- Home

- »

- Clothing, Footwear & Accessories

- »

-

Hosiery Market Size & Share, Industry Report, 2019-2025GVR Report cover

![Hosiery Market Size, Share & Trends Report]()

Hosiery Market Size, Share & Trends Analysis Report By Product (Sheer, Non-sheer), By Application (Women, Men), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-3-68038-721-6

- Number of Pages: 75

- Format: Electronic (PDF)

- Historical Range: 2015 - 2017

- Industry: Consumer Goods

Report Overview

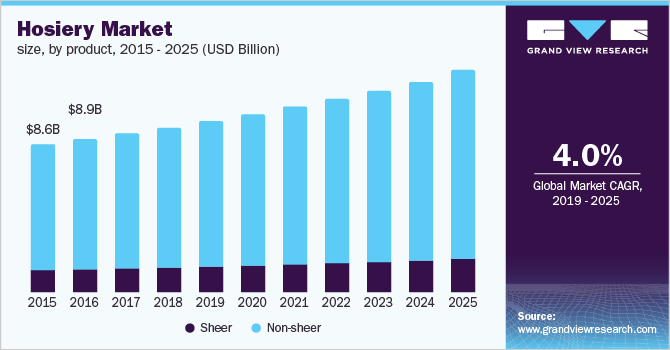

The global hosiery market size to be valued at USD 44.2 billion by 2025 and is expected to grow at a compound annual growth rate (CAGR) of 4.0% during the forecast period. The market growth is primarily attributed to growing importance of hosiery as a durable clothing, which reduces leg fatigue and provides excellent comfort characteristics to sports professionals. Furthermore, these hosiery products are preferred by the female consumers due to its virtually invisible features, thus providing natural and shiny looks. By understanding the market demand, companies are working on different types of innovative fabric designs. Some of the trending designs are striped tights, python print tights, stirrups tights, and patterned over-the-knee socks. Companies such as Sock Dreams and BAREWEB, INC. are introducing such products. Leading suppliers are using ultrasonic and laser technologies to develop product offerings.

With the help of these technologies, they can provide perfect edge cutting to the fabric in less time and seal the cut edges, hence preventing from fraying. They are transforming their hosiery products to include weather adaptive fabric, strong elasticity, and silver-based microbial finish. Some of the major third party manufacturers who provide training and manufacturing of these hosiery products are Disabled Living Foundation (DLF) and Adaptive Textiles. People prefer to purchase stronger elastic products that can provide appropriate compression, thereby leading to increasing blood circulation.

Shifting buyers’ preference towards the e-commerce industry is also expected to be one of the key factors driving the global market. The major reason behind the market growth is hassle free and convenient shopping features offered by the online retailers. It has been observed that the average time spent by the consumers on intimate apparel shopping at retail outlets is declining at the global level, which has increased the sales of hosiery products by online channels. Changing demographic factors such as disposable income and lifestyle are transforming the demand patterns of this market.

It has been observed that obesity levels are increasing at the global level, which is driving the demand for plus size hosiery products. In the U.S., around 65% of adults are either obese or overweight with no sign of associated visible improvement. Majority of the women are joining the plus size acceptance movement in different countries. By understanding the need for these hosiery products, different manufacturers have started selling exclusive plus size products to meet the market demand. Some of the suppliers are Hanesbrands Inc., Macy’s, and BAREWEB, INC.

Hosiery Market Trends

The hosiery market is experiencing an increase in visibility, particularly in supermarkets and affordable stores, which is expected to drive market growth. Plus-size or obese customers are also boosting the demand for hosiery items as they wish to appear fitter. Additionally, fitness is a significant aspect of hosiery as people between the age group of 30 to 60 are eager to look young and are also engaged in fitness and sports activities. The rising focus on health and fitness, coupled with the desire to look attractive is expected to drive the industry growth in the forecast period.

The rising demand for hosiery legwear apparel among men and women is expected to propel the market of hosiery. Furthermore, rising awareness of the advantages of hosiery wear such as stylish and comfortable material, lightweight fabric, soft and smooth quality, flexibility, high moisture absorbency, free airflow that boosts blood circulation, prevent fungal infections, and the possibility of preventing varicose veins is expected to drive preference and demand for these products and support the global market's growth.

Growing adoption of hosiery apparel for infants to prevent rashes and enable proper breathing ability, absorb sweat, avoid infections, and keep legs warm in cold conditions are also expected to drive industry growth. High demand for hosiery products from various sectors such as fashion, sport and fitness, entertainment, and healthcare are some of the key sectors expected to drive significant growth in the global market.

During the COVID-19 pandemic, purchases of hosiery items shifted to various online alternatives. In addition, the demand for sports equipment declined significantly, owing to the cancellation of outdoor events due to lockdown restrictions. The hosiery products industry has been impacted by the closure of supermarkets, shopping malls, and hypermarkets which restrained the industry growth for some time. However, the COVID-19 pandemic has forced many hosiery manufacturers to focus more on the adoption and long-term sustainability of eco-textiles, which are in high demand in the market and are expected to provide growth opportunities for the market in the forecast period.

Product Insights

Non-sheer hosiery products accounted for the largest share of 85.7% in 2018. Major popular products under this segment include ankle socks, dress socks, and training socks. Non-sheer products are majorly preferred by sports professionals, nurses, and kitchen staff. It is also popular among common mass due to its ease and wearing comfort. Major fast-fashion players such as H&M and sports retailers such as Decathlon are catering to the growing demand for non-sheer hosiery products.

Sheer hosiery products is expected to be the fastest growing category with a CAGR of 5.1% from 2019 to 2025. Millennials are increasingly interested in purchasing sheer hosiery, which is impacting the segment growth. Consumers of this category of generation prefer to use sheer hosiery with socks. Some of the major suppliers of this category in the U.S. are Woodland Hosiery Inc., Holt Hosiery Mills Inc., and WOODLAND HOSIERY INC.

Application Insights

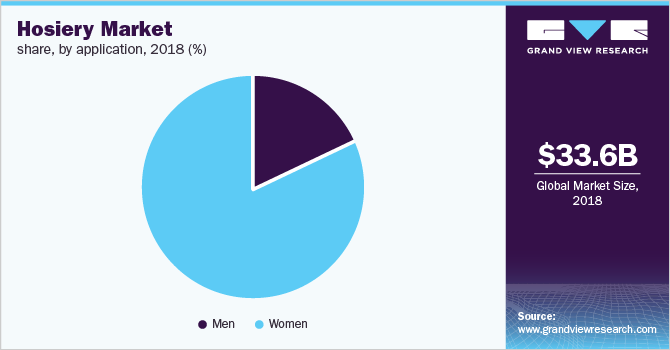

The women application segment accounted for the largest share of 82.0% in 2018. Increased usage of hosiery items for workout as well as professional use as these products are perceived as a fashionable wearable among women. Additionally, majority of the women population prefer hosiery products with different colors and designs, which is projected to expand the market reach.

The men application segment is expected to be the fastest growing market with a CAGR of 4.5% from 2019 to 2025. The segment growth is attributed to shifting trend towards athleisure among male adults. Products such as weather adaptive tights are gradually gaining acceptance among men. Some of the leading men tight suppliers are UNIQLO CO. LTD., Adidas America Inc., and Nike, Inc. Companies including Stolen Goat Ltd. offer unique features such as wet weather cycling clothes for men, which is significantly contributing to this segment growth.

Regional Insights

North America was the largest regional market for hosiery, accounting for 37.4% share of the overall revenue in 2018. Demand for stylish and comfortable fabric products among the consumers is boosting the market growth. High penetration of online retailers is promoting the consumer interaction with the brands. Companies are using big data analytics technology, along with machine learning, to analyze customer requirements and thus, publish the advertisements accordingly.

Asia Pacific is the fastest growing market, expanding at a CAGR of 5.0% from 2019 to 2025. Changing consumer behavior towards fashionable sports attire, along with rising disposable income especially in developing countries such as China and India, is expected to boost the market growth. Increasing consumer per capita spending on garment products and rising interest in buying branded products are positively impacting the market growth. It has been observed that the demand for sports hosiery is comparatively high in China. The Chinese government is taking initiatives to spread awareness among millennials and working class population about the importance of sports activities. People prefer to use hosiery products during workouts due to its comfortable features, which will propel the market growth in the upcoming years.

Key Companies & Market Share Insights

The market is competitive in nature due to the presence of many private level brands. Some of the major companies operating in the market for hosiery are Gilden Activewear Inc.; Hanesbrands; Spanx, Inc.; Golden Lady; Gatta Hosiery USA LLC; CSP INTERNATIONAL FASHION GROUP S.P.A.; adidas America Inc.; Jockey; and Carolina hosiery.

Due to high competition, companies are working on new product launches to increase their share in the market. For instance, in October 2017, Hanes Hosiery has launched a perfect tights to compete other legwear manufacturers. This product is designed with X-TEMP technology to adapt body temperature for all-day comfort.

Recent Developments

-

In April2022, Centric Brands LLC announced its acquisition of a subsidiary of Daytona Apparel Group, a retail business owned by Windsong Brands. Centric will now own the whole hosiery product division of Daytona Apparel Group, which sells its hosiery items under numerous brands in retailersacross the world. As a result, this acquisition will expand the business of Centric in terms of diversity, scale, improved relationships with retailers, and overall replenish the business

-

In October 2021, Blackstone acquired a large stack of SPANX, Inc. The rapid digital transformation and worldwide footprint development of SPANX across more categories will be accelerated by the acquisition. The motive of this acquisition is to develop products that will be innovative and ground-breaking for customers

-

At a virtual Investor & Media Day in March 2021, Adidas unveiled their new 'Own the Game' strategy.The main objective of this strategy is to increase the Adidas brand's credibility, provide a distinctive consumer experience, and keep expanding the company's sustainability efforts. Until 2025, the new strategy is expected to considerably boost sales, profitability, and market share

Hosiery Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 36.2 billion

Revenue forecast in 2025

USD 44.2 billion

Growth Rate

CAGR of 4.0% from 2019 to 2025

Base year for estimation

2018

Historical data

2015 - 2017

Forecast period

2019 - 2025

Quantitative units

Revenue in USD billion & CAGR from 2019 to 2025

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East; Africa

Country scope

U.S.; U.K.; Germany; India; China; Brazil

Key companies profiled

Gilden Activewear Inc.; Hanesbrands; Spanx, Inc.; Golden Lady; Gatta Hosiery USA LLC; CSP INTERNATIONAL FASHION GROUP S.P.A.; Adidas America Inc.; Jockey; Carolina hosiery

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hosiery Market SegmentationThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2015 to 2025. For the purpose of this study, Grand View Research has segmented the global hosiery market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Billion, 2015 - 2025)

-

Sheer

-

Non-sheer

-

-

Application Outlook (Revenue, USD Billion, 2015 - 2025)

-

Women

-

Men

-

-

Regional Outlook (Revenue, USD Billion, 2015 - 2025)

-

North America

-

The U.S.

-

-

Europe

-

The U.K.

-

Germany

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global hosiery market size was estimated at USD 34.8 billion in 2019 and is expected to reach USD 36.2 billion in 2020.

b. The global hosiery market is expected to grow at a compound annual growth rate of 4.0% from 2019 to 2025 to reach USD 44.2 billion by 2025.

b. North America dominated the hosiery market with a share of 37.5% in 2019. This is attributable to the high penetration of online retailers in countries including the U.S. and Canada.

b. Some key players operating in the hosiery market include Gilden Activewear Inc.; Hanesbrands; Spanx, Inc.; Golden Lady; Gatta Hosiery USA LLC; CSP INTERNATIONAL FASHION GROUP S.P.A.; adidas America Inc.; Jockey; and Carolina hosiery.

b. Key factors that are driving the hosiery market growth include globally evolving fashion trends and the increasing popularity of weather adaptive fabric in hosiery products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."