- Home

- »

- Conventional Energy

- »

-

Horizontal Directional Drilling Market Size Report, 2030GVR Report cover

![Horizontal Directional Drilling Market Size, Share & Trends Report]()

Horizontal Directional Drilling Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Onshore And Offshore), By Parts Type , By End Use, By Machine Type, By Tooling, By Machine Size, By Region, And Segment Forecasts

- Report ID: 978-1-68038-589-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Horizontal Directional Drilling Market Summary

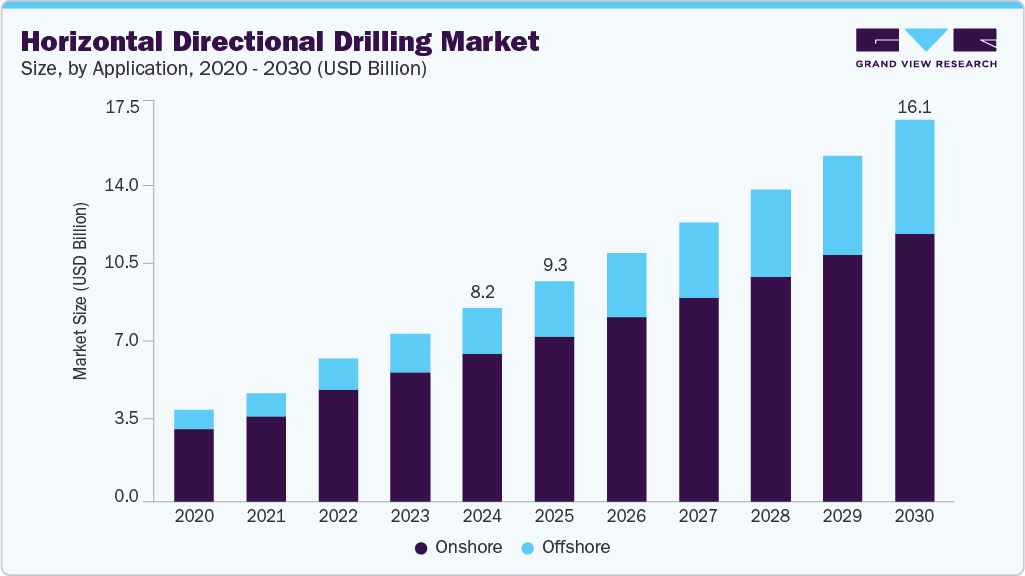

The global horizontal directional drilling market size was estimated at USD 8.18 billion in 2024 and is projected to reach USD 16.08 billion by 2030, growing at a CAGR of 11.6% from 2025 to 2030. The rising demand for efficient, cost-effective, and environmentally friendly underground utility installation methods drives market growth.

Key Market Trends & Insights

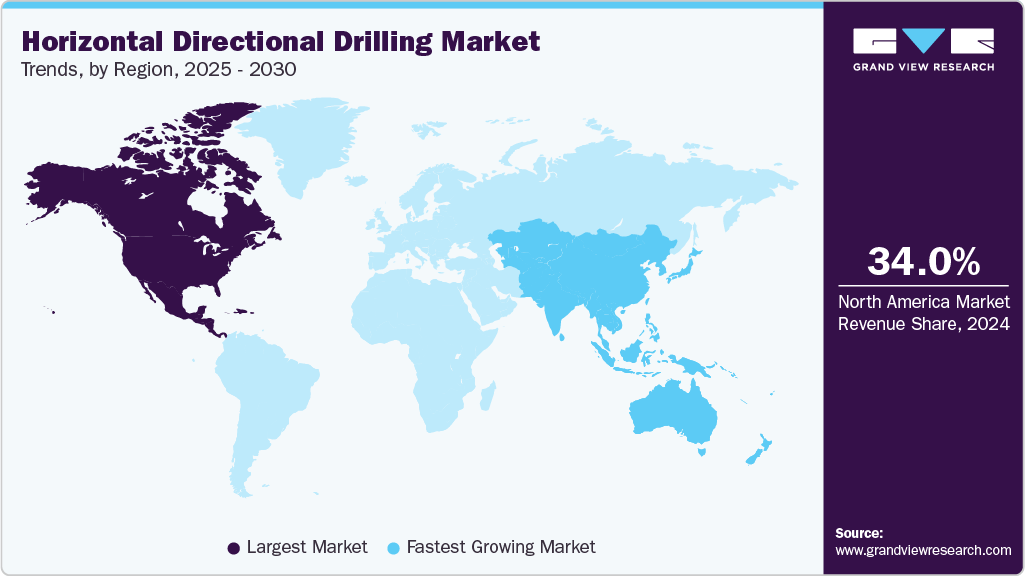

- North America horizontal directional drilling market held the largest share of 34% of the global market in 2024.

- The horizontal directional drilling market in the U.S. is expected to grow significantly over the forecast period.

- By machine type, boring machines held the highest market share of 44% in 2024.

- Based on technology, the conventional segment held the highest market share in 2024.

- Based on machine size, the midi segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.18 Billion

- 2030 Projected Market Size: USD 16.08 Billion

- CAGR (2025-2030): 11.6%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Horizontal directional drilling (HDD) technology enables the installation of pipelines, cables, and conduits with minimal surface disruption, making it especially suitable for urban areas and challenging terrains. Key applications in oil & gas, telecommunications, water & wastewater, and power distribution sectors fuel steady adoption. In North America, market growth is primarily supported by extensive infrastructure development and government initiatives promoting sustainable utility installation. The United States leads adoption, driven by the need to upgrade aging underground pipelines, expand telecommunications networks, and deploy renewable energy infrastructure with minimal surface disruption. Increasing urbanization and regulatory support for trenchless technologies encourage the deployment of HDD systems across utility, industrial, and commercial projects. Technological advancements in drilling equipment, real-time monitoring, and precision guidance systems enhance efficiency and safety, supporting sustained market momentum throughout the forecast period.

Europe represents another significant growth region for the HDD market, with Germany, the UK, and France leading adoption due to stringent environmental regulations and a strong focus on minimizing the ecological impact of construction activities. Investments in urban infrastructure modernization, renewable energy projects, and underground utility networks are key drivers of regional demand. Strategic collaborations between local contractors and international HDD technology providers, combined with government incentives for trenchless construction methods, reinforce Europe’s position as a critical contributor to the global HDD market. The region’s emphasis on sustainable and low-impact construction practices is expected to accelerate the adoption of HDD systems across multiple sectors.

Drivers, Opportunities & Restraints

The global Horizontal Directional Drilling (HDD) market is primarily driven by the growing need for efficient, cost-effective, and environmentally friendly underground utility installation methods. Increasing urbanization, expansion of energy infrastructure, and the growing demand for telecommunication and water pipelines have accelerated the adoption of HDD as a preferred trenchless technology. HDD enables the installation of pipelines, cables, and conduits beneath roads, rivers, and urban landscapes with minimal surface disruption, significantly reducing environmental and social impact. Furthermore, government initiatives promoting sustainable construction practices, infrastructure modernization programs, and renewable energy projects fuel market growth. The technology’s versatility, operational precision, and suitability for challenging terrains make it a critical solution in the global infrastructure landscape.

Opportunities in the HDD market are expanding as advancements in drilling technology enhance accuracy, efficiency, and safety. Innovations such as real-time tracking systems, automation, advanced drill heads, and rotary steerable systems are improving operational performance and cost-effectiveness. Growing investments in smart city development, fiber-optic network expansion, and oil & gas pipeline projects present substantial growth avenues for HDD technology. In addition, emerging economies with accelerating industrialization and urban development offer lucrative HDD deployment opportunities. Strategic collaborations between drilling contractors, equipment manufacturers, and technology providers strengthen the global HDD ecosystem, ensuring continuous innovation and skill development across the value chain.

However, challenges such as high initial equipment costs, complex operational requirements, and the need for skilled labor can limit widespread adoption of HDD. Difficult geotechnical conditions, including rocky or unstable soil formations, may increase project risks and operational costs. Furthermore, uncertainties in project financing, varying regional regulations, and competition from conventional open-cut methods can restrain market expansion in some regions. Maintaining drilling accuracy in large-scale projects and ensuring environmental compliance are additional concerns for operators. Overcoming these challenges through technology standardization, workforce training, and investment in automation will be essential for the sustained growth of the global HDD market.

Application Insights

The onshore segment held the largest revenue share of 76% in 2024, primarily due to the widespread use of horizontal directional drilling (HDD) in infrastructure development, utility installation, and pipeline replacement projects. Onshore HDD enables efficient and environmentally friendly underground installation of cables, pipelines, and conduits in urban and semi-urban areas, minimizing surface disruption and reducing overall project costs. Growing investments in telecommunication networks, oil and gas distribution, and water management infrastructure have reinforced its dominance.

Governments and private developers increasingly favor HDD to meet environmental compliance standards and minimize land disturbance. Advancements in drilling fluid systems, borehole navigation, and rig automation have enhanced operational reliability and reduced risks associated with complex subsurface conditions. Continuous equipment innovation and the growing number of contractors specializing in trenchless drilling are expected to sustain onshore HDD dominance throughout the forecast period. The segment’s scalability and adaptability across diverse applications from small-diameter telecom conduits to large-diameter energy pipelines further reinforce its leadership in the global HDD market.

Machine Type Insights

The boring machines segment held the largest revenue share of 44% in 2024, driven by their extensive use in large-scale infrastructure, utility, and energy projects that require precision drilling and high operational efficiency. These machines are critical in executing complex horizontal directional drilling (HDD) operations across varied geological conditions, enabling accurate underground installation of pipelines, cables, and conduits. Technological advancements such as automated steering systems, enhanced torque capacity, and real-time monitoring have improved drilling accuracy and reduced downtime.

These machines are critical in executing complex horizontal directional drilling (HDD) operations across varied geological conditions, enabling accurate underground installation of pipelines, cables, and conduits. Technological advancements such as automated steering systems, enhanced torque capacity, and real-time monitoring have improved drilling accuracy and reduced downtime.

Technology Insights

The conventional segment held the largest revenue share of 44% in 2024, primarily due to its established presence and widespread adoption across various horizontal directional drilling (HDD) projects. Conventional HDD systems are extensively used in onshore infrastructure, utility installation, and pipeline projects where proven technology, reliability, and cost-effectiveness are prioritized. Their ability to handle diverse geological conditions and support medium to large-diameter drilling makes them a preferred choice for contractors in oil & gas, water management, telecommunication, and energy distribution sectors. The segment’s dominance reflects the balance between operational efficiency and manageable capital investment, making it accessible to small and large-scale projects.

The segment also benefits from the growing demand for trenchless technology in urban and environmentally sensitive areas, where minimal surface disruption is critical. As infrastructure development, utility expansion, and renewable energy projects continue to rise globally, the conventional HDD segment is expected to maintain its leading position throughout the forecast period.

Machine Size Insights

The midi segment held the largest revenue share of 46% in 2024. The segment's market leadership is driven by its versatility, which allows it to efficiently handle medium-scale utility, pipeline, and telecommunication installation projects across urban and suburban areas. The growing infrastructure development, modernization of utility networks, and demand for cost-effective trenchless solutions are expected to sustain the segment’s dominant position throughout the forecast period.

Midi HDD offer an optimal balance between power, maneuverability, and operational efficiency, making them ideal for urban utility installations, telecommunications networks, and medium-diameter pipeline projects. Their compact design allows for easier deployment in constrained or densely populated areas, while still providing sufficient drilling capability for most onshore infrastructure needs.

Parts Type Insights

The rigs segment held the largest revenue share of 45% in 2024, primarily due to the critical role rigs play in executing horizontal directional drilling (HDD) operations across various applications. HDD rigs are essential for installing pipelines, cables, and conduits with precision, particularly in onshore infrastructure, oil & gas, water management, and telecommunication projects. The segment’s dominance reflects the widespread adoption of robust, high-capacity rigs capable of handling medium to large-diameter drilling operations, ensuring efficiency, reliability, and reduced project timelines.

Manufacturers are increasingly offering modular and energy-efficient rigs that can be deployed quickly across diverse geographies, reducing setup and operational costs. Rising investments in urban infrastructure, renewable energy pipelines, and utility network expansion continue to drive demand for advanced HDD rigs, ensuring the segment maintains its leading position in the global market throughout the forecast period.

Tooling Insights

The HDD drill rods segment held the largest revenue share of 27% in 2024, driven by its essential role in horizontal directional drilling operations. Drill rods provide the structural connection between the rig and the drill bit, transmitting torque and thrust to navigate various geological formations. Their durability, strength, and resistance to wear and corrosion are critical factors determining drilling efficiency and project success.

Manufacturers also optimize drill rod lengths and configurations to meet project-specific requirements, increasing efficiency in urban and complex terrain installations. As global infrastructure development, utility expansion, and renewable energy projects continue to rise, the HDD drill rods segment is expected to maintain steady growth and remain a critical component of the HDD value chain throughout the forecast period.

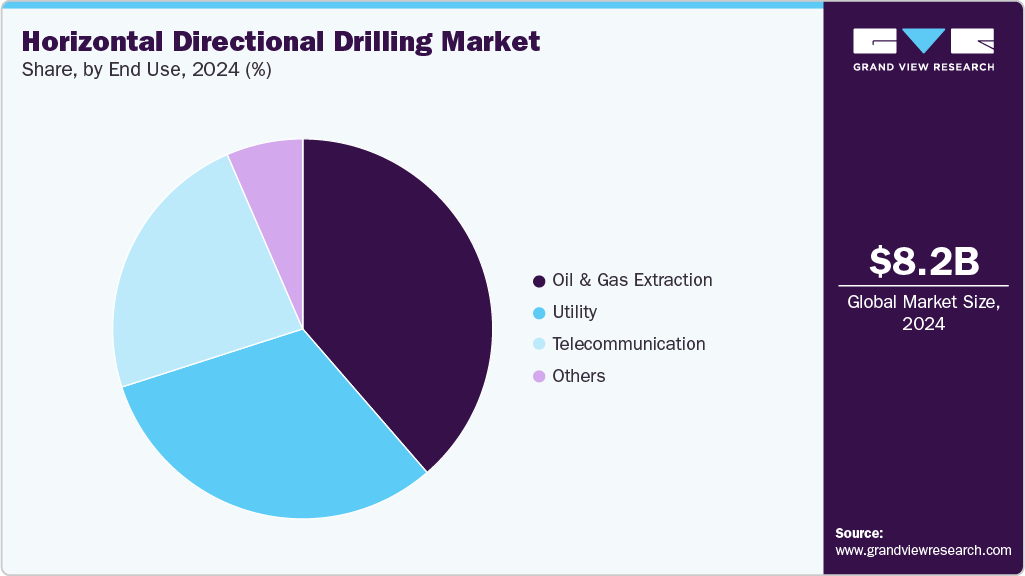

End Use Insights

The oil & gas extraction segment held the largest market share of approximately 39% in 2024, driven by the extensive use of horizontal directional drilling (HDD) technology in installing pipelines, flowlines, and related infrastructure. HDD enables efficient and precise underground placement of oil and gas pipelines, minimizing surface disruption and reducing environmental impact, which is particularly important in ecologically sensitive urban areas.

Technological advancements in HDD equipment, such as enhanced torque capacity, real-time monitoring systems, and advanced drill heads, have improved operational efficiency and reduced project timelines. In addition, the rising focus on reducing construction-related environmental damage and maintaining regulatory compliance continues to drive the adoption of HDD in the oil & gas sector, ensuring that this segment remains the leading contributor to the global HDD industry.

Regional Insights

North America holds the largest share of approximately 37% in the global Horizontal Directional Drilling (HDD) market in 2024, driven by substantial investments in infrastructure modernization, energy pipeline expansion, and telecommunication network deployment. The U.S. leads the region, supported by federal and state-level infrastructure programs, regulatory incentives, and the adoption of trenchless construction techniques. Canada also contributes through large-scale utility projects and urban development initiatives. Strong public-private collaboration, technological innovation in HDD rigs and equipment, and increased demand for efficient underground installations reinforce North America’s position as a significant HDD market.

U.S. Horizontal Directional Drilling Market Trends

The U.S. is the largest single-country HDD market, driven by high utility, oil & gas investments, and telecommunication infrastructure. Federal and state-level initiatives promoting trenchless construction and rising urbanization and industrial development have created a favorable investment environment for HDD deployment. With ongoing infrastructure development and technological innovation, the U.S. is expected to remain a leading market for HDD throughout the forecast period.

Europe Horizontal Directional Drilling Market Trends

Europe is a key market for the Horizontal Directional Drilling industry. Strong infrastructure development, urban utility modernization, and stringent environmental regulations support the region’s leadership. Countries such as Germany, France, the Netherlands, and the UK actively deploy HDD technology for pipeline installation, telecommunications networks, and energy distribution projects. Policy support, including government subsidies, research funding, and incentives for trenchless construction, combined with mature urban infrastructure, creates a favorable environment for large-scale HDD adoption. Europe’s focus on sustainable construction practices and minimizing surface disruption continues to drive market expansion and maintain its dominant position globally.

Asia Pacific Horizontal Directional Drilling Market Trends

The Asia Pacific region is emerging as the fastest-growing HDD market, driven by rapid urbanization, industrialization, and large-scale infrastructure projects in countries such as China, India, Japan, and South Korea. Governments in the region are investing heavily in pipeline networks, energy distribution systems, and telecommunication infrastructure, promoting the adoption of trenchless HDD technology. Rising electricity demand, urban utility expansion, and the need for minimally disruptive construction methods position Asia-Pacific as a critical contributor to global HDD market growth.

Latin America Horizontal Directional Drilling Market Trends

Latin America is gradually expanding its HDD market, supported by increasing investments in urban infrastructure, oil & gas pipelines, and telecommunication networks. Countries such as Brazil, Mexico, and Argentina are adopting HDD technology to reduce surface disruption, lower project costs, and accelerate installation timelines. Government policies, regional infrastructure programs, and international partnerships encourage market growth, positioning the region for steady expansion over the forecast period.

Middle East & Africa Horizontal Directional Drilling Market Trends

The Middle East & Africa (MEA) region is witnessing gradual growth in the HDD market, driven by energy infrastructure expansion, urban development, and pipeline installation projects. Key economies such as the UAE, Saudi Arabia, South Africa, and Egypt are investing in trenchless technologies to support utility networks, oil & gas pipelines, and telecommunication systems. Sub-Saharan Africa is leveraging smaller-scale HDD projects to improve infrastructure access in remote areas. Policy support, public-private collaborations, and international funding facilitate regional development, with HDD adoption expected to grow steadily over the forecast period.

Key Horizontal Directional Drilling Company Insights

Some of the key players operating in the global Horizontal Directional Drilling (HDD) market include Barbco, Inc., Vermeer Corporation, Direct Horizontal Drilling, Inc., The Charles Machine Works, Inc. (Ditch Witch), The Toro Company, Horizontal Technology, Inc., Vision Directional Drilling, Kondex Corporation U.S.A., and VMT GmbH Gesellschaft Für Vermessungstechnik.

Key Horizontal Directional Drilling Companies:

The following are the leading companies in the horizontal directional drilling market. These companies collectively hold the largest market share and dictate industry trends.

- Barbco, Inc.

- Vermeer Corporation

- Direct Horizontal Drilling, Inc.

- The Charles Machines Works, Inc. (Ditch Witch)

- The Toro Company

- Mclaughlin Group, Inc.,

- Laney Directional Drilling Co.

- Ellingson Companies

- Vmt Gmbh Gesellschaft Für Vermessungstechnik

Recent Developments

-

In October 2025, Vermeer launched the enhanced D20x22 S3 horizontal directional drill in the U.S., featuring improved hydraulic protection, redesigned components, and upgraded hood design to boost reliability and productivity for urban utility contractors.

-

In January 2025, Ditch Witch launched the JT21 directional drill in the U.S., offering 40% more downhole horsepower and 53% faster carriage speed, enhancing efficiency for underground utility and fiber installations.

Horizontal Directional Drilling Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.28 billion

Revenue forecast in 2030

USD 16.08 billion

Growth rate

CAGR of 11.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Machine type, application, machine size, parts type, tooling, machine type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Brazil; Saudi Arabia; UAE

Key companies profiled

Barbco, Inc.; Direct Horizontal Drilling, Inc.; Ellingson Companies; Laney Directional Drilling Co.; Mclaughlin Group, Inc.; The Charles Machines Works, Inc. (Ditch Witch); The Toro Company; Vermeer Corporation; Vmt Gmbh Gesellschaft Für Vermessungstechnik

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Horizontal Directional Drilling Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global horizontal directional drilling market report on the basis of machine type, application, machine size, parts type, tooling, and region:

-

Machine Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Utility vibratory plow

-

Utility tractor

-

Pile driver

-

Foundation machines

-

Boring machine

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Machine Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Mini

-

Midi

-

Maxi

-

-

Parts Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Rigs

-

Pipes

-

Bits

-

Reamers

-

-

Tooling Outlook (Revenue, USD Million, 2018 - 2030)

-

Transition rods

-

HDD Drill Rods

-

HDD Paddle Bits

-

HDD Drive Collars, Chucks, and Subs

-

HDD Swivels & Pulling Equipment

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & gas extraction

-

Utility

-

Telecommunication

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.