- Home

- »

- Biotechnology

- »

-

HLA Typing Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![HLA Typing Market Size, Share & Trends Report]()

HLA Typing Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Reagents & Consumables, Software & Services), By Technique, By Application (Diagnosis, Research), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-007-6

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

HLA Typing Market Summary

The global HLA typing market size was estimated at USD 1,032.1 million in 2022 and is projected to reach USD 1.7 billion by 2030, growing at a CAGR of 6.7% from 2023 to 2030. The increasing demand for organ transplantation, along with extensive use of human leukocyte antigen (HLA) testing in pharmacogenetics is expected to be the key growth determinant of the market.

Key Market Trends & Insights

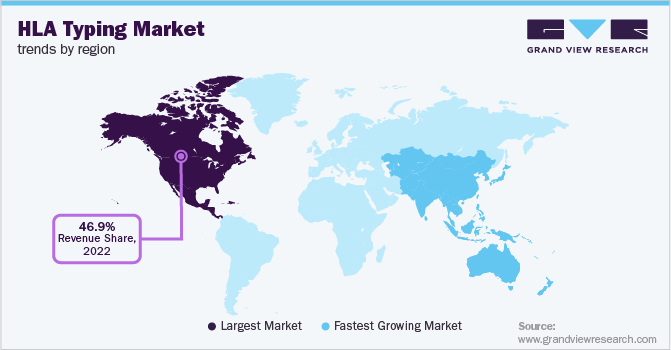

- North America is observed to have dominance in the HLA typing market with a share of 46.94% in 2022.

- Asia Pacific is estimated to witness the fastest growth in the human leukocyte antigen matching market.

- Based on product, the reagents and consumables in human leukocyte antigen typing is considered to be revenue generating segment with the largest market share of 54.2% in 2022 and fastest growth rate between 2023 to 2030.

- Based on application, the diagnosis is anticipated to be the fastest-growing segment of HLA typing with a 6.8% CAGR during the forecast period.

- Based on technique, the molecular assay segment dominated the market and accounted for the largest revenue share of 53.0% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 1,032.1 Million

- 2030 Projected Market Size: USD 1.7 Billion

- CAGR (2023-2030): 6.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

HLA matching is considered to be a commonly used test for determining the compatibility of tissue transplantation. Every donor is compelled to undergo this test, including organs from a deceased, relatives, or others. Hence, a good match lowers the probability of complications after the transplant.Over a span of time, the number of transplantations has increased. According to the Organ Procurement and Transplantation Network, around 41,354 organ transplantations have been performed alone in the U.S. in 2021, which is a 5.9% increase from 2020. The most common transplants in 2021 were kidney with 24,669 transplants, liver with 9,236 transplants, and heart with 3,817. However, deceased due to lack of organ donors is the loss of a potential number of human leukocyte antigen testing. In 2021, approximately 17 individuals per day lost their lives due to the organ shortage and 105,800 people are on the U.S. transplant waiting list.

Similarly, the adoption of HLA testing in numerous applications expands the scope of the test and its demand. For instance, in February 2022, NEC Oncolmmunity AS, a biotech company, announced the publication of its research describing a method to test new alleles of human leukocyte antigen and characterize the tumors’ HLA, which can assist in personalized cancer immunotherapy. The approach conducted human leukocyte antigen testing through the data of NGS. The company collaborated with Ultimovacs ASA in the research to verify the approach from the blood of various donors through deep target sequencing of human leukocyte antigen. The verification was a success with 100% of HLA typing.

Integration of HLA typing in the area of personalized immunotherapy is expected to be an important breakthrough. It is likely to assist the professionals in HLA testing by filling gaps in the human leukocyte antigen libraries at the global level and assist in identifying the human leukocyte antigen variants in disease. Along with that, further innovation in this area can enhance the HLA typing accuracy for organ transplants and vaccine design.

Similarly, increasing strategic initiatives by companies in the human leukocyte antigen matching market are anticipated to accelerate the innovation in the product offering and increase the regional footprint. For instance, in November 2022, Werfen SA announced to initiate the buying out process of Immuncor Inc. for USD 2 billion. The acquirer company believes Immuncor Inc. is a well complementary to the existing product portfolio in transplants or transfusion. Immmuncor's offering includes human leukocyte antigen testing software that provides rapid analysis of gene sequencing. Post-acquisition, Werfen is expected to surpass USD 2.25 (EUR 2.2) billion in revenue, with 7 technology centers and around 7,000 employees in total. This strategy is expected to assist Werfen to create a direct presence in over 30 countries and 100 territories via distributors.

Product Insights

The reagents and consumables in human leukocyte antigen typing is considered to be revenue generating segment with the largest market share of 54.2% in 2022 and fastest growth rate between 2023 to 2030. The HLA reagents and consumables are also complementary products in a range of diagnostic test kits, including HLA typing, that are used to enhance the accuracy and speed of diagnoses. According to the 2021 annual report of Thermo Fisher Scientific Inc., the key users of reagents are from healthcare, clinical and pharmaceutical industry.

The exponential growth of the segment is likely to attract players from similar or related markets, which enable them to establish synergy amongst the resources and maximize the profit. For instance, in August 2022, Eurobio Scientific announced the acquisition of Genome Diagnostics BV (GenDx), a key player in the HLA typing market with a strong presence in the U.S. and Europe. GenDx develops and commercializes a comprehensive solution for HLA typing, including reagents for conducting HLA typing through sequencing, supporting software, and training modules.

Application Insights

The diagnosis is anticipated to be the fastest-growing segment of HLA typing with a 6.8% CAGR during the forecast period. It can be used to diagnose diseases such as rheumatoid arthritis, narcolepsy, and Behcet’s disease which paves the way to accelerate the market for HLA matching. Recently in May 2022, Mylab Discovery Solutions announced to launch a detection kit, DiscoverSeries HLAB*27 for diagnosing Ankylosing spondylitis. The requirement for molecular diagnostic tests has surged due to their promising results.

Similarly, in March 2022, NeoGenomics Laboratories announced receiving U.S.FDA for using HLA typing for companion diagnostics. The company believes that the demand for HLA typing, and applicable companion diagnostic assays are expected to grow for multiple therapeutics. Hence, there is a noticeable demand for human leukocyte antigen typing which pushes the market. However, molecular tests and gene sequencing tests are expensive which restrains the adoption and market growth of human leukocyte antigen matching to an extent.

Technique Insights

The molecular assay segment dominated the market and accounted for the largest revenue share of 53.0% in 2022. Molecular techniques such as massively parallel sequencing or probe-based hybridization methods are the most performed technique in HLA typing. Molecular typing can be conducted through various genetic approaches including PCR followed by massively parallel sequencing. The use of technique differs according to the donors and organs to be transplanted. For instance, for deceased donors, molecular typing class I and II HLA loci are performed; while for hematopoietic stem cell transplantation, high-resolution molecular class typing I HLA loci is recommended.

The HLA matching market is witnessing the increasing adoption of next-generation sequencing in human leukocyte antigen typing, resulting in the growing demand for sequencing-based molecular assays. For instance, in June 2022, a team of researchers developed a high-resolution assay for HLA typing through RNA sequencing that can offer accurate HLA allele-specific transcript expression and HLA genotyping in 7 to 8 hours. Hence, the sequencing-based molecular assay is proven to reduce the time and cost to get high-resolution HLA typing.

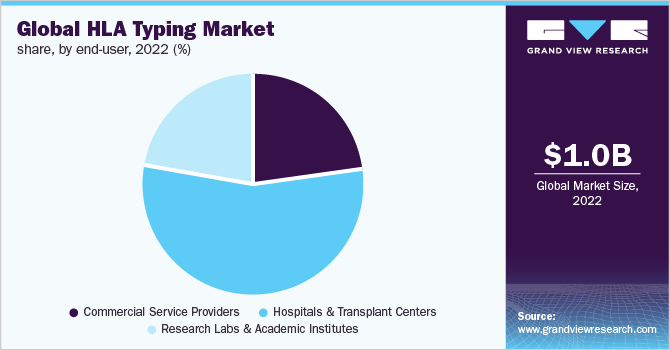

End-user Insights

The hospitals and transplant centers segment dominated the market and accounted for the largest revenue share of 55.0% in 2022.In the U.S., there are approximately 147 hospitals and transplant centers for liver transplants. From January 2021 to December 2021, around 181 candidates received the transplant from a deceased donor and 1 from a living donor in Houston Methodist Hospital. Similarly, in Stanford Health Care and VCU Health System Authority, VCUMC, 103 and 164 transplants were performed in the same time frame, respectively. Hence, the increasing number of transplantations in hospitals and transplant centers accelerates the demand for HLA typing.

Furthermore, the increasing services by research labs & academic institutes of HLA typing are anticipated to have a significant impact on the valuation of the market. For instance, the University of Rochester Medical Center Rochester offers comprehensive services in antibody testing, HLA typing, and cross-matching at various levels of resolutions that can be customized according to the client's requirements. Thus, the demand for service providers for sensitivity testing of drugs, transplantation programs, and eligibility screening for the vaccine is increasing among these end-users.

Regional Insights

North America is observed to have dominance in the HLA typing market with a share of 46.94% in 2022. The foremost determinant of the largest market share is the existence of well-established academic institutions and research centers in the region coupled with the rising genetic disorders. Hence, there are advanced healthcare and research facilities available. Moreover, the government and companies are focused on the advancements in organ transplant.

Asia Pacific is estimated to witness the fastest growth in the human leukocyte antigen matching market owing to the enhanced infrastructure of the health care facilities, well-designed reimbursement policies, and improving growth of economic factors, resulting in a positive impact on the market. Along with the increasing availability of skilled professionals and transplant hospitals, laboratories with advanced technologies will boost the market.

Key Companies & Market Share Insights

Companies and service providers in HLA matching market are adopting strategies such as technology discovery, and development, vertical collaboration, establishing a strong product portfolio through startups, mergers and acquisitions, and regional expansion to increase their global footprint. For instance, in October 2022, CareDx, Inc., a transplant company, announced to present its data on the recent development of next-generation sequencing HLA typing kits for hematopoietic stem cell transplantation. The product is expected to assist lab professionals in the process of matching transplant potential donors and recipients. Some of the prominent players in the global HLA typing market include:

-

Thermo Fisher Scientific Inc.

-

Bio-Rad Laboratories Inc.

-

Qiagen N.V.

-

Omixon Inc.

-

GenDx

-

Illumina Inc.

-

TBG Diagnostics Limited

-

Dickinson and Company

-

Takara Bio Inc.

-

F. Hoffman-La Roche Limited

-

Pacific Biosciences

HLA Typing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1,097.9 million

Revenue forecast in 2030

USD 1.7 billion

Growth rate

CAGR of 6.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, technique, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Mexico, Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Bio-Rad Laboratories Inc.; Qiagen N.V.; Omixon Inc.; GenDx; Illumina Inc.; TBG Diagnostics Limited; Dickinson and Company; Takara Bio Inc.; F. Hoffman-La Roche Limited; Pacific Biosciences

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HLA Typing Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global HLA typing market report on the basis of product, application, technique, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents & Consumables

-

Software & Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis

-

Research

-

-

Technique Outlook (Revenue, USD Million, 2018 - 2030)

-

Molecular Assay

-

Sequenced-based Molecular Assay

-

Non-Molecular Assay

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Service Providers

-

Hospitals and Transplant Centers

-

Research Labs & Academic Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. North America has strengthened its regional position in the market with 46.94% of the overall market share in 2022. This is attributed to the presence of transplant centers and clinics, along with the existence of key players in the region.

b. Some key players operating in the HLA typing market include Thermo Fisher Scientific Inc., Bio-Rad Laboratories Inc., Qiagen N.V., Omixon Inc., GenDx, Illumina Inc., TBG Diagnostics Limited, Dickinson and Company, Takara Bio Inc., F. Hoffman-La Roche Limited and Pacific Biosciences

b. Key factors that are driving the market growth include increasing stem cell and organ transplantations, expanding the use of HLA typing in other applications, and increasing the adoption of next-generation sequencing.

b. The global HLA typing market size was estimated at USD 1,032.1 million in 2022 and is expected to reach USD 1,097.9 million in 2023.

b. The global HLA typing market is expected to grow at a compound annual growth rate of 6.7% from 2023 to 2030 to reach USD 1.7 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.