Report Overview

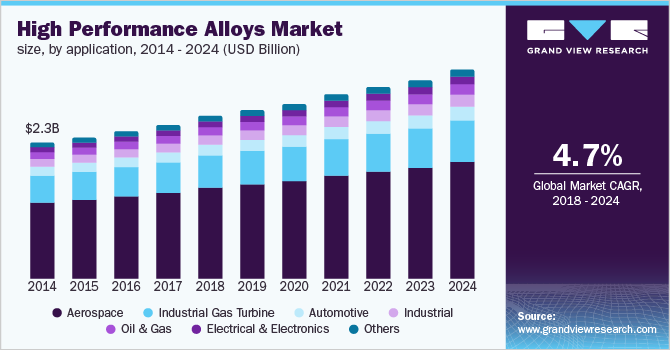

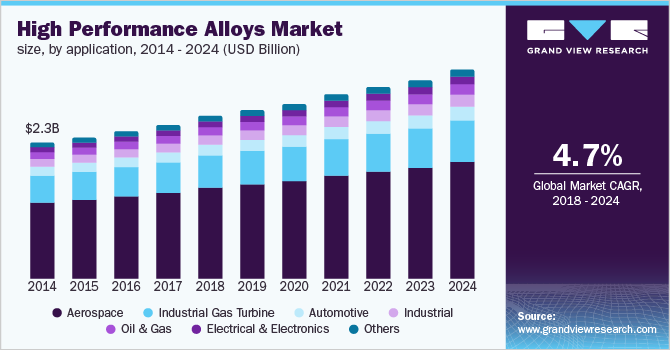

The global high performance alloys market size to be valued at USD 11.34 billion by 2024 and is expected to grow at a compound annual growth rate (CAGR) of 4.7% during the forecast period. The growing demand for light materials in the aerospace industry coupled with high demand for new generation aircraft is expected to drive the market growth over the forecast period. The industry is likely to grow on account of rising demand for the alloys in critical applications including oil & gas extraction, thermal processing, and petroleum. In addition, increasing usage in power generation for the production of industrial gas turbine components is likely to boost the demand.

The industry in the U.S. is characterized by growing developments in magnesium and aluminum mining and increasing extraction of metals used for alloying, which is likely to drive the demand. In addition, technological enhancements in the processing techniques of high-performance alloys are expected to positively impact the market over the forecast period.

High initial capital investment coupled with increased cost for the raw material procurement is anticipated to restraint the demand over the forecast period. In addition, the production of such alloys requires high energy consumption, which further elevates the manufacturing cost, thereby limiting market growth.

The industry is also impacted by the presence of a stringent regulatory framework pertaining to raw material extraction and mining. The use of recycled materials for the production of such alloys is also expected to be one of the major trends driving the industry growth over the forecast period.

High Performance Alloys Market Trends

The technological advancements for high-performance alloy processing techniques and the growing preference for the alloys for thermal processing for gas and oil extraction. Moreover, the increasing usage in power generation for the process of manufacturing gas turbine components is expected to drive significant revenue growth in the coming years.

Several factors, including a rising focus on high materials in the automated, defence, and aerospace industries, increased use of the goods or services in steam turbines, economies of scale, technological advancements, and rise in government spending, especially in the developing countries are expected to drive market growth.

The high initial investment combined with higher raw material costs is expected to limit market revenue growth during the projected period. Furthermore, the alloy manufacturing requires high power consumption that further increases the manufacturing costs thereby limiting the market growth. Besides, the high-performance alloys face particular challenges during the manufacturing process. For instance, they produce heat, and accumulated high temperature interrupts the cutting process of alloys causing serious damage or deformation. The shapes of high-performance alloy parts are difficult to retain together for machining.

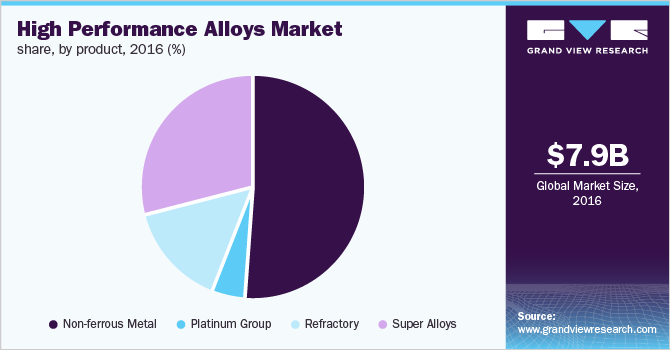

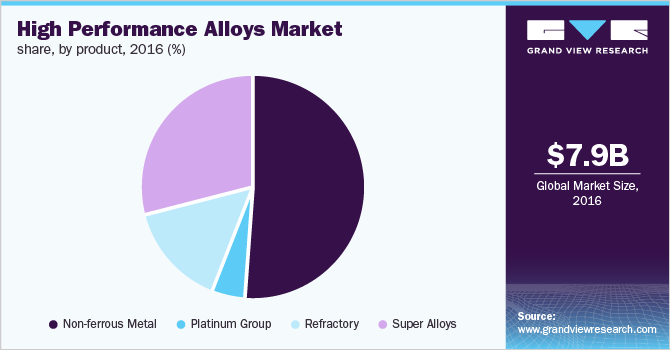

Product Insights

Non-ferrous alloys are expected to emerge the fastest growing product, registering a CAGR of 4.0%, in terms of volume owing to their increased usage in the automotive industry. The use of such products in automobiles results in a reduction in weight and an increase in fuel efficiency. The superior recycling ability of the metals used in the alloys is likely to boost the demand.

Superalloys is estimated to be the second-largest product segment on account of extensive usage in industries including power generation, aerospace & oil & gas, In addition, the product finds extensive use in chemical processing & heat exchanging tubes due to the superior heat resistance exhibited by the products.

Material Insights

Aluminum is expected to witness the fastest growth, registering a CAGR of 5.4%, in terms of revenue owing to increasing usage in automotive and aerospace applications. It is used in combination with other metals to enhance operational efficiency, which is likely to boost the demand over the forecast period.

The market for titanium-based alloys is expected to rise on account of increasing usage in aerospace applications in building the fuel nozzles of jet engines. In addition, superior product characteristics such as toughness, high tensile strength, and lightweight, it is expected to drive the demand.

Application Insights

Industrial gas turbine application is estimated to account for 19.7% of the market share, in terms of volume in 2016. Growth in the demand for such products in gas turbines on account of high-temperature resistance is likely to drive the demand over the forecast period. In addition, the use of the alloys in the turbines increases the performance lifetime which results in high demand.

The use of the product in the manufacture of critical industrial components is expected to drive the market growth over the forecast period. In addition, growing product usage in the oil & gas and defense equipment manufacturing industry is expected to drive the market growth over the forecast period.

Regional Insights

Asia Pacific region is expected to emerge as the fastest-growing region, registering a CAGR of 5.9%, in terms of revenue owing to increased production of automobiles coupled with the rise of the aerospace industry. Growing GDP of the emerging economies coupled with increased indigenous manufacturing in the region is likely to drive the demand over the forecast period.

The market in largely dominated by North America on account of high consumption volume realized by the aerospace industry in the U.S. In addition, the rebuilding of the oil & gas industry in the economy is expected to provide the necessary impetus to the growth over the forecast period.

Key Companies & Market Share Insights

The market is characterized by the presence of international and regional industry players engaged in strategic partnerships for gaining higher market share. The companies have established the manufacturing facilities across the globe in a bid to increase footprint which is expected to remain the trend over the forecast period.

Industry players are engaged in offering unique value propositions to cater to a higher market share. In addition, a growing number of manufacturers are innovating the product by offering high precision and lightweight components for the specific application industry which is anticipated to drive the demand.

Recent Developments

-

In January 2022, one of the UK’s largest flat, round and profile wire producers brought a new alloy to its expanding portfolio. Alloy Wire International with over 5,000 global customers has seen its research and development investments compensate by adding a new 'high-performance alloy.

-

In December 2021, The Korea Institute of Industrial Technology and Desktop Metal announced a partnership to promote rapid additive manufacturing modernization and recognition in South Korea, beginning with the setup of the Production System P-1 and desktop metal shop system

High Performance Alloys Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2024

|

USD 11.34 billion

|

|

Growth rate

|

CAGR of 4.7% from 2018 to 2024

|

|

Base year for estimation

|

2017

|

|

Historical data

|

2014 - 2016

|

|

Forecast period

|

2018 - 2024

|

|

Quantitative units

|

Revenue in USD billion and CAGR from 2018 to 2024

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, material, application, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

|

|

Country scope

|

The U.S.; Canada; Mexico; Germany; The U.K.; Russia; France; China; India; Japan; Brazil; Argentina; South Africa.

|

|

Key companies profiled

|

Alcoa Inc.; Precision Castparts Corp.; Outokumpu; Hitachi Metals Ltd.; Aperam SA; Allegheny Technologies Incorporated; Carpenter Technology; Haynes International Inc.; Timken Company; VSMPO-Avisma Corporation; ThyssenKrupp AG; RTI International Metals.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global High Performance Alloys Market Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2012 to 2024. For the purpose of this study, Grand View Research has segmented the high-performance alloys market on the basis of product, material, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million; 2012 - 2024)

-

Non-ferrous metal

-

Platinum group

-

Refractory

-

Super alloys

-

Material Outlook (Volume, Kilotons; Revenue, USD Million; 2012 - 2024)

-

Aluminum

-

Titanium

-

Magnesium

-

Others

-

Application Outlook (Volume, Kilotons; Revenue, USD Million; 2012 - 2024)

-

Aerospace

-

Industrial Gas Turbine

-

Industrial

-

Automotive

-

Oil & Gas

-

Electrical & Electronics

-

Others

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million; 2012 - 2024)

-

North America

-

Europe

-

Germany

-

The U.K.

-

Russia

-

France

-

Asia Pacific

-

Central & South America

-

Middle East & Africa