- Home

- »

- Advanced Interior Materials

- »

-

Home Appliances Glass Market Size & Trends Report, 2030GVR Report cover

![Home Appliances Glass Market Size, Share & Trends Report]()

Home Appliances Glass Market Size, Share & Trends Analysis Report By Application (Refrigerators, Cooking Appliances, Hot Water Appliances, Microwaves), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68040-014-1

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2017 - 2020

- Industry: Advanced Materials

Report Overview

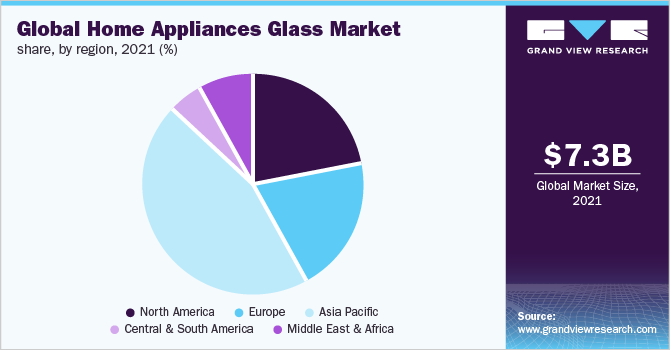

The global home appliances glass market size was valued at USD 7.32 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 4.0% from 2022 to 2030. Increasing sales and the production of refrigerators, ovens, display cabinets, microwaves, and induction cooktops are anticipated to augment the market growth. In September 2021, as part of its USD 60 million investment, GE Appliances opened a new assembly line for producing four-door refrigerators in Kentucky, U.S. Tempered glass is a common material used in the interior, exterior, and control panels of appliances such as refrigerators, cookware, and microwaves. Thus, rising investments in expanding the production capacity of appliances are benefiting market growth.

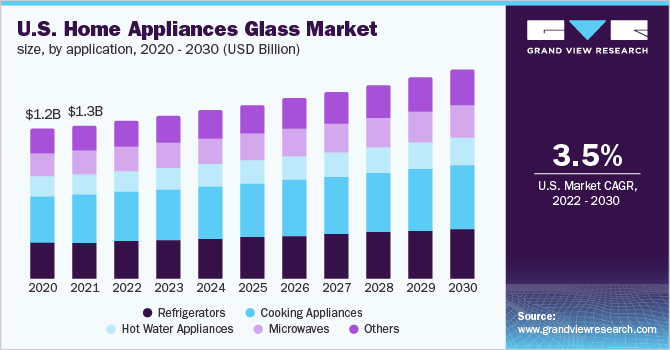

The increasing production of white goods in the U.S. and growing investments in economic development are projected to augment the demand for home appliance glass over the forecast period. According to the U.S. Census Bureau, new orders for manufactured durable goods rose by USD 1.0 billion in the country, reaching USD 274.7 billion in September 2022 compared to August 2022. Also, in April 2021, Apple Inc. announced an investment worth USD 430 billion in the U.S. over the coming five years. The company aims at boosting innovation and economic benefits in every state.

Moreover, market growth is attributed to the rising demand for smart devices. For instance, the average number of connected and smart devices per home was 17.1 across the world in the first half of 2022, which is 10% more than in 2021. The U.S. ranks first in terms of the average number of connected devices per home, which is 20.2. The average in Europe increased by 12.8%, from 15.4 in H1 2021 to 17.4 in H1 2022.

The penetration of connected devices is increasing in developing economies such as India as well, which is anticipated to prove fruitful for market growth. For instance, in November 2022, Up, a Bengaluru, India-based smart home appliance start-up company, raised USD 1.3 million in pre-seed funding. The start-up company is engaged in making connected home appliances and will use its funding in a go-to-market strategy for its first product delishUp.

The market growth is however anticipated to be restrained by the availability of substitutes. For instance, acrylic polymer makes an excellent replacement for glass on account of its optical clarity, less weight, and scratch resistance. As a result, along with windows and lenses, acrylic is replacing the product in refrigerators as well.

Application Insights

The others segment held the largest revenue share of over 25.0% in 2021. Refrigerators held the second-largest revenue share in 2021. Glass finds use in shelves, drawers, and doors of commercial refrigerators. Growing competition from new market entrants and the consequent rise in investments in production/assembly plants are likely to fuel the segment growth across the forecast period.

For instance, in March 2022, Bosch announced an investment worth USD 260 million in a new plant in Nuevo Leon, Mexico. The new plant is expected to have a production capacity of 600,000 large-size refrigerators. Also, in February 2021, Haier Europe invested USD 71.1 million to start a refrigerator plant in Romania to increase production in the region. Such initiatives shall contribute to the demand for glass in refrigerators in Europe.

Cooking appliances are expected to witness growth in the years to come. The segment growth can be attributed to the rising use of kitchen appliances to reduce efforts in household tasks and save time in day-to-day activities. Within kitchen appliances, greater demand for electric hobs and induction cooktops is boosting the growth trajectory of the segment. For instance, in September 2021, Whirlpool India announced the acquisition of a 38% additional stake in Elica PB India to expand their business in electric kitchen appliances.

Region Insights

Asia Pacific held the largest revenue share of over 45.0% in 2021. Investments in consumer electronics and growing production capacities in China, India, and Southeast Asia play a key role in boosting market growth in the region. For instance, in September 2022, Veira Group announced an investment of INR 200 crore (~USD 24.8 million) in its second plant in Greater Noida, India. This new facility will increase the company’s manufacturing capacity to over 3 million smart TV units per year.

In terms of revenue, North America is projected to expand at a CAGR of 3.4% from 2022 to 2030. The region shall benefit from rising investments in new home appliance production facilities. For instance, in June 2022, Samsung Electronics Co. Ltd. announced an investment of USD 500 million to increase its production of home appliances in Mexico. The company already has a TV assembly plant in Tijuana with a yearly production of 19 million units.

Also, in December 2021, GE Appliances, a subsidiary of Haier, announced that it would invest USD 118 million to expand its factory capacity in northwest Georgia. The plant mainly focuses on manufacturing washing machines, wall ovens, electric gas stoves, and electric cooktops. Thus, growing investments in consumer electronics are aiding regional growth.

In Europe, the Russia-Ukraine conflict has impacted market dynamics in the recent past, resulting in the disruption of trade activities. For instance, in the first quarter of 2022, Bosch & Siemens Hausgeräte, one of the leading producers of home appliances, decided to reduce its production capacity owing to a shortage of glass components required for manufacturing products.

Key Companies & Market Share Insights

The leading manufacturers of home appliances glass are investing in R&D and new facilities to spread their presence in the market. For instance, in June 2022, SCHOTT inaugurated its new flat glass plant in Bolu, Turkey. The company intends to cater to value-added glass solutions for the home appliance industry worldwide through its plants in Turkey. Some prominent players in the global home appliances glass market include:

-

Dongguan Hongxi Glass Intelligence Technology Co., Ltd.

-

Glaston Corporation

-

Guardian Industries Holdings

-

Ningbo Bilily Tempered Glass Products Co., Ltd.

-

Nippon Electric Glass Co., Ltd.

-

Nippon Sheet Glass Co., Ltd.

-

Qingdao Lansen Glass Technology Co., Ltd.

-

SCHOTT

-

Sinclair Glass

Home Appliances Glass Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 7.56 billion

Revenue forecast in 2030

USD 10.40 billion

Growth rate

CAGR of 4.0% from 2022 to 2030

Market demand in volume in 2022

1,277.1 kilotons

Volume forecast in 2030

1,694.6 kilotons

Growth rate

CAGR of 3.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2022 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; U.K.; France; Italy; China; India; Japan; Brazil

Key companies profiled

Guardian Industries Holdings; Nippon Electric Glass Co., Ltd.; Ningbo Bilily Tempered Glass Products Co., Ltd.; Nippon Sheet Glass Co., Ltd.; SCHOTT; Glaston Corporation; Qingdao Lansen Glass Technology Co., Ltd.; Sinclair Glass; Dongguan Hongxi Glass Intelligence Technology Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Appliances Glass Market Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global home appliances glass market report on the basis of application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

Refrigerators

-

Cooking Appliances

-

Hot Water Appliances

-

Microwaves

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global home appliances glass market size was estimated at USD 7.32 billion in 2021 and is expected to reach USD 7.56 billion in 2022.

b. The global home appliances glass market is expected to grow at a compound annual growth rate of 4.0% from 2022 to 2030 to reach USD 10.40 billion by 2030.

b. Based on region, Asia Pacific accounted for the largest revenue share of more than 45% of the overall market, in 2021. The rising production of home appliances in the region is expected to boost market growth over the projected period.

b. The key players operating in the home appliances glass market include Guardian Industries Holdings, Nippon Electric Glass Co., Ltd., Nippon Sheet Glass Co., Ltd, SCHOTT, Glaston Corporation, Qingdao Lansen Glass Technology Co., Ltd, Sinclair Glass, and Dongguan Hongxi Glass Intelligence Technology Co., Ltd.

b. Rising home appliance production is expected to fuel market growth across the forecast period. Ceramic glass is a preferred raw material in refrigerators and electric hob manufacturing to increase the toughness and increase life span of components such as shelves and stovetops.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."