- Home

- »

- Medical Devices

- »

-

Home Infusion Therapy Market Size & Share Report, 2030GVR Report cover

![Home Infusion Therapy Market Size, Share & Trends Report]()

Home Infusion Therapy Market Size, Share & Trends Analysis Report By Product (Infusion Pumps, Needleless Connectors), By Application (Anti-infective, Chemotherapy), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-389-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Home Infusion Therapy Market Size & Trends

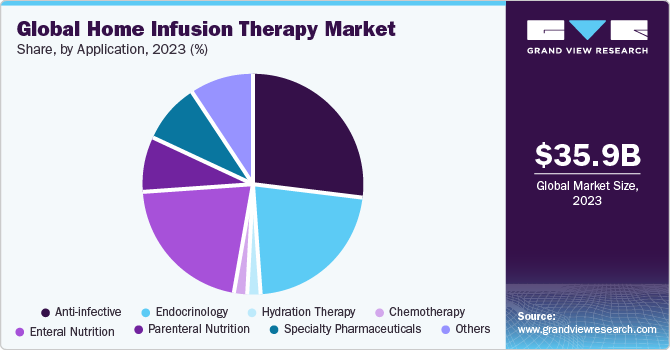

The global home infusion therapy market size was valued at USD 35.96 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2030. Home infusion therapy involves delivering therapeutic treatments, medications, or fluids directly into a patient's bloodstream through intravenous (IV) infusion, usually in the comfort and convenience of their home.

The growth of the market is driven by several key factors, including the expanding geriatric population characterized by decreased mobility, a rising preference for home care, and the swift evolution of technological advancements. Infusion therapy, encompassing essential components like IV therapy and IV hydration therapy, plays a crucial role in addressing conditions such as immune deficiencies, cancer, and congestive heart failure, where oral medication is not a viable treatment option. The increasing demand for these therapies stems from the need for long-term treatment among patients, positioning home infusion therapy as a notably cost-effective alternative to hospital-based care. The incorporation of IV therapy and IV hydration therapy serves as a driving force, providing patients with enhanced accessibility to effective and personalized medical solutions in the comfort of their homes.

The home infusion market experienced a positive shift during the COVID-19 pandemic, with home infusion becoming a crucial necessity as healthcare facilities faced a surge in COVID patients. Despite the challenges posed by regional and country-wide lockdowns, causing disruptions in operations and supply chains, the market witnessed a substantial increase in 2020. As reported by Medtech Dive in October 2020, Baxter disclosed third-quarter sales of USD 2.97 billion, marking a 4% growth attributed to the rising demand for its COVID-related medical products. Furthermore, Baxter reported operational sales growth of 6% (reaching 3.2 billion) in Q3 2021 compared to 3.0 billion in Q3 2020, indicating a sustained recovery from the pandemic's impact.

Moreover, the market's expansion is propelled by the enhanced outcomes observed in patients and the cost-effectiveness and convenience provided by home infusion therapy. The increasing demographic of baby boomers struggling with diminished mobility due to conditions such as paralysis, osteoarthritis, and diabetes is expected to amplify the demand for home infusion therapy. The growing imperative to reduce the duration of inpatient stays is a pivotal factor poised to contribute significantly to the market's growth. Remarkably, continuous subcutaneous (SC) apomorphine infusion emerges as an exceptionally effective treatment for Parkinson's disease (PD), with diverse drug formulations available for the management of PD through subcutaneous delivery. In response to the mounting burden of PD, there is a notable surge in the demand for subcutaneous infusion therapy. For instance, in line with the Parkinson's Foundation's 2022 data update, approximately 90,000 individuals receive a PD diagnosis annually in the U.S. Furthermore, the anticipated number of people living with PD in the country is projected to soar to nearly 1.2 million by the year 2030.

Market Concentration & Characteristics

The home infusion therapy market is characterized by a robust demand for patient-centric healthcare solutions, with a notable emphasis on personalized treatment in the comfort of one's home. This dynamic landscape is further marked by an increasing integration of advanced technologies, fostering innovations in infusion devices, remote monitoring, and data-driven healthcare delivery.

Moreover, strategic collaborations between healthcare providers, pharmaceutical companies, and technology firms contribute to the market's vibrancy, ensuring a comprehensive and evolving approach to home-based infusion therapy.

The market is also characterized by a high level of merger and acquisition (M&A) activity undertaken by the leading players. This is due to several factors, the rising focus on increasing the company’s products & services portfolio, the need to consolidate in a rapidly growing market, and the increasing strategic importance of home infusion therapy.

Furthermore, in March 2021, Terumo and Glooko, a company specializing in remote patient monitoring software and mobile apps, announced a technological integration to jointly provide new diabetes data solutions globally. This collaboration enables the integration of data from Terumo's diabetes care devices into Glooko's diasend diabetes data management platform.

Product Insights

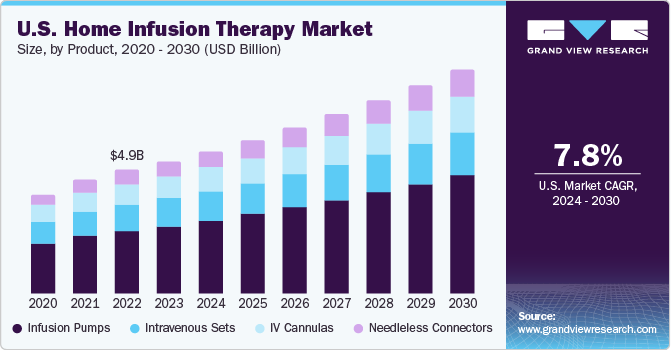

The infusion pumps segment accounted for the largest revenue share of over 51.3% in 2023. Infusion pumps, designed for controlled delivery of fluids, medications, and nutrients, were initially exclusive to healthcare facilities but are now widely adopted in outpatient settings. These devices ensure precision, reducing medication errors. The surge in home healthcare has driven the demand for syringe and ambulatory pumps. Smart pumps, featuring barcode technology, enhance patient identity verification, preventing administration errors. These pumps also provide alerts to healthcare workers in case of inappropriate dosage selection. The introduction of advanced infusion pumps, like the CADD-Solis ambulatory infusion pump by Smiths Medical, is expected to propel market growth in the forecast period.

Needleless connectors are anticipated to register the highest CAGR over the forecast period. Needless connectors are small devices employed in intravenous systems to reduce needlestick injuries, thereby preventing bacterial contamination and improving safety. These devices are evaluated on the basis of interstitial surface mechanisms, blood refluxes, visibility, and external surface mechanisms. Needless connectors enable smooth operative procedures, ensure safety, and aid in adhering to clinical practices.

Application Insights

The anti-infective segment dominated the market for home infusion therapy in 2023 with a revenue share of over 26.9%. This is attributed to the considerable number of procedures performed for the administration of antifungal and antibiotic drugs. It also helps reduce exposure to patients with other hospital-acquired infections (HAIs).

Chemotherapy is estimated to be the fastest-growing segment over the forecast period. With the growing incidences of cancer, the demand for pressure pumps is expected to increase in the coming years. Pumps used for chemotherapy at home are compact, continuous pressure pumps that do not require a battery and can hence be used for a longer period of time. With the help of these pumps, chemotherapy drugs can be administered at the appropriate infusion speed and in the right amounts.

Regional Insights

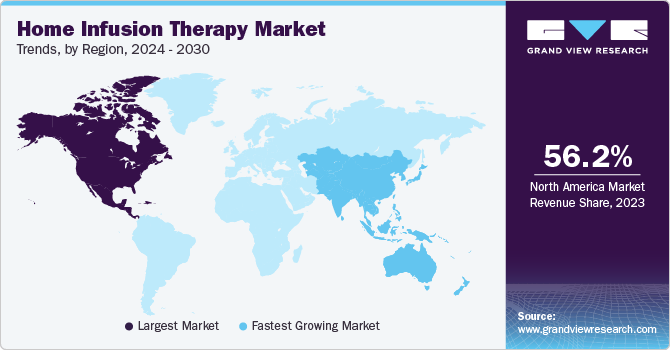

North America dominated the market in 2023 with a revenue share of over 56.22% and this trend is expected to continue throughout the forecast period. This can be attributed to the increasing R&D in the region and the rising adoption of new technology in infusion pumps. The increasing need for long-term therapy for patients with certain conditions is driving the regional market. Development of alternate healthcare settings and home infusion services and shifting preference from acute care to home care settings due to the low cost and enhanced patient mobility would boost the growth of this market in the coming years.

The Asia Pacific market is expected to register the fastest CAGR over the forecast period. This is attributed to rising patient awareness regarding the benefits of home infusion therapy over in-hospital procedures and the growing prevalence of diabetes in the region. The growing geriatric population and the rise in chronic diseases in the region are expected to further fuel the market growth. According to the Times of India, around 75 million people over the age of 60 years suffer from some chronic disease in India, which might increase the adoption of home care services in the country.

Key Companies & Market Share Insights

Some of the key players operating in the market include Baxter, BD, Smiths Medical, Terumo Corporation, ICU Medical, etc

-

Baxter International Inc., commonly known as Baxter, is a global healthcare company that specializes in providing a wide range of medical products, therapies, and technologies. With a rich history dating back to the 1930s, Baxter has evolved into a leading player in the healthcare industry. The company develops innovative solutions for critical medical needs, including renal care, medication delivery, pharmaceuticals, and various therapeutic areas.

-

Becton, Dickinson and Company (BD) is a global medical technology company. BD specializes in developing and manufacturing medical devices, laboratory equipment, and diagnostic products aimed at advancing the diagnosis and treatment of various medical conditions. With a commitment to improving healthcare outcomes, BD focuses on delivering solutions in areas such as medication management, infection prevention, diagnostics, and biosciences.

Recent Developments

-

In June 2023, Baxter International, an American healthcare company, introduced Progressa+ Next Gen ICU bed for addressing critical needs of patients at their homes. This technology makes it easier for nurses to take care of patients, while supporting therapy at home.

-

In May 2023, Fresenius Kabi, a global healthcare company, initiated an agreement with Premier, Inc., an American healthcare company, that resulted in pricing and term benefits for the Ivenix Infusion System. This system is designed to advance the reliability and simplicity of infusion pumps.

-

In May 2023, Option Care Health, a healthcare service provider, created an independent platform for home care services in collaboration with Amedisys Inc., a leading provider of home health services. This platform comprises pharmacists, dieticians, therapists, social workers, and others for providing high quality healthcare services at home.

-

In April 2023, CareFusion, currently owned by Becton Dickinson, an American medical technology company, launched an advanced ultrasound technology to provide clinicians with optimal IV insertions. More than 90% hospitalized patients receive the IV therapy, thus contributing towards the market growth of home infusion therapy.

-

In January 2022, ICU Medical, a California-based global operations company, finalized the acquisition of Smiths Medical from Smiths Group Plc for creating a leading infusion therapy company with a combined revenue of USD 2.5 billion.

-

In November 2021, Terumo Corporation, a global medical device company, developed a smartphone device for controlling insulin pump. This device can be utilized as a home infusion therapy by patients for harmonizing the insulin therapy at home.

Key Home Infusion Therapy Companies:

- CVS/Coram

- Option Care Health

- BriovaRx/Diplomat (UnitedHealth Optum)

- PharMerica

- Fresenius Kabi

- ICU Medical, Inc.

- B. Braun Melsungen AG

- Baxter

- BD

- Caesarea Medical Electronics

- Smiths Medical

- Terumo Corporation

- JMS Co. Ltd.

Home Infusion Therapy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 38.66 billion

Revenue forecast in 2030

USD 61.7 billion

Growth Rate

CAGR of 8.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Netherlands; Belgium; Switzerland; Russia; Sweden; Norway; Denmark; China; India; Japan; Australia; South Korea; Malaysia; Indonesia; Singapore; Philippines; Thailand; Mexico; Brazil; Argentina; Colombia; Chile; South Africa; Saudi Arabia; UAE; Israel; Egypt; Kuwait

Key companies profiled

CVS/Coram; Option Care Health; BriovaRx/Diplomat (UnitedHealth Optum); PharMerica; Fresenius Kabi; ICU Medical, Inc.; B. Braun Melsungen AG; Baxter; BD; Caesarea Medical Electronics; Smiths Medical; Terumo Corporation; JMS Co. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Home Infusion Therapy Market Report Segmentation

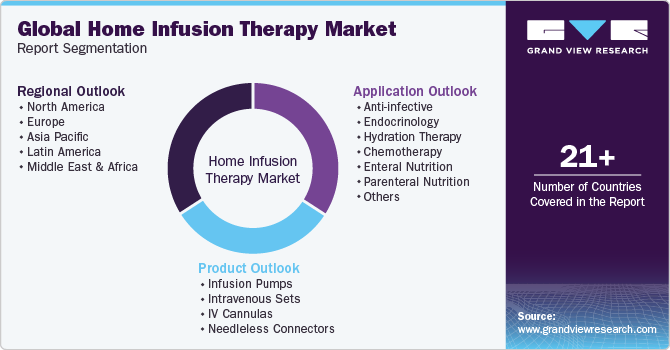

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global home infusion therapy market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Infusion Pumps

-

Elastomeric

-

Electromechanical

-

Gravity

-

Others

-

-

Intravenous Sets

-

IV Cannulas

-

Needleless Connectors

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-infective

-

Endocrinology

-

Diabetes

-

Others

-

-

Hydration Therapy

-

Athletes

-

Others

-

-

Chemotherapy

-

Enteral Nutrition

-

Parenteral Nutrition

-

Specialty Pharmaceuticals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Italy

-

Netherlands

-

Belgium

-

Switzerland

-

Russia

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

South Korea

-

Malaysia

-

Indonesia

-

Singapore

-

Philippines

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Colombia

-

Chile

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Israel

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global home infusion therapy market size was estimated at USD 33.5 billion in 2022 and is expected to reach USD 35.9 billion in 2023.

b. The global home infusion therapy market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 61.7 billion by 2030.

b. North America dominated the home infusion therapy market with a share of 56.5% in 2022. This can be attributed to increasing R&D in the region and the rising adoption of new technology in infusion pumps. The increasing need for long-term therapy for patients with certain conditions is driving the regional market growth.

b. Some key players operating in the home infusion therapy market include B. Braun Melsungen AG; Baxter; Caesarea Medical Electronics; CareFusion Corporation; Fresenius Kabi; ICU Medical, Inc.; JMS Co. Ltd.; Smiths Medical; and Terumo Corporation.

b. Key factors that are driving the home infusion therapy market growth include the increasing geriatric population with decreased mobility profile, rising preference for home care, and rapid technological advancements.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation & Scope

1.1.1. Product

1.1.2. Application

1.1.3. Regional scope

1.1.4. Estimates and forecast timeline

1.2. Research Methodology

1.3. Information Procurement

1.3.1. Purchased database

1.3.2. GVR’s internal database

1.3.3. Secondary sources

1.3.4. Primary research

1.4. Information or Data Analysis

1.4.1. Data analysis models

1.5. Market Formulation & Validation

1.6. Model Details

1.6.1. Commodity flow analysis (Model 1)

1.6.1.1. Approach 1: Commodity flow approach

1.7. List of Secondary Sources

1.8. List of Primary Sources

1.9. Objectives

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Home Infusion Therapy Market Variables, Trends & Scope

3.1. Market Lineage outlook

3.1.1. Parent market outlook

3.1.2. Related/ancillary market outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing geriatric population

3.2.1.2. Rising prevalence of chronic diseases

3.2.1.3. Recent technological advancements in infusion pumps

3.2.1.4. Home healthcare as cost-effective alternative

3.2.1.5. Improving healthcare infrastructure in emerging economies

3.2.2. Market Restraint Analysis

3.2.2.1. Product recall

3.2.2.2. Presence of complicated reimbursement framework and reimbursement cuts

3.2.3. Industry Challenges

3.2.3.1. Rising cost of home infusion therapy

3.3. Home Infusion Therapy: Market Analysis Tools

3.3.1. Industry Analysis - Porter’s

3.3.1.1. Supplier Power

3.3.1.2. Buyer Power

3.3.1.3. Substitution Threat

3.3.1.4. Threat from new entrants

3.3.1.5. Competitive rivalry

3.3.2. PESTEL Analysis

3.3.2.1. Political Landscape

3.3.2.2. Environmental Landscape

3.3.2.3. Social Landscape

3.3.2.4. Technology Landscape

3.3.2.5. Legal Landscape

Chapter 4. Home Infusion Therapy Market: Segment Analysis, by Product, 2018 - 2030 (USD Million)

4.1. Definitions & Scope

4.2. Product market share analysis, 2023 & 2030

4.3. Segment Dashboard

4.4. Global Home Infusion Therapy Market, by Product, 2018 to 2030

4.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

4.5.1. Infusion pumps

4.5.1.1. Elastomeric

4.5.2.1 Electrochemical

4.5.2.2 Gravity

4.5.2.3 Others

4.5.2. Intravenous Sets

4.5.3. IV cannulas

4.5.4. Needleless connectors

Chapter 5. Home Infusion Therapy Market: Segment Analysis, By Application, 2018 - 2030 (USD Million)

5.1. Definitions & Scope

5.2. Application market share analysis, 2023 & 2030

5.3. Segment Dashboard

5.4. Global Home Infusion Therapy Market, By Application, 2018 to 2030

5.5. Market Size & Forecasts and Trend Analyses, 2018 to 2030 for the following

5.5.1. Anti-infective

5.5.2. Endocrinology

5.5.2.1 Diabetes

5.5.2.2 Others

5.5.3. Hydration Therapy

5.5.3.1. Athletes

5.5.3.2. Others

5.5.4. Chemotherapy

5.5.5. Enteral Nutrition

5.5.6. Parenteral Nutrition

5.5.7. Specialty Pharmaceuticals

5.5.8. Others

Chapter 6. Home Infusion Therapy Market: Regional Market Analysis, by Product, 2018 - 2030 (USD Million)

6.1. Regional Market Share Analysis, 2023 & 2030

6.2. Regional Market Dashboard

6.3. Regional Market Snapshot

6.4. Regional Market Share, 2023

6.5. Market Size, & Forecasts, and Trend Analysis, 2018 to 2030:

6.6. North America

6.6.1. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

6.6.2. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.6.3. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.6.4. U.S.

6.6.4.1. Key Country Dynamics

6.6.4.2. Competitive Scenario

6.6.4.3. Regulatory Framework

6.6.4.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.6.4.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.6.5. Canada

6.6.5.1. Key Country Dynamics

6.6.5.2. Competitive Scenario

6.6.5.3. Regulatory Framework

6.6.5.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.6.5.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7. Europe

6.7.1. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

6.7.2. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.3. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.4. Germany

6.7.4.1. Key Country Dynamics

6.7.4.2. Competitive Scenario

6.7.4.3. Regulatory Framework

6.7.4.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.4.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.5. U.K.

6.7.5.1. Key Country Dynamics

6.7.5.2. Competitive Scenario

6.7.5.3. Regulatory Framework

6.7.5.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.5.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.6. France

6.7.6.1. Key Country Dynamics

6.7.6.2. Competitive Scenario

6.7.6.3. Regulatory Framework

6.7.6.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.6.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.7. Italy

6.7.7.1. Key Country Dynamics

6.7.7.2. Competitive Scenario

6.7.7.3. Regulatory Framework

6.7.7.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.7.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.8. Spain

6.7.8.1. Key Country Dynamics

6.7.8.2. Competitive Scenario

6.7.8.3. Regulatory Framework

6.7.8.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.8.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.9. Netherlands

6.7.9.1. Key Country Dynamics

6.7.9.2. Competitive Scenario

6.7.9.3. Regulatory Framework

6.7.9.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.9.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.10. Belgium

6.7.10.1. Key Country Dynamics

6.7.10.2. Competitive Scenario

6.7.10.3. Regulatory Framework

6.7.10.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.10.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.11. Switzerland

6.7.11.1. Key Country Dynamics

6.7.11.2. Competitive Scenario

6.7.11.3. Regulatory Framework

6.7.11.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.11.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.12. Russia

6.7.12.1. Key Country Dynamics

6.7.12.2. Competitive Scenario

6.7.12.3. Regulatory Framework

6.7.12.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.12.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.13. Sweden

6.7.13.1. Key Country Dynamics

6.7.13.2. Competitive Scenario

6.7.13.3. Regulatory Framework

6.7.13.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.13.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.14. Denmark

6.7.14.1. Key Country Dynamics

6.7.14.2. Competitive Scenario

6.7.14.3. Regulatory Framework

6.7.14.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.14.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.7.15. Norway

6.7.15.1. Key Country Dynamics

6.7.15.2. Competitive Scenario

6.7.15.3. Regulatory Framework

6.7.15.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.7.15.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8. Asia Pacific

6.8.1. Market estimates and forecast, by country, 2018 - 2030 (USD Million)

6.8.2. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.3. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8.4. China

6.8.4.1. Key Country Dynamics

6.8.4.2. Competitive Scenario

6.8.4.3. Regulatory Framework

6.8.4.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.4.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8.5. Japan

6.8.5.1. Key Country Dynamics

6.8.5.2. Competitive Scenario

6.8.5.3. Regulatory Framework

6.8.5.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.5.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8.6. India

6.8.6.1. Key Country Dynamics

6.8.6.2. Competitive Scenario

6.8.6.3. Regulatory Framework

6.8.6.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.6.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8.7. Australia

6.8.7.1. Key Country Dynamics

6.8.7.2. Competitive Scenario

6.8.7.3. Regulatory Framework

6.8.7.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.7.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8.8. South Korea

6.8.8.1. Key Country Dynamics

6.8.8.2. Competitive Scenario

6.8.8.3. Regulatory Framework

6.8.8.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.8.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.8.9. Malaysia

6.8.9.1. Key Country Dynamics

6.8.9.2. Competitive Scenario

6.8.9.3. Regulatory Framework

6.8.9.4. Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.8.9.5. Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.9.10 Indonesia

6.9.10.1 Key Country Dynamics

6.9.10.2 Competitive Scenario

6.9.10.3 Regulatory Framework

6.9.10.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.9.10.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.9.11 Singapore

6.9.11.1 Key Country Dynamics

6.9.11.2 Competitive Scenario

6.9.11.3 Regulatory Framework

6.9.11.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.9.11.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.9.12 Philippines

6.9.12.1 Key Country Dynamics

6.9.12.2 Competitive Scenario

6.9.12.3 Regulatory Framework

6.9.12.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.9.12.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.9.13 Thailand

6.9.13.1 Key Country Dynamics

6.9.13.2 Competitive Scenario

6.9.13.3 Regulatory Framework

6.9.13.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.9.13.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10 Latin America

6.10.1 Market estimates and forecast, by country, 2018 - 2030 (USD Million)

6.10.2 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.3 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10.4 Brazil

6.10.4.1 Key Country Dynamics

6.10.4.2 Competitive Scenario

6.10.4.3 Regulatory Framework

6.10.4.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.4.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10.5 Mexico

6.10.5.1 Key Country Dynamics

6.10.5.2 Competitive Scenario

6.10.5.3 Regulatory Framework

6.10.5.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.5.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10.6 Argentina

6.10.6.1 Key Country Dynamics

6.10.6.2 Competitive Scenario

6.10.6.3 Regulatory Framework

6.10.6.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.6.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10.7 Colombia

6.10.7.1 Key Country Dynamics

6.10.7.2 Competitive Scenario

6.10.7.3 Regulatory Framework

6.10.7.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.7.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10.8 Chile

6.10.8.1 Key Country Dynamics

6.10.8.2 Competitive Scenario

6.10.8.3 Regulatory Framework

6.10.8.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.8.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.11 Middle East and Africa

6.11.1 Market estimates and forecast, by country, 2018 - 2030 (USD Million)

6.11.2 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.11.3 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.11.4 South Africa

6.11.4.1 Key Country Dynamics

6.11.4.2 Competitive Scenario

6.11.4.3 Regulatory Framework

6.11.4.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.11.4.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.11.5 Saudi Arabia

6.11.5.1 Key Country Dynamics

6.11.5.2 Competitive Scenario

6.11.5.3 Regulatory Framework

6.11.5.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.11.5.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.11.6 UAE

6.11.6.1 Key Country Dynamics

6.11.6.2 Competitive Scenario

6.11.6.3 Regulatory Framework

6.11.6.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.11.6.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.11.7 Israel

6.11.7.1 Key Country Dynamics

6.11.7.2 Competitive Scenario

6.11.7.3 Regulatory Framework

6.11.7.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.11.7.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.11.8 Egypt

6.11.8.1 Key Country Dynamics

6.11.8.2 Competitive Scenario

6.11.8.3 Regulatory Framework

6.11.8.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.11.8.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

6.10.1 Kuwait

6.10.1.1 Key Country Dynamics

6.10.1.2 Competitive Scenario

6.10.1.3 Regulatory Framework

6.10.1.4 Market estimates and forecast, by Product, 2018 - 2030 (USD Million)

6.10.1.5 Market estimates and forecast, by Application, 2018 - 2030 (USD Million)

Chapter 7 Home Infusion Therapy Market - Competitive Analysis

7.10 Key companies profiled

7.10.1 Caesarea Medical Electronics

7.10.1.1 Company Overview

7.10.1.2 Financial Performance

7.10.1.3 Product Benchmarking

7.10.1.4 Strategic Initiatives

7.10.2 CareFusion Corporation

7.10.2.1 Company Overview

7.10.2.2 Financial Performance

7.10.2.3 Product Benchmarking

7.10.2.4 Strategic Initiatives

7.10.3 Baxter

7.10.3.1 Company Overview

7.10.3.2 Financial Performance

7.10.3.3 Product Benchmarking

7.10.3.4 Strategic Initiatives

7.10.4 B. Braun Melsungen AG

7.10.4.1 Company Overview

7.10.4.2 Financial Performance

7.10.4.3 Product Benchmarking

7.10.4.4 Strategic Initiatives

7.10.5 Fresenius Kabi

7.10.5.1 Company Overview

7.10.5.2 Financial Performance

7.10.5.3 Product Benchmarking

7.10.5.4 Strategic Initiatives

7.10.6 ICU Medical, Inc.

7.10.6.1 Company Overview

7.10.6.2 Financial Performance

7.10.6.3 Product Benchmarking

7.10.6.4 Strategic Initiatives

7.10.7 JMS Co. Ltd.

7.10.7.1 Company Overview

7.10.7.2 Financial Performance

7.10.7.3 Product Benchmarking

7.10.7.4 Strategic Initiatives

7.10.8 Smiths Medical

7.10.8.1 Company Overview

7.10.8.2 Financial Performance

7.10.8.3 Product Benchmarking

7.10.8.4 Strategic Initiatives

7.10.9 Terumo Corporation

7.10.9.1 Company Overview

7.10.9.2 Financial Performance

7.10.9.3 Product Benchmarking

7.10.9.4 Strategic Initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global Home Infusion Therapy Market, By Region 2018 - 2030 (USD Million)

Table 4 Global Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 5 Global Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 6 North America Home Infusion Therapy Market, By Country, 2018 - 2030 (USD Million)

Table 7 North America Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 8 North America Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 9 U.S. Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 10 U.S. Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 11 Canada Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 12 Canada Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 13 Europe Home Infusion Therapy Market, By Country, 2018 - 2030 (USD Million)

Table 14 Europe Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 15 Europe Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 16 U.K. Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 17 U.K. Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 18 Germany Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 19 Germany Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 20 France Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 21 France Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 22 Italy Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 23 Italy Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 24 Spain Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 25 Spain Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 26 Netherlands Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 27 Netherlands Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 28 Belgium Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 29 Belgium Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 30 Switzerland Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 31 Switzerland Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 32 Russia Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 33 Russia Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 34 Sweden Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 35 Sweden Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 36 Norway Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 37 Norway Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 38 Denmark Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 39 Denmark Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 40 Asia Pacific Home Infusion Therapy Market, By Country, 2018 - 2030 (USD Million)

Table 41 Asia Pacific Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 42 Asia Pacific Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 43 India Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 44 India Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 45 Japan Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 46 Japan Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 47 China Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 48 China Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 49 Australia Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 50 Australia Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 51 South Korea Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 52 South Korea Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 53 Malaysia Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 54 Malaysia Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 55 Indonesia Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 56 Indonesia Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 57 Singapore Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 58 Singapore Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 59 Philippines Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 60 Philippines Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 61 Thailand Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 62 Thailand Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 63 Latin America Home Infusion Therapy Market, By Country, 2018 - 2030 (USD Million)

Table 64 Latin America Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 65 Latin America Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 66 Brazil Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 67 Brazil Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 68 Mexico Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 69 Mexico Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 70 Argentina Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 71 Argentina Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 72 Colombia Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 73 Colombia Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 74 Chile Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 75 Chile Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 76 MEA Home Infusion Therapy Market, By Country, 2018 - 2030 (USD Million)

Table 77 MEA Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 78 MEA Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 79 South Africa Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 80 South Africa Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 81 Saudi Arabia Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 82 Saudi Arabia Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 83 UAE Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 84 UAE Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 85 Israel Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 86 Israel Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 87 Egypt Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 88 Egypt Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

Table 89 Kuwait Home Infusion Therapy Market, By Product, 2018 - 2030 (USD Million)

Table 90 Kuwait Home Infusion Therapy Market, By Application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market research process

Fig. 2 Data triangulation techniques

Fig. 3 Primary research pattern

Fig. 4 Market research approaches

Fig. 5 Value-chain-based sizing & forecasting

Fig. 6 Market formulation & validation

Fig. 7 Home Infusion Therapy Market: Market snapshot

Fig. 8 Home Infusion Therapy Market: Market segmentation

Fig. 9 Home Infusion Therapy Market Strategy framework

Fig. 10 Parent market outlook

Fig. 11 Related/ancillary market outlook

Fig. 12 Home Infusion Therapy Market driver impact

Fig. 13 Home Infusion Therapy Market restraint impact

Fig. 14 Home Infusion Therapy Market Porter’s Five Forces Analysis

Fig. 15 Home Infusion Therapy Market PESTEL analysis

Fig. 16 Home Infusion Therapy Market segment dashboard

Fig. 17 Home Infusion Therapy Market: Product Movement Analysis

Fig. 18 Infusion pumps estimates and forecast, 2018 - 2030 (USD Million)

Fig. 19 Intravenous Sets estimates and forecast, 2018 - 2030 (USD Million)

Fig. 20 IV cannulas estimates and forecast, 2018 - 2030 (USD Million)

Fig. 21 Needleless connectors estimates and forecast, 2018 - 2030 (USD Million)

Fig. 22 Home Infusion Therapy Market segment dashboard

Fig. 23 Home Infusion Therapy Market: Application Movement Analysis

Fig. 24 Anti-Infective market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 25 Endocrinology market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 26 Hydration Therapy market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 27 Chemotherapy market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 28 Enteral Nutrition market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 29 Parenteral Nutrition market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 30 Specialty Pharmaceuticals market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 31 Others market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 32 Global Home Infusion Therapy Market: Regional movement analysis

Fig. 33 Global Home Infusion Therapy Market: Regional outlook and key takeaways

Fig. 34 Global market share, by region

Fig. 35 North America market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 36 U.S. market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 37 Canada market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 38 Europe market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 39 U.K. market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 40 Germany market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 41 France market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 42 Italy market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 43 Spain market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 44 Netherlands market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 45 Belgium market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 46 Switzerland market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 47 Russia market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 48 Sweden market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 49 Norway market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 50 Denmark market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 51 Asia Pacific market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 52 China market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 53 Japan market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 54 India market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 55 Australia market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 56 South Korea market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 57 Malaysia market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 58 Indonesia market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 59 Singapore market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 60 Philippines market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 61 Thailand market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 62 Latin America market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 63 Brazil market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 64 Mexico market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 65 Argentina market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 66 Colombia market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 67 Chile market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 68 Middle East and Africa. market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 69 South Africa market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 70 Saudi Arabia market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 71 UAE market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 72 Israel market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 73 Egypt market estimates and forecast, 2018 - 2030 (USD Million)

Fig. 74 Kuwait market estimates and forecast, 2018 - 2030 (USD Million)What questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Home Infusion Therapy Product Outlook (Revenue, USD Million, 2017 - 2030)

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Home Infusion Therapy Application Outlook (Revenue, USD Million, 2017 - 2030)

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Home Infusion Therapy Route of Administration Outlook (Revenue, USD Million, 2017 - 2030)

- Intramuscular

- Subcutaneously

- Epidural

- Home Infusion Therapy Regional Outlook (Revenue, USD Million, 2017 - 2030)

- North America

- North America Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- North America Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- North America Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- U.S.

- U.S. Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- U.S. Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- U.S. Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Canada

- Canada Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Canada Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Canada Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Canada Home Infusion Therapy Market, By Product

- North America Home Infusion Therapy Market, By Product

- Europe

- Europe Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Europe Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Europe Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- U.K.

- U.K. Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- U.K. Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- U.K. Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- U.K. Home Infusion Therapy Market, By Product

- Germany

- Germany Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Germany Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Germany Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Germany Home Infusion Therapy Market, By Product

- France

- France Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- France Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- France Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- France Home Infusion Therapy Market, By Product

- Spain

- Spain Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Spain Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Spain Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Spain Home Infusion Therapy Market, By Product

- Italy

- Italy Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Italy Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Italy Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Italy Home Infusion Therapy Market, By Product

- Netherlands

- Netherlands Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Netherlands Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Netherlands Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Netherlands Home Infusion Therapy Market, By Product

- Belgium

- Belgium Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Belgium Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Belgium Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Belgium Home Infusion Therapy Market, By Product

- Switzerland

- Switzerland Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Switzerland Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Switzerland Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Switzerland Home Infusion Therapy Market, By Product

- Russia

- Russia Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Russia Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Russia Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Russia Home Infusion Therapy Market, By Product

- Sweden

- Sweden Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Sweden Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Sweden Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Sweden Home Infusion Therapy Market, By Product

- Europe Home Infusion Therapy Market, By Product

- Asia Pacific

- Asia Pacific Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Asia Pacific Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Asia Pacific Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- India

- India Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- India Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- India Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- India Home Infusion Therapy Market, By Product

- Japan

- Japan Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Japan Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Japan Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Japan Home Infusion Therapy Market, By Product

- China

- China Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- China Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- China Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- China Home Infusion Therapy Market, By Product

- Australia

- Australia Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Australia Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Australia Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Australia Home Infusion Therapy Market, By Product

- South Korea

- South Korea Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- South Korea Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- South Korea Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- South Korea Home Infusion Therapy Market, By Product

- Malaysia

- Malaysia Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Malaysia Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Malaysia Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Malaysia Home Infusion Therapy Market, By Product

- Indonesia

- Indonesia Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Indonesia Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Indonesia Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Indonesia Home Infusion Therapy Market, By Product

- Singapore

- Singapore Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Singapore Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Singapore Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Singapore Home Infusion Therapy Market, By Product

- Philippines

- Philippines Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Philippines Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Philippines Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Philippines Home Infusion Therapy Market, By Product

- Thailand

- Thailand Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Thailand Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Thailand Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Thailand Home Infusion Therapy Market, By Product

- Latin America

- Latin America Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Latin America Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Latin America Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Brazil

- Brazil Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Brazil Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Brazil Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Brazil Home Infusion Therapy Market, By Product

- Mexico

- Mexico Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Mexico Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Mexico Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Mexico Home Infusion Therapy Market, By Product

- Argentina

- Argentina Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Argentina Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Argentina Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Argentina Home Infusion Therapy Market, By Product

- Colombia

- Colombia Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Colombia Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Colombia Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Colombia Home Infusion Therapy Market, By Product

- Chile

- Chile Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Chile Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Chile Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Chile Home Infusion Therapy Market, By Product

- Latin America Home Infusion Therapy Market, By Product

- Middle East & Africa

- Middle East & Africa Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Middle East & Africa Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Middle East & Africa Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- South Africa

- South Africa Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- South Africa Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- South Africa Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- South Africa Home Infusion Therapy Market, By Product

- Saudi Arabia

- Saudi Arabia Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Saudi Arabia Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Saudi Arabia Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Saudi Arabia Home Infusion Therapy Market, By Product

- UAE

- UAE Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- UAE Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- UAE Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- UAE Home Infusion Therapy Market, By Product

- Israel

- Israel Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Israel Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Israel Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Israel Home Infusion Therapy Market, By Product

- Egypt

- Egypt Home Infusion Therapy Market, By Product

- Infusion Pumps

- Elastomeric

- Electromechanical

- Gravity

- Others

- Intravenous Sets

- IV Cannulas

- Needleless Connectors

- Infusion Pumps

- Egypt Home Infusion Therapy Market, By Application

- Anti-Infective

- Endocrinology

- Diabetes

- Others

- Hydration Therapy

- Athletes

- Others

- Chemotherapy

- Enteral Nutrition

- Parenteral Nutrition

- Specialty Pharmaceuticals

- Others

- Egypt Home Infusion Therapy Market, By Route of Administration

- Intramuscular

- Subcutaneously

- Epidural

- Egypt Home Infusion Therapy Market, By Product

- North America

Home Infusion Therapy Market Dynamics

Driver: Increasing geriatric population