- Home

- »

- Homecare & Decor

- »

-

Home Bedding Market Size And Share, Industry Report, 2033GVR Report cover

![Home Bedding Market Size, Share & Trends Report]()

Home Bedding Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Mattress, Bed Linen, Pillows, Blankets, Mattress Toppers & Pads), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-343-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Bedding Market Summary

The global home bedding market size was estimated at USD 126.88 billion in 2024 and is expected to reach USD 277.00 billion by 2033, growing at a CAGR of 8.8% from 2025 to 2033. Consumer preferences for comfort, health, and aesthetics primarily influence the global home bedding industry.

Key Market Trends & Insights

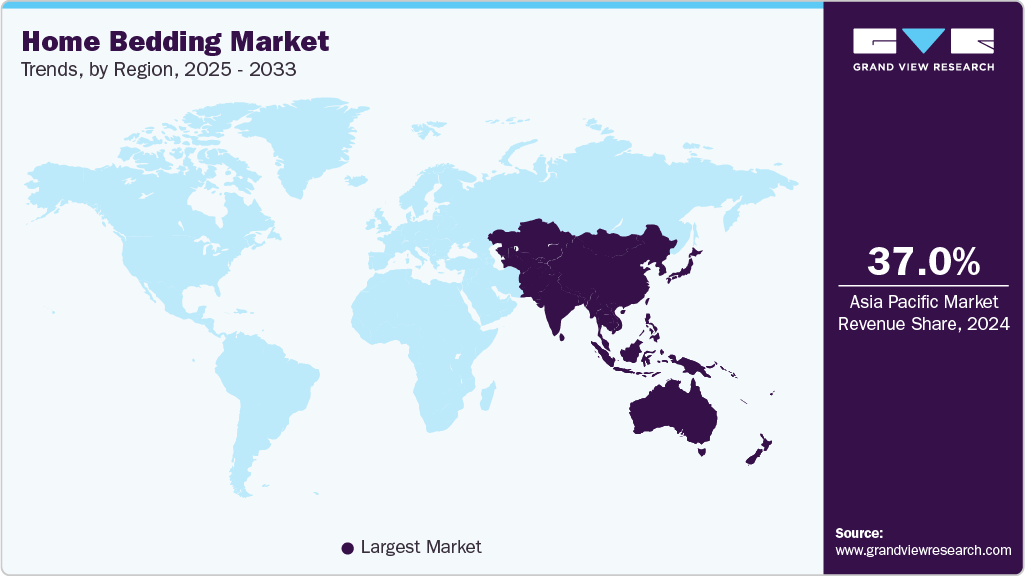

- Asia Pacific led the market with a share of 37.02% in 2024.

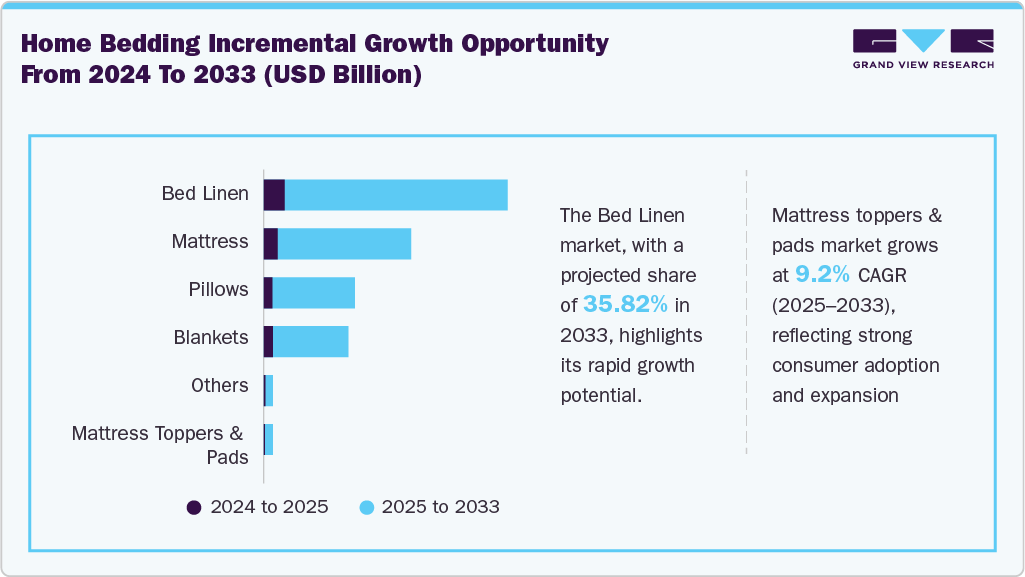

- By type, bed linen led the market with a revenue share of 35.82% in 2024.

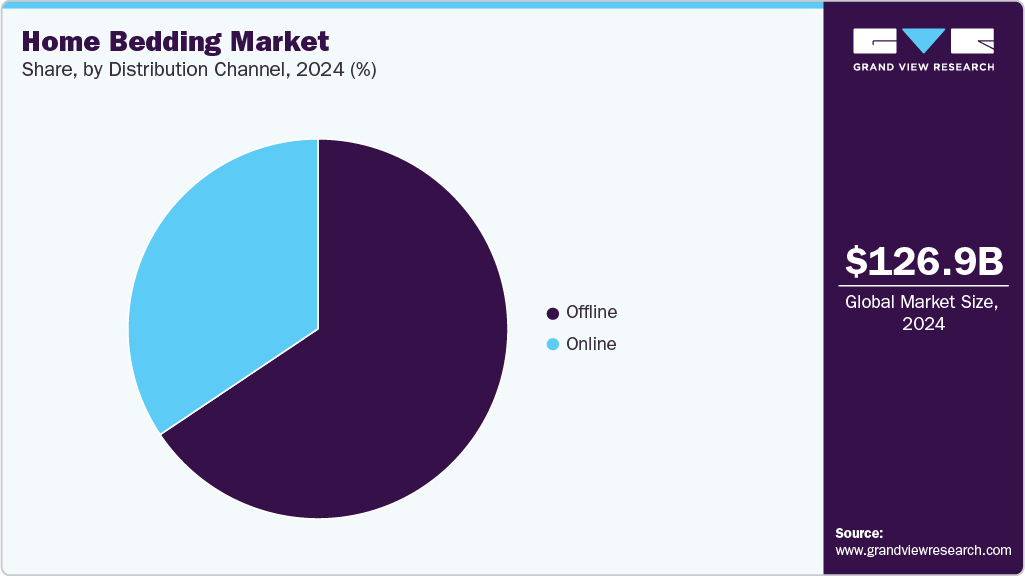

- By distribution channel, the offline segment led the market with a revenue share of 65.61% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 126.88 Billion

- 2033 Projected Market Size: USD 277.00 Billion

- CAGR (2025-2033): 8.8%

- Asia Pacific: Largest market in 2024

As awareness about the importance of sleep quality grows, consumers are increasingly seeking high-quality bedding that enhances their sleep experience. Innovations in materials, such as organic fabrics and temperature-regulating textiles, cater to this demand.The demand for home bedding is set to increase with the rise in home improvement projects as homeowners undertake renovations and redecorations. They often seek to upgrade their bedrooms to enhance comfort and align with new aesthetic themes, prompting purchases of new bedding. Additionally, the emphasis on creating personalized and luxurious living spaces encourages investment in high-quality bedding products that offer enhanced comfort, durability, and design.

52% of American homeowners planned on renovating in 2024 compared to 55% in 2023, according to the Houzz study. Homeowners are investing more in upgrading their living spaces, particularly bedrooms, to enhance both aesthetics and functionality. As part of a bedroom renovation or upgrade, many are replacing older or lower-quality mattresses with premium alternatives that align with their improved lifestyle preferences. Latex mattresses, renowned for their comfort, durability, and health benefits, are gaining popularity as a choice for these renovation projects.

Furthermore, home improvement projects typically involve a holistic approach to enhancing the home's functionality and appearance, making the bedroom a key area of focus. This leads to increased spending on mattresses, pillows, sheets, and other bedding accessories to ensure that the improved space is both visually appealing and comfortable.

The home bedding market is experiencing significant growth driven by continuous innovation in materials and design. Advances in material science have led to the development of bedding products that offer enhanced comfort, durability, and health benefits. For instance, the introduction of memory foam, gel-infused mattresses, and temperature-regulating fabrics has revolutionized sleep quality by providing better support and maintaining optimal sleeping temperatures.

Some of the other key innovations in the blankets category include cooling technology, such as Zonli's launch of the Summer Bamboo Cooling Comforter, health-focused innovations, and sports-inspired designs, as seen in the introduction of throw blankets through Faribault Mill's collaboration with WinCraft and Fanatics Commerce, which targets sports enthusiasts.

In February 2023, Zonli, a Hong Kong-based online retailer, launched its Summer Bamboo Cooling Comforter. It combines bamboo viscose and cooling fiber technology for optimal cooling with a Qmax of 0.42. It has gained attention on platforms like TikTok for its innovative cooling design. The product offers year-round usability, promoting comfortable sleep by regulating body temperature and promoting melatonin release.

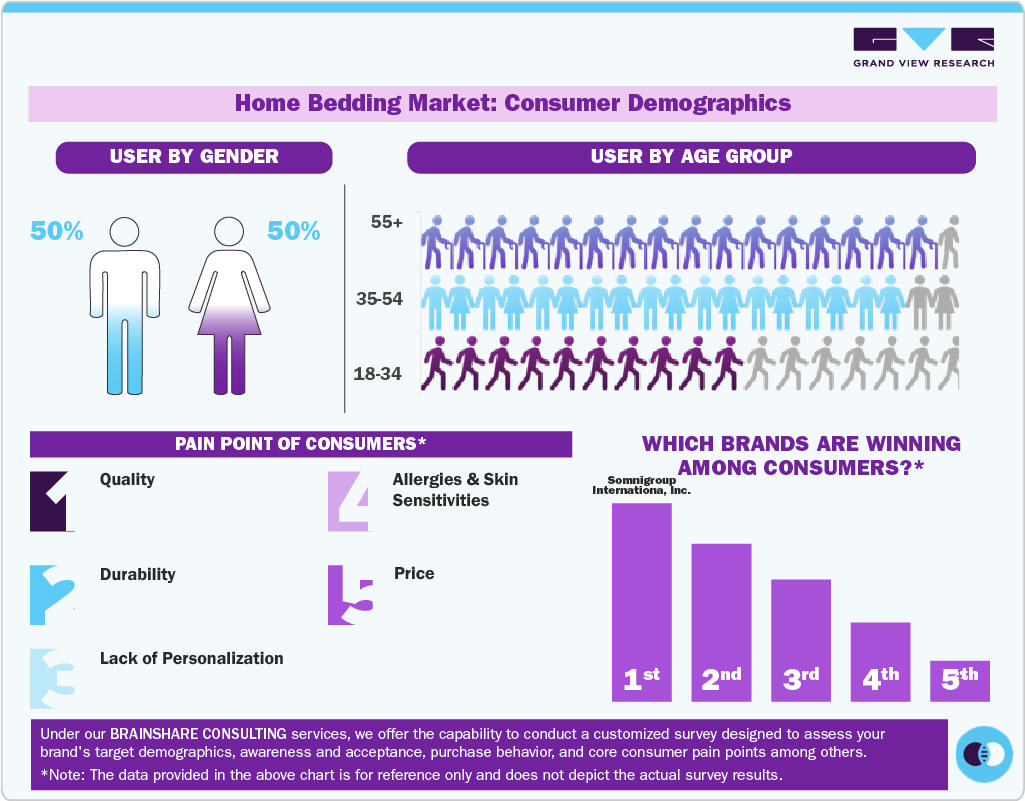

Consumer Insights

Consumers who are shopping for sheets and bedding prioritize quality. According to the Home Textiles Survey by Cotton Incorporated, conducted in March 2023, 79% of respondents prioritize quality when choosing sheets, with 70% actively seeking products labeled as "100% cotton."

Furthermore, 87% recognize the link between quality bedding and better sleep, while 71% express a genuine interest in environmentally friendly bedding. The survey included respondents from countries such as the U.S., Germany, Italy, and the UK. These findings suggest that consumer preferences regarding home bedding tend to prioritize quality, material authenticity, comfort, and sustainability.

Type Insights

Bed linen is the largest segment in the home bedding industry. It accounted for a revenue share of 35.82% in 2024. Increasing awareness of sleep health has led to a greater emphasis on high-quality, comfortable bed linen, driving the demand for premium materials such as Egyptian cotton, silk, and bamboo-derived rayon. Innovations in fabric technology and sustainable practices are also major drivers, with eco-friendly and hypoallergenic options gaining popularity among health-conscious and environmentally aware consumers. Additionally, the rising trend of home aesthetics and decor, driven by social media and interior design influencers, has prompted consumers to invest in visually appealing and luxurious bed linen.

For instance, in March 2024, Naturalmat, a company specializing in natural fiber mattresses and organic bedding, introduced two new collections of Global Organic Textile Standard (GOTS) certified organic hemp bed linens. The company selected organic hemp and the eco-friendly staple, organic linen, as the basis for its newest bed linen collections. These collections are designed to blend form, function, and sustainability, enhancing the sleep experience by keeping individuals cool in summer and warm in winter, owing to the fabrics' naturally breathable properties.

Mattress toppers & pads are anticipated to witness a CAGR of 9.2% from 2025 to 2033. Key market players are innovating their products to not only enhance comfort but also offer health benefits, catering to the increasing consumer focus on wellness. They are leveraging technological innovation, such as dual-action allergen protection in mattress pads and toppers, and cutting-edge materials science to meet market demand for performance and sustainability in bedding solutions. In March 2023, American Textile Company (ATC), a provider of sleep solutions to retail, eCommerce, and hospitality, collaborated with HeiQ, a Swiss materials innovation company, to introduce bedding products with HeiQ Allergen Tech in the North American market.

Distribution Channel Insights

The offline distribution channel is the largest growing segment, accounting for a share of around 65.61% in 2024. Offline stores, such as Walmart, offer a variety of high-quality yet budget-friendly options that cater to diverse customer preferences and budgets, solidifying supermarkets and hypermarkets as preferred destinations for home bedding products. These stores also focus on launching premium bedding collections to cater to higher-income families looking for luxury bedding options.

In April 2024, Walmart introduced affordable luxury sheet sets from popular brands such as Better Homes & Gardens, Allswell, and Hotel Style. Shoppers can inspect the softness, breathability, and fit of the sheets firsthand, which is crucial for making informed decisions.

The online distribution channel segment is expected to grow at a CAGR of 9.5% from 2025 to 2033. Rapid digitization, increasing smartphone penetration, and growing access to the internet have led businesses in the home bedding market to gradually shift from brick-and-mortar sales to e-commerce channels. With the aim of expanding their product visibility, especially in emerging markets, manufacturers are showcasing their products across various online platforms, including company-owned portals and third-party retailers. This shift toward online shopping is particularly prominent among younger generations. The Better Sleep Council's 2023 survey revealed that 54% of consumers are now open to purchasing mattresses online, a notable increase from 27% in 2016 and 47% in 2020. This trend is led by Millennials and Gen Z, with 71% and 69%, respectively, considering online options. The convenience of online shopping, along with the ability to research and compare products easily, has driven this growth.

Regional Insights

The demand for home bedding in North America has been on the rise due to changing consumer preferences and broader socio-economic trends. There has been a significant shift toward health and wellness among consumers. Sleep is increasingly recognized as a critical component of overall health, influencing physical health, mental well-being, and productivity.

Mattress companies are offering organic mattresses in response to growing sustainability concerns. For instance, in April 2024, Essentia Organic Mattress launched the Grateful Eight Organic Latex Mattress, handcrafted with certified organic materials in its GOLS & GOTS-certified factory. This eco-luxury mattress offers a medium feel, combining support, contouring, and resilience without compromising comfort. Similarly, in February 2022, Parachute, a premium multi-category lifestyle brand known for its home comfort products, introduced its first Organic Cotton Collection in Canada. Nearly all of the 22 items in this collection are certified by the Global Organic Textile Standard (GOTS). This collection showcases Parachute's commitment to a more responsible supply chain, offering high-quality, natural-fiber home essentials.

Europe Home Bedding Market Trends

The growing presence of numerous home decor and home retail stores across the region increases the accessibility and availability of a wide range of home bedding products for consumers to shop from conveniently. The presence of multiple chains of departmental stores and hypermarkets such as Aldi, Schwarz, Tesco, and Carrefour, which provide a variety of home bedding products, is also contributing to the growth of the offline channel.

The France home bedding market is expected to grow during the forecast period. In France, interior design trends significantly impact the market growth. French consumers are heavily influenced by trends that emphasize comfort, minimalism, and aesthetics. Styles such as Scandinavian, Hygge, and contemporary French chic prioritize cozy, well-designed bedroom spaces. Additionally, the increasing number of new home sales in the country is propelling market growth. For instance, according to the Ministry of Ecology of the French Government, new home sales in France increased to 14,442 units in the fourth quarter of 2023, up from 13,034 units in the third quarter of the same year.

Asia Pacific Home Bedding Market Trends

The growing middle-class population in Asia Pacific has transformed it into a lucrative market for global bedding companies. With rising disposable incomes, consumers in China, India, and other emerging economies are increasingly investing in premium bedding products. A growing focus on quality, comfort, and wellness drives this shift. The diverse and expanding middle-class population across both urban and rural areas demands tailored solutions, offering immense opportunities for brands. The Brookings Institution's Global Economy and Development paper estimates that by 2030, two out of every three members of the middle class will be Asian. As Asian consumers are willing to spend more on luxury and high-quality bedding, companies are strategically targeting this market to capitalize on its significant growth potential.

Nitori Holdings Co., Ltd., Japan's largest furniture and home-furnishing retail chain, is aggressively expanding its presence in Asia to achieve its vision of operating 3,000 stores and generating 3 trillion yen in sales by 2032. As of March 2024, Nitori operates 983 stores, with 173 located in countries such as Malaysia, China, Hong Kong, South Korea, Taiwan, Singapore, Thailand, and Vietnam. The company plans to open 50 stores in the Philippines by 2032, recognizing the country's growth potential.

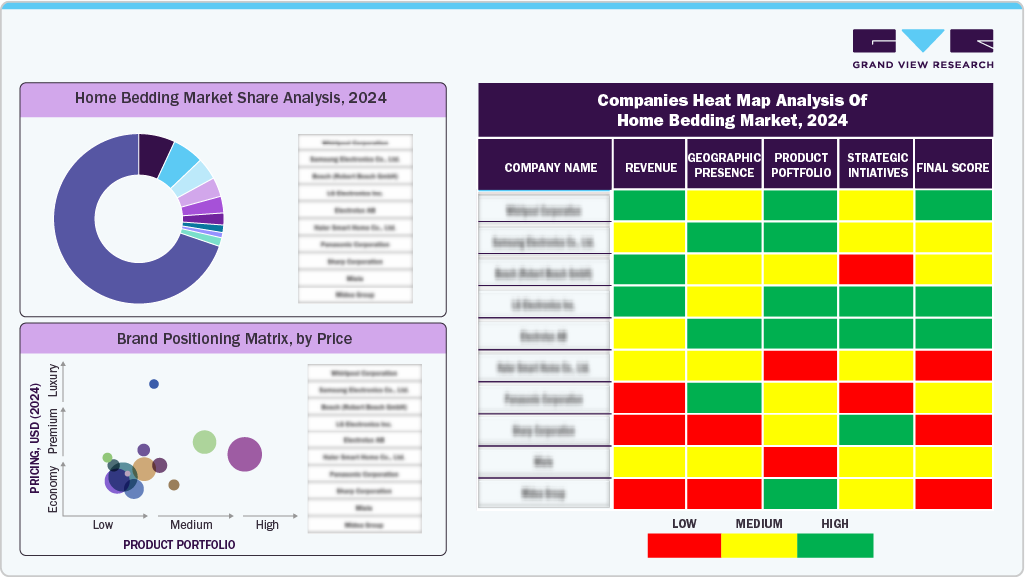

Key Home Bedding Company Insights

Leading players in the home bedding market include Somnigroup International Inc., Sleep Number Corporation, and Bombay Dyeing & Manufacturing Company Limited. The global home bedding industry remains highly competitive, with key players focusing on expanding production capacities and strengthening distribution networks across both online and offline retail channels. Manufacturers are investing in material innovation, sustainable fabric sourcing, and advanced manufacturing technologies to meet the growing demand for premium, comfortable, and eco-friendly bedding products. Rising consumer spending on home décor, increasing awareness of sleep quality and wellness, and expanding applications of bedding products across residential, hospitality, and institutional sectors further drive market growth.

Key Home Bedding Companies:

The following are the leading companies in the home bedding market. These companies collectively hold the largest market share and dictate industry trends.

- Somnigroup International Inc.

- Bombay Dyeing & Manufacturing Company Limited

- Casper Sleep Inc.

- Beaumont & Brown

- Restful Nights

- American Textile Company

- Peacock Alley

- Purple Innovation, Inc.

- The White Company

- Sleep Number Corporation

Recent Developments

-

In August 2025, Pacific Coast Feather Company (PCFC), a renowned bedding manufacturer established in 1884, underwent significant rebranding. The company transitioned to the new identity of Restful Nights, reflecting its evolution and expanded product offerings.

-

In May 2025, in partnership with fellow Dallas-based company Peacock Alley, American Leather debuted a new line of sheets specifically designed for its sleeper sofas and chairs. Recognizing that designers seek high-quality linens for their projects, this collaboration ensures that the bedding complements the luxury and comfort of American Leather's furniture offerings.

-

In May 2025, Somnigroup International Inc. entered into supply arrangements with Purple Innovation and Leggett & Platt to diversify its product offerings. These products are expected to be available in late 2025 and 2026.

-

In February 2025, Somnigroup International Inc. announced the successful completion of its previously announced acquisition of Mattress Firm Group Inc. ("Mattress Firm"), a mattress specialty retailer in the country. This vertical integration enables them to control both manufacturing and distribution channels, improving customer reach and profitability.

Home Bedding Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 141.17 billion

Revenue forecast in 2033

USD 277.00 billion

Revenue growth rate

CAGR of 8.8% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Countries covered

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; Japan; India; Australia; South Korea; Brazil; Argentina; South Africa; UAE

Key companies profiled

Somnigroup International Inc.; Bombay Dyeing & Manufacturing Company Limited; Casper Sleep Inc.; Beaumont & Brown; Restful Nights; American Textile Company; Peacock Alley; Purple Innovation, Inc.; The White Company; Sleep Number Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Bedding Market Report Segmentation

This report forecasts revenue growth at the global, regional & country levels and provides an analysis of the latest trends and opportunities in each sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the home bedding market report based on type, distribution channel, and region:

-

Type Outlook (Revenue: USD Billion, 2021 - 2033)

-

Mattress

-

Bed Linen

-

Pillows

-

Blankets

-

Mattress Toppers & Pads

-

Others

-

-

Distribution Channel Outlook (Revenue: USD Billion, 2021 - 2033)

-

Offline

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue: USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.