-low latency performance. The partnership aims to deliver a state-of-the-art solution to meet the demanding requirements of the HFT industry.

High-frequency Trading Server Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 674.9 million

Revenue forecast in 2030

USD 918.0 million

Growth rate

CAGR of 6.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report services

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Processor, form factor, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; Kingdom of Saudi Arabia; South Africa

Key companies profiled

ASA Computers, Inc.; Exacta Technologies; Hypertec Group Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; HyperShark Technologies Corp.; Lenovo; SMART Global Holdings, Inc.; Super Micro Computer, Inc.; Tyrone Systems; XENON Systems Pty Ltd.

Customization scope

Free report customization (equivalent to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-frequency Trading Server Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high-frequency trading server market report based on processor, form factor, application, and region:

-

Processor Outlook (Revenue, USD Million, 2018 - 2030)

-

X-86 Based

-

ARM-based

-

Non-X86 Based

-

-

Form Factor Outlook (Revenue, USD Million, 2018 - 2030)

-

1U

-

2U

-

4U

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Equity Trading

-

Forex Markets

-

Commodity Markets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high-frequency trading server market size was estimated at USD 637.0 million in 2024 and is expected to reach USD 674.9 million in 2025.

b. The global high-frequency trading server market is expected to grow at a compound annual growth rate of 6.3% from 2025 to 2030 to reach USD 918.0 million by 2030.

b. North America dominated the high-frequency trading server market with a share of 39.0% in 2024. Co-location services, where high-frequency trading firms place their servers within the same data centers as the exchange’s infrastructure, continue to be a dominant trend in North America

b. Some key players operating in the high-frequency trading server market include ASA Computers, Inc., Exacta Technologies, Hypertec Group Inc., Dell Inc., Hewlett Packard Enterprise Development LP, HyperShark Technologies Corp., Lenovo, SMART Global Holdings, Inc., Super Micro Computer, Inc., Tyrone Systems, and XENON Systems Pty Ltd.

b. The need for Ultra-Low Latency (ULL) in the trading ecosystem and the advancements in quantum computing in financial services are expected to drive market growth over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.