- Home

- »

- Advanced Interior Materials

- »

-

High Purity Alumina Market Size, Industry Report, 2030GVR Report cover

![High Purity Alumina Market Size, Share & Trends Report]()

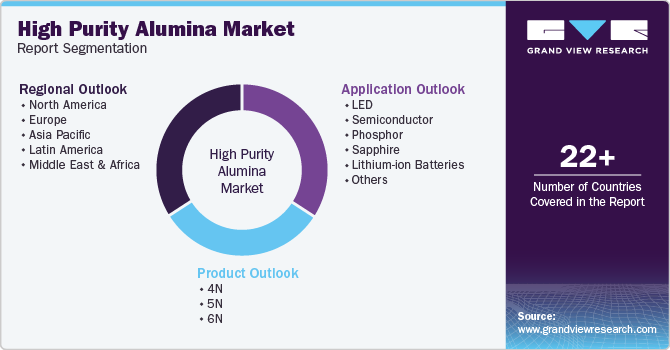

High Purity Alumina Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (4N, 5N, 6N), By Application (LED, Li-ion Battery, Semiconductor, Phosphor), By Region (Asia Pacific, North America), And Segment Forecasts

- Report ID: GVR-1-68038-009-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Purity Alumina Market Summary

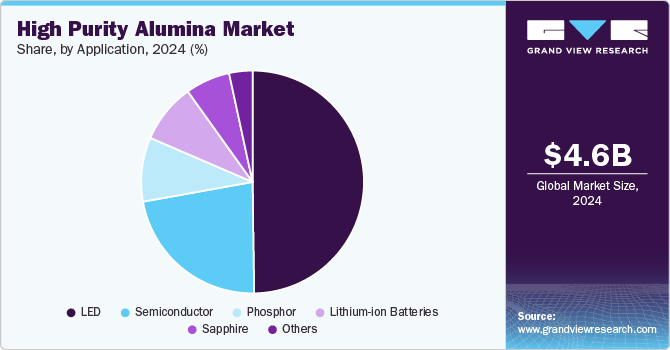

The global high purity alumina market size was estimated at USD 4.63 billion in 2024 and is projected to reach USD 15.81 billion by 2030, growing at a CAGR of 23.0% from 2025 to 2030. The increasing use of high-purity alumina (HPA) in batteries of electric vehicles (EVs) and components in electronics manufacturing is anticipated to drive industry growth during the forecast period.

Key Market Trends & Insights

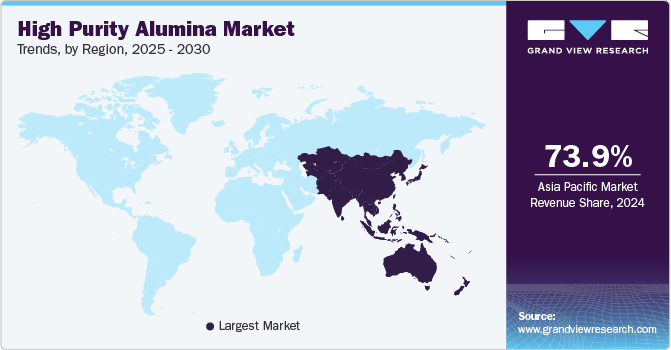

- In terms of region, Asia Pacific dominated the global market with a revenue share of 73.9% in 2024.

- Country-wise, China is expected to register a significant CAGR from 2025 to 2030.

- In terms of segment, 4n accounted for a revenue share of 41.1% in 2024.

- 5N is the most lucrative product segment registering the fastest CAGR of 23.6% during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.63 Billion

- 2030 Projected Market Size: USD 15.81 Billion

- CAGR (2025-2030): 23.0%

- Asia Pacific: Largest market in 2024

The lithium-ion battery consists of a thin coating on the separator sheet and a nano thickness for alumina-coated separators to improve battery performance. This HPA enhances the durability of the battery by increasing its ability to withstand a high rate of discharge.

High Purity Alumina (HPA) is a refined form of aluminum oxide with a purity of 99.9% or greater. Its purity, classified by the number of "nines" (4N, 5N, 6N), significantly impacts its properties and applications. According to the U.S. Energy Department, the country is expected to implement most of its lighting installation projects by 2035 and is likely to have LED lighting technology in the residential sector using ENERGY STAR products. ENERGY STAR-qualified products consume around 75% less energy when compared to LCD. As a result of its consumption in LED manufacturing for residential and commercial lighting, the HPA market is anticipated to grow over the forecast period.

The global HPA market is experiencing substantial growth, driven by the increasing demand for electric vehicle batteries and LED manufacturing. In addition, HPA is a crucial component in lithium-ion batteries due to its conductivity and stability. The market is also seeing trends such as strategic partnerships and the development of new technologies to reduce costs.

Furthermore, the growing demand for LED lighting, electronics, and EV batteries is one of the key drivers for the industry, where the product is widely used for its properties, such as thermal stability, brightness, and superior hardness. HPA witnesses significant demand in plasma displays, as it is an energy-efficient and cost-effective substitute for conventional materials, including incandescent light bulbs. It is also an essential base material for synthetic sapphire substrates used in numerous microelectronics, especially semiconductors.

Product Insights

The 4N product segment dominated the global high purity alumina industry and accounted for the largest revenue share of 41.1% in 2024. This growth can be attributed to the application of the product in LEDs. It is also used as a battery separator for lithium-ion batteries. Growth in the lighting and EV industries is anticipated to drive the market during the forecast period. Furthermore, it provides sufficient purity for improving LED brightness and durability and is favored in large-scale industrial applications where a balance of performance and cost is essential. The booming lighting and EV industries significantly contribute to its market share.

The 5N product segment is expected to grow at a CAGR of 23.6% over the forecast period, owing to the properties, such as chemical stability, scratch resistance, and extreme hardness, make it suitable for sapphire production, which is used in the production of high-quality lenses. Furthermore, it is also used in applications for high-quality industrial ceramics, such as crucibles for high-purity metals and wear-resistant parts. The rising need for efficient and durable components in industries such as chemical processing and mining is driving the demand for high-quality industrial ceramics.

Application Insights

The LED segment led the market and accounted for the largest revenue share of 49.8% in 2024, primarily driven by the increasing demand for energy-efficient lighting solutions. In addition, governments worldwide are promoting the adoption of LEDs to reduce carbon emissions, leading to a significant shift from traditional incandescent bulbs. In addition, high purity alumina is essential in producing sapphire substrates for LEDs, enhancing their brightness and durability. Furthermore, the expanding applications of LEDs in smart city infrastructure and automotive lighting further drive the demand for high purity alumina, ensuring continued market growth.

The semiconductor segment is expected to grow at a CAGR of 24.2% over the forecast period, owing to the rising demand for advanced electronics and electric vehicles (EVs). In addition, as global investments in technology and EV production increase, the need for reliable materials such as high purity alumina becomes paramount. Furthermore, ongoing innovations in semiconductor technology and battery applications are expected to bolster market expansion, making high purity alumina indispensable for future advancements.

Regional Insights

The North American high purity alumina market demonstrates strong growth potential due to advanced technological adoption and robust research and development activities. The region's market is primarily driven by the U.S., Canada, and Mexico, with significant developments in electric vehicle production, semiconductor manufacturing, and LED lighting applications. Furthermore, increased investments in high purity alumina production capabilities aim to develop domestic mineral supply chains and reduce dependence on imports, further contributing to market growth.

U.S. High Purity Alumina Market Trends

The high purity alumina market in U.S. dominates the North American market with the highest revenue share in 2024, owing to its world-leading electronics sector and significant semiconductor manufacturing capabilities. In addition, The rising consumer demand further drives market growth, particularly within the semiconductor industry. Furthermore, substantial investments in new manufacturing facilities and research capabilities highlight the U.S.'s commitment to maintaining its leadership role in high purity alumina production.

Europe High Purity Alumina Market Trends

The Europe high purity alumina market is expected to be driven by increasing demand for energy-efficient lighting solutions and advancements in semiconductor technology. The region's focus on sustainability and reducing carbon emissions supports the adoption of LEDs and electric vehicles. Furthermore, strong regulatory frameworks encourage investment in innovative technologies that utilize high purity alumina. Moreover, as Europe transitions towards greener technologies, the demand for high purity alumina is expected to grow significantly.

Asia Pacific High Purity Alumina Market Trends

The APAC high purity alumina market dominated the global market and accounted for the largest revenue share of 73.9% in 2024. This growth can be attributed to the robust manufacturing capabilities in countries such as China, Japan, South Korea, and India. In addition, this region dominates the global LED market and is witnessing increasing production of electric vehicles, particularly in China. Furthermore, the presence of major battery production facilities further strengthens the region's market position.

The high-purity alumina market in China dominated the Asia-Pacific market and accounted for a significant revenue share in 2024, driven by the country's extensive semiconductor manufacturing base and robust LED lighting industry. In addition, China has emerged as a global leader in lighting products, supported by government initiatives and increasing domestic demand. Furthermore, the expanding electric vehicle sector spurs demand for high-purity alumina in battery applications, reinforcing China's pivotal role in the global market.

Latin America High Purity Alumina Market Trends

Latin America high purity alumina market is expected to grow at a CAGR of 19.6% over the forecast period, due to increasing investments in infrastructure expansion and renewable energy projects. Furthermore, countries such as Brazil are focusing on expanding their industrial capabilities, which includes adopting advanced materials such as high purity alumina for various applications. Furthermore, rising awareness about energy efficiency and sustainability is driving demand for LEDs and electric vehicles, which will likely boost the high purity alumina market across the region.

Key High Purity Alumina Company Insights

Major global high purity alumina companies include Almatis, Inc., Altech Chemicals Ltd., Orbite Technologies Inc., and others. The industry is highly competitive and is anticipated to expand due to the growing penetration of HPA use in various end-use industries. Key players are expected to continue to cater to market demand in the coming years.

-

Altech Chemicals uses a specific process to produce HPA from its kaolin clay deposit. Altech is also exploring using HPA to manufacture epoxy molding compounds (EMCs) used in the semiconductor industry to improve heat dissipation.

-

Nippon Light Metal Holdings Co., Ltd. produces high purity alumina for various applications. Their high purity alumina lineup is made by improving the refining process of alumina for applications including mobile phone cover glass and LED boards. The company also produces aluminum hydroxide, alumina, and several chemicals used in flame retardants, ceramics, chemical products, and water purification.

Key High Purity Alumina Companies:

The following are the leading companies in the high purity alumina market. These companies collectively hold the largest market share and dictate industry trends.

- Almatis, Inc.

- Altech Chemicals Ltd.

- Alpha HPA

- Baikowski

- CoorsTek Inc.

- FYI RESOURCES

- HONGHE CHEMICAL

- Nippon Light Metal Holdings Co., Ltd.

- Orbite Technologies Inc.

- Polar Sapphire Ltd.

- Sumitomo Chemical Co., Ltd.

Recent Developments

-

In May 2024, Alpha HPA announced its final investment decision to begin full-scale High Purity Alumina (HPA) production in Gladstone, Queensland. This project aimed to establish the world's largest single-site HPA refinery. Construction of the 10-hectare facility was expected to begin in mid-2024, creating 120 local jobs in addition to 300 during construction. The project is supported by substantial funding from government agencies and investors.

-

In August 2023, Sumitomo Chemical announced plans to begin mass production of its innovative ultra-fine α-alumina products (NXA series) in September, manufactured at its Ehime Works. These new grades, featuring homogeneous ultra-fine particles of 150 nm or less, targeted emerging markets in ICT, energy-saving, and life science sectors. As a prominent player in High Purity Alumina, Sumitomo aimed to increase sales revenue in its ultrahigh purity alumina business by 30% by FY2025.

High Purity Alumina Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.62 billion

Revenue forecast in 2030

USD 15.81 billion

Growth rate

CAGR of 23.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, Italy, France, UK, China, India, Japan, South Korea, Brazil, Qatar

Key companies profiled

Almatis, Inc.; Altech Chemicals Ltd.; Alpha HPA; Baikowski; CoorsTek Inc.; FYI RESOURCES; HONGHE CHEMICAL; Nippon Light Metal Holdings Co., Ltd.; Orbite Technologies Inc.; Polar Sapphire Ltd.; Sumitomo Chemical Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Purity Alumina Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global high purity alumina market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

4N

-

5N

-

6N

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

LED

-

Semiconductor

-

Phosphor

-

Sapphire

-

Lithium-ion Batteries

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.