- Home

- »

- Medical Devices

- »

-

Home Healthcare Market Size, Share & Growth Report, 2030GVR Report cover

![Home Healthcare Market Size, Share & Trends Report]()

Home Healthcare Market Size, Share & Trends Analysis Report By Component (Equipment, Services), By Indication (Cardiovascular Disorder & Hypertension, Diabetes & Kidney Disorders), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-010-1

- Number of Report Pages: 252

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Home Healthcare Market Size & Trends

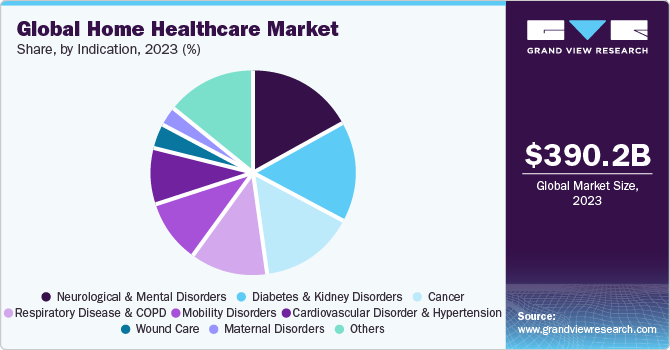

The global home healthcare market size was valued at USD 390.24 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.96% from 2024 to 2030. This can be attributed to rising demand for cost-effective alternatives to curb rising healthcare costs and growing penetration of virtual and remote care industry. Increasing treatment cost is one of the prime concerns for governments and health organizations, and hence they are striving to curb healthcare costs. Home healthcare is a cost-efficient alternative to an expensive hospital stay. For instance, as per a report by The Commonwealth Fund, “hospital at home,” programs enable patients to receive acute care at home with fewer complications and over 30% reduction in cost of care. This helps ensure patient comfort and is projected to serve as a high impact rendering driver of the market.

Advancement in technology is expected to favor the home healthcare market growth. The use of technology, such as telemedicine and remote patient monitoring, is also driving innovation in the market. These technologies enable home healthcare agencies to monitor patients remotely and provide timely interventions, which can improve patient outcomes and reduce healthcare costs. The integration of remote patient monitoring devices such as smart sensors, telehealth platforms, medical monitoring devices, and many others is expected to boost the demand for these services globally.

Rising awareness of home care facilities and disposable income is leading to demand of for home healthcare services. The bed-ridden and old patients opt for home healthcare services and products, as it reduces readmission to hospital and recovery rate is higher in comparison to in-hospital. Companies are also focusing more on untapped countries such as India and China. For instance, Apollo Homecare offers long term plans for various categories such as ortho rehab, heart rehab, neuro rehab, lung rehab, mother & baby care, and elderly care. These programs include medical supervision and personalized healthcare services.

The COVID-19 pandemic had a substantial impact on market expansion. COVID-19 has raised the demand for patient monitoring in region such as Asia and MEA as a result of hospital visit restrictions. Government agencies provided various services to help monitor condition of COVID-19-infected individuals. For instance, in April 2020, the Ministry of Health of Saudi Arabia released an app designed to track the health of individuals suspected of having COVID-19. During the pandemic, the government made attempts to monitor the health of patients, contributing to the expansion of the market. Moreover, during the post-pandemic period, the growing usage of patient monitoring across MEA is anticipated to boost the market.

Market Concentration & Characteristics

Degree of Innovation: The market has witnessed significant innovation in recent years. With the increasing demand for home healthcare services and the need for more efficient and patient-centric care, companies are investing heavily in research and development to launch new and innovative solutions.

Level of M & A Activities: The level of merger and acquisition in the market has been steadily increasing over the past few years. Many companies are looking to expand their services and reach in new markets through strategic acquisitions or mergers with other companies. For instance, in August 2023, Extendicare Inc. acquired Revera and its affiliates and gained a 15% managed stakes in 25 LTC homes operated by Revera and oversaw an extra 31 LTC homes owned by Revera.

Impact of Regulations: The regulatory scenario for the market varies depending on the country and region. In general, most countries have regulatory frameworks in place to ensure that home healthcare services are safe, effective, and of high quality. These regulations cover areas such as licensing requirements for home healthcare providers, accreditation of home healthcare agencies, and reimbursement policies for home care services. For instance, in the U.S., according to federal laws and regulations, each province and territory has its own set of rules and requirements for home healthcare services. These may include requirements for licensing, training, and certification of providers, and rules around the types of services that can be provided and the conditions under which they can be provided.

Service Expansion: The market is experiencing a significant degree of service expansion as the demand for home-based care services continues to increase. Companies are expanding their services to include a broader range of healthcare services, beyond traditional medical services such as wound care and medication management. For instance, many companies are now offering services such as physical therapy, occupational therapy, speech therapy, and palliative care. Additionally, companies are expanding their service offerings to include non-medical services, such as meal preparation, transportation, and companionship.

Regional Expansion: Many companies are expanding their services to new regions and countries, driven by factors such as demographic changes, increasing healthcare costs, and the need for more patient-centric care models.

Component Insights

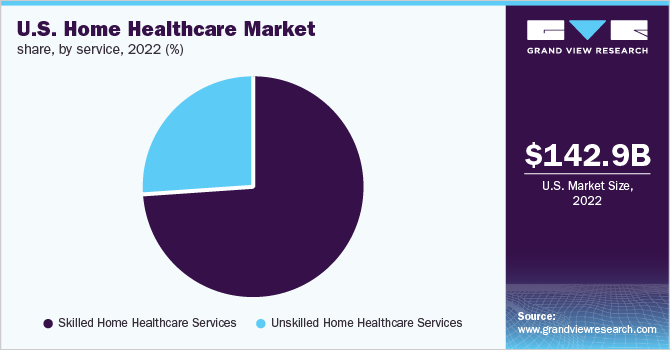

The services segment dominated the market and held the largest revenue share of 84.21% in 2023. The market by services is segmented into skilled home healthcare and unskilled home healthcare. Skilled services are provided by healthcare professionals. Unskilled services includes non-medical home care services provided for daily living aid to home-bound patients and are categorized as basic assistance care/personal care service. Rising medical expenditure associated with hospital stays is expected to boost the demand for skilled care.

Under skilled nursing services, medical professionals such as physicians, registered nurses, physiotherapists, and specialty care providers aid patients at home or home care centers. The aging population suffering from diseases, such as diabetes and cardiac disorders, require medical assistance services such as medication management and continuous monitoring. With advancements in medical technology, many procedures can be performed at home in a more comfortable and convenient environment, which can be attributed to the growth of skilled home care services in the market for home healthcare.

Equipment is segmented as therapeutic, diagnostic, and mobility assistance. Diagnostics accounted for largest share in 2023 and is expected to gain a lucrative share over the forecast period. Technologically advanced products that enable accurate and timely diagnosis, such as remote heart rate monitor, iPhone heart-rate monitor, and TQR heart rate watches are likely to propel the diagnostic equipment segment growth. Further, increasing patient awareness and health consciousness is also likely to boost segment growth.

Indication Insights

Neurological & mental disorder accounted for the largest revenue share in 2023 owing to increasing disease prevalence. Neurological disorders, including epilepsy, Alzheimer's & other dementias, stroke, migraine & other headaches, multiple sclerosis, and Parkinson's disease, can affect the functioning of the brain, spine, and nerves. Home healthcare services, such as physical therapy, occupational therapy, speech therapy, and mental health services, can help those with such disorders manage symptoms. According to the NCBI, in 2022, an estimated 6.5 million people aged 65 and over in the US were suffering from Alzheimer's disease, which is expected to rise to 13.8 million by 2060. In addition, women are more likely to be diagnosed with Alzheimer’s than men due to their longer life expectancy, and it is becoming the most common cause of death in neurodegenerative diseases, as well as a common cause of physical disability that requires urgent treatment.

Mobility disorders have been estimated to be the fastest growing segment. According to the CDC, 11.1% of U.S. adults have a mobility-related disability with serious difficulty walking or climbing stairs. Mobility disorders are conditions that limit movement due to physical, psychological, or neurological impairment, and treatment may include physical therapy, assistive devices, and medications. Home healthcare services can provide numerous benefits to individuals with mobility disorders, such as assistance with daily tasks & activities to help maintain independence and physiotherapists to help regain mobility, functionality, & strength & reduce pain through exercise, movements, & massage. The increasing prevalence of mobility disorders is expected to drive the growth of this segment over the forecast period.

Diabetes is one of the leading causes of disability & death worldwide, and the number of people living with diabetes is expected to grow in the coming years. This growing prevalence of diabetes is expected to have a significant impact on the growth of the home healthcare services market. For instance, according to the International Diabetes Federation estimates, in 2021, approximately 536 million adults were living with diabetes, and this number is expected to increase to 783 million by 2045. Home healthcare services can enable people with diabetes to manage their conditions in the comfort of their homes, thereby reducing the need for hospital visits and the overall cost of care. Such services can involve care planning, monitoring, and education, as well as providing diabetes-related equipment & supplies.

Regional Insights

North America accounted for the largest market share of 42.60% in 2023. The large geriatric population in this region, coupled with sophisticated healthcare infrastructure and relatively high disposable incomes, are some key drivers of this market. Moreover, an increasing number of government initiatives that aim to curb healthcare expenditure levels, by promoting home healthcare is expected to serve as a vital impact-rendering driver.

In addition, by 2030, one in five Americans will be above 65 years of age. Around 90% of the population aged above 65 in the U.S. is expected to have one or more chronic diseases requiring long-term care. Home healthcare services are very useful for the geriatric population, as they enable elderly people to manage chronic conditions at home, thereby reducing hospital visits and the cost of treatment.

Asia Pacific has been estimated to be the fastest-growing segment. Factors such as underdeveloped healthcare infrastructure, expensive in-hospital healthcare facilities, and chronic diseases that require long-term care are resulting in an increase in home healthcare products and services. Thailand, Australia, India, South Korea, and New Zealand are some of the emerging countries in the region. Technological advancements in patient monitoring devices and an increasing geriatric population coupled with the growing prevalence of lifestyle diseases, such as obesity & diabetes, are anticipated to drive the growth of the market.

India home healthcare market

The market is expected to witness significant growth over the forecast period owing to the need for better primary and postoperative care and demand for cost-effective alternative for hospital services.

UAE home healthcare market

The market held significant market share in MEA region owing to growing number of facilities offering home healthcare services. Some of key players operating in UAE include Al Tawam Hospital, Sheikh Khalifa Medical City in Abu Dhabi city, and others.

Saudi Arabia home healthcare market

Home care services in Saudi Arabia are growing at a significant pace owing to growing patient volumes in hospitals, changing healthcare reforms such as shift towards value-based care services.

Key Companies & Market Share Insights

The market is highly fragmented due to presence of large number of multinational as well as local market players. Moreover, the activities such as home healthcare marketing strategies undertaken by multinational companies are estimated to increase competition in home health care industry. Players in the home healthcare market undertake the strategy to strengthen their product portfolios and offer diverse technologically advanced & innovative products to their customers.

Key Home Healthcare Companies:

- B. Braun Melsungen AG

- Abbott

- Sunrise Medical

- 3M Healthcare

- Baxter International Inc.

- Medtronic PLC

- Cardinal Health Inc.

- F. Hoffmann-La Roche AG

- Air Liquide

- Amedisys, Inc.

- NxStage Medical, Inc. (Fresenius Medical Care)

- Arkray, Inc.

- BD

- Omron Healthcare, Inc.

- Drive DeVilbiss Healthcare

- GE Healthcare

- Medline Industries, Inc

- Koninklijke Philips N.V.

- Johnson & Johnson Services, Inc.

- Linde Healthcare

- Acelity (3M)

- Vygon

- Teleflex, Inc.

- Moog Inc.

- Intersurgical Ltd.

- Fresenius Kabi AG.

- Bayer HealthCare

- Comp14

- GF Health Products, Inc.

- Kindred Healthcare, Inc.

- Almost Family, Inc.

- National HealthCare Corporation

- Chubb Fire & Security Pty Ltd

- Gentiva Health Services, Inc.

- Medco Home Healthcare, Inc.

- Addus Homecare

- Brookdale Senior Living Solutions

- Sunrise Carlisle, LP (Sunrise Senior Living, LLC)

- Genesis Healthcare, Inc.

- Extendicare, Inc.

- SONIDA SENIOR LIVING. (CAPITAL SENIOR LIVING CORPORATION)

- Diversicare Healthcare Services, Inc.

- Home Instead, Inc.

- Senior Care Centers of America

- Atria Senior Living, Inc

Recent Developments

-

In June 2023, Amedisys agreed to combine with Optum, a company specializing in providing diversified health services. Amedisys provides personalized home health and hospice care services and performs over 11.2 million visits to patient homes annually.

-

In May 2023, Medtronic announced that it had entered into an agreement to acquire EOFlow Co. Ltd., which manufactures the EOPatch tubeless, wearable, and fully disposable insulin delivery device.

-

In May 2023, Home Instead, Inc. partnered with Meals on Wheels America to increase awareness, gather funds, and recruit volunteers. It aimed to help elderly community members and solve health problems.

-

In April 2023, Health Care At Home Private Limited (HCAH) acquired Nightingales Home Health Services, The company offers specialty home healthcare services.

-

In March 2023, Koninklijke Philips N.V. launched the Philips Virtual Care Management solutions and services portfolio, which has been designed to improve patient engagement and health outcomes through a more comprehensive telehealth approach.

-

In February 2023, OMRON Healthcare announced the addition of new educational components to its OMRON Connect mobile application. These include articles relating to study summaries and AFib identification, as well as pointers for behavioral and lifestyle changes to reduce risks of heart attack and stroke.

Home Healthcare Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 420.79 billion

Revenue forecast in 2030

USD 666.91 billion

Growth rate

CAGR of 7.96% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Netherlands; Sweden; Ireland; Switzerland; Denmark; China; Japan; India; Australia; Singapore; Thailand; Philippines; South Korea; Malaysia; New Zealand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Oman; UAE; Egypt

Key companies profiled

B. Braun Melsungen AG; Abbott; Sunrise Medical; 3M Healthcare; Baxter International Inc.; Medtronic PLC; Cardinal Health Inc; F. Hoffmann-La Roche AG; Air Liquide; Amedisys, Inc; NxStage Medical, Inc. (Fresenius Medical Care); Arkray, Inc.; Becton, Dickinson and Company; Omron Healthcare, Inc; Drive DeVilbiss Healthcare; GE Healthcare; Medline Industries, Inc; Koninklijke Philips N.V; Johnson & Johnson Services, Inc.; Linde Healthcare; Acelity (3M); Vygon; Teleflex, Inc; Moog Inc.; Intersurgical Ltd.; Fresenius Kabi AG; GF Health Products, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Healthcare Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global home healthcare market report on the basis of component, indication, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Therapeutic

-

Home respiratory therapy equipment

-

Insulin delivery devices

-

Home IV pumps

-

Home dialysis equipment

-

Others

-

-

Diagnostic

-

Diabetic care unit

-

BP monitors

-

Multi para diagnostic monitors

-

Home pregnancy and fertility kits

-

Apnea and sleep monitors

-

Holter monitors

-

Heart rate monitors

-

Others

-

-

Mobility Assist

-

Wheel chair

-

Home medical furniture

-

Walking assist devices

-

-

-

Services

-

Skilled Home Healthcare Services

-

Physician primary care

-

Nursing care

-

Physical/occupational/speech therapy

-

Nutritional support

-

Hospice & palliative care

-

Others

-

-

Unskilled Home Healthcare Services

-

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiovascular Disorder & Hypertension

-

Diabetes & Kidney Disorders

-

Neurological & Mental Disorders

-

Respiratory Disease & COPD

-

Maternal Disorders

-

Mobility Disorders

-

Cancer

-

Wound Care

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

Sweden

-

France

-

Italy

-

Russia

-

Netherlands

-

Spain

-

Ireland

-

Switzerland

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Singapore

-

Malaysia

-

Thailand

-

Philippines

-

South Korea

-

New Zealand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Oman

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global home healthcare market size was estimated at USD 362.1 billion in 2022 and is expected to reach USD 390.2 billion in 2023.

b. The global home healthcare market is expected to grow at a compound annual growth rate of 7.96% from 2023 to 2030 to reach USD 666.9 billion by 2030.

b. North America dominated the home healthcare market with a share of around 43% in 2022. This is attributable to shifting trends towards in-home healthcare from nursing homes, technological advancement, and the presence of advanced medical infrastructure.

b. Some key players operating in the home healthcare market include Brookdale Senior Living, Inc.; Home Health Services Ltd.; Sunrise Carlisle, LP; Extendicare, Inc.; Care UK Limited; Senior Care Centers of America; Genesis Healthcare Corp.; Sompo Holdings, Inc.; Kindred Healthcare, Inc.; and Home Instead Senior Care, Inc.

b. Key factors that are driving the home healthcare market growth include population aging around the world and increased patient preference for value-based healthcare. The aging population demands more patient-centric healthcare services, which in return increases the demand for healthcare workers and agencies and is anticipated to drive market growth.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definitions

1.2.1. Component

1.2.2. Indication

1.3. Regional Scope

1.4. Estimates and Forecast Timeline

1.5. Information Procurement

1.5.1. Purchased Database

1.5.2. GVR’s Internal Database

1.5.3. Secondary Sources & Third-Party Perspectives

1.5.4. Primary Research

1.5.5. Details of Primary Research

1.6. Information Analysis

1.6.1. Data Analysis Models

1.7. Market Formulation & Data Visualization

1.7.1. Commodity Flow Analysis

1.7.1.1. Approach 1: Commodity flow approach

1.7.1.2. Approach 2: Country wise market estimation using bottom up approach

1.8. Data Validation & Publishing

1.9. Global Market: CAGR Calculation

1.10. List of Secondary Sources

1.11. List of Primary Sources

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Segmental Snapshot

2.3. Competitive Insights Snapshot

Chapter 3. Market Variables, Trends, and Scope

3.1. Market Lineage

3.1.1. Parent Market Analysis

3.1.2. Ancillary Market Analysis

3.2. Home Healthcare Market - Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Home healthcare as a cost-effective alternative

3.2.1.2. Hospital solution providers penetrating the home healthcare market

3.2.1.3. Geographical expansion of services by providers

3.2.1.4. Advancement in technology

3.2.2. Market Restraint Analysis

3.2.2.1. Lower remunerations

3.2.2.2. Shortage of skilled healthcare staff

3.2.2.3. Complicated reimbursement framework and reimbursement cuts

3.3. Business Environmental Tools Analysis: Home Healthcare Market

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTLE Analysis

Chapter 4. Home Healthcare Market: Component Estimates & Trend Analysis

4.1. Home Healthcare Market, By Component Key Takeaways

4.2. Home Healthcare Market: Component Movement & Market Share Analysis, 2023 & 2030

4.3. Services

4.3.1. Global Home Healthcare Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

4.3.2. Skilled home healthcare

4.3.2.1. Global skilled home healthcare services market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.2. Nursing care

4.3.2.2.1. Global nursing care market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.3. Physician primary care

4.3.2.3.1. Global physician primary care market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.4. Physical/occupational/speech therapy

4.3.2.4.1. Global physical/occupational/speech therapy market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.5. Hospice & palliative

4.3.2.5.1. Global hospice & palliative market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.6. Nutritional support & infusion therapy

4.3.2.6.1. Global nutritional support market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.2.7. Other skilled home healthcare

4.3.2.7.1. Global other skilled home healthcare services market estimates and forecasts, 2018 - 2030 (USD Million)

4.3.3. Unskilled Home Healthcare

4.3.3.1. Global unskilled home healthcare services market estimates and forecasts, 2018 - 2030 (USD Million)

4.4. Equipment

4.4.1. Global Home Healthcare Equipment Market Estimates and Forecasts, 2018 - 2030 (USD Million)

4.4.2. Therapeutic

4.4.2.1. Global therapeutic home healthcare equipment market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.2.2. Home respiratory therapy

4.4.2.2.1. Global home respiratory therapy market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.2.3. Home intravenous pumps

4.4.2.3.1. Global home IV pumps market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.2.4. Home dialysis equipment

4.4.2.4.1. Global home dialysis equipment market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.2.5. Insulin delivery

4.4.2.5.1. Global insulin delivery market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.2.6. Other therapeutic equipment

4.4.2.6.1. Global other therapeutic equipment market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3. Diagnostic

4.4.3.1. Global diagnostic home healthcare equipment market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.2. Diabetic care unit

4.4.3.2.1. Global diabetic care unit market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.3. Blood pressure monitoring

4.4.3.3.1. Global blood pressure monitoring market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.4. Multi parameter diagnostics monitors

4.4.3.4.1. Global multi parameter diagnostics market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.5. Apnea and sleep monitors

4.4.3.5.1. Global apnea and sleep monitors market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.6. Home pregnancy and fertility kits

4.4.3.6.1. Global home pregnancy and fertility kits market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.7. Holter monitors

4.4.3.7.1. Global holter monitors market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.8. Heart rate meters

4.4.3.8.1. Global heart rate meter market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.3.9. Other diagnostic equipment

4.4.3.9.1. Global other diagnostic equipment market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.4. Mobility Assist Equipment

4.4.4.1. Global mobility assist equipment market estimates and forecasts, 2018 - 2030 (USD Million

4.4.4.2. Wheelchair

4.4.4.2.1. Global wheelchair market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.4.3. Home medical furniture

4.4.4.3.1. Global home medical furniture market estimates and forecasts, 2018 - 2030 (USD Million)

4.4.4.4. Walking assist devices

4.4.4.4.1. Global walking assist devices market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 5. Home Healthcare Market: Indication Estimates & Trend Analysis

5.1. Home Healthcare Market, By Indication: Key Takeaways

5.2. Home Healthcare Market: Indication Movement & Market Share Analysis, 2023 & 2030

5.3. Neurological & Mental Disorders

5.3.1. Global Neurological & Mental Disorders Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.4. Diabetes & Kidney Disorders

5.4.1. Global Diabetes & Kidney Disorders Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.5. Cancer

5.5.1. Global Cancer Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.6. Respiratory Disease & COPD

5.6.1. Global Respiratory Disease & COPD Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.7. Mobility Disorders

5.7.1. Global Mobility Disorders Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.8. Cardiovascular Disorder & Hypertension

5.8.1. Global Cardiovascular Disorder & Hypertension Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.9. Wound Care

5.9.1. Global Wound Care Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.10. Maternal Disorders

5.10.1. Global Maternal Disorders Market Estimates and Forecasts, 2018 - 2030 (USD Million)

5.11. Other Indications

5.11.1. Global Other Indications Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Home Healthcare Market: Regional Estimates & Trend Analysis

6.1. Regional Outlook

6.2. Home Healthcare Market by Region: Key Marketplace Takeaway

6.3. North America

6.3.1. North America Home Healthcare Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.3.2. U.S.

6.3.2.1. U.S. estimated disease burden by indication, 2018 -2022

6.3.2.2. Regulatory framework & reimbursement structure

6.3.2.3. Competitive scenario

6.3.2.4. U.S. home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.3.3. Canada

6.3.3.1. Canada estimated disease burden by indication, 2018 -2022

6.3.3.2. Regulatory framework & reimbursement structure

6.3.3.3. Competitive scenario

6.3.3.4. Canada home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4. Europe

6.4.1. Europe Home Healthcare Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.4.2. UK

6.4.2.1. UK estimated disease burden by indication, 2018 -2022

6.4.2.2. Regulatory framework & reimbursement structure

6.4.2.3. Competitive scenario

6.4.2.4. UK home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.3. Germany

6.4.3.1. Germany estimated disease burden by indication, 2018 -2022

6.4.3.2. Regulatory framework & reimbursement structure

6.4.3.3. Competitive scenario

6.4.3.4. Germany home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.4. France

6.4.4.1. France estimated disease burden by indication, 2018 -2022

6.4.4.2. Regulatory framework & reimbursement structure

6.4.4.3. Competitive scenario

6.4.4.4. France home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.5. Italy

6.4.5.1. Italy estimated disease burden by indication, 2018 -2022

6.4.5.2. Regulatory framework & reimbursement structure

6.4.5.3. Competitive scenario

6.4.5.4. Italy Home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.6. Spain

6.4.6.1. Spain estimated disease burden by indication, 2018 -2022

6.4.6.2. Regulatory framework & reimbursement structure

6.4.6.3. Competitive scenario

6.4.6.4. Spain home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.7. Netherlands

6.4.7.1. Netherlands estimated disease burden by indication, 2018 -2022

6.4.7.2. Regulatory framework & reimbursement structure

6.4.7.3. Competitive scenario

6.4.7.4. Netherlands home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.8. Sweden

6.4.8.1. Sweden estimated disease burden by indication, 2018 -2022

6.4.8.2. Regulatory framework & reimbursement structure

6.4.8.3. Competitive scenario

6.4.8.4. Sweden home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.9. Ireland

6.4.9.1. Ireland estimated disease burden by indication, 2018 -2022

6.4.9.2. Regulatory framework & reimbursement structure

6.4.9.3. Competitive scenario

6.4.9.4. Ireland home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.10. Russia

6.4.10.1. Russia estimated disease burden by indication, 2018 -2022

6.4.10.2. Regulatory framework & reimbursement structure

6.4.10.3. Competitive scenario

6.4.10.4. Russia home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.11. Switzerland

6.4.11.1. Switzerland estimated disease burden by indication, 2018 -2022

6.4.11.2. Regulatory framework & reimbursement structure

6.4.11.3. Competitive scenario

6.4.11.4. Switzerland home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.4.12. Denmark

6.4.12.1. Denmark estimated disease burden by indication, 2018 -2022

6.4.12.2. Regulatory framework & reimbursement structure

6.4.12.3. Competitive scenario

6.4.12.4. Denmark home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific Home Healthcare Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.5.2. Japan

6.5.2.1. Japan estimated disease burden by indication, 2018 -2022

6.5.2.2. Regulatory framework & reimbursement structure

6.5.2.3. Competitive scenario

6.5.2.4. Japan home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.3. China

6.5.3.1. China estimated disease burden by indication, 2018 -2022

6.5.3.2. Regulatory framework & reimbursement structure

6.5.3.3. Competitive scenario

6.5.3.4. China home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.4. India

6.5.4.1. India estimated disease burden by indication, 2018 -2022

6.5.4.2. Regulatory framework & reimbursement structure

6.5.4.3. Competitive scenario

6.5.4.4. India home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.5. Australia

6.5.5.1. Australia estimated disease burden by indication, 2018 -2022

6.5.5.2. Regulatory framework & reimbursement structure

6.5.5.3. Competitive scenario

6.5.5.4. Australia home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.6. South Korea

6.5.6.1. South Korea estimated disease burden by indication, 2018 -2022

6.5.6.2. Regulatory framework & reimbursement structure

6.5.6.3. Competitive scenario

6.5.6.4. South Korea home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.7. Singapore

6.5.7.1. Singapore estimated disease burden by indication, 2018 -2022

6.5.7.2. Regulatory framework & reimbursement structure

6.5.7.3. Competitive scenario

6.5.7.4. Singapore home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.8. Thailand

6.5.8.1. Thailand estimated disease burden by indication, 2018 -2022

6.5.8.2. Regulatory framework & reimbursement structure

6.5.8.3. Competitive scenario

6.5.8.4. Thailand home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.9. Philippines

6.5.9.1. Philippines estimated disease burden by indication, 2018 -2022

6.5.9.2. Regulatory framework & reimbursement structure

6.5.9.3. Competitive scenario

6.5.9.4. Philippines home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.10. Malaysia

6.5.10.1. Malaysia estimated disease burden by indication, 2018 -2022

6.5.10.2. Regulatory framework & reimbursement structure

6.5.10.3. Competitive scenario

6.5.10.4. Malaysia home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.5.11. New Zealand

6.5.11.1. New Zealand estimated disease burden by indication, 2018 -2022

6.5.11.2. Regulatory framework & reimbursement structure

6.5.11.3. Competitive scenario

6.5.11.4. New Zealand home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.6. Latin America

6.6.1. Latin America Home Healthcare Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.6.2. Brazil

6.6.2.1. Brazil estimated disease burden by indication, 2018 -2022

6.6.2.2. Regulatory framework & reimbursement structure

6.6.2.3. Competitive scenario

6.6.2.4. Brazil home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.6.3. Mexico

6.6.3.1. Mexico estimated disease burden by indication, 2018 -2022

6.6.3.2. Regulatory framework & reimbursement structure

6.6.3.3. Competitive scenario

6.6.3.4. Mexico home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.6.4. Argentina

6.6.4.1. Argentina estimated disease burden by indication, 2018 -2022

6.6.4.2. Regulatory framework & reimbursement structure

6.6.4.3. Competitive scenario

6.6.4.4. Argentina home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa SWOT Analysis

6.7.2. Middle East & Africa Home Healthcare Market Estimates and Forecasts, 2018 - 2030 (USD Million)

6.7.3. South Africa

6.7.3.1. South Africa estimated disease burden by indication, 2018 -2022

6.7.3.2. Regulatory framework & reimbursement structure

6.7.3.3. Competitive scenario

6.7.3.4. South Africa home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.7.4. Saudi Arabia

6.7.4.1. Saudi Arabia estimated disease burden by indication, 2018 -2022

6.7.4.2. Regulatory framework & reimbursement structure

6.7.4.3. Competitive scenario

6.7.4.4. Saudi Arabia home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.7.5. UAE

6.7.5.1. UAE estimated disease burden by indication, 2018 -2022

6.7.5.2. Regulatory framework & reimbursement structure

6.7.5.3. Competitive scenario

6.7.5.4. UAE home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.7.6. Egypt

6.7.6.1. Egypt estimated disease burden by indication, 2018 -2022

6.7.6.2. Regulatory framework & reimbursement structure

6.7.6.3. Competitive scenario

6.7.6.4. Egypt home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

6.7.7. Oman

6.7.7.1. Oman estimated disease burden by indication, 2018 -2022

6.7.7.2. Regulatory framework & reimbursement structure

6.7.7.3. Competitive scenario

6.7.7.4. Oman home healthcare market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

7.1. Company Categorization

7.2. Company Market Position Analysis: Suppliers

7.3. Company Market Position Analysis: Service Providers

7.4. Strategy Mapping

7.5. Company Profiles: Suppliers

7.5.1. McKesson Medical-Surgical Inc.

7.5.1.1. Overview

7.5.1.2. Financial Performance

7.5.1.3. Product Benchmarking

7.5.1.4. Strategic Initiatives

7.5.2. Fresenius Medical Care

7.5.2.1. Overview

7.5.2.2. Financial Performance

7.5.2.3. Product Benchmarking

7.5.2.4. Strategic Initiatives

7.5.3. Medline Industries, Inc.

7.5.3.1. Overview

7.5.3.2. Financial Performance

7.5.3.3. Product Benchmarking

7.5.3.4. Strategic Initiatives

7.5.4. Medtronic PLC

7.5.4.1. Overview

7.5.4.2. Financial Performance

7.5.4.3. Product Benchmarking

7.5.4.4. Strategic Initiatives

7.5.5. 3M Healthcare

7.5.5.1. Overview

7.5.5.2. Financial Performance

7.5.5.3. Product Benchmarking

7.5.5.4. Strategic Initiatives

7.5.6. Baxter International Inc.

7.5.6.1. Overview

7.5.6.2. Financial Performance

7.5.6.3. Product Benchmarking

7.5.6.4. Strategic Initiatives

7.5.7. B. Braun Melsungen AG

7.5.7.1. Overview

7.5.7.2. Financial Performance

7.5.7.3. Product Benchmarking

7.5.7.4. Strategic Initiatives

7.5.8. Arkray, Inc.

7.5.8.1. Overview

7.5.8.2. Financial Performance

7.5.8.3. Product Benchmarking

7.5.8.4. Strategic Initiatives

7.5.9. F. Hoffmann-La Roche AG

7.5.9.1. Overview

7.5.9.2. Financial Performance

7.5.9.3. Product Benchmarking

7.5.9.4. Strategic Initiatives

7.5.10. Becton, Dickinson and Company

7.5.10.1. Overview

7.5.10.2. Financial Performance

7.5.10.3. Product Benchmarking

7.5.10.4. Strategic Initiatives

7.5.11. Acelity L.P.

7.5.11.1. Overview

7.5.11.2. Financial Performance

7.5.11.3. Product Benchmarking

7.5.11.4. Strategic Initiatives

7.5.12. Hollister Inc.

7.5.12.1. Overview

7.5.12.2. Financial Performance

7.5.12.3. Product Benchmarking

7.5.12.4. Strategic Initiatives

7.5.13. ConvaTec Group PLC

7.5.13.1. Overview

7.5.13.2. Financial Performance

7.5.13.3. Product Benchmarking

7.5.13.4. Strategic Initiatives

7.5.14. Molnlycke Health Care

7.5.14.1. Overview

7.5.14.2. Financial Performance

7.5.14.3. Product Benchmarking

7.5.14.4. Strategic Initiatives

7.6. Company Profile: Service Providers

7.6.1. Brookdale Senior Living, Inc.

7.6.1.1. Overview

7.6.1.2. Financial Performance

7.6.1.3. Service Benchmarking

7.6.1.4. Strategic Initiatives

7.6.2. Home Health Services Ltd.

7.6.2.1. Overview

7.6.2.2. Financial Performance

7.6.2.3. Service Benchmarking

7.6.2.4. Strategic Initiatives

7.6.3. Sunrise Carlisle, LP

7.6.3.1. Overview

7.6.3.2. Financial Performance

7.6.3.3. Service Benchmarking

7.6.3.4. Strategic Initiatives

7.6.4. Extendicare, Inc.

7.6.4.1. Overview

7.6.4.2. Financial Performance

7.6.4.3. Service Benchmarking

7.6.4.4. Strategic Initiatives

7.6.5. Care UK Limited

7.6.5.1. Overview

7.6.5.2. Financial Performance

7.6.5.3. Service Benchmarking

7.6.5.4. Strategic Initiatives

7.6.6. Senior Care Centers of America

7.6.6.1. Overview

7.6.6.2. Financial Performance

7.6.6.3. Service Benchmarking

7.6.6.4. Strategic Initiatives

7.6.7. Genesis Healthcare Corp.

7.6.7.1. Overview

7.6.7.2. Financial Performance

7.6.7.3. Service Benchmarking

7.6.7.4. Strategic Initiatives

7.6.8. Sompo Holdings, Inc.

7.6.8.1. Overview

7.6.8.2. Financial Performance

7.6.8.3. Service Benchmarking

7.6.8.4. Strategic Initiatives

7.6.9. Kindred Healthcare, Inc.

7.6.9.1. Overview

7.6.9.2. Financial Performance

7.6.9.3. Service Benchmarking

7.6.9.4. Strategic Initiatives

7.6.10. Home Instead Senior Care, Inc.

7.6.10.1. Overview

7.6.10.2. Financial Performance

7.6.10.3. Service Benchmarking

7.6.10.4. Strategic Initiatives

Chapter 8. Key Recommendations/Key Market Insights

List of Tables

Table 1 List of secondary sources

Table 2 List of abbreviation

Table 3 U.S. regulatory procedures for different classes of medical device

Table 4 U.S. regulatory procedures for different classes of medical device

Table 5 Canada regulatory approval process for medical device

Table 6 Europe regulatory approval process for medical device

Table 7 Japan regulatory approval process for medical device

Table 8 China regulatory approval process for medical device

Table 9 North America home healthcare market, by country, 2018 - 2030 (USD Million)

Table 10 North America home healthcare market, by component, 2018 - 2030 (USD Million)

Table 11 North America home healthcare equipment market, 2018 - 2030 (USD Million)

Table 12 North America home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 13 North America home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 14 North America home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 15 North America home healthcare services market, 2018 - 2030 (USD Million)

Table 16 North America home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 17 U.S. home healthcare market, by component, 2018 - 2030 (USD Million)

Table 18 U.S. home healthcare equipment market, 2018 - 2030 (USD Million)

Table 19 U.S. home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 20 U.S. home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 21 U.S. home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 22 U.S. home healthcare services market, 2018 - 2030 (USD Million)

Table 23 U.S. home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 24 Canada home healthcare market, by component, 2018 - 2030 (USD Million)

Table 25 Canada home healthcare equipment market, 2018 - 2030 (USD Million)

Table 26 Canada home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 27 Canada home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 28 Canada home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 29 Canada home healthcare services market, 2018 - 2030 (USD Million)

Table 30 Canada home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 31 Europe home healthcare market, by country, 2018 - 2030 (USD Million)

Table 32 Europe home healthcare market, by component, 2018 - 2030 (USD Million)

Table 33 Europe home healthcare equipment market, 2018 - 2030 (USD Million)

Table 34 Europe home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 35 Europe home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 36 Europe home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 37 Europe home healthcare services market, 2018 - 2030 (USD Million)

Table 38 Europe home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 39 UK home healthcare market, by component, 2018 - 2030 (USD Million)

Table 40 UK home healthcare equipment market, 2018 - 2030 (USD Million)

Table 41 UK home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 42 UK home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 43 UK home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 44 UK home healthcare services market, 2018 - 2030 (USD Million)

Table 45 UK home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 46 Germany home healthcare market, by component, 2018 - 2030 (USD Million)

Table 47 Germany home healthcare equipment market, 2018 - 2030 (USD Million)

Table 48 Germany home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 49 Germany home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 50 Germany home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 51 Germany home healthcare services market, 2018 - 2030 (USD Million)

Table 52 Germany home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 53 Italy home healthcare market, by component, 2018 - 2030 (USD Million)

Table 54 Italy home healthcare equipment market, 2018 - 2030 (USD Million)

Table 55 Italy home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 51 Italy home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 52 Italy home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 53 Italy home healthcare services market, 2018 - 2030 (USD Million)

Table 54 Italy home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 55 Spain home healthcare market, by component, 2018 - 2030 (USD Million)

Table 56 Spain home healthcare equipment market, 2018 - 2030 (USD Million)

Table 57 Spain home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 58 Spain home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 59 Spain home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 60 Spain home healthcare services market, 2018 - 2030 (USD Million)

Table 61 Spain home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 62 Sweden home healthcare market, by component, 2018 - 2030 (USD Million)

Table 63 Sweden home healthcare equipment market, 2018 - 2030 (USD Million)

Table 64 Sweden home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 65 Sweden home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 65 Sweden home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 67 Sweden home healthcare services market, 2018 - 2030 (USD Million)

Table 68 Sweden home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 69 France home healthcare market, by component, 2018 - 2030 (USD Million)

Table 70 France home healthcare equipment market, 2018 - 2030 (USD Million)

Table 71 France home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 72 France home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 73 France home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 74 France home healthcare services market, 2018 - 2030 (USD Million)

Table 75 France home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 76 Russia home healthcare market, by component, 2018 - 2030 (USD Million)

Table 77 Russia home healthcare equipment market, 2018 - 2030 (USD Million)

Table 78 Russia home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 79 Russia home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 80 Russia home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 81 Russia home healthcare services market, 2018 - 2030 (USD Million)

Table 82 Russia home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 83 Ireland home healthcare market, by component, 2018 - 2030 (USD Million)

Table 84 Ireland home healthcare equipment market, 2018 - 2030 (USD Million)

Table 85 Ireland home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 86 Ireland home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 87 Ireland home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 88 Ireland home healthcare services market, 2018 - 2030 (USD Million)

Table 89 Ireland home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 90 Switzerland home healthcare market, by component, 2018 - 2030 (USD Million)

Table 91 Switzerland home healthcare equipment market, 2018 - 2030 (USD Million)

Table 92 Switzerland home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 93 Switzerland home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 94 Switzerland home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 95 Switzerland home healthcare services market, 2018 - 2030 (USD Million)

Table 96 Switzerland home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 97 Denmark home healthcare market, by component, 2018 - 2030 (USD Million)

Table 98 Denmark home healthcare equipment market, 2018 - 2030 (USD Million)

Table 99 Denmark home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 100 Denmark home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 101 Denmark home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 102 Denmark home healthcare services market, 2018 - 2030 (USD Million)

Table 103 Denmark home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 104 Netherlands home healthcare market, by component, 2018 - 2030 (USD Million)

Table 105 Netherlands home healthcare equipment market, 2018 - 2030 (USD Million)

Table 106 Netherlands home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 107 Netherlands home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 108 Netherlands home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 109 Netherlands home healthcare services market, 2018 - 2030 (USD Million)

Table 110 Netherlands home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 111 Asia Pacific home healthcare market, by country, 2018 - 2030 (USD Million)

Table 112 Asia Pacific home healthcare market, by component, 2018 - 2030 (USD Million)

Table 113 Asia Pacific home healthcare equipment market, 2018 - 2030 (USD Million)

Table 114 Asia Pacific home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 115 Asia Pacific home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 116 Asia Pacific home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 117 Asia Pacific home healthcare services market, 2018 - 2030 (USD Million)

Table 118 Asia Pacific home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 119 Japan home healthcare market, by component, 2018 - 2030 (USD Million)

Table 120 Japan home healthcare equipment market, 2018 - 2030 (USD Million)

Table 121 Japan home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 122 Japan home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 123 Japan home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 124 Japan home healthcare services market, 2018 - 2030 (USD Million)

Table 125 Japan home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 126 China home healthcare market, by component, 2018 - 2030 (USD Million)

Table 127 China home healthcare equipment market, 2018 - 2030 (USD Million)

Table 128 China home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 129 China home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 130 China home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 131 China home healthcare services market, 2018 - 2030 (USD Million)

Table 132 China home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 133 India home healthcare market, by component, 2018 - 2030 (USD Million)

Table 134 India home healthcare equipment market, 2018 - 2030 (USD Million)

Table 135 India home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 136 India home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 137 India home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 138 India home healthcare services market, 2018 - 2030 (USD Million)

Table 139 India home healthcare market, by indication, 2018 - 2030 (USD Million

Table 140 Australia home healthcare market, by component, 2018 - 2030 (USD Million)

Table 141 Australia home healthcare equipment market, 2018 - 2030 (USD Million)

Table 142 Australia home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 143 Australia home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 144 Australia home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 145 Australia home healthcare services market, 2018 - 2030 (USD Million)

Table 146 Australia home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 147 Singapore home healthcare market, by component, 2018 - 2030 (USD Million)

Table 148 Singapore home healthcare equipment market, 2018 - 2030 (USD Million)

Table 149 Singapore home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 150 Singapore home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 151 Singapore home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 152 Singapore home healthcare services market, 2018 - 2030 (USD Million)

Table 153 Singapore home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 154 Malaysia home healthcare market, by component, 2018 - 2030 (USD Million)

Table 155 Malaysia home healthcare equipment market, 2018 - 2030 (USD Million)

Table 156 Malaysia home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 157 Malaysia home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 158 Malaysia home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 159 Malaysia home healthcare services market, 2018 - 2030 (USD Million)

Table 160 Malaysia home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 161 Thailand home healthcare market, by component, 2018 - 2030 (USD Million)

Table 162 Thailand home healthcare equipment market, 2018 - 2030 (USD Million)

Table 163 Thailand home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 164 Thailand home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 165 Thailand home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 166 Thailand home healthcare services market, 2018 - 2030 (USD Million)

Table 167 Thailand home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 168 Philippines home healthcare market, by component, 2018 - 2030 (USD Million)

Table 169 Philippines home healthcare equipment market, 2018 - 2030 (USD Million)

Table 170 Philippines home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 171 Philippines home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 172 Philippines home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 173 Philippines home healthcare services market, 2018 - 2030 (USD Million)

Table 174 Philippines home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 175 South Korea home healthcare market, by component, 2018 - 2030 (USD Million)

Table 176 South Korea home healthcare equipment market, 2018 - 2030 (USD Million)

Table 177 South Korea home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 178 South Korea home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 179 South Korea home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 180 South Korea home healthcare services market, 2018 - 2030 (USD Million)

Table 181 South Korea home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 182 New Zealand home healthcare market, by component, 2018 - 2030 (USD Million)

Table 183 New Zealand home healthcare equipment market, 2018 - 2030 (USD Million)

Table 184 New Zealand home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 185 New Zealand home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 186 New Zealand home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 187 New Zealand home healthcare services market, 2018 - 2030 (USD Million)

Table 188 New Zealand home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 189 Latin America home healthcare market, by country, 2018 - 2030 (USD Million)

Table 190 Latin America home healthcare market, by component, 2018 - 2030 (USD Million)

Table 191 Latin America home healthcare equipment market, 2018 - 2030 (USD Million)

Table 192 Latin America home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 193 Latin America home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 194 Latin America home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 195 Latin America home healthcare services market, 2018 - 2030 (USD Million)

Table 196 Latin America home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 197 Brazil home healthcare market, by component, 2018 - 2030 (USD Million)

Table 198 Brazil home healthcare equipment market, 2018 - 2030 (USD Million)

Table 199 Brazil home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 200 Brazil home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 201 Brazil home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 202 Brazil home healthcare services market, 2018 - 2030 (USD Million)

Table 203 Brazil home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 204 Mexico home healthcare market, by component, 2018 - 2030 (USD Million)

Table 205 Mexico home healthcare equipment market, 2018 - 2030 (USD Million)

Table 206 Mexico home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 207 Mexico home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 208 Mexico home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 209 Mexico home healthcare services market, 2018 - 2030 (USD Million)

Table 210 Mexico home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 211 Argentina home healthcare market, by component, 2018 - 2030 (USD Million)

Table 212 Argentina home healthcare equipment market, 2018 - 2030 (USD Million)

Table 213 Argentina home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 214 Argentina home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 215 Argentina home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 216 Argentina home healthcare services market, 2018 - 2030 (USD Million

Table 217 Argentina home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 218 MEA home healthcare market, by country, 2018 - 2030 (USD Million)

Table 219 MEA home healthcare market, by component, 2018 - 2030 (USD Million)

Table 220 MEA home healthcare equipment market, 2018 - 2030 (USD Million)

Table 221 MEA home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 222 MEA home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 223 MEA home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 224 MEA home healthcare services market, 2018 - 2030 (USD Million)

Table 225 MEA home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 226 South Africa home healthcare market, by component, 2018 - 2030 (USD Million)

Table 227 South Africa home healthcare equipment market, 2018 - 2030 (USD Million)

Table 228 South Africa home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 229 South Africa home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 230 South Africa home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 231 South Africa home healthcare services market, 2018 - 2030 (USD Million)

Table 232 South Africa home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 233 Saudi Arabia home healthcare market, by component, 2018 - 2030 (USD Million)

Table 234 Saudi Arabia home healthcare equipment market, 2018 - 2030 (USD Million)

Table 235 Saudi Arabia home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 236 Saudi Arabia home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 237 Saudi Arabia home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 238 Saudi Arabia home healthcare services market, 2018 - 2030 (USD Million)

Table 239 Saudi Arabia home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 240 Oman home healthcare market, by component, 2018 - 2030 (USD Million)

Table 241 Oman home healthcare equipment market, 2018 - 2030 (USD Million)

Table 242 Oman home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 243 Oman home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 244 Oman home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 245 Oman home healthcare services market, 2018 - 2030 (USD Million)

Table 246 Oman home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 247 UAE home healthcare market, by component, 2018 - 2030 (USD Million)

Table 248 UAE home healthcare equipment market, 2018 - 2030 (USD Million)

Table 249 UAE home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 250 UAE home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 251 UAE home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 252 UAE home healthcare services market, 2018 - 2030 (USD Million)

Table 253 UAE home healthcare market, by indication, 2018 - 2030 (USD Million)

Table 254 Egypt home healthcare market, by component, 2018 - 2030 (USD Million)

Table 255 Egypt home healthcare equipment market, 2018 - 2030 (USD Million)

Table 256 Egypt home healthcare therapeutic equipment market, 2018 - 2030 (USD Million)

Table 257 Egypt home healthcare diagnostic equipment market, 2018 - 2030 (USD Million)

Table 258 Egypt home healthcare mobility assist equipment market, 2018 - 2030 (USD Million)

Table 259 Egypt home healthcare services market, 2018 - 2030 (USD Million)

Table 260 Egypt home healthcare market, by indication, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Home healthcare market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value-chain-based sizing & forecasting

Fig. 7 QFD modelling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market snapshot

Fig. 10 Segment outlook

Fig. 11 Competitive scenario

Fig. 12 Home healthcare parent market outlook

Fig. 13 Market dynamics

Fig. 14 Market driver relevance analysis (Current & future impact)

Fig. 15 Market restraint relevance analysis (Current & future impact)

Fig. 16 Average cost of home healthcare services (USD)

Fig. 17 Home healthcare market component outlook: Key takeaways

Fig. 18 Home healthcare market, by Component: Market share, 2023 & 2030

Fig. 19 Services market, 2018 - 2030 (USD Million)

Fig. 20 Skilled home healthcare market, 2018 - 2030 (USD Million)

Fig. 21 Nursing care market, 2018 - 2030 (USD Million)

Fig. 22 Physician primary care market, 2018 - 2030 (USD Million)

Fig. 23 Physical/occupational/speech therapy market, 2018 - 2030 (USD Million)

Fig. 24 Hospice & palliative market, 2018 - 2030 (USD Million)

Fig. 25 Nutritional support & infusion therapy market, 2018 - 2030 (USD Million)

Fig. 26 Other skilled home healthcare market, 2018 - 2030 (USD Million)

Fig. 27 Unskilled home healthcare market, 2018 - 2030 (USD Million)

Fig. 28 Equipment market,2018- 2030 (USD Million)

Fig. 29 Therapeutic market, 2018 - 2030 (USD Million)

Fig. 30 Home respiratory therapy market, 2018 - 2030 (USD Million)

Fig. 31 Home IV pumps market, 2018 - 2030 (USD Million)

Fig. 32 Home dialysis equipment market, 2018 - 2030 (USD Million)

Fig. 33 Insulin delivery market, 2018 - 2030 (USD Million)

Fig. 34 Other therapeutic equipment market, 2018 - 2030 (USD Million)

Fig. 35 Diagnostics market, 2018 - 2030 (USD Million)

Fig. 36 Diabetic care unit market, 2018- 2030 (USD Million)

Fig. 37 Blood pressure monitors market, 2018 - 2030 (USD Million)

Fig. 38 Multi parameter diagnostic monitors market, 2018 - 2030 (USD Million)

Fig. 39 Apnea and sleep monitors market, 2018 - 2030 (USD Million)

Fig. 40 Home pregnancy and fertility kits market, 2018 - 2030 (USD Million)

Fig. 41 Holter monitors market, 2018 - 2030 (USD Million)

Fig. 42 Heart rate monitor market, 2018 - 2030 (USD Million)

Fig. 43 Other diagnostic equipment market, 2018 - 2030 (USD Million)

Fig. 44 Mobility assist equipment market, 2018 - 2030 (USD Million)

Fig. 45 Wheelchair market, 2018 - 2030 (USD Million)

Fig. 46 Home medical furniture market, 2018 - 2030 (USD Million)

Fig. 47 Walking assist devices market, 2018 - 2030 (USD Million)

Fig. 48 Home healthcare market indication outlook: Key takeaways

Fig. 49 Home healthcare market, by Indication: Market share, 2023 & 2030

Fig. 50 Neurological & mental disorders market, 2018 - 2030 (USD Million)

Fig. 51 Diabetes & kidney disorders market, 2018 - 2030 (USD Million)

Fig. 52 Cancer market, 2018 - 2030 (USD Million)

Fig. 53 Respiratory disease & COPD market, 2018 - 2030 (USD Million)

Fig. 54 Mobility disorders market, 2018 - 2030 (USD Million)

Fig. 55 Cardiovascular disorders & hypertension market, 2018 - 2030 (USD Million)

Fig. 56 Wound care market, 2018 - 2030 (USD Million)

Fig. 57 Maternal disorders market, 2018 - 2030 (USD Million)

Fig. 58 Other indications market, 2018 - 2030 (USD Million)

Fig. 59 Home healthcare market revenue, by region

Fig. 60 Regional key marketplace takeaway

Fig. 61 North America home healthcare market, 2018 - 2030 (USD Million)

Fig. 62 U.S. estimated disease burden, by indication, 2018 - 2022

Fig. 63 U.S. home healthcare market, 2018 - 2030 (USD Million)

Fig. 64 Canada estimated disease burden, by indication, 2018 - 2022

Fig. 65 Canada home healthcare market, 2018 - 2030 (USD Million)

Fig. 66 Europe home healthcare market, 2018 - 2030 (USD Million)

Fig. 67 Germany estimated disease burden, by indication, 2018 - 2022

Fig. 68 Germany home healthcare market, 2018 - 2030 (USD Million)

Fig. 69 UK estimated disease burden, by indication, 2018 - 2022

Fig. 70 UK home healthcare market, 2018 - 2030 (USD Million)

Fig. 71 France estimated disease burden, by indication, 2018 - 2022

Fig. 72 France home healthcare market, 2018 - 2030 (USD Million)

Fig. 73 Italy estimated disease burden, by indication, 2018 - 2022

Fig. 74 Italy home healthcare market, 2018 - 2030 (USD Million)

Fig. 75 Spain estimated disease burden, by indication, 2018 - 2022

Fig. 76 Spain home healthcare market, 2018 - 2030 (USD Million)

Fig. 77 Sweden estimated disease burden, by indication, 2018 - 2022

Fig. 78 Sweden home healthcare market, 2018 - 2030 (USD Million)

Fig. 79 The Netherlands estimated disease burden, by indication, 2018 - 2022

Fig. 80 The Netherlands home healthcare market, 2018 - 2030 (USD Million)

Fig. 81 Russia estimated disease burden, by indication, 2018 - 2022

Fig. 82 Russia home healthcare market, 2018 - 2030 (USD Million)

Fig. 83 Ireland estimated disease burden, by indication, 2018 - 2022

Fig. 84 Ireland home healthcare market, 2018 - 2030 (USD Million)

Fig. 85 Switzerland estimated disease burden, by indication, 2018 - 2022

Fig. 86 Switzerland home healthcare market, 2018 - 2030 (USD Million)

Fig. 87 Denmark estimated disease burden, by indication, 2018 - 2022

Fig. 88 Denmark home healthcare market, 2018 - 2030 (USD Million)

Fig. 89 Asia Pacific home healthcare market, 2018 - 2030 (USD Million)

Fig. 90 Japan estimated disease burden, by indication, 2018 - 2022

Fig. 91 Japan home healthcare market, 2018 - 2030 (USD Million)

Fig. 92 China estimated disease burden, by indication, 2018 - 2022

Fig. 93 China home healthcare market, 2018 - 2030 (USD Million)

Fig. 94 India estimated disease burden, by indication, 2018 - 2022

Fig. 95 India home healthcare market, 2018 - 2030 (USD Million)

Fig. 96 Australia estimated disease burden, by indication, 2018 - 2022

Fig. 97 Australia home healthcare market, 2018 - 2030 (USD Million)

Fig. 98 South Korea estimated disease burden, by indication, 2018 - 2022

Fig. 99 South Korea home healthcare market, 2018 - 2030 (USD Million)

Fig. 100 Singapore estimated disease burden, by indication, 2018 - 2022

Fig. 101 Singapore home healthcare market, 2018 - 2030 (USD Million)

Fig. 102 Thailand estimated disease burden, by indication, 2018 - 2022

Fig. 103 Thailand home healthcare market, 2018 - 2030 (USD Million)

Fig. 104 Philippines estimated disease burden, by indication, 2018 - 2022

Fig. 105 Philippines home healthcare market, 2018 - 2030 (USD Million)

Fig. 106 Malaysia estimated disease burden, by indication, 2018 - 2022

Fig. 107 Malaysia home healthcare market, 2018 - 2030 (USD Million)

Fig. 108 New Zealand estimated disease burden, by indication, 2018 - 2022

Fig. 109 New Zealand home healthcare market, 2018 - 2030 (USD Million)

Fig. 110 Latin America home healthcare market, 2018 - 2030 (USD Million)

Fig. 111 Brazil estimated disease burden, by indication, 2018 - 2022

Fig. 112 Brazil home healthcare market, 2018 - 2030 (USD Million)

Fig. 113 Mexico estimated disease burden, by indication, 2018 - 2022

Fig. 114 Mexico home healthcare market, 2018 - 2030 (USD Million)

Fig. 115 Argentina estimated disease burden, by indication, 2018 - 2022

Fig. 116 Argentina home healthcare market, 2018 - 2030 (USD Million)

Fig. 117 MEA home healthcare market, 2018 - 2030 (USD Million)

Fig. 118 Saudi Arabia estimated disease burden, by indication, 2018 - 2022

Fig. 119 Saudi Arabia home healthcare market, 2018 - 2030 (USD Million)

Fig. 120 South Africa estimated disease burden, by indication, 2018 - 2022

Fig. 121 South Africa home healthcare market, 2018 - 2030 (USD Million)

Fig. 122 UAE estimated disease burden, by indication, 2018 - 2022

Fig. 123 UAE home healthcare market, 2018 - 2030 (USD Million)

Fig. 124 Egypt estimated disease burden, by indication, 2018 - 2022

Fig. 125 Egypt home healthcare market, 2018 - 2030 (USD Million)

Fig. 126 Oman estimated disease burden, by indication, 2018 - 2022

Fig. 127 Oman home healthcare market, 2018 - 2030 (USD Million)

Fig. 128 Company/competition categorization

Fig. 129 Company market position analysis: Suppliers

Fig. 130 Company market position analysis: Service Providers

Fig. 131 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Home Healthcare Market Component Outlook (USD Million, 2018 - 2030)

- Equipment

- Therapeutic

- Home respiratory therapy equipment

- Insulin delivery devices market

- Home IV pumps

- Home dialysis equipment

- Others

- Diagnostic

- Diabetic care unit

- BP monitors

- Multi para diagnostic monitors

- Home pregnancy and fertility kits

- Apnea and sleep monitors

- Holter monitors

- Heart rate meters

- Others

- Mobility assist

- Wheel chair

- Home medical furniture

- Walking assist devices

- Services

- Skilled home healthcare

- Physician Primary Care

- Nursing Care

- Physical/occupational/speech therapy

- Nutritional support & infusion therapy

- Hospice & Palliative

- Others

- Unskilled home healthcare

- Skilled home healthcare

- Therapeutic

- Equipment

- Indication Outlook (Revenue, USD Million, 2018 - 2030)

- Cardiovascular Disorder & Hypertension

- Diabetes & Kidney Disorders

- Neurological & Mental Disorders

- Respiratory Disease & COPD

- Maternal Disorders

- Mobility Disorders

- Cancer

- Wound Care

- Others

- Home Healthcare Market Regional Outlook (USD Million, 2018 - 2030)

- North America

- U.S. Home Healthcare Market, By Component (USD Million, 2018 - 2030)

- U.S. Home Healthcare Equipment Market (USD Million, 2018 - 2030)

- Therapeutic

- Home respiratory equipment

- Insulin delivery market

- Home IV pumps

- Home dialysis equipment

- Others

- Diagnostic

- Diabetic care unit

- BP monitors

- Multi para diagnostic monitors

- Home pregnancy and fertility kits

- Apnea and sleep monitors

- Holter monitors

- Heart rate meters

- Others

- Mobility Assist

- Wheel chair

- Home medical furniture

- Walking assist devices

- Therapeutic

- U.S. Home Healthcare Equipment Market (USD Million, 2018 - 2030)

- U.S. Home Healthcare Services Market (USD Million, 2018 - 2030)

- Skilled home healthcare

- Physician Primary Care

- Nursing Care

- Physical/occupational/speech therapy

- Nutritional support & infusion therapy

- Hospice & Palliative

- Others

- Unskilled home healthcare

- Skilled home healthcare

- U.S. Home Healthcare Market, By Indication (USD Million, 2018 - 2030)

- Cardiovascular Disorder & Hypertension

- Diabetes & Kidney Disorders

- Neurological & Mental Disorders

- Respiratory Disease & COPD