- Home

- »

- Medical Devices

- »

-

Hospital Furniture Market Size, Share & Trends Report, 2030GVR Report cover

![Hospital Furniture Market Size, Share & Trends Report]()

Hospital Furniture Market Size, Share & Trends Analysis Report By Application (Patient's Furniture, Staff's Furniture), By Product (Patient Lifts, Beds), By Material (Metal, Wood), By End-use, By Sales Channel, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-007-2

- Number of Report Pages: 190

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

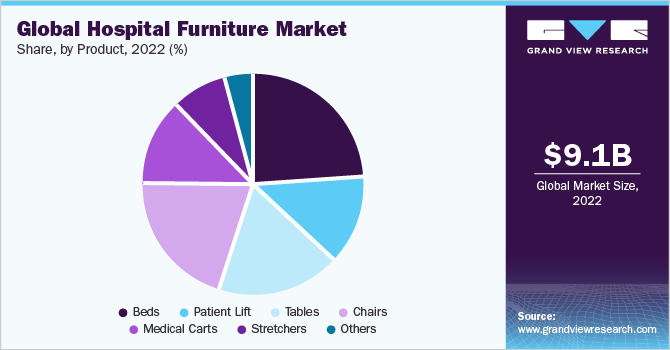

The global hospital furniture market size was estimated at USD 9.11 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 6.80% from 2023 to 2030. The growth of the market is due to the rising number of hospital admissions globally, favorable insurance & reimbursement scenarios, and government support for the hospitals that are covered under the healthcare sector. However, a hindrance in hospital furniture designs and production is the lack of research and development in many countries. While some countries are technologically ahead of the curve and have highly developed hospital infrastructure and furnishings, several other nations lack the fundamental advancements required in the sector.

The primary factor driving the market expansion is the world’s growing network of hospitals and clinics. To prevent other circumstances like pandemics, public organizations are working to construct an increasing number of hospitals. The demand for more modern hospitals and clinics is the primary growth driver in the market over the forecast period. The public sector’s initiatives to modernize current hospital infrastructure also play a significant role in driving the industry. The market for hospital furniture is seeing a surge in the adoption of contract production. With more focus on product quality and a high-end finish, the idea of personalized furniture has become more and more popular.

Manufacturers are implementing well-considered ideas that emphasize the aesthetics, comfort, and hospitality of end customers. Conventional hospital furniture has several drawbacks including the development of skin ulcers and bed sores in obese patients due to extra pressure from the furniture on already thin skin. As a result, companies are working to enhance the usability and appearance of healthcare furnishings for overweight people. This is encouraging for medical facilities that are spending money on furniture that can support several hundred pounds of patient weight. According to the report published by the World Obesity Federation, The World Obesity Atlas 2022, one million people across the world, including one in five women and one in seven men, will be obese by 2030.

According to the World Health Organization, 650 million adults, 340 million adolescents, and 39 million children worldwide are obese. This value is still rising. According to the WHO, 167 million individuals would be less healthy by 2025 as a result of being overweight or obese. Obesity increases the risk of developing a number of major disorders, such as heart disease, stroke, diabetes, and several types of cancer. Although none of these health effects are directly caused by obesity, it can raise the likelihood that they will occur. According to the Global Burden of Disease report, obesity caused 4.7 million premature deaths in 2017.

Hospital furniture is a significant factor to consider as it impacts a major part of a hospital’s functions. Trends in hospital furniture have been affected by the COVID-19 pandemic. Healthcare design considerations would inevitably be impacted by the pandemic in the coming years. So it’s essential to design waiting spaces that follow physical distance rules and have better cleaning capabilities. To deal with Healthcare-associated Illnesses or Infections (HAIs), prevention is currently the main focus in furniture design. Infection control is becoming more crucial as hospital cleanliness standards improve.

Product Insights

The beds segment dominated the industry in 2022 and accounted for the maximum share of 24.03% of the overall revenue. The hospital beds segment has been classified into sub-segments, such as ICU beds, fowler beds, plain hospital beds, pediatric beds, maternity beds, and others. The growing demand for ICU beds due to the higher prevalence of chronic disorders that needs critical care services is expected to drive the segment during the forecast period. In addition, electrical or powered beds are preferred over plain beds from private hospitals due to the rising number of bariatric surgeries and the growing geriatric population.

The COVID-19 pandemic has significantly driven the demand for hospital beds across the world. To fulfill this rising demand, the majority of top corporations had practically doubled their production capacity. The chairs segment has secured the second position in 2022. The chairs include examination chairs, birthing chairs, dialysis chairs, ophthalmic chairs, ENT chairs, dental chairs, pediatric chairs, bariatric chairs, and geriatric chairs. The growing demand for rehabilitation chairs including pediatric, bariatric, and geriatric chairs used for bathing, positioning, and mobility of the patient is expected to drive the segment. The growing geriatric population and rising cases of paralysis & spinal injuries are also anticipated to drive the segment.

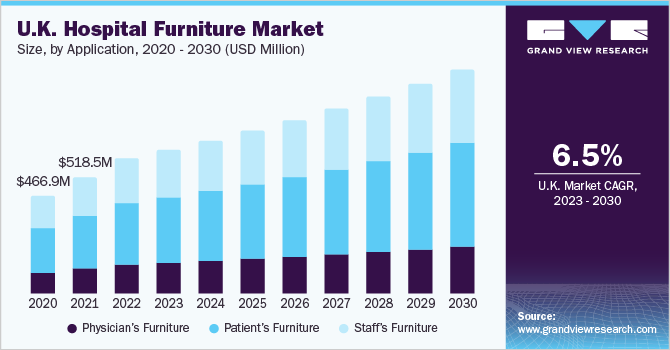

Application Insights

Based on applications, the global industry has been further categorized into physician furniture, patient furniture, and staff furniture. The patient’s furniture segment dominated the global industry in 2022 and accounted for the largest share of more than 45.57% of the overall revenue. The segment is estimated to expand further at the fastest growth rate retaining its dominant position in the industry throughout the forecast period. The demand for patient furniture, such as examination couches, examination lights, drawers, benches, bedside tables, over-bed tables, and chairs, is quite high.

Easier maintenance of the products is the major driving factor for the market. Furthermore, the physician’s furniture segment is expected to grow at the highest CAGR during the forecast period. The physician’s furniture segment is further classified into examination tables, surgical chairs, and others. The rising patient footfall in the larger hospitals, growing concerns regarding the safety & mobility of the patients, and providing good support during medical examinations, are expected to boost the segment growth during the forecast period.

Sales Channel Insights

The offline sales channel dominated the industry in 2022 and accounted for the maximum share of more than 64.20% of the overall revenue. The real-time experience, high purchase confidence, lower rejection rates, availability of customization options, immediate delivery, sales personnel assistance, complete installation support, and simple returns are some of the factors influencing the growth of the offline sales channel segment.

On the other hand, the online sales channel segment is estimated to register the fastest growth rate during the forecast period owing to several factors, such as the ease of comparison, availability of a variety of product options and product reviews from other customers, and great offers & discounts on product prices. However, factors, such as delayed deliveries and uncertain quality, may restrict the online sales channel penetration in the industry practice.

Material Insights

The metal segment dominated the industry in 2022 and accounted for the largest share of more than 41.10% of the global revenue. Increasing adoption coupled with the rising demand for metal furniture owing to its excellent durability that offers comfort will drive the segment growth during the forecast period. In addition, stainless steel contains anti-microbial properties for healthcare equipment and operating room. Thus, the wide usage of metal-based furniture equipment is also estimated to propel the segment growth. The wood segment is expected to grow at the fastest CAGR during the forecast period due to the wide usage of wooden furniture.

Wooden furniture is preferred due to its inherent warmth and appeal, its intrinsic organic qualities can provide thermal advantages and have a balancing impact on internal moisture and humidity. Wood feels warmer to the touch than other structural materials like steel because of its relatively low thermal conductivity. However, the use of harsh cleaning agents could damage the surface. After being used for a while, moisture causes the wood to swell, which may cause the growth of bacteria. The furniture made of wood is porous by nature and prone to nicks and scratches.

End-use Insights

The Ambulatory Surgery Centers (ASCs) segment is anticipated to exhibit the highest CAGR of 7.10% during the forecast period. The demand for hospital furniture in ASCs is primarily driven by the increased preference for same-day surgeries due to significant cost savings & waiting-time reductions and an increase in the number of patients needing surgical procedures. It is also projected that the availability of reimbursement policies for ASCs will aid in the development of this market. In 2022, the hospitals & specialty clinics segment dominated the market, in terms of revenue share.

The segment's growth is mainly attributed to the growing number of hospitals. Strong competition has increased the demand for various types of furniture in the market, which has led to technological improvement in furniture-attached devices for hospitals. In addition, the segment is anticipated to expand as a result of the growing geriatric population, high prevalence of chronic diseases, increase in COVID-19 hospitalizations, and rise in hospitals with modern infrastructure, furnishings, and equipment. Hospitals provide patients with higher treatment and pay for certain operations, both of which are fostering segment expansion.

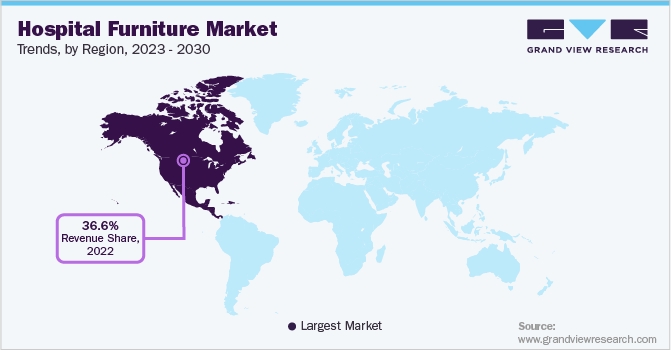

Regional Insights

The North America region held the largest share of 36.59% in 2022. This is due to the increased prevalence of chronic health issues, such as obesity, diabetes, and cardiac arrest that may lead to hospitalizations. As per the American Heart Association, cardiac arrest continues to be a public health emergency. Nearly 90% of all Out-of-Hospital Cardiac Arrests (OHCA) that occur in the U.S. each year are lethal and need hospitalization. Moreover, bariatric surgery and procedures continue to be the most successful long-term weightless option, and their effectiveness has grown dramatically over the past ten years.

According to the American Society for Metabolic and Bariatric Surgery (ASMBS), 228,000 Americans received weight loss surgery in 2017. Every year, over 580,000 people worldwide have bariatric surgery. Asia Pacific is expected to grow at the highest CAGR during the forecast period. Favorable government policies, such as reimbursements provided for hospital furnishings and other equipment, are attributed to the region’s growth. Due to the rising cases of communicable diseases and public awareness about infectious diseases acquired in hospitals, China has had the fastest growth in Asia Pacific. Japan has a robust healthcare system in terms of infrastructure, hospital beds, hospital supplies, and equipment, among other things, which has helped the total market to hold a substantial industry share.

Key Companies & Market Share Insights

The market is fragmented with the high competition at the global level as it has the presence of severe key players. These players focus on growth strategies, such as new product launches, collaborations, partnerships, operational expansions, mergers & acquisitions, and patient awareness campaigns. For instance, Hill-Rom Holdings, Inc. was acquired by Baxter International Inc. in December 2021, according to the company’s announcement.

Hillrom provides a range of equipment to help with patient care, including patient lifts and smart beds. In October 2020, Stryker announced the global launch of ProCuity, the first and only fully wireless hospital bed in the market. This smart bed was created to help decrease in-hospital patient falls across the board, increase nurse productivity and safety, and assist in bringing down hospital expenses. Some of the prominent players in the global hospital furniture market include:

-

Stryker

-

Invacare Corp.

-

ARJO AB

-

Steris Plc.

-

Medline Industries, Inc.

-

Hill-Rom Holdings, Inc.

-

Drive DeVilbiss Healthcare

-

GF Health Products, Inc.

-

NAUSICAA Medical

-

Sunrise Medical (US) LLC

-

Herman Miller Furniture

-

Kovonox

-

Getinge AB

Hospital Furniture Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 9.71 billion

Revenue forecast in 2030

USD 15.39 billion

Growth Rate

CAGR of 6.80% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, sales channel, material, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Stryker; Invacare Corporation; ARJO AB; Steris Plc.; Medline Industries, Inc.; Hill-Rom Holdings, Inc.; Drive DeVilbiss Healthcare; GF Health Products, Inc.; NAUSICAA Medical; Sunrise Medical (US) LLC; Herman Miller Furniture; Kovonox; and Getinge AB

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Furniture Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital furniture market report based on product, application, sales channel, material, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Beds

-

ICU Beds

-

Fowler Beds

-

Plain Hospital Beds

-

Pediatric Beds

-

Maternity Beds

-

Others

-

-

Patient Lift

-

Manual Lifts

-

Power Lifts

-

Stand up Lifts

-

Heavy duty Lifts

-

Overhead Track Lifts

-

Others

-

-

Tables

-

Examination Tables

-

Obstetric Tables

-

Surgical Tables

-

Others

-

-

Chairs

-

Medical Carts

-

Stretchers

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician’s Furniture

-

Patient’s Furniture

-

Staff’s Furniture

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Wood

-

Metal

-

Plastic

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Specialty Clinics

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital furniture market size was estimated at USD 9.11 billion in 2022 and is expected to reach USD 9.71 billion in 2023.

b. The global hospital furniture market is expected to grow at a compound annual growth rate of 6.8 % from 2023 to 2030 to reach USD 15.39 billion by 2030.

b. North America dominated the hospital furniture market with a share of 36.59 % in 2022. This is attributable to the rising prevalence of chronic diseases such as obesity, diabetes, and cardiac arrest that may lead to hospitalizations and is anticipated to surge the demand for the hospital furniture market.

b. Some key players operating in the hospital furniture market include Stryker, Invacare Corporation, ARJO AB, Steris Plc., Medline Industries, Inc., Hill-Rom Holdings, Inc., Drive DeVilbiss Healthcare, GF Health Products, Inc., NAUSICAA Medical, Sunrise Medical (US) LLC, Herman Miller Furniture, Kovonox, Getinge AB

b. Key factors that are driving the hospital furniture market growth include the increasing number of hospital admissions globally, favorable insurance and reimbursement scenarios, and government support for the hospitals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."