- Home

- »

- Medical Devices

- »

-

HIV Clinical Trials Market Size, Share, Industry Report, 2030GVR Report cover

![HIV Clinical Trials Market Size, Share & Trends Report]()

HIV Clinical Trials Market Size, Share & Trends Analysis Report By Phase (Phase I, Phase II, Phase III, Phase IV), By Study Design (Interventional Studies, Observational Studies, Expanded Access Studies), By Sponsor, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-955-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

HIV Clinical Trials Market Size & Trends

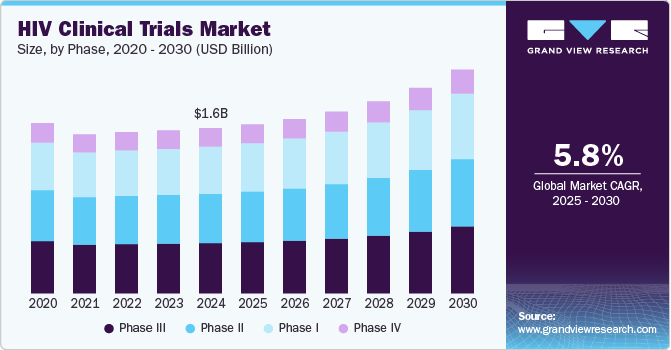

The global HIV clinical trials market size was estimated at USD 1.56 billion in 2024 and is projected to grow at a CAGR of 5.8% from 2025 to 2030. The market presents significant growth opportunities, driven by increasing drug approvals for HIV, rising R&D investment in HIV clinical trials by pharmaceutical & biotechnology companies, and growing incidence of HIV in the population. In addition, clinical trials support innovative new therapies, precision medicines, and vaccines, further improving patient outcomes and reducing the incidence rate globally.

Furthermore, the HIV clinical trial market landscape is continuously evolving as companies focus on improving treatment adherence, growing innovation of long-acting therapies, advancing toward a cure, and addressing the diverse needs of patients across the globe, which is expected to drive the market. Additionally, a growing emphasis on making treatments more accessible is expected to drive the HIV clinical trials industry. These innovations are creating ample opportunity for market growth.

Moreover, numerous drug improvements have occurred in recent years as a result of the increased expenditure on HIV drug innovations. For instance, in June 2023, Addimmune mentioned its launch in Montgomery County with plans to cure HIV. The company will focus strictly on developing gene & cell therapy technologies to eliminate HIV. It will build on the company's decades of research and success, including its successful Phase 1 clinical trial. Such factors are anticipated to drive the HIV clinical trials industry.

Phase Insights

In 2024, the phase III segment dominated the HIV clinical trials industry, accounting for a revenue share of 30.0%. Phase I studies help to assess the drug's safety & toxicity at different levels of dose & determine drug pharmacokinetics. It also benefits the drug being tested in several hundred to several thousand participants. Furthermore, it helps to assess the effect of HIV drugs on humans by the way it is metabolized, absorbed, & excreted. It also supports evaluating the drug's side effects in case of the increased dosage level.

The phase I segment is anticipated to register a CAGR of 5.8% during the forecast period. This is due to the increasing research and development investments for HIV clinical trials by industry & non-industry sponsors. The growing number of sponsored and non-industry-sponsored clinical trials in Phase I, growing requirement for HIV Phase I clinical trials, and the globalization of clinical trials are expected to drive the HIV clinical trials industry. For instance, in July 2024, ACTG announced the pausing antiretroviral treatment under a structured evaluation study (PAUSE study), the HIV cure clinical trial on the African continent. The study is to evaluate two long-acting neutralizing antibodies. Such factors are anticipated to drive the segment.

Study Design Insights

In 2024, the interventional studies segment dominated the HIV clinical trials industry, accounting for a revenue share of 69.8%. This growth can be attributed to cost-effectiveness and rising preventive measures for treating HIV infection. It is also used to determine a trial's strengths and weaknesses, estimate the treatment's impact on individuals, and further minimize the limitations at the initial stage. In addition, of the total HIV studies listed on clinicaltrials.gov, over 7,684 are interventional. For instance, an ongoing interventional study titled "Analytical Treatment Interruption (ATI) to assess the immune system's ability to control HIV in participants who became HIV-infected during the HVTN 704/HPTN 085 AMP Study" was completed by July 2024.

The expanded access studies segment is anticipated to register the fastest CAGR during the forecast period. Growth can be attributed to a large number of expanded access studies on HIV conditions across the globe and increasing innovation for HIV treatment. Expanded access is a good approach for patients with severe, life-threatening HIV conditions as it allows the use of investigational drugs outside of clinical trials. In addition, expanded access offers an option for patients who won't meet the criteria for clinical trials or who don't have access to them.

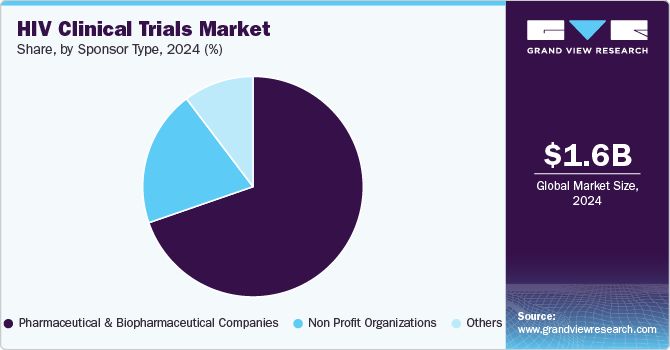

Sponsor Insights

The pharmaceutical and biopharmaceutical companies segment accounted for the largest market share in 2024. This growth can be attributed to factors such as increasing R&D investments, an increase in the demand for better treatment, and the introduction of new drugs for HIV prevention, which have led to a rise in demand for the segment growth. In addition, the integration of novel therapies like long-acting ART, vaccines, and precision medicine is anticipated to drive the segment. For instance, the U.S. based biotechnology company HOOKIPA Pharma mentioned that it has dosed the first patient in a Phase Ib clinical trial of HB-500, a vaccine candidate for HIV.

The non-profit organizations’ segment is anticipated to register a CAGR of 5.6% during the forecast period. The segment is driven by the increasing staff, reinvesting the revenue generated for new drug discoveries for HIV treatment, & improving service offering. In addition, non-profit organizations are searching for new ways to conduct trials for treating HIV infection. Such factors are anticipated to drive the segment.

Regional Insights

North America HIV clinical trials market dominated the global market in 2024 with the largest share of 47.3%. This can be attributed to the increased number of HIV clinical trials being conducted in the region. Besides, government support and rising research activities for HIV clinical trials are further promoting market growth. In addition, the presence of established market players and an increasing focus on personalized medicine improving patient adherence is anticipated to drive market growth.

Moreover, well-planned regulations, funding policies, and developed healthcare infrastructure are some of the major factors that support the region’s growth. For instance, in September 2023, according to the National Institutes of Health (NIH) (.gov), the preventive clinical trial of HIV vaccine candidates began its enrollment in the U.S. & South Africa. Its Phase 1 trial will assess vaccine VIR-1388 in the HIV patient population for its safety & ability to induce a specific immune response.

U.S. HIV Clinical Trials Market Trends

The U.S. accounts for the highest share of the North America HIV clinical trials market owing to the presence of several pharma/biopharmaceutical companies and an increasing number of product pipelines in the country. Besides, the demand for HIV Clinical Trials is growing in the U.S. due to the high R&D spending on clinical trials. For instance, in October 2021, the U.S. FDA mentioned approval for 11 clinical trial research with over USD 25 million in funding over the next 4 years. It aims to support the development of new medical products for treating rare diseases. Moreover, growing innovation for prevention medication, such as PrEP formulation and HIV vaccine candidates, and rising support from government & regulatory authorities are expected to drive the market. Furthermore, the industry is embracing personalized medicine, using pharmacogenomics to optimize treatment regimens based on individual genetic profiles.

The HIV clinical trials market in Canada is driven by the rising number of clinical trials and clinical sites and strong healthcare infrastructure for conducting trials within the country. Additionally, high research & development activities, growing innovation of products, and product approval are expected to drive the country’s growth. For instance, in Canada, around 77% of biopharmaceutical products are in the early stages of research & development (research to phase I/II), whereas 23% are in the mid- to late-stage of development (late-stage clinical trials). Such actions by the government are expected to drive the market.

Europe HIV Clinical Trials Market Trends

Europe's HIV clinical trials market is driven by growing partnerships between public & private sectors, favorable initiatives of government, rising technological advancement, an increasing number of clinical trials, and the presence of key players offering HIV clinical trials services. Additionally, the market is driven by the presence of well-established companies, the growing prevalence of diseases, the innovation of new drugs, and the expansion of new facilities. Such factors are anticipated to improve the clinical trial landscape.

HIV Clinical Trials Market in Germany accounts for the highest share of the European HIV clinical trials market owing to growing clinical trials outsourcing, technological advancements, enhanced clinical team expertise, increased demand for investigating gene therapies (e.g., CRISPR-Cas9), and immunotherapies, including broadly neutralizing antibodies (bNAbs), and low labor costs support the demand for HIV clinical trials market trends which has led increased competitiveness in the global market.

The HIV Clinical Trials market in the UK is driven by growing digital health technologies, an increasing trend of outsourcing, growing drug innovation, and a rising number of personalized HIV treatments being undertaken to address the diseases. Besides, improved patient adherence and reduced treatment fatigue further focusing on improving patient outcomes is expected to drive the market.

Asia Pacific HIV Clinical Trials Market Trends

Asia Pacific is expected to grow at a CAGR of 7.63% during the forecast period owing to the higher cost-efficiency of conducting clinical trials, evolving business models of outsourcing and R&D activities among key market players, changing market dynamics, prevalence of chronic diseases, and growing technological advancements. Besides, a growing number of researchers working with non-profit organizations aiming to test vaccine candidates for HIV is expected to drive the market. In addition, a growing pool of scientific & development expertise, enabling rapid adoption of advanced technologies & quality clinical outsourcing services, fuels the market.

Japan HIV Clinical Trials market is witnessing demand due to the increased quality & quantity of clinical trials conducted, rising number of clinical trial activities, advanced healthcare, and rising incidence of HIV have made the country one of the top locations worldwide for clinical trials. Such factors are anticipated to drive the market.

The HIV Clinical Trials market in China is driven by a growing outsourcing of clinical trials, increased cost efficiency, accelerating innovations in clinical practice, established clinical research infrastructure, a strong hospital network, and the presence of skilled practitioners for HIV prevention treatment. In addition, the diverse patient pools are anticipated to drive the market.

India HIV Clinical Trials market is driven by cost-effectiveness, favorite sites for clinical trials due to its diversified patient pool, and growing organizational research activities, which is expected to support market growth over the forecast period further. For instance, in October 2023, the Clinical Trial Excellence Project was launched by Roche Pharma in India. The project’s main objective is to strengthen public health institutions’ capabilities to do clinical trials & drug research in the country. It will enable government hospitals to become the centers of excellence for clinical research in the country and move up the value chain. Such factors are anticipated to drive the market.

Key HIV Clinical Trials Company Insights

The market players operating across the HIV Clinical Trials are seeking to enhance their customer base, production capacities, and market presence with the adoption of in-organic strategic initiatives such as service launches, partnerships & agreements, expansions, mergers & acquisitions, and others to increase market presence & revenue and gain a competitive edge drives the market growth. Hence, a rising number of strategic initiatives are expected to boost the market share of prominent players operating across the market. For instance, in June 2023, American Gene Technologies launched its new Addimmune company to develop gene & cell therapy technologies to cure HIV. The company will focus on advancing an HIV cure that led to a successful Phase 1 HIV gene & cell therapy clinical trial.

Key HIV Clinical Trials Companies:

The following are the leading companies in the HIV clinical trials market. These companies collectively hold the largest market share and dictate industry trends.

- PPD Inc.

- IQVIA Inc.

- Parexel International Corporation

- ICON plc

- Syneos Health

- WuXi AppTec

- Janssen Global Services, LLC

- Gilead Sciences, Inc.

- Bionor Holding AS

- Charles River Laboratories

- GSK plc.

- SGS SA

Recent Developments

-

In July 2024, ViiV Healthcare mentioned 48-week findings from PASO DOBLE, the largest phase IV randomized clinical trial examining the 2-drug regimen Dovato compared to the 3-drug regimen Biktarvy for the treatment of HIV-1 patients who are virologically suppressed & who could benefit from treatment optimization.

-

In October 2023, Gilead Sciences mentioned clinical trials to assess Lenacapavir for HIV as a part of a prevention program in the Europe region. PURPOSE 5 trial program will evaluate lenacapavir in UK & France patients benefiting from HIV PrEP.

HIV Clinical Trials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.59 billion

Revenue forecast in 2030

USD 2.11 billion

Growth rate

CAGR of 5.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Phase, study design, sponsor, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

PPD Inc.; IQVIA Inc.; Parexel International Corporation; ICON plc; Syneos Health; WuXi AppTec ; Janssen Global Services, LLC; Gilead Sciences, Inc.; Bionor Holding AS; Charles River Laboratories; GSK plc.; SGS SA among others.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global HIV Clinical Trials Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global HIV clinical trials market report based on phase, study design, sponsor, and region:

-

Phase Outlook (Revenue, USD Million, 2018 - 2030)

-

Phase I

-

Phase II

-

Phase III

-

Phase IV

-

-

Study Design Outlook (Revenue, USD Million, 2018 - 2030)

-

Interventional Studies

-

Observational Studies

-

Expanded Access Studies

-

-

Sponsor Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical & Biopharmaceutical Companies

-

Non-Profit Organizations

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global HIV clinical trials market size was estimated at USD 1.56 billion in 2024 and is expected to reach USD 1.59 billion in 2025.

b. The global HIV clinical trials market witnessed a moderate growth rate of 5.78% from 2025 to 2030 to reach USD 2.11 billion by 2030.

b. Phase III segment dominated the market and held the largest revenue share of 29.97% in 2024 This can largely be attributed to the growing requirement for drug safety & toxicity at different levels of dose & determine drug pharmacokinetics. It also benefits the drug being tested in several hundred to several thousand participants.

b. Some of the players operating in the market include PPD Inc., IQVIA Inc., Parexel International Corporation, ICON plc, Syneos Health, WuXi AppTec, Janssen Global Services, LLC, Gilead Sciences, Inc., Bionor Holding AS, Charles River Laboratories, GSK plc., and SGS SA among others

b. Key factors that are driving the market growth include rising drug approvals and new product launches, increasing incidence of HIV cases, and rising R&D initiatives by biotechnology & pharmaceutical companies. In addition, clinical trials support innovative new HIV therapies, precision medicines, and vaccines, further improving patient outcomes and reducing the incidence rate globally is expected to drive the market

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."