- Home

- »

- Consumer F&B

- »

-

Hot Chocolate Market Size, Share, Global Industry Report, 2027GVR Report cover

![Hot Chocolate Market Size, Share & Trends Report]()

Hot Chocolate Market Size, Share & Trends Analysis Report By Distribution Channel (Offline, Online), By Region (North America, Europe, APAC, CSA, MEA), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-440-6

- Number of Pages: 80

- Format: Electronic (PDF)

- Historical Range: 2016 - 2018

- Industry: Consumer Goods

Report Overview

The global hot chocolate market size was valued at USD 3.24 billion in 2019 and is expected to witness significant growth in the years to come. Growing health awareness among consumers in urban households has led to the increase in the consumption of drinks, including hot chocolate. Moreover, shifting consumer inclination towards nutritional foods and drinks on account of changing lifestyle and eating habits is expected to drive the demand for hot chocolate in the upcoming years.

Hot chocolate, also known as drinking chocolate, consists of chopped chocolate, melted chocolate or cocoa powder stirred into milk or water with sugar. Cocoa is rich in polyphenols that are known for their various health benefits. Polyphenols are naturally occurring antioxidants, well known for improving blood flow, alleviating inflammation, and lowering blood pressure.

Dark chocolate consumption is associated with reducing the risk of cardiovascular diseases owing to the presence of good fats and flavonoids that are considered to lower blood pressure and bad cholesterol level. According to the Wellness Creative Co., in 2018, the U.S. gym industry market size was valued at USD 32.3 billion, increased from USD 30 billion in 2017. This is further expected to increase over the forecast period owing to rising health awareness among individuals. Therefore, improving lifestyle of people and increasing awareness among individuals about health benefits associated with hot chocolate consumption is expected to influence its demand over the forecast period.

Major vendors operating in the market introduced nutrient-enriched chocolate products owing to rising awareness regarding adverse effects of sugar. Increasing number of cafés in emerging economies is expected to favor the growth of hot chocolate in coming years. For instance, coffee giant Starbucks is increasingly expanding in China owing to presence of a large tea drinking population. To tap this opportunity, the company is opening about 600 stores annually in the country.

Cocoa is considered a key ingredient in the manufacturing of hot chocolate that has no substitute in the market owing to which the manufacturers increasingly rely on these nations for their supply. Disturbances and irregular supply leads to volatility in the prices of cocoa in the market, thereby hampering the growth of hot chocolate market.

Distribution Channel Insights

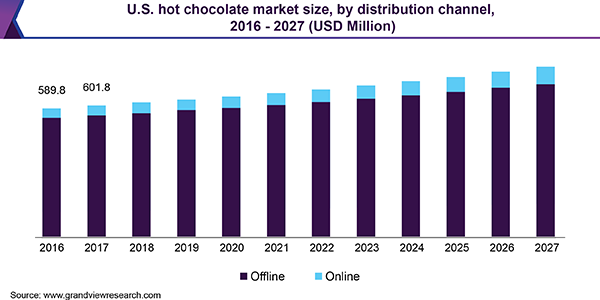

Offline distribution channel emerged as the largest segment with a share of over 90.0% in 2019. High product visibility at supermarkets and hypermarkets and convenience stores is the major factor favoring the sales of hot chocolate through offline channel. Additionally, increasing number of retailers in countries, such as India, China, and Brazil, will positively influence market growth in coming years. For instance, as of May 2018, Walmart had 21 stores and is planning to open around 50 more stores by the end of 2023 in India.

Online distribution channel is expected to expand at the fastest CAGR of 7.5% from 2020 to 2027. Increasing familiarity and dependence of generation X, millennials, and generation Z parents on internet and e-commerce are the major factors expected to drive the sales of hot chocolate through online channel in coming years. Several value-added services such as discounted prices, cash-on-delivery, and paybacks offered by e-retailers are expected to promote the growth of online channels in the coming years.

Regional Insights

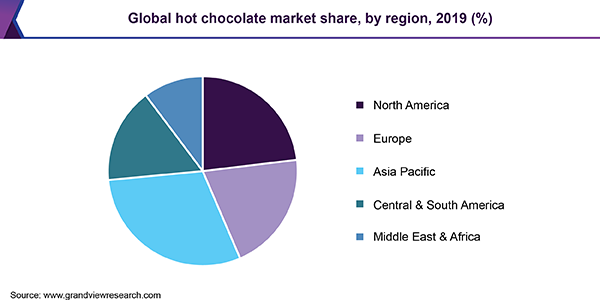

Asia Pacific accounted for 30.2% share of global revenue in 2019. Consumption of cocoa can help fight diabetes, obesity, and stress. Rising awareness among consumers regarding associated health benefits of cocoa is the major factor expected to drive demand for hot chocolate in coming years. In addition, increasing number of quick service restaurants in India and China on account of changing eating habits and craving for chocolate drinks is expected to open avenue for hot chocolate in the near future. For instance, according to the CARE Ratings Limited, the market size of the Indian restaurants and food services industry was valued at Rs 3.7 trillion as of 2018.

North America is projected to expand at a CAGR of 3.0% from 2020 to 2027 and reach a value of USD 956.5 million by 2027. Increase in chronic diseases, like diabetes cardiovascular diseases and obesity, in the region is expected to reduce the demand for chocolates, including hot chocolate. However, recent studies have proved that consuming chocolates reduce the risk of cardiovascular diseases owing to the presence of flavonoids that increase the flexibility of arteries and veins, thereby propelling the demand for hot chocolates in the region.

Middle East and Africa are expected to expand at the fastest CAGR of 5.8% from 2020 to 2027. Increasing presence of modern retailing, coupled with rising number of cafés, is the main factor expected to drive the demand for hot chocolate in the region. Furthermore, increasing number of expatriates in countries, such as UAE, Saudi Arabia, Oman, and Nigeria, is fueling the demand for hot chocolate. Moreover, rising awareness related to health benefits of chocolate and increasing disposable income will contribute to the growth of the market over the forecast period.

Hot Chocolate Market Share Insights

The market is highly consolidated due to the presence of few major players. Consumers across the globe are increasingly adopting healthy eating habits owing to which they are reducing sugar intake. This trend has forced major vendors to introduce sugar-free products. Moreover, companies are focusing on expanding their geographical reach with the launch of nutrient-enriched products owing to rising disposable income in emerging economies. Some of the vendors operating in the market are Nestle; MondelÄ“z International; The Hershey Company; Mars; Incorporated; Chocoladefabriken Lindt & Sprüngli AG; Xucker GmbH; Cocosutra; HARIBO of America, Inc.; Twinings (Associated British Foods plc); and Valrhona Inc.

Report Scope

Attribute

Details

Base year for estimation

2019

Actual estimates/Historical data

2016 - 2018

Forecast period

2020 - 2027

Market representation

Revenue in USD Million and CAGR from 2020 to 2027

Regional scope

North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa

Report coverage

Revenue forecast, company share, competitive landscape, growth factors and trends

Country Scope

U.S., Germany, U.K., China, India, Brazil, and South Africa

15% free customization scope (equivalent to 5 analyst working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2016 to 2027. For the purpose of this study, Grand View Research has segmented the global hot chocolate market report on the basis of distribution channel and region:

-

Distribution Channel Outlook (Revenue, USD Million, 2016 - 2027)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2027)

-

North America

-

The U.S.

-

-

Europe

-

Germany

-

The U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."