- Home

- »

- Semiconductors

- »

-

High-k And CVD ALD Metal Precursors Market Report, 2030GVR Report cover

![High-k And CVD ALD Metal Precursors Market Size, Share & Trends Report]()

High-k And CVD ALD Metal Precursors Market Size, Share & Trends Analysis Report By Technology (Interconnect, Capacitors, Gates), By Region (North America, APAC), And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-445-1

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Report Overview

The global high-k and CVD ALD metal precursors market size was valued at USD 521.9 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030. The industry expansion can be ascribed to the metal-organic composites’ low thermal stability. The demand for first-row metal films (conducting) and dielectric (insulating) precursors to be deposited onto microelectronic devices is expected to increase as a result of extensive R&D operations by key firms that are expected to improve copper metallization techniques, thereby driving the industry growth. The COVID-19 pandemic had a detrimental effect on a number of global businesses in 2020, including the market for high-k and ALD/CVD metal precursors.

As a result, the pandemic response remained the principal challenge for the majority of semiconductor sector participants in 2020. Most of the manufacturing plants across the world were closed or shut down due to the COVID-19-induced lockdowns. The semiconductor industry witnessed a decline during the first half of 2020 due to the lockdowns and associated supply chain disruptions. Although the factories reopened in the second half of the year, the industry took time to normalize to the pre-COVID-19 level and is projected to rebound at a slower pace. This posed a major challenge for most industry players. However, the rising need for rapidly accessing and storing data has prompted the demand for materials with higher dielectric values.

The Atomic Layer Deposition (ALD) of noble metals, such as ruthenium, rhodium, iridium, palladium, and platinum, is anticipated to be an active research area. The high demand for several thin-film materials for new industrial applications can be attributed to the rapid development of ALD technology. All these factors are expected to drive the industry growth over the forecast period. The selection and designing of appropriate metal-organic precursors are crucial for successfully developing new Chemical Vapor Deposition (CVD) processes. Buyers prefer insulators with high dielectric constants as they play several critical roles in modern semiconductor devices, including decreasing power consumption in Metal-Insulator-Semiconductor (MIS) field-effect transistors.

The demand for metal precursors, such as aluminum, hafnium, cobalt, titanium, tantalum, tungsten, and zirconium, with a higher dielectric constant, is expected to increase over the forecast period, thus supporting the growth of the global industry. Such antecedents are employed in the production of thin metallic films. Due to its use in non-semiconductor domains and the semiconductor industry’s rapid expansion, ALD has undergone significant improvements. Modern deposition techniques like atomic layer deposition make it possible to precisely control the deposition of ultra-thin films that are only a few nanometers thick.

Moreover, ALD also provides thickness control at the Angstrom level and impressive deposition conformity in high aspect-ratio structures. Hence, driving the growth of the industry. To produce the needed high-k material for next-generation scalable memory and Metal Oxide Semiconductor Field Effect Transistors (MOSFETs) devices, choosing the appropriate precursor is a significant problem. For these semiconductor devices, conformal thin films with a large aspect ratio and low deposition temperatures are necessary. Complexities brought on by high-temperature deposition methods may include decreased adhesion of irregularly shaped layers, interlayer atomic diffusion, morphological alterations, and crystallinity modifications.

Technology Insights

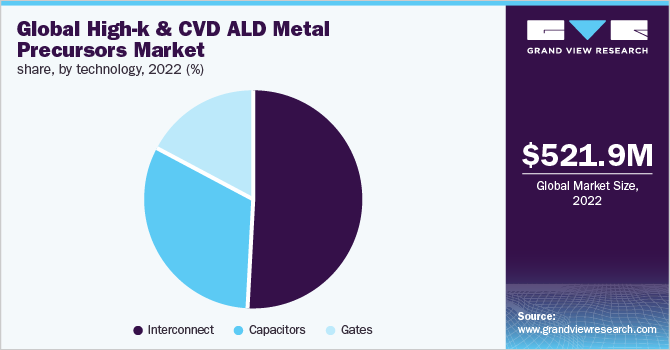

Based on technology, the industry is segmented into interconnects, capacitors, and gates. Metal precursors are utilized to make electrodes and interconnect, while high-k precursors are mostly employed to make gates and capacitors. In 2022, the interconnect segment led the industry and accounted for the biggest share of more than 50.55% of the overall revenue. In the fabrication process, known as interconnect, Copper (Cu) or Aluminum (Al) are used to pattern metals and provide barrier metal layers that shield Silicon (Si) from potential harm in an Integrated Circuit (IC).

A growing number of electronic parts and gadgets, including sophisticated Metal-Insulator-Metal (MIM) capacitors, DRAMs, organic thin-film transistors, OLEDs, and non-volatile memory devices, use high-k dielectric layers. For transistor scaling, high-k metal gate technology is employed. The gate segment is expected to register the highest CAGR from 2023 to 2030. Significant research has been done on the ALD technique to produce thin films using high-k dielectric materials, such as Al2O3, Ta2O5, HfO2, and ZrO2 for DRAMs, high-k gate oxides, and nitrides for electrodes and interconnects.

The combination of high-k dielectric and metal gate technologies offers a substantial reduction in gate leakage when transistor size is downscaled to a thickness of 1.0 nm or below. Semiconductor companies incorporate High-k Metal Gate (HKMG) stacks in MOSFETs used in the CMOS technology to continue device scaling for up to 45 nm and below nodes. The major technology introduced by Intel includes enhanced channel strain, hafnium-based and high-k gate electric, and dual work-function metal replacement gates.

Regional Insights

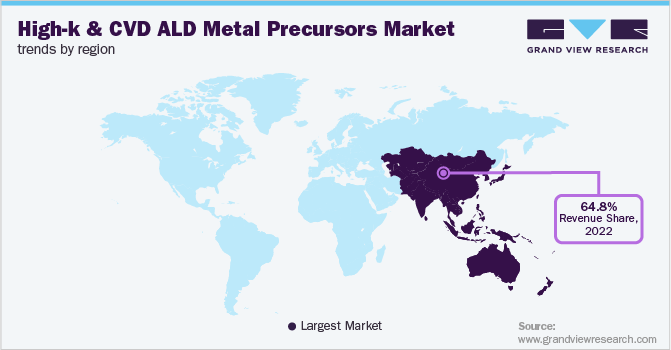

The Asia Pacific region dominated the industry in 2022 and accounted for the largest share of more than 64.80% of the overall revenue. The region is expected to continue to dominate over the forecast period owing to factors, such as above-average demand for electronic products in China and continued outsourcing of electronic equipment production to China. The growing demand for semiconductor devices in Brazil, Russia, India, and China (BRIC) economies, owing to the rising need for end-use electronic products with low cost, high portability, and variety, is also expected to significantly boost the regional market growth.

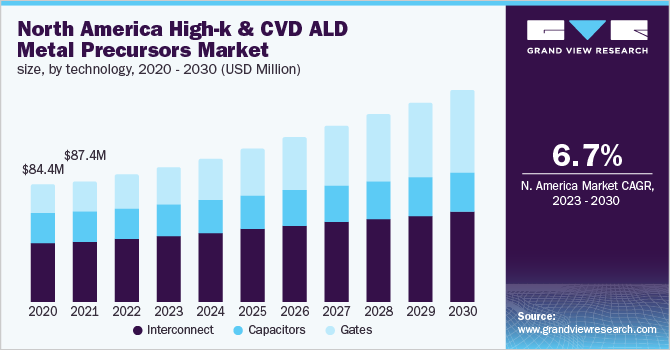

North America is also estimated to register significant growth during the forecast period. The key trend favoring industry growth in the U.S. is the increasing R&D activities in nanotechnologies used in the semiconductor industry. Furthermore, the rising demand for fabricating semiconductor devices, such as 3D-stacked ICs, having multifaceted architecture and producing using cost-effective and seamless manufacturing processes, such as ALD, is expected to drive the growth of the market in the country.

Key Companies & Market Share Insights

The majority of industry participants are increasing their industry share globally through partnerships and acquisitions. Following the acquisition, SAFC Hitech’s operations were merged with those of Merck’s Performance Materials division and were intended to operate as a component of the latter’s Integrated Circuits business unit. The Centre for Process Innovation (CPI) and Beneq, a manufacturer of ALD technology and thin-film coating services, entered into a strategic collaboration agreement to utilize printed electronics applications. Some of the prominent players operating in the global high-k and CVD ALD metal precursors market are:

-

Air Liquide

-

Air Products & Chemicals, Inc.

-

Praxair

-

Linde

-

Dow Chemical

-

Tri Chemical Laboratories Inc.

-

Samsung

-

Strem Chemicals, Inc.

-

Colnatec

-

Merck KGAA

High-k And CVD ALD Metal Precursors MarketReport Scope

Report Attribute

Details

Market size value in 2023

USD 551.6 million

Revenue forecast in 2030

USD 857.8 million

Growth rate

CAGR of 6.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

Air Liquide; Air Products & Chemicals, Inc.; Praxair; Linde; Dow Chemical; Tri Chemical Laboratories Inc.; Samsung; Strem Chemicals, Inc.; Colnatec; Merck KGAA

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-k And CVD ALD Metal Precursors Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global high-k and CVD ALD metal precursors market report based on technology and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Interconnect

-

Capacitors

-

Gates

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Rest of Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Rest of Asia Pacific

-

-

Latin America

-

Brazil

-

Mexico

-

Rest of Latin America

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global high-k and CVD ALD metal precursors market size was estimated at USD 521.9 million in 2022 and is expected to reach USD 551.6 million in 2022.

b. The global high-k and CVD ALD metal precursors market is expected to grow at a compound annual growth rate of 6.5% from 2022 to 2030 to reach USD 857.8 million by 2030.

b. The Asia Pacific dominated the high-k and CVD ALD metal precursors market with a share of 64.80% in 2022. This is attributable to the demand for electronic products in China and the continued outsourcing of electronic equipment production to China.

b. Some key players operating in the high-k & CVD ALD metal precursors market include Air Liquide; Air Products &Chemicals, Inc.; Praxair; Merck KGaA; and Dow Chemical Company amongst others.

b. Key factors that are driving the high-k & CVD ALD metal precursors market growth include the rising need for rapidly accessing and storing data and the demand for metal precursors, such as aluminum, hafnium, cobalt, titanium, tantalum, tungsten, and zirconium, with higher dielectric constants.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."