- Home

- »

- Electronic & Electrical

- »

-

Household Beauty Appliances Market, Industry Report, 2030GVR Report cover

![Household Beauty Appliances Market Size, Share & Trends Report]()

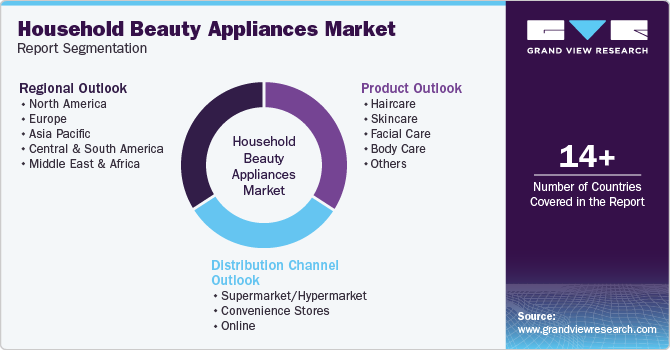

Household Beauty Appliances Market Size, Share & Trends Analysis Report By Product (Haircare, Skincare, Facial Care, Body Care), By Distribution Channel (Supermarket/Hypermarket), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-158-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Household Beauty Appliances Market Trends

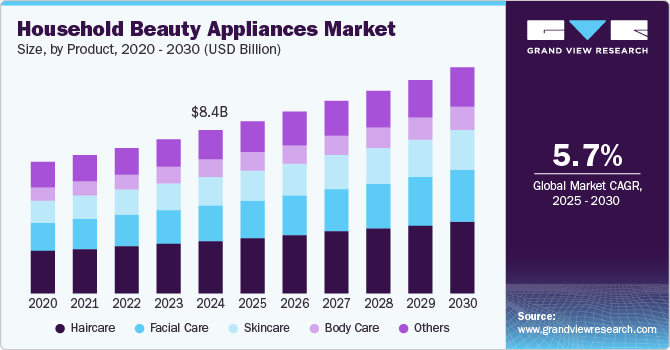

The global household beauty appliances market was valued at USD 8.43 billion in 2024 and is projected to grow at a CAGR of 5.7% from 2025 to 2030. The rising awareness of personal grooming and aesthetic appeal, coupled with hygiene concerns and increasing costs of professional beauty treatments, are key factors driving the growth of the household beauty appliance industry. Personal beauty appliances are affordable and can be used flexibly, regardless of time and location constraints. Additionally, the growing interest of male consumers in personal grooming has further expanded the market for these appliances.

While salon visits can be enjoyable, they often come with significant costs, limiting their frequency to special occasions. According to a survey conducted by Advance Dermatology in the U.S., women spend approximately USD 844 annually on personal appearance, while men spend approximately USD 592. Additionally, concerns about hygiene at salons can deter some consumers. This has led to increased demand for personalized household beauty products. Consumers are willing to invest in household beauty appliances that meet their specific needs and are affordable. This trend has significantly boosted the growth of the household beauty appliance industry in the past few years.

The household beauty appliance market is a dynamic and customer-centric industry, significantly influenced by evolving beauty trends and innovative product launches. In 2024, Dyson introduced a new hair dryer featuring a hyperdymium motor and RFID sensors. Similarly, L'Oréal Groupe unveiled its next-generation hair drying tool, which utilizes infrared light technology and consumes 31% less energy compared to conventional hair dryers. These innovative approaches enable companies to attract new customers by prioritizing their needs. Moreover, the integration of innovative technology helps justify the premium pricing of these products, boosting profitability for companies.

The changing lifestyles and increasing urbanization have fostered a growing emphasis on self-grooming and aesthetic presentation among young people worldwide. The younger generation has access to a wealth of content on social media platforms. Social media influencers often showcase and promote the latest trends in fashion and beauty, including beauty products and appliances. According to a consumer survey, 72% of social shoppers are influenced by Facebook in at least one fashion or beauty category. Additionally, content on other social media platforms, such as TikTok, Instagram, and YouTube, is also promoting fashion, beauty, health, and wellness among young consumers. This presents a lucrative opportunity for household beauty appliance manufacturers to collaborate with social media influencers and promote their products on these platforms.

Product Insights

The haircare segment dominated the global household beauty appliances market based on product, with a revenue share of 32.2% in 2024. Haircare is an ever-evolving aspect of personal grooming, encompassing a variety of appliances that cater to changing styles and seasons. These appliances include hair dryers, straightening and curling irons, rollers, stylers, and brushes. Consumers often prefer to use their haircare appliances and tools over professional salon equipment, primarily due to hygiene concerns. Additionally, most haircare appliances are portable, allowing users to style their hair on the go. As hairstyling trends continue to evolve, companies are introducing innovative products that help consumers maintain stylish hair without compromising their health. For example, Philips India recently launched a new no-heat damage hair straightener. Such innovations from major haircare appliance manufacturers are driving consumer demand for these products.

The skincare segment is also expected to experience the fastest CAGR from 2025 to 2030. Skincare products are gaining popularity as companies introduce innovative products for personalized skincare regimens. These products include skincare wands, massagers, steamers, body exfoliators, and brushes, among others. These devices offer consumers professional-quality treatments at a fraction of the cost and with complete control. Additionally, social media influencers and their collaborations with leading skincare companies are attracting consumers of all ages to incorporate these products into their daily skincare routines. As a result, the demand for skincare appliances is expected to grow significantly.

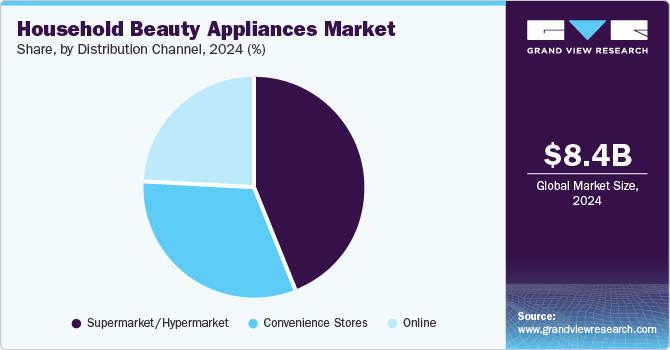

Distribution Channel Insights

The supermarket/hypermarket channel segment held the largest revenue share of the household beauty appliances market in 2024. Many consumers prefer to purchase personal beauty appliances through offline channels such as supermarkets and hypermarkets. These channels offer a wide range of products from various brands, allowing consumers to compare features and prices. Supermarkets and hypermarkets often employ knowledgeable sales associates or brand representatives who can assist customers in selecting suitable appliances. Consumers can discuss their specific needs with these representatives and examine products through live demonstrations or usage scenarios. This hands-on experience instills confidence in consumers and encourages them to purchase household beauty appliances.

The online segment is expected to experience the fastest market growth during the forecast period. The COVID-19 pandemic compelled consumers to shift towards online shopping. However, even after the pandemic, consumer interest in online shopping, including beauty products and appliances, has persisted. Factors such as convenience, brand deals and discounts, free deliveries, and hassle-free returns are key drivers of online distribution channels. Additionally, influencers promoting specific brands often offer exclusive online discounts through giveaways and coupons.

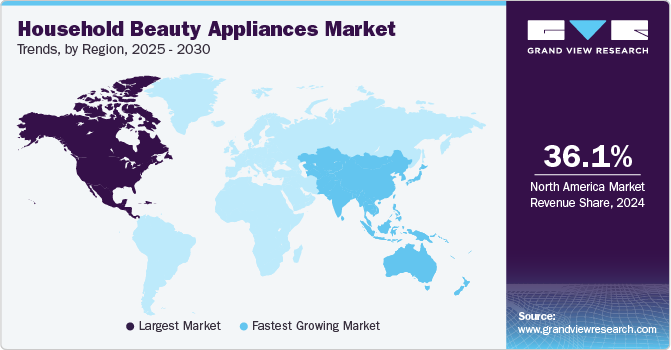

Regional Insights

The North American household beauty appliances industry dominated the global market, with a revenue share of 36.1% in 2024. A fast-paced lifestyle and increasing pressure to maintain a polished appearance among younger generations are major driving factors for industry growth in the region. North American consumers are keen to follow the latest beauty trends and have access to the most advanced beauty appliances. Additionally, the region is significantly influenced by social media platforms such as TikTok and Instagram, which promote the use of household beauty appliances.

The U.S. dominated the North American household beauty appliances market in 2024. Consumers in the U.S. invest significantly in personal appearance and fashion and have access to a wealth of information on beauty and style. As professional beauty treatments become increasingly expensive, consumers are turning to technologically advanced beauty appliances. American consumers are discerning purchasers who make informed decisions based on their specific needs. This has driven major companies to develop innovative products that align with consumer preferences. These products offer personalized treatments and cater to busy lifestyles at relatively affordable prices. According to a consumer survey conducted in 2022, 75% of women and 60% of men are regularly involved in a dedicated skincare routine. The younger generation's inclination towards following the latest beauty trends and the influence of social media is further contributing to the growth of the household beauty appliance industry in the country.

Asia Pacific Household Beauty Appliances Market Trends

Asia Pacific household beauty appliances market is anticipated to experience the fastest CAGR during the forecast period. Growing spending capacity and rising urbanization have influenced the growth of the household beauty appliances industry in the region. Consumers in Asia Pacific are diversifying their beauty preferences and are willing to pay prices for premium products. Besides dedicated appliances, products with multiple uses are also in demand, delivering multiple benefits in one package. Growing awareness of personal care and the adoption of advanced skincare technologies has helped countries, including China, Japan, and South Korea, to stand out as market leaders in the region.

China held the largest revenue share of the regional industry in 2024. Factors such as social media influence, growing self-awareness, flourishing e-commerce, and the adoption of Western lifestyles are driving market growth in the country. Chinese consumers are increasingly seeking advanced products to enhance their personal care routines. The country boasts a well-established beauty and wellness industry that competes fiercely with foreign brands. According to a report published by BDA Partners, approximately 50% of Chinese consumers prefer to use domestic appliances. Local companies are increasingly introducing technologically innovative products to cater to consumer needs. For instance, a renowned Chinese brand, OGP, launched a new photorejuvenation device. This device emits three different wavelengths of photons to address various skin issues, including melanin, redness, and dullness.

Europe Household Beauty Appliances Market Trends

The European household beauty appliances market is anticipated to experience significant growth during the forecast period. The beauty and fashion industry has been an integral part of European culture. Countries such as France, Italy, Spain, and the U.K. have historically set trends for the global beauty industry. The presence of a discerning consumer base with a demand for high-end and luxury products has driven the household beauty appliance market in Europe. The region is also home to industry giants, including Koninklijke Philips N.V. and L'Oréal SA, providing early access to advanced products launched on the market. Additionally, the growing influence of social media and the thriving e-commerce sector are major contributing factors promoting the household beauty appliance industry.

Key Household Beauty Appliances Company Insights

Some of the key companies operating in the global household beauty appliances market are Koninklijke Philips N.V., Home Skinovation, Conair Corporation, TRIA Beauty, Inc., Vega, Syska, Panasonic Corporation, Carol Cole Company, Croma, and L’Oreal SA. The incorporation of advanced technology and the development of innovative products are key strategies employed by major market players. Intense competition among companies drives the introduction of new products that differentiate themselves in terms of features, design, innovation, and pricing.

-

L'Oréal is a France-based global leader in the beauty and cosmetics industry. The company offers an array of products, including haircare, skincare, makeup, and fragrances. L'Oréal also owns other iconic brands, including Lancôme, Maybelline New York, and Garnier. The country has a rich heritage of research and innovation and invests heavily in R&D to create innovative products catering to diverse consumer preferences.

-

Koninklijke Philips N.V. is a Netherlands-based company that specializes in manufacturing state-of-the-art beauty appliances. It offers a wide range of hair care products for men and women, including hair removal products, epilators, hair dryers, hairbrushes, straighteners, and curlers. It has a keen focus on its product development and frequently collaborates with social media influencers to promote their products on social media.

Key Household Beauty Appliances Companies:

The following are the leading companies in the household beauty appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Koninklijke Philips N.V.

- Home Skinovation

- Conair Corporation

- TRIA Beauty, Inc.

- Vega

- Syska

- Panasonic Corporation

- Carol Cole Company

- Croma

- L’Oreal SA.

Recent Developments

-

In October 2024, SharkNinja, Inc., a leading product design and technology company, introduced its new blue, red, and infrared LED mask, the Shark CryoGlow. This mask is designed to slow down signs of aging, reduce blemishes, and brighten the skin. As the first LED facemask launched in the U.K., the company plans to expand its availability to other countries in 2025.

-

In June 2023, Koninklijke Philips N.V. launched its first air styler, BHA301/10, for men in India. The product was designed for hairstyling at home and has features that allow hair drying and styling simultaneously. It is helpful for consumers with fine, dry, or damaged hair.

Household Beauty Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.86 billion

Revenue forecast in 2030

USD 11.69 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa

Key companies profiled

Koninklijke Philips N.V.; Home Skinovation; Conair Corporation; TRIA Beauty; Inc.; Vega; Syska; Panasonic Corporation; Carol Cole Company; Croma; L’Oreal SA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Beauty Appliances Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the household beauty appliances market report based on product, distribution channel, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Haircare

-

Skincare

-

Facial Care

-

Body Care

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarket/Hypermarket

-

Convenience Stores

-

Online

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

India

-

China

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

MEA

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."