High Performance Computing Market Size, Share & Trends Analysis Report By Component (Servers, Storage, Networking Devices), By Deployment (On-premise, Cloud), By End-use, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-492-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

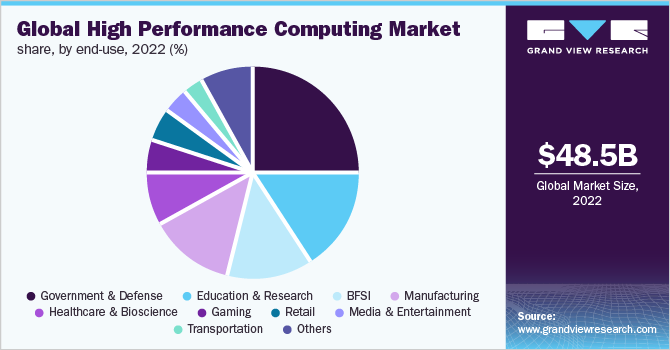

The global high-performance computing market size was valued at USD 48.51 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.5% from 2023 to 2030. The growing demand for high-efficiency computing, advancements in virtualization, continued diversification and expansion of the IT industry, and the increasing preference for hybrid high-performance computing (HPC) solutions are the factors that are expected to drive the growth. The capacity of HPC systems to process huge amounts of data at high speeds is encouraging academic institutions, defense agencies, energy companies, government agencies, and the utility sector to adopt HPC systems, which also helps in the expansion of the high-performance computing industry’s growth.

High-performance computing is growing due to the increased use of this technology in government sectors as well as in applications that require solving scientific, complex, and business problems. These uses and applications make it a high-demand and high-investment area. Additionally, HPC is being supported and identified at a higher rate because of its adoption in government, enterprise, and industrial applications. Furthermore, high-performance computing is required due to the adoption of cloud-based high-performance and complex application management.

Factors such as a lack of expertise and the high cost of high-performance computing maintenance remain hindrances to the growth of the industry. Furthermore, one of the restraining factors in the high-performance computing industry is the lack of advancements in high-performance workstations. As the use of HPC systems grows, so do concerns about cyber security. Because multiple entities access HPC systems, data security remains a major concern. As a result, security concerns are expected to limit the growth of the high-performance computing industry.

The opportunities for growth for high-performance computing in various industries in the U.S. continue to increase. HPC has enabled many industries and enterprises to discover new things and innovate their products and services. High-performance computing in aerospace, steel & welding, automotive, consumer packaged goods & manufacturing, weather forecasting, energy consumption and production, finance, healthcare, sports & entertainment, and space research are among the opportunities. High-performance computing systems are also made up of a group of computers whose combined or total power offers high computational capabilities. That is, high-performance computing systems can potentially simplify complex business procedures. As a result, the demand for High-performance computing systems is expected to rise in the forthcoming years.

The rising popularity of cloud computing coupled with the digitization initiatives being adopted by many governments would play a critical role in catapulting the HPC industry growth over the forecast period. For instance, the government of the United Arab Emirates (UAE) has launched digital transformation projects, such as Smart Abu Dhabi and Smart Dubai. These projects would promote the adoption of cloud computing and stimulate the demand for HPC systems. A new system of working from home was implemented because of COVID-19. This system was aided by the high-performance computing industry by resolving many computation power limitations and enhanced with the use of solutions like data analysis.

Incumbents of the manufacturing industry, defense agencies, government agencies, educational institutes, and research institutions often must perform complicated calculations and solve complex problems. Applications, such as space exploration, and weather forecasting, also involve complex calculations and processing large volumes of data. High processing power and processing efficiency are crucial in such cases and HPC systems can be very useful for these applications.

Component Insights

The component segment has been segmented further into servers, networking devices, storage, software, cloud, services, and others. The servers segment held the largest market share in 2022 and is anticipated to grow at a significant growth rate during the forecast period. The growth can be attributed to the increase in the number of data centers, as various small and mid-size enterprises (SMEs). Furthermore, many businesses are in the process of investing in on-premises and colocation infrastructure to support the growing demand for public cloud services.

The services segment accounted for over 9.0% of the market share in 2022 and is expected to grow at a CAGR exceeding 5.0% from 2023 to 2030. HPC vendors provide various services, including maintenance, support, and management. Support is especially required during the installation of HPC systems and their initial use. On the other hand, maintenance services involve upgrading existing systems and troubleshooting. Owing to this, the market size of the services segment is expected to surpass USD 7,000 million over the forecast period.

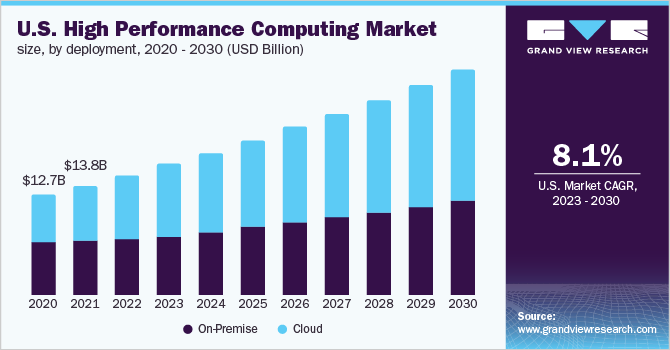

Deployment Insights

The on-premise segment held the largest market share in 2022 and is anticipated to experience significant growth during the forecast period. While governments remain keen on securing sensitive data related to national security and the personal data of the citizens, enterprises are concerned about the protection of their respective organizational data. As a result, an on-premise infrastructure is still preferred over a cloud-based infrastructure.

For instance, in Mexico, the Data Protection Laws, which came into force in 2010, allow for the distribution of data assets across Mexico. However, the government remains protectionist in its outlook on data security. For example, the Mexican government maintains that all citizen-related information and information used by government agencies should remain within the country’s jurisdiction to protect national security. Such factors are expected to drive the growth of the on-premise segment.

The cloud segment is expected to grow at the highest CAGR of over 8.5% during the forecast period. cloud deployment allows organizations to reduce their operational costs owing to the zero requirements of additional in-house computing resources. Other advantages, such as increased efficiency and cost-effectiveness, are expected to fuel the cloud segment's growth.

End-use Insights

The manufacturing segment is anticipated to grow significantly during the forecast period. Manufacturing processes tend to be computation-intensive and time-consuming. Hence, incumbents of the manufacturing industry often adopt simulation and CAD software along with HPC systems. In the manufacturing industry, HPC systems can be particularly useful for computational fluid dynamics, computational structural mechanics, and computational electromagnetics. These attributes enhance performance, improve computational speeds, and ensure rapid access to data.

However, the government & defense segment is predicted to grow at a CAGR exceeding 9.0% during the forecast period. While defense agencies are anticipated to aggressively adopt cutting-edge IT solutions to improve computing efficiency, government agencies are expected to adopt HPC systems to support digitization initiatives and contribute to economic development.

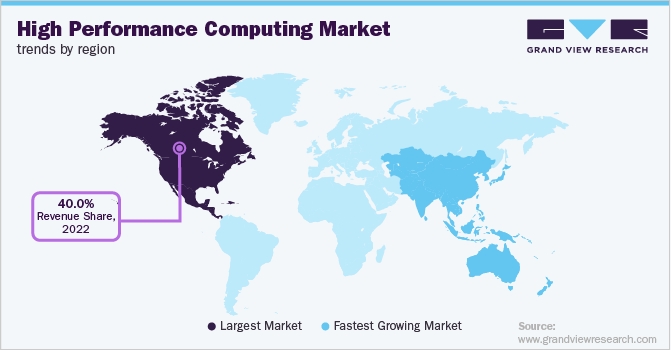

Regional Insights

North America accounted for more than 40.0% of the overall market share in 2022. North America is the largest market for technology-based solutions. Additionally, it is also expected to be a player in the global economy, especially in the development and implementation of new technologies. While the need to process large volumes of raw data is increasing, having robust security measures in place is also gaining importance.

This is driving the need to implement the latest technologies and in turn encouraging the adoption of HPC systems. Moreover, the North American region is home to some of the largest global enterprises, such as Boeing and General Motors, which along with other SMEs, are aggressively adopting HPC systems to help them ease the technical restraints they face. The adoption of HPC systems is growing in North America as a result.

The Asia Pacific region is projected to grow at the highest CAGR of over 8.9% during the forecast period owing to the growing adoption of HPC systems for scientific research and weather forecasting, among others. At the same time, China happens to be among the top 10 countries leading in the high-performance computing industry.

China is also home to supercomputers, such as Tianhe-2 (Milkyway-2) and Sunway TaihuLight. Tianhe-2 (Milkyway-2) was developed by the National University of Defense Technology of China and was funded by the government of Guangzhou city and the government of Guangdong province.

Key Companies & Market Share Insights

The global HPC industry can be described as a highly consolidated and competitive market dominated by some major players. While various governments encouraging research and academic institutions to introduce advanced IT systems and contribute toward economic development, vendors of HPC systems are leveraging the situation by offering their HPC systems to the research and academic institutions and trying to cement their position in the market. For instance, in August 2018, The Garvan institute of medicine partnered with Dell Technologies, Inc. to use high-performance computing in genomics research.

Cloud computing is one of the potential factors responsible for the growth and rising adoption of HPC systems. Owing to this, various key players such as Cray Research Inc., Cisco Systems, Inc., Dell Technologies, Inc., HP, Inc., and Intel Corporation, among others focus on acquisition, mergers, collaboration, or partnership with major pioneers in the cloud computing market to introduce cloud computing or to provide cloud computing solutions to gain a competitive edge and enhance its product portfolio.

For instance, in January 2022, NVIDIA Corporation, a US-based software company that delivers graphics processing units (GPUs), system on a chip (SoC), and application programming interfaces (APIs) acquired Bright Computing, a U.S.-based firm that delivers HPC and ML automation and management software for an undisclosed sum. Through this acquisition, NVIDIA Corporation will expand its accelerated computing by providing its Bright Cluster Manager solution and opening new market opportunities for Bright Computing. Some prominent players in the global high-performance computing market include:

-

Atos SE

-

Advanced Micro Devices, Inc

-

Hewlett Packard Enterprise Development LP

-

Dell Inc.

-

Cisco Systems, Inc.

-

Fujitsu

-

Intel Corporation

-

IBM

-

Microsoft

-

Amazon Web Services, Inc.

High-Performance Computing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 52.64 billion |

|

Revenue forecast in 2030 |

USD 87.31 billion |

|

Growth Rate |

CAGR of 7.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Component, deployment, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Singapore; Australia; South Korea; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Atos SE; Advanced Micro Devices, Inc; Hewlett Packard Enterprise Development LP; Dell Inc.; Cisco Systems, Inc.; Fujitsu; Intel Corporation; IBM; Microsoft; Amazon Web Services, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High-Performance Computing Market Segmentation

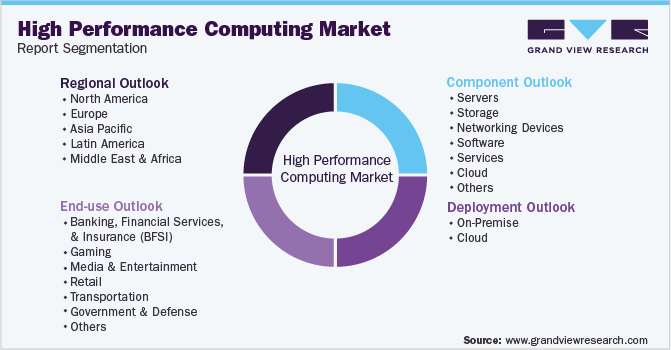

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2023 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global high-performance computing market report based on component, deployment, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Servers

-

Storage

-

Networking Devices

-

Software

-

Services

-

Cloud

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Banking, Financial Services, and Insurance (BFSI)

-

Gaming

-

Media & Entertainment

-

Retail

-

Transportation

-

Government & Defense

-

Education & Research

-

Manufacturing

-

Healthcare & Bioscience

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Singapore

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high performance computing market size was estimated at USD 48,518.9 million in 2022 and is expected to reach USD 52,647.8 million in 2023.

b. The global high performance computing market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 87,312.6 million by 2030.

b. North American held the largest share of 40.0% in 2022. This is attributable to the region being the largest high performance computing market for technology-based solutions. Additionally, it is also anticipated to be a strong player in the global economy, especially, in the implementation and development of new technologies.

b. Some key players operating in the high performance computing market include Atos SE, Advanced Micro Devices, Inc. (AMD), Cray Research, Inc., Cisco Systems, Inc., Dell Technologies, Inc., Fujitsu Limited, Hewlett Packard, Inc. (HP), Intel Corporation, International Business Machines Corporation (IBM), and Silicon Graphics International Corp.

b. Key factors that are driving the high performance computing market growth include the rising need for high-efficiency computing, continued diversification and expansion of the IT industry, advances in the virtualization concept, and rising preference for hybrid HPC solutions worldwide.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."