- Home

- »

- Clinical Diagnostics

- »

-

HPV Testing & Pap Test Market Size, Industry Report, 2033GVR Report cover

![HPV Testing And Pap Test Market Size, Share & Trends Report]()

HPV Testing And Pap Test Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Pap Test, HPV Test), By Application (Cervical Cancer, Vaginal Cancer), By Product, By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-895-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

HPV Testing And Pap Test Market Summary

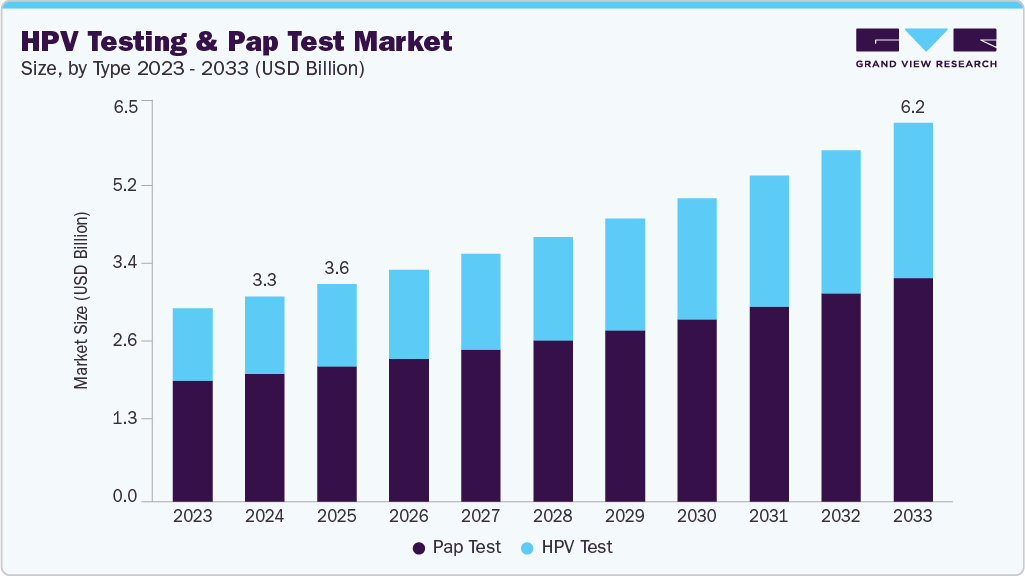

The global HPV testing and Pap test market size was estimated at USD 3.34 billion in 2024 and is projected to reach USD 6.18 billion by 2033, growing at a CAGR of 7.2% from 2025 to 2033. Technological advancements in testing products, increasing prevalence of cervical cancer, and government initiatives to reduce disease burden are some of the key factors driving the market growth over the forecast period.

Key Market Trends & Insights

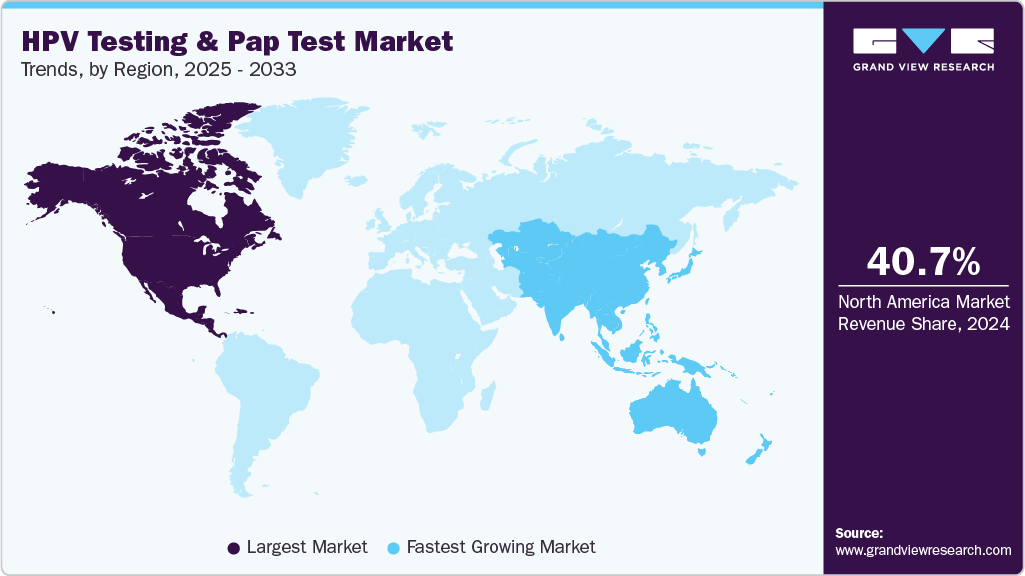

- North America HPV testing and Pap test market held the largest share of 40.7% of the global market in 2024.

- By type, the Pap test segment held the highest market share of 62.4% in 2024.

- By application, the cervical cancer screening segment held the highest market share in 2024.

- By product, the services segment is expected to grow at the fastest CAGR from 2025 to 2033.

- By technology, the PCR segment is expected to grow at the fastest CAGR from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 3.34 Billion

- 2033 Projected Market Size: USD 6.18 Billion

- CAGR (2025-2033): 7.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Cervical cancer remains a critical health issue for women worldwide. In March 2024, the WHO published a fact sheet showing that approximately 660,000 women were diagnosed with cervical cancer in 2022, and about 350,000 women died from it. The highest incidence and mortality rates are found in low- and middle-income countries, particularly in sub-Saharan Africa, Central America, and Southeast Asia, where disparities in access to vaccination, screening, and treatment continue to drive this significant health burden.

Making screening and early detection must remain at the forefront of public health planning. At the root of much of this burden lies the human papillomavirus (HPV). A meta-analysis and systematic review published by the Technical University of Munich in January 2025 found that in women aged 50 and older with normal cytology, the pooled global prevalence of any HPV was 11.70% and the prevalence of high-risk HPV types was 6.45%. The high prevalence of HPV infection highlights the large population eligible for screening and emphasizes the critical role of HPV testing in cervical cancer prevention programs. Given that persistent HPV infection is the leading cause of cervical cancer, incorporating reliable HPV tests alongside Pap test is increasingly essential.

Favorable initiatives undertaken by governments for cervical cancer screening of women in the average-to-high-risk group are further anticipated to drive the market. Some of the guideline committees are ACS, the U.S. Preventive Services Task Force (USPSTF), the American Society for Colposcopy and Cervical Pathology (ASCCP), the American College of Obstetricians and Gynecologists (ACOG), and the Society of Gynecologic Oncology (SGO) is continuously increasing awareness about the disease among people. Moreover, in May 2023, the National Cervical Screening Program (NCSP) of Australia updated guidelines to prevent cervical cancer by increasing screening of women aged between 25 to 74 years.

An increase in awareness programs for screening by organizations including National Cervical Cancer Coalition (NCCC), WHO, CDC, and USPSTF is one of the major factors expected to boost market growth during the forecast period. For instance, in January 2023, the WHO launched the Cervical Cancer Elimination Strategy for the Eastern Mediterranean region and announced January as a Cervical Cancer Awareness month. Under this program, the WHO set the target to screen 70% of women aged 35 to 45 years. In addition, major market players are undertaking initiatives to increase awareness about cervical and vaginal cancer screening to detect diseases at an early stage.

The introduction of technologically advanced testing products and guidelines for utilizing novel tests is expected to further increase market growth over the forecast period. Market players are expanding their R&D activities to introduce novel and effective HPV tests for diagnosing infections. In March 2025, WHO prequalified the Alinity m HR HPV diagnostic test by Abbott, which detects DNA from 14 high-risk HPV genotypes, including genotypes 16, 18, and 45. The test's results, combined with clinical assessment and guidelines, can help guide patient management.

Market Concentration & Characteristics

The HPV testing and Pap test market exhibits a high level of innovation, driven by rapid progress in molecular assays, self-collection devices, and AI-assisted cytology, which is shifting screening from clinic-only Pap smears toward scalable HPV-first workflows and laboratory automation. In February 2024, Hologic, Inc. announced FDA clearance of the Genius Digital Diagnostics System, the first and only AI-enabled digital cytology system designed to enhance the accuracy of both HPV and Pap tests, thereby improving cervical cancer screening.

M&A activity remains moderate, focusing on acquiring point-of-care technologies, molecular platforms, and laboratory networks to address capability gaps and increase distribution scale, rather than pursuing broad sector-wide consolidations. Large diagnostic and healthcare firms continue to acquire specialized molecular testing companies, digital health platforms, and lab networks to expand their screening offerings and enhance operational capacity.

The impact of regulations on the HPV testing and Pap test market is significant, as approvals, label expansions, and WHO prequalification determine which tests national programs and payers will purchase and where self-collection can be utilized. In December 2024, the USPSTF published a draft recommendation for HPV primary screening using either clinician- or patient-collected samples.

Type Insights

The Pap test segment dominated the market, accounting for the largest revenue share of 62.4% in 2024, owing to the widespread implementation of screening programs. The Pap test is used to screen for abnormalities in normal or precancerous cells that may eventually turn into cervical cancer. The test is recommended for women aged 21 years or older. The Pap test remains a cornerstone of early cervical cancer detection, particularly in regions where molecular HPV testing is still gaining ground. Its long-established infrastructure, cost-effectiveness, and integration into national screening programs continue to support strong adoption across both developed and emerging markets. Ongoing advancements, such as AI-assisted cytology and digital slide interpretation, are further enhancing diagnostic accuracy and laboratory efficiency.

The HPV testing segment is projected to grow at the fastest CAGR of 8.2% over the forecast period, due to the increasing introduction of various HPV tests and adoption of the more efficient HPV screenings. HPV-DNA testing detects high-risk strains of HPV which is the major cause of cervical cancer. Increasing adoption of these tests as primary tests, global availability, and increasing adoption due to higher sensitivity are expected to drive the HPV testing industry during the forecast period. WHO recommends that self-retrieved samples can be used for HPV DNA testing. Ongoing studies support the notion that women often feel more comfortable collecting their samples rather than visiting a testing laboratory for the same. However, women require confidence in their ability and appropriate support to carry out the sample collection. In May 2024, Roche announced U.S. FDA approval of one of the first HPV self-collection solutions, allowing individuals to collect vaginal samples in healthcare settings for cervical cancer screening.

Application Insights

The cervical cancer screening segment held the largest revenue share in 2024. This segment is anticipated to grow at the fastest CAGR over the forecast period. This is due to the increasing investments by market players in the field and higher incidences of cervical cancer as compared to vaginal cancer.

The vaginal screening segment is projected to grow at a significant CAGR over the forecast period. Vaginal screening tests are conducted when a person is at high risk of developing cancer but shows no symptoms. The disease can be treated effectively when detected at an early stage. There are no reliable or simple tests for screening vaginal cancers. In addition, Pap tests can fail early detection of vaginal cancer as it is a comparatively rare form of cancer. However, advancements in HPV DNA testing and molecular diagnostic platforms are helping improve the sensitivity of vaginal screening for early detection.

Product Insights

The consumables segment held the largest share in the HPV testing and Pap test market in 2024, due to the repetitive use of these products in HPV and cervical screenings. Moreover, continuous development activities by key players operating in the market, along with the introduction of innovative consumables such as assays & kits, are anticipated to boost segment growth. Rising screening volumes and recurring test requirements continue to drive steady demand for reagents, slides, fixatives, and molecular test kits used in cytology and HPV diagnostics. Manufacturers are also focusing on developing high-throughput and automated consumable systems to improve testing accuracy and reduce turnaround times in laboratories.

The services segment is expected to witness the fastest CAGR during the forecast period, driven by the introduction of self-administered and at-home HPV screening services, which aim to increase the frequency of cervical cancer screening rates in key markets. The expansion of telehealth platforms and partnerships between diagnostic companies and healthcare providers is further supporting the accessibility of such services, particularly in underserved regions.

Technology Insights

The other segment dominated the market in 2024. This large share can be attributed to the high adoption of colposcopy and cystoscopy techniques in HPV screenings. Moreover, the cost-effectiveness of these tests compared to novel molecular diagnostics and immunoassays has increased the adoption of these tests across the globe. Furthermore, advancements in digital colposcopy systems and AI-assisted image analysis are enhancing diagnostic accuracy and enabling real-time visualization of abnormal cervical and vaginal tissues. The integration of these technologies into routine gynecological screening programs is helping clinicians improve early detection rates and streamline patient management, especially in low-resource and outpatient settings.

The PCR segment is expected to witness the fastest CAGR over the forecast period, owing to the implementation of new guidelines to utilize DNA HPV testing methods due to their higher accuracy. Moreover, the use of PCR for HPV testing improves the sensitivity of cervical cancer screening programs by early identification of risky lesions in women aged 30 and older. Moreover, the replacement of conventional tests for HPV screening with DNA tests is further expected to drive segment growth.In April 2025, the International Agency for Research on Cancer (IARC) and its partners validated and launched new HPV detection tests developed in India, specifically designed for cervical cancer screening in low- and middle-income countries.

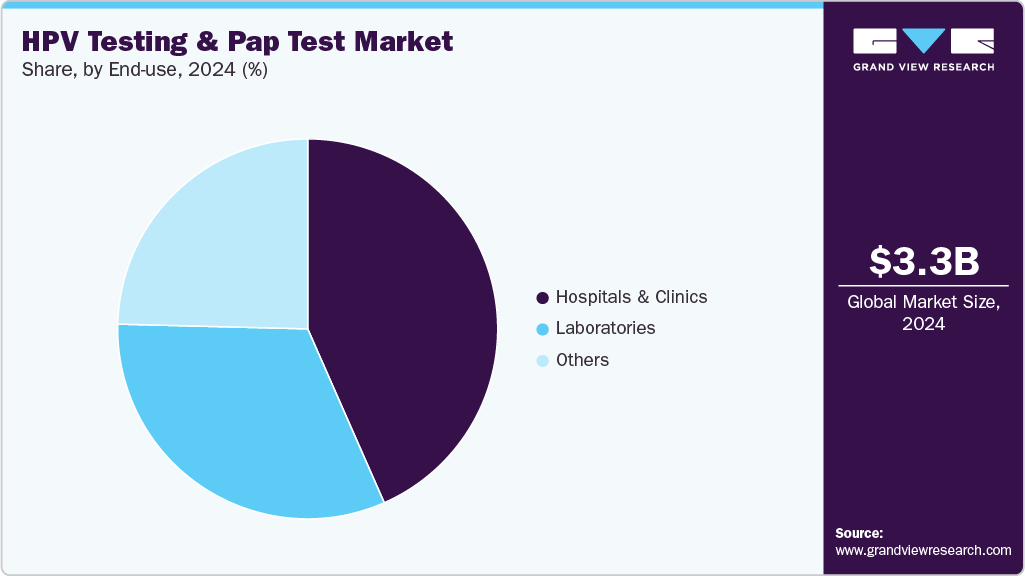

End Use Insights

The hospitals & clinics segment held the largest share in the HPV testing and Pap test market in 2024.A large number of patient visits, improved healthcare infrastructure, and a rising healthcare expenditure are key factors enhancing diagnostic services in hospitals and clinics. Thus, several hospitals and clinics in key markets are adopting technologically advanced solutions to provide more accurate and efficient results.

The laboratories segment plays a crucial role in the HPV and Pap test industry, driven by the high testing volumes, centralized workflows, and adoption of automated high-throughput PCR and digital cytology systems that enhance accuracy and efficiency. Laboratories serve as central hubs for processing self-collected and clinician-collected samples, ensuring standardized quality control and faster turnaround times. The growing integration of AI tools and molecular diagnostic automation is further enhancing the precision and scalability of results.

Regional Insights

North America dominated the HPV testing and Pap test market and held the largest revenue share of 40.7% in 2024. It is projected to maintain the lead throughout the forecast period. High awareness about early diagnosis of cervical cancer, well-established screening guidelines, and favorable healthcare reimbursement scenario are the factors driving the growth of the market in the region.

U.S. HPV Testing And Pap Test Trends

The U.S. accounted for the largest share in North America in 2024. Persistent disease burden and high infection rates create ongoing demand for screening. Evolving clinical guidelines increasingly recommend HPV-first screening and self-collection for women aged 30 to 65, reducing access barriers and supporting DNA-based workflows. Advanced technologies, such as high-sensitivity PCR assays, automated high-throughput platforms, and AI-enabled digital cytology, enhance detection accuracy and laboratory efficiency. A robust lab and payer infrastructure supports wide-scale adoption of new screening models, including telehealth and mail-in or clinic self-collection options, ensuring reimbursement for guideline-based tests.

Europe HPV Testing And Pap Test Trends

Europe held a significant market share in 2024. Strong public health initiatives, updated screening guidelines, and the rapid adoption of molecular diagnostics across national programs drive the European HPV and Pap test market. WHO and EU directives promoting HPV-based primary screening have accelerated the shift from cytology to DNA testing. Meanwhile, the widespread implementation of self-sampling pilots and AI-assisted cytology tools enhances accessibility and accuracy. Well-established laboratory infrastructure and performance-based procurement policies further support scaling high-throughput testing. For instance, in June 2025, NHS England announced the rollout of a more personalized cervical screening program using advanced HPV testing and self-sampling pathways, underscoring Europe’s leadership in adopting modern screening approaches.

Asia Pacific HPV Testing And Pap Test Trends

Asia Pacific HPV testing And Pap test market is expected to register the fastest CAGR of 9.0% over the forecast period, driven by the rising incidence of cervical cancer, expanding government screening programs, and increased accessibility of molecular diagnostics across emerging economies. Growing awareness campaigns by the WHO South-East Asia Region and national health authorities are promoting the integration of HPV vaccination and screening, leading to higher testing volumes.

China dominated the Asia Pacific market in 2024 and is expected to register the fastest CAGR over the forecast period. China’s market growth is driven by large-scale screening pilots, strong central policy support for prevention, and high-profile validation studies of novel, non-invasive sampling methods that could expand reach. Notably, in September 2025, a major urine-based HPV screening clinical study led by Phase Scientific, in collaboration with Chinese hospitals, was launched as one of the world’s largest efforts to validate urine-based HPV DNA/methylation screening and AI-supported image triage, a development that, if successful, would simplify sample collection and boost screening uptake.

Key HPV Testing And Pap Test Company Insights

Some of the key companies in the HPV testing and Pap test market include Abbott, QIAGEN,Quest Diagnostics Incorporated, and others. Key players are taking several strategic initiatives, such as mergers and acquisitions, collaborations, and partnerships with other major companies.

Key HPV Testing And Pap Test Companies:

The following are the leading companies in the HPV testing and pap test market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott.

- QIAGEN

- BD.

- Quest Diagnostics Incorporated

- Hologic, Inc.

- F. Hoffmann-La Roche Ltd

- Femasys Inc.

- Arbor Vita Corporation

- NURX Inc.

- Seegene Inc.

- Thermo Fisher Scientific Inc.

- BIOMÉRIEUX S.A.

Recent Developments

- In October 2025, BD (Becton, Dickinson and Company) launched a new self-collection HPV testing solution for markets outside the U.S., simplifying at-home sample collection and automating lab processing with advanced robotics using the BD COR System.

HPV Testing And Pap Test Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.55 billion

Revenue forecast in 2033

USD 6.18 billion

Growth rate

CAGR of 7.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, application, product, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Sweden; Denmark; Norway; Russia, Japan; China; India; Australia; South Korea; Thailand; Singapore, Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Abbott.; QIAGEN; BD.; Quest Diagnostics Incorporated; Hologic, Inc.a; F. Hoffmann-La Roche Ltd; Femasys Inc.; Arbor Vita Corporation; NURX Inc.; Seegene Inc.; Thermo Fisher Scientific Inc.; BIOMÉRIEUX S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global HPV Testing And Pap Test Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global HPV testing and Pap test market report based on type, application, product, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Pap Test

-

HPV Test

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Cervical Cancer Screening

-

Vaginal Cancer Screening

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Consumables

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

PCR

-

Immunodiagnostics

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Laboratories

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

Spain

-

France

-

Italy

-

Sweden

-

Denmark

-

Norway

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

- Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the HPV testing and Pap test market growth include increasing incidence rate of cervical and vaginal cancer and rising awareness created by various government organizations in order to increase cervical cancer screening.

b. The global HPV testing and Pap test market size was estimated at USD 3.34 billion in 2024 and is expected to reach USD 3.55 billion in 2025.

b. The global HPV testing and Pap test market is expected to grow at a compound annual growth rate of 7.2% from 2025 to 2033 to reach USD 6.18 billion by 2033.

b. North America dominated the HPV testing and Pap test market with a share of 40.66% in 2024. This is attributable to increased cases of cervical cancer and the growing awareness amongst women due to the various government initiatives and research studies that were undertaken in this direction.

b. Some key players in the HPV testing and Pap test market include Abbott Laboratories, Qiagen N. V., Becton, Dickinson and Company, Quest Diagnostics, Hologic Inc., Roche, Arbor Vita Corporation, Femasys Inc., Onco Health Corporation, and Seegene Inc.

b. The Pap test segment dominated the market for HPV testing and Pap test in 2024 with a revenue share of 62.44%, owing to its widespread implementation in screening programs.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.