- Home

- »

- Homecare & Decor

- »

-

Home Textile Market Size, Share And Growth Report, 2030GVR Report cover

![Home Textile Market Size, Share & Trends Report]()

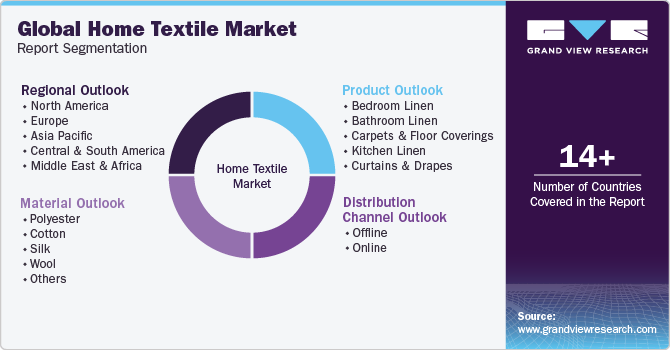

Home Textile Market Size, Share & Trends Analysis Report By Product (Bedroom Linen, Bathroom Linen, Carpets and Floor Coverings, Kitchen Linen, Curtains and Drapes), By Material (Polyester, Cotton, Silk), By Distribution Channel Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-095-8

- Number of Report Pages: 83

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Home Textile Market Size & Trends

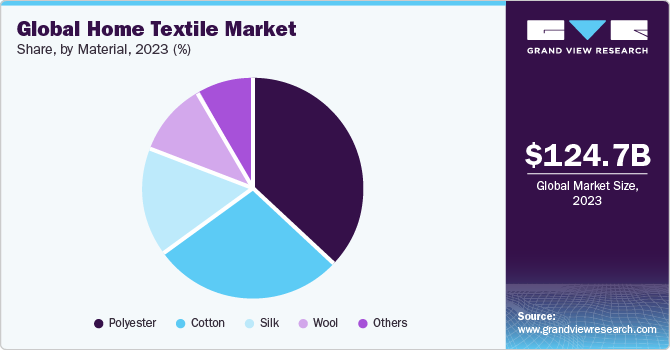

The global home textile market size was valued at USD 124.72 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) 6.0% from 2024 to 2030. Home textiles have become more than a basic necessity in modern homes across the globe. They are increasingly being viewed as an extended part of a homeowner’s personality, tastes, and preferences. Product manufacturers have been constantly innovating in terms of designs, styles, quality, patterns, and applications to attract more consumers. Spending on interior design and house decoration has expanded as a result of the expanding real estate industry and rising standards of living. This is also anticipated to be one of the major drivers of market expansion throughout the foreseeable future.

The market for home textiles & furnishing fabrics is extremely wide and varied in terms of prices, designs, as well as colors. While affluent consumers have refined international taste in terms of quality and design, with no price constraints, mid and economy-segment consumers opt for huge volumes of reasonably priced products. With growing awareness regarding the environment, safety, hygiene, and functionality, the demand for better-quality stain-resistant and flame-retardant home textiles is increasing.

Home textile products that blend well with the walls and the color of the house to complement modern furniture as well as lights and colors of the rooms to elevate the overall look of the house have always been a prime expectation of people. Most manufacturers have gained popularity for a similar reason as they provide complete sets of fashionable and luxurious home textile products.

Innovation in design focusing on vintage high-end home textile has become a significant consumer preference. Market players are now catering to this demand by offering a wide range of old-school and vintage textiles for both interior and exterior decor. These fabrics often feature timeless patterns, luxurious textures, and classic color palettes, resonating with consumers who appreciate the charm and elegance of vintage aesthetics. This trend allows individuals to infuse their living spaces with a sense of nostalgia and sophistication, creating unique and timeless atmospheres.

Market Concentration & Characteristics

Market growth stage is moderate, and pace of the market growth is accelerating. The home textile market is characterized by increasing consumer preferences for luxury home décor and favoring cozy and striong focus on healthy home textile fabrics. Als, the consumers are moving away from synthetic textiles, and the market is favoring organic and recycled fibers owing to the growing popularity of sustainable and environmentally friendly materials with transparency certifications.

Acquisitions are essential in the luxury fabric market as they allow companies to quickly expand their product offerings, tap into new customer segments, and strengthen their brand presence. By acquiring established brands or complementary businesses, companies can access valuable resources, such as design expertise, distribution networks, and customer relationships, that are crucial for thriving in this competitive market.

Innovations in the product and brand launches are crucial for launching innovative products in this market. Home décor and home furniture sector rely on new product offerings to stay competitive and meet the evolving consumer demands for home textile with innovative features and prints or fabric.

Regulatory standards often set quality benchmarks for home textiles, ensuring consumer safety and product integrity. Also, regulations related to international trade can affect the competition by influenching import/export regulations. Companies that can consistently meet or exceed these standards may gain a comparative advantage in the global marketplace.

The concentration of end-users can influence the negotiation dynamics between suppliers and buyers. Changes in the preferences or economic conditions of major end-uers can have a major impact on the entire home textile industry. Also, existing relationships between major end-users and established suppliers could create entry barriers for new companies trying to gain a foothold in the market.

Product subsitututes impact the home textioe industry by influencing the price sensitivity, consumer choice and competitive strategies. Companies must differentiate and consider factors like supply chain, market saturation and regulatory compliance to have an absolute advantage over the home textile marketplace on a global level.

Product Insights

The bedroom linen market accounted for a share of over 45% of the global revenues in 2023. In traditional blankets, soft-twist yarns are used in the filling while higher-twist yarns are used in the warp. Wool, acrylic, polyester, or a mix of these fibers may be used in the yarns. Nylon-based blends are also often used. The fabric is highly napped to create a thick, tight, fuzzy surface. Thermal blankets are knitted with an open lightweight construction or woven in a variation of the plain weave, such as a honeycomb design.

Curtains are generally less expensive than blinds and shades. Therefore, they have gained significant popularity among the low- and middle-income population groups. Over the past few years, the demand for soundproof and blackout curtains has been gaining popularity in the commercial sector such as transportation, malls, airports, movie theatres, and hospitals. Additionally, curtains are a traditional way to cover windows, and thus, these products are widely popular among consumers looking for economical options. Furthermore, the rise of smart homes has led to the integration of advanced technology into everyday items, enhancing convenience and automation.

Material Insights

Polyester-based home textiles dominated with a share of over 37% of the global revenues in 2023. This material is durable and long-lasting, making it a popular choice for items such as bedding, curtains, and upholstery. It is also relatively easy to care for, as it is resistant to wrinkles and shrinking, and can be machine-washed and dried. Also, unlike some natural fibers, poilyester is likely to harbor allegens like dust mites, making it a preferred choice for those with allergies.

The cotton-based home textiles market is projected to grow at a CAGR of over 6% from 2024 to 2030. Himatsingka has introduced a new line of Calvin Klein bedding that is composed of a combination of 35% recycled cotton scraps and 65% lyocell fibers. In the meantime, Pem America has unveiled its Upcycle line of bedding, throws, and shower and bathroom curtains made from recycled materials. Additionally, licensed goods sold in Canada under the London Fog and Crayola brands are available in recycled packaging.

Distribution Channel Insights

Offline sales dominated the global revenues with a share of over 65% in 2023. Growing urbanization, coupled with the expansion of supermarkets and hypermarkets to further extend their reach to maximum consumers, is expected to drive the global market through offline distribution channels across the globe over the forecast period. Moreover, major manufacturers in the market are inclined to sell their products via offline channels, positively impacting the growth of the distribution channel market.

Online sales of home textiles are projected to grow at a CAGR of over 6% from 2024 to 2030. Third-party sellers sell products of major manufacturers as well as local producers. They excel by establishing a strong supply chain that extends across India. Thus, when customers buy from international players that might not be available in the country, third-party suppliers offer the perfect solution. Manufacturers also offer online assistance through specialists and experts, who—after understanding the requirements of the buyers—suggest appropriate products from their product lines.

Regional Insights

The Asia Pacific home textiles market dominated the global industry with a revenue share of over 20% in 2023. The home textiles market in this region is highly competitive owing to the presence of manufacturers with wide geographical presence, brand awareness, and vast distribution networks. Market players are expected to increase their focus on product innovation with increasing expenditure on research and development. The development of products as per application area, price competition, and competent distribution channels are among the prime strategies for competitive advantage. The number of mergers and acquisitions is expected to grow over the period as companies are expanding their geographical reach with this approach. Further, this inorganic method of growth is the fastest way to incorporate newer technologies, products, and customer base in one’s organization.

The Europe home textile market is expected to grow at a CAGR of around 7.5% from 2024 to 2030. The country is also the largest importer and exporter of home textiles in Europe. In 2022, made-ups such as kitchen linens topped the list of home textile imports in Germany, with a total value of $1.794 billion, representing 27.89% of the country's total imports in this category. Increased imports can help stimulate competition in the domestic market, encouraging local manufacturers to improve their product offerings and pricing to remain competitive.

Economic growth in the Central & South American region has led to an increased disposable income, allowing the consumers to spend more on the home décor and textiles. Also, the region’s popularity as a tourist destination has contributed to the growth of the home textile market as the tourists usually seek locally inspired or crafted home textiles, specially ones that reflect their heritage and traditions.

The home textile market in the UK is gaining a potential surge that is mainly driven by the increasing adoption of sustainable home textile products. Haines Collection, a UK-based home textile designer started an online platform in 2020 for the resale of unwanted wallpapers, lights, textiles, and accessories.

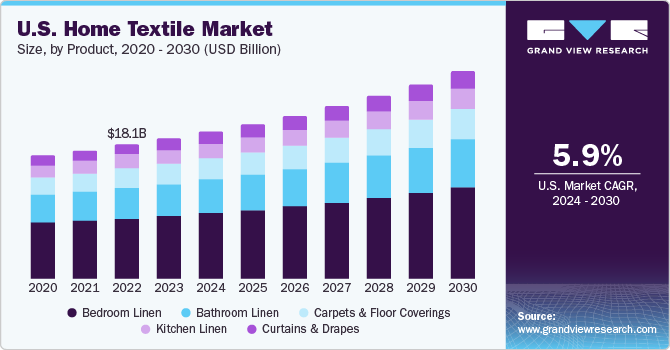

The North America home textiles market is expected to grow at a CAGR of over 5% from 2024 to 2030. A shift towards sustainable and environmentally-friendly products, and this has impacted the home textiles industry as well. Consumers are increasingly seeking out eco-friendly and organic products, such as bedding, towels, and curtains made from sustainable materials, which are manufactured in an environmentally responsible manner. Welspun Group; Ralph Lauren; New Sega Home Textiles; Standard Textiles; and companies under the H&M Group are actively contributing to the promotion of sustainable home textiles in the U.S. home textiles industry.

Key Companies & Market Share Insights

The industry is characterized by the presence of a several established players and new entrants. Players in the market are diversifying and expanding their operations, adopting product launches, and other strategies in order to maintain market share. Welspun Group has a wide variety of home textile brands and a product portfolio comprising three major categories: bed, bath, and flooring. Welspun utilizes both offline and online distribution channels to market its home textile brands through strategic partnerships with major retailers such as Amazon, Flipkart, IKEA, Lifestyle, and Shoppers Stop. Its brand, Welhome, which is marketed through retail partnerships with e-commerce platforms such as Amazon, Flipkart, and Myntra. The company exports its home textile products to over 50 countries around the world.

Key Home Textile Companies:

The following are the leading companies in the home textile market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these home textile companies are analyzed to map the supply network.

- Welspun Group

- Springs Global

- New Sega Home Textiles

- Ralph Lauren Corporation

- Shenzhen Fuanna

- Trident Group

- Marvic Textiles

- Shanghai Hometex, Honsun

- Hunan Mendale Hometextile Company Ltd.

- LLC Honsun Home Textile

Recent Developments

-

In January 2023, BKS Textiles, a home textile brand based in India announced its plans to launch the sustainable bedding brand ‘Ekoscious’ which consists of materials that include cotton, hemp, linen, bamboo, recycled polyester and Tencel.

-

In December 2022, Textile Firm based in Milan Gruppo Piacenza SpA acquired Arte Tessile Snc,. A brand that specializes in oatternmacking for jacquard and raschel textiles. These textiles are widely used in producing net curtains, table covers and outwear garments.

-

In October 2021, Himatsingka Seide expanded its sheet towel production by 60% and production by 80%. The sheet capacity grew from 61 million meters per year to 108 million meters. Towel capacity grew from 25,000 tons per year to 40,000 tons.

-

In August 2022, Surya Inc. expanded its value-focused offering of on-trend area rugs during the New York Home Fashions Market. The offering was available in affordable styles, which included a broad mix of trendy design themes in two constructions: machine-woven from Turkey and hand-woven and hand-tufted varieties from India. The rugs were made from ultra-soft polyester, new versions of space-dyed polypropylene.

Home Textile Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 130.93 billion

Revenue forecast in 2030

USD 185.97 billion

Growth Rate

CAGR of 6.0% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, distribution channel, and region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, Argentina, Saudi Arabia, South Africa, UAE

Key companies profiled

Welspun Group, Springs Global, New Sega Home Textiles, Ralph Lauren Corporation, Shenzhen Fuanna, Trident Group, Marvic Textiles, Shanghai Hometex, Honsun, Hunan Mendale Hometextile Company Ltd., LLC Honsun Home Textile

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Textile Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global home textiles market report on the basis of product, material, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion; 2018 - 2030)

-

Bedroom Linen

-

Bathroom Linen

-

Carpets and Floor Coverings

-

Kitchen Linen

-

Curtains and Drapes

-

-

Material Outlook (Revenue, USD Billion; 2018 - 2030)

-

Polyester

-

Cotton

-

Silk

-

Wool

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion; 2018 - 2030)

-

Offline

-

Supermarket/Hypermarket

-

Specialty Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The home textiles market was estimated at USD 119.09 billion in 2022 and is expected to reach USD 124.72 billion in 2023.

b. The home textiles market is expected to grow at a compound annual growth rate of 5.7% from 2022 to 2030 to reach USD 185.97 billion by 2030.

b. Asia Pacific dominated the home textiles market with a share of around 44% in 2022. The growth of the regional market is driven on account of growth in home real estate, lifestyle, and hospitality sectors.

b. Some of the key players operating in the home textiles market include Welspun Group, Springs Global, New Sega Home Textiles, Ralph Lauren Corporation, Shenzhen Fuanna, Trident Group, Marvic Textiles, Shanghai Hometex, Honsun, Hunan Mendale Hometextile Company Ltd., LLC Honsun Home Textile

b. Key factors that are driving the home textiles market growth include a shift towards sustainable and environmentally-friendly products, and increase in spending on interior design and house decoration.

b. The ASEAN home textiles market was estimated at USD 7.19 billion in 2022 and is expected to reach USD 7.52 billion in 2023.

b. The U.K. home textiles market was estimated at USD 6.62 billion in 2022 and is expected to reach USD 6.81 billion in 2023.

b. The Germany home textiles market was estimated at USD 8.21 billion in 2022 and is expected to reach USD 8.50 billion in 2023.

b. The China home textiles market was estimated at USD 16.54 billion in 2022 and is expected to reach USD 17.10 billion in 2023.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."