- Home

- »

- Pharmaceuticals

- »

-

Human Growth Hormone Market Size & Share Report, 2030GVR Report cover

![Human Growth Hormone Market Size, Share & Trends Report]()

Human Growth Hormone Market Size, Share & Trends Analysis Report By Product, By Application (Growth Hormone Deficiency, Turner Syndrome), By Distribution Channel (Hospital Pharmacy, Retail Pharmacy), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-057-6

- Number of Report Pages: 129

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Human Growth Hormone Market Trends

The global human growth hormone market size was valued at USD 6.32 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 12.3% from 2024 to 2030. The market is experiencing expansion due to factors such as the growing awareness of growth hormones and its increased utilization for the treatment of hormonal imbalance disorders. Moreover, leading pharmaceutical and biopharmaceutical companies are undertaking significant R&D efforts to bring novel hormone therapies to the market. These therapies aim to provide long-term action and enhanced safety profiles, further driving the development of the market on a global scale.

The increasing incidence of growth hormone deficiencies resulting from congenital conditions, genetic disorders, brain injuries, and specific medical therapies has led to a higher demand for hormone treatments. According to the NCBI, pediatric growth hormone deficiency are diagnosed in approximately 1 in each 3,500-4,000 children in the UK. Additionally, the growth hormone industry is experiencing an increase due to ongoing research and development activities in this field. For example, in February 2022, OPKO and Pfizer obtained marketing approval from the European Union for its Once-Weekly NGENLA (somatrogon) Injection, which is used in the treatment of pediatric growth hormone deficiency.

Furthermore, the early detection of endocrine illnesses including Hashimoto thyroiditis, Graves' disease, Cushing's disease, Addison's disease, hyperthyroidism/hypothyroidism, and prolactinoma among others, plays a crucial role in improving treatment outcomes and preventing severe complications.

The expansion of human growth hormone market is expected to be influenced by the COVID-19 pandemic. According to a Frontiers article, individuals with low production of growth hormone are considered at risk for COVID-19, emphasizing the importance of preventive measures in this population. Individuals with Turner syndrome and Prader-Willi disorder are advised to take extra precautions due to their heightened susceptibility to severe illness caused by the COVID-19 virus. Growth hormone deficiency happens as the pituitary gland fails to produce an adequate amount of growth hormone. Such a hormone deficiency is usually managed through subcutaneous injections of human growth hormone. Genetic conditions such as Turner syndrome and Prader-Willi condition can also lead to deficiency, which has resulted in delayed puberty and shorter stature compared to the general population.

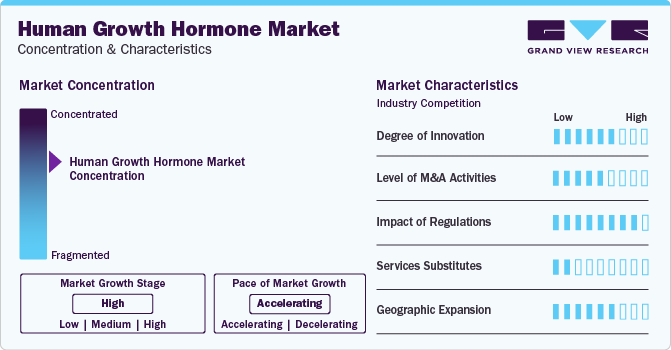

Market Concentration & Characteristics

Market growth stage is high, and pace of the market growth is accelerating. Industry is characterized by a high degree of innovation. This can be attributed to high R&D investment and methodologies for transforming treatment practices. The space witnesses a notable M&A activities by the leading players. Industry participants are focusing their investments on the delivery and monitoring aspects of human growth hormone therapy to enhance effectiveness and scalability for future advancements. For instance, in October 2022, Merck KGaA partnered with Biocorp to develop and supply a customized version of the Mallya device for monitoring the treatment of HGH disorders.

The space is subject to increasing regulatory scrutiny. To launch products in the U.S. market, the company must submit a Biologic License Application (BLA) under section 351(a) under U.S. Public Health Service Act (PHSA). Medicare benefits are categorized into; Medicare Part A: Hospital Insurance, Medicare Part B, Medical Insurance. Medicare Part A and Part B pay for injectable drugs to treat HGH. Patients had to pay 20.0% of the Medicare approved cost of the drug and the Part B deductible applies under the reimbursement policy. A patient does not have to pay for the visit of a home health nurse to inject the drug. HGH treatment & associated medical services are eligible for reimbursement. However, prescriptions require for reimbursement with Health Savings Account (HSA), Health Reimbursement Arrangement (HRA), or a Flexible Spending Account (FSA).

Moreover, the industry is witnessing growing number of geographical expansion strategies, for instance, in January 2022, Ascendis Pharma A/S received approval from the European Commission for its product TransCon hGH. TransCon hGH is indicated for the treatment of paediatric patients diagnosed with growth hormone deficiency. It contains somatropin, a synthetic form of human growth hormone. The approval from the European Commission signifies that TransCon hGH has met the necessary regulatory requirements and can be marketed and used for the intended indication in the European Union.

Product Insights

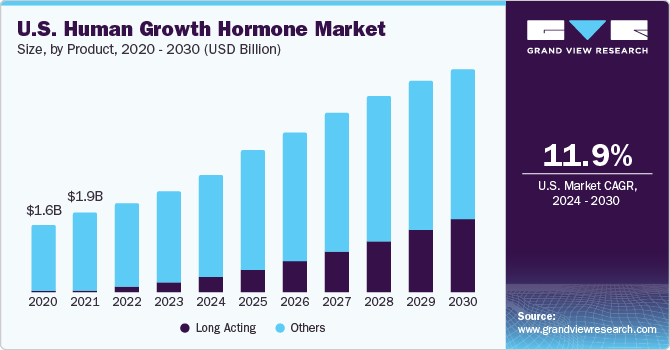

Based on product, market is divided into long acting, and others. In 2023, the others segment accounted for the largest market share, representing 95.5% of the market size. This segment is projected to maintain a steady progress rate throughout the forecast period. Other segments within the market include short-acting and intermediate-acting growth hormones.

The segment is anticipated to witness significant traction over the forecast period owing to increase in incidence of insufficiency coupled with presence of various products, such as Genotropin (Pfizer Inc.), Humatrope (Eli Lilly & Co.), Saizen (Merck & Co. Inc.), and Norditropin (Novo Nordisk A/S), among others.In addition, the recent product launches and high adoption of short acting preparations owing to their less incidence of side effects is another factor contributing segment expansion.

Long-acting segment is expected to register a fastest growth rate throughout the forecast period. Advantages such as reduced frequency of administration, improved patient compliance, and convenience are augmenting segment uptake. Similarly, the robust investigational pipeline and recent product launches is fueling segment demand. For instance, In January 2022, Ascend is Pharma A/S announced the EC approval for marketing authorization of SKYTROFA for the treatment of children and adolescents ages 3 to 18 years with growth failure.

Application Insights

The growth hormone deficiency segment the human growth hormone market in 2023 and is anticipated to grow at the fastest rate during the forecast period. Increasing awareness about the importance of early diagnosis and treatment of hormone deficiency, along with the endeavors of biopharmaceutical companies to introduce innovative therapies, are driving the adoption of this segment. For instance, in May 2023, Novo Nordisk declared that the committee for Medicinal Products for Human Use of the European Medicines Agency has released a favorable statement recommending the use of once-weekly Sogroya (somapacitan). The recommendation is for the treatment of growth hormone deficiency in children aged three years and above, as well as adolescents with development failure. This positive development highlights the potential of Sogroya as a replacement therapy for endogenous growth hormone in these patient populations.

The high prevalence of Turner syndrome, increased research in the field of rare genetic conditions, and various initiatives by public and private organizations to raise awareness about the condition are key factors driving the significant market share of the Turner syndrome segment. Organizations such as the Turner Syndrome Foundation, Turner Syndrome Society of the United States, and Turner Syndrome Support Society are playing a crucial role in spreading awareness and promoting the diagnosis of Turner syndrome.

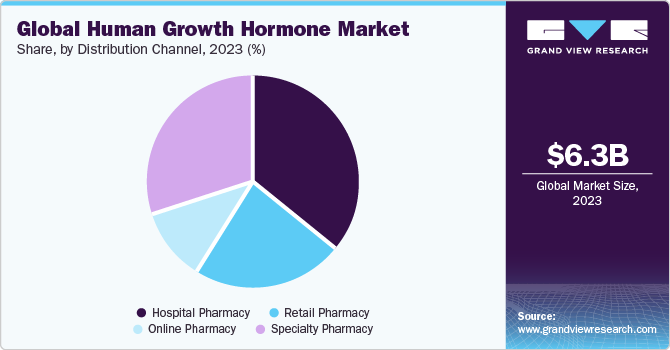

Distribution Channel Insights

The hospital pharmacy segment dominated the human growth hormone market with largest revenue share in 2023. The increasing prevalence of the disease, higher frequency of hospital visits, and favorable reimbursement policies are driving the adoption of this segment. Moreover, patients are showing a preference for recombinant and artificial human growth hormone (HGH), which is readily available in hospital pharmacies. These factors are contributing to the growth and application of this hospital pharmacy segment.

The online pharmacy segment is expected to experience rapid growth in the coming years. This increase can be attributed to the widespread presence of online pharmacies in lucrative regions such as Europe and North America, increased patient awareness, and the growing popularity of e-commerce and telehealth services. The online pharmacy segment benefits from factors such as flexibility, convenience, and attractive discounts on medicines, which further contribute to its rise in revenue.

Furthermore, the retail pharmacy segment held the second highest market share in terms of revenue, primarily due to the wide availability of major pharmacy chains such as Walgreens, Walmart, CVS Caremark, and others. These retail pharmacies play a significant role in providing access to a wide range of medications and healthcare products to consumers, contributing to the segment's revenue.

Regional Insights

North America led the overall human growth hormone market with a revenue share of 42.27% in 2023 due to growing healthcare awareness among people, significant government initiatives, and favorable reimbursement policies in the region. Increasing R&D activities in the region, adequate research funding and presence of organizations that facilitate awareness and treatment rates in the region is anticipated to support region expansion. Furthermore, the extensive presence of leading participants such as Pfizer Inc, Lilly and others is responsible for the lucrative revenue share of the region.

Europe holds the second-largest market share, primarily driven by factors such as the increasing burden of growth hormone deficiencies, the availability of artificial growth hormones, and extensive research and development activities in the region. The prevalence of growth hormone deficiency is on the rise in Europe due to factors such as stress, inadequate sleep, and low glucose levels among individuals. For instance, in 2023, the European Medicines Agency reported that growth hormone deficiency impacted around 4.7 out of 10,000 people in the European Union. Additionally, the Germany holds the largest market share in Europe, while the France is experiencing the fastest expansion in the region.

Asia Pacific is anticipated to have a lucrative growth rate during the forecast period, driven by factors such as the high disease burden of rare genetic conditions, unmet medical needs, and the increasing demand for innovative therapeutics. Furthermore, the region benefits from the rising investments made by leading market participants, attracted by the flourishing pharmaceutical sector in APAC, which is anticipated to support the expansion of the region in the market.

Key Companies & Market Share Insights

Some of the key players operating in the industry are Pfizer Inc., Novartis AG, Merck & Co., Inc. The leading players in space are focusing on growth strategies, such as product launches, and R&D investments. Furthermore, emerging players such as OPKO Health, Inc are employing strategies such as mergers & acquisitions to expand their footprint and grow at a fast pace

Key Human Growth Hormone Companies:

- Novo Nordisk A/S

- Eli Lilly and Company

- Pfizer, Inc

- Sandoz International GmbH (Novartis AG)

- Genentech, Inc. (Roche)

- Merck KGaA

- Ferring Pharmaceuticals

- Ipsen

- Teva Pharmaceutical Industries, Ltd.

Recent Developments

-

In August 2023, FDA approved Opko Health, Inc. and Pfizer’s once-weekly somatrogon for children with growth hormone deficiency, key players are strategically advancing their presence in the market. The long-acting injectable, Somatrogon-ghla (Ngenla), demonstrates noninferiority to somatropin in improving annual height velocity based on phase 3 trial data. With a similar safety profile to somatropin, this approval reinforces Opko Health and Pfizer's commitment to addressing growth failure in children through innovative therapeutic solutions.

-

In May 2023, Novo Nordisk advanced in the human growth hormone therapy market with a favorable statement from the European Medicines Agency, recommending once-weekly Sogroya for children aged three and above, addressing growth hormone deficiency and development failure in adolescents. This positions Sogroya as a promising replacement therapy, signaling a noteworthy stride in Novo Nordisk's strategic foothold.

Human Growth Hormone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.41 billion

Revenue forecast in 2030

USD 14.28 billion

Growth rate

CAGR of 12.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Sweden; Norway; Denmark; Russia; China; Japan; India; Australia; South Korea;Singapore; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Novo Nordisk A/S; Pfizer, Inc; Eli Lilly and Company; Sandoz International GmbH (Novartis AG); Merck KGaA; Genentech, Inc (Roche); Ferring Pharmaceuticals; Teva Pharmaceutical Industries, Ltd; Ipsen.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Human Growth Hormone Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented global human growth hormone market report on the basis of product, application, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Long Acting

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Growth Hormone (GH) Deficiency

-

Adult GH Deficiency

-

Pediatric GH Deficiency

-

Turner Syndrome

-

Idiopathic Short Stature

-

Prader-Willi Syndrome

-

Small For Gestational Age

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

Specialty Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018- 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Russia

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Singapore

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global human growth hormone market size was estimated at USD 5.47 billion in 2022 and is expected to reach USD 6.32 billion in 2023.

b. The global human growth hormone market is expected to witness a compound annual growth rate of 12.3% from 2023 to 2030 to reach USD 14.28 billion by 2030.

b. North America dominated the global human growth hormone market with a share of 42.27% in 2022. This is attributable to factors such as favorable reimbursement scenario, established healthcare infrastructure, significant government initiatives, and growing healthcare awareness.

b. Some of the key players operating in the human growth hormone market include Novo Nordisk A/S; Pfizer, Inc; Eli Lilly and Company; Sandoz International GmbH (Novartis AG); Merck KGaA; Genentech, Inc (Roche); Ferring Pharmaceuticals; Teva Pharmaceutical Industries, Ltd; and Ipsen.

b. Key factors that are driving the human growth hormone market growth include increasing R&D activities, a robust product pipeline, and initiatives taken by various government and private organizations to spread awareness about GH deficiencies and its treatment.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.1.1. Segment Definitions

1.1.1.1. Application segment

1.1.1.2. Product segment

1.1.1.3. Distribution channel segment

1.2. Regional Scope

1.3. Estimates and Forecast Timeline

1.4. Objectives

1.4.1. Objective - 1

1.4.2. Objective - 2

1.4.3. Objective - 3

1.5. Research Methodology

1.6. Information Procurement

1.6.1. Purchased Database

1.6.2. GVR’s Internal Database

1.6.3. Secondary Sources

1.6.4. Primary research

1.7. Information or Data Analysis

1.7.1. Data Analysis Models

1.8. Market Formulation & Validation

1.9. Model Details

1.9.1. Commodity Flow Analysis

1.10. List of Secondary Sources

1.11. List of Abbreviations

Chapter 2. Executive Summary

2.1. Market Snapshot

2.2. Application and Product Snapshot

2.3. Distribution Channel Snapshot

2.4. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market Driver Analysis

3.2.1.1. Increasing prevalence of human growth hormone

3.2.1.2. Growing investments and governmental funding in the development of diagnostics

3.2.1.3. Growing awareness of human growth hormone

3.2.2. Market Restraint Analysis

3.2.2.1. Shift of funds to tackle other diseases in low health budgets.

3.2.2.2. Shortage of funding from international partners and foreign government

3.3. Industry Analysis Tools

3.3.1. Porter’s Five Forces Analysis

3.3.2. PESTEL Analysis

3.3.3. COVID-19 Impact Analysis

3.4. Pricing Analysis

Chapter 4. Product Business Analysis

4.1. Human Growth Hormone Market: Product Movement Analysis

4.2. Long Acting

4.2.1. Long Acting Market, 2018 - 2030 (USD Million)

4.3. Others

4.3.1. Others Market, 2018 - 2030 (USD Million)

Chapter 5. Application Business Analysis

5.1. Human Growth Hormone Market: Application Movement Analysis

5.2. Growth Hormone Deficiency

5.2.1. Growth Hormone Deficiency Market, 2018 - 2030 (USD Million)

5.2.2. Adult Growth Hormone Deficiency

5.2.2.1. Adult Growth Hormone Deficiency Market, 2018 - 2030 (USD Million)

5.2.3. Pediatric Growth Hormone Deficiency

5.2.3.1. Pediatric Growth Hormone Deficiency Market, 2018 - 2030 (USD Million)

5.3. Turner Syndrome

5.3.1. Turner Syndrome Market, 2018 - 2030 (USD Million)

5.4. Idiopathic Short Stature

5.4.1. Idiopathic Short Stature Market, 2018 - 2030 (USD Million)

5.5. Prader-Willi Syndrome

5.5.1. Prader-Willi Syndrome Market, 2018 - 2030 (USD Million)

5.6. Small for Gestational Age

5.6.1. Small for Gestational Age Market, 2018 - 2030 (USD Million)

5.7. Other

5.7.1. Other Market, 2018 - 2030 (USD Million)

Chapter 6. Distribution Channel Business Analysis

6.1. Human Growth Hormone Market: Distribution Channel Movement Analysis

6.2. Hospital Pharmacy

6.2.1. Hospital Pharmacy Market, 2018 - 2030 (USD Million)

6.3. Retail Pharmacy

6.3.1. Retail Pharmacy Market, 2018 - 2030 (USD Million)

6.4. Online Pharmacy

6.4.1. Online Pharmacy Market, 2018 - 2030 (USD Million)

6.5. Specialty Pharmacy

6.5.1. Specialty Pharmacy Market, 2018 - 2030 (USD Million)

Chapter 7. Regional Business Analysis

7.1. Human Growth Hormone Market Share By Region, 2022 & 2030

7.2. North America

7.2.1. SWOT Analysis

7.2.2. North America Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.2.3. U.S.

7.2.3.1. Key Country Dynamics

7.2.3.2. Competitive Scenario

7.2.3.3. Regulatory Framework

7.2.3.4. U.S. Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.2.4. Canada

7.2.4.1. Key Country Dynamics

7.2.4.2. Competitive Scenario

7.2.4.3. Regulatory Framework

7.2.4.4. Canada Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3. Europe

7.3.1. SWOT Analysis

7.3.2. Europe Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.3. UK

7.3.3.1. Key Country Dynamics

7.3.3.2. Competitive Scenario

7.3.3.3. Regulatory Framework

7.3.3.4. UK Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.4. Germany

7.3.4.1. Key Country Dynamics

7.3.4.2. Competitive Scenario

7.3.4.3. Regulatory Framework

7.3.4.4. Germany Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.5. France

7.3.5.1. Key Country Dynamics

7.3.5.2. Competitive Scenario

7.3.5.3. Regulatory Framework

7.3.5.4. France Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.6. Italy

7.3.6.1. Key Country Dynamics

7.3.6.2. Competitive Scenario

7.3.6.3. Regulatory Framework

7.3.6.4. Italy Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.7. Spain

7.3.7.1. Key Country Dynamics

7.3.7.2. Competitive Scenario

7.3.7.3. Regulatory Framework

7.3.7.4. Spain Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.8. Sweden

7.3.8.1. Key Country Dynamics

7.3.8.2. Competitive Scenario

7.3.8.3. Regulatory Framework

7.3.8.4. Sweden Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.9. Norway

7.3.9.1. Key Country Dynamics

7.3.9.2. Competitive Scenario

7.3.9.3. Regulatory Framework

7.3.9.4. Norway Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.10. Denmark

7.3.10.1. Key Country Dynamics

7.3.10.2. Competitive Scenario

7.3.10.3. Regulatory Framework

7.3.10.4. Denmark Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.3.11. Russia

7.3.11.1. Key Country Dynamics

7.3.11.2. Competitive Scenario

7.3.11.3. Regulatory Framework

7.3.11.4. Russia Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4. Asia Pacific

7.4.1. SWOT Analysis

7.4.2. Asia Pacific Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.3. Japan

7.4.3.1. Key Country Dynamics

7.4.3.2. Competitive Scenario

7.4.3.3. Regulatory Framework

7.4.3.4. Japan Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.4. China

7.4.4.1. Key Country Dynamics

7.4.4.2. Competitive Scenario

7.4.4.3. Regulatory Framework

7.4.4.4. China Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.5. India

7.4.5.1. Key Country Dynamics

7.4.5.2. Competitive Scenario

7.4.5.3. Regulatory Framework

7.4.5.4. India Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.6. Australia

7.4.6.1. Key Country Dynamics

7.4.6.2. Competitive Scenario

7.4.6.3. Regulatory Framework

7.4.6.4. Australia Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.7. Thailand

7.4.7.1. Key Country Dynamics

7.4.7.2. Competitive Scenario

7.4.7.3. Regulatory Framework

7.4.7.4. Thailand Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.8. South Korea

7.4.8.1. Key Country Dynamics

7.4.8.2. Competitive Scenario

7.4.8.3. Regulatory Framework

7.4.8.4. South Korea Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.4.9. Singapore

7.4.9.1. Key Country Dynamics

7.4.9.2. Competitive Scenario

7.4.9.3. Regulatory Framework

7.4.9.4. Indonesia Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.5. Latin America

7.5.1. SWOT Analysis

7.5.2. Latin America Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.5.3. Brazil

7.5.3.1. Key Country Dynamics

7.5.3.2. Competitive Scenario

7.5.3.3. Regulatory Framework

7.5.3.4. Brazil Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.5.4. Mexico

7.5.4.1. Key Country Dynamics

7.5.4.2. Competitive Scenario

7.5.4.3. Regulatory Framework

7.5.4.4. Mexico Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.5.5. Argentina

7.5.5.1. Key Country Dynamics

7.5.5.2. Competitive Scenario

7.5.5.3. Regulatory Framework

7.5.5.4. Argentina Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.6. MEA

7.6.1. SWOT Analysis

7.6.2. MEA Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.6.3. South Africa

7.6.3.1. Key Country Dynamics

7.6.3.2. Competitive Scenario

7.6.3.3. Regulatory Framework

7.6.3.4. South Africa Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.6.4. Saudi Arabia

7.6.4.1. Key Country Dynamics

7.6.4.2. Competitive Scenario

7.6.4.3. Regulatory Framework

7.6.4.4. Saudi Arabia Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.6.5. UAE

7.6.5.1. Key Country Dynamics

7.6.5.2. Competitive Scenario

7.6.5.3. Regulatory Framework

7.6.5.4. UAE Human Growth Hormone Market, 2018 - 2030 (USD Million)

7.6.6. Kuwait

7.6.6.1. Key Country Dynamics

7.6.6.2. Competitive Scenario

7.6.6.3. Regulatory Framework

7.6.6.4. Kuwait Human Growth Hormone Market, 2018 - 2030 (USD Million)

Chapter 8. Competitive Landscape

8.1. Company Categorization

8.2. Strategy Mapping

8.3. Company Market Share Analysis, 2023

8.4. Company Profiles/Listing

8.4.1. Novo Nordisk A/S

8.4.1.1. Overview

8.4.1.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.1.3. Product Benchmarking

8.4.1.4. Strategic Initiatives

8.4.2. Pfizer, Inc

8.4.2.1. Overview

8.4.2.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.2.3. Product Benchmarking

8.4.2.4. Strategic Initiatives

8.4.3. Eli Lilly and Company

8.4.3.1. Overview

8.4.3.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.3.3. Product Benchmarking

8.4.3.4. Strategic Initiatives

8.4.4. Sandoz International GmbH (Novartis AG)

8.4.4.1. Overview

8.4.4.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.4.3. Product Benchmarking

8.4.4.4. Strategic Initiatives

8.4.5. Merck KGaA

8.4.5.1. Overview

8.4.5.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.5.3. Product Benchmarking

8.4.5.4. Strategic Initiatives

8.4.6. Genentech, Inc (Roche)

8.4.6.1. Overview

8.4.6.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.6.3. Product Benchmarking

8.4.6.4. Strategic Initiatives

8.4.7. Ferring Pharmaceuticals

8.4.7.1. Overview

8.4.7.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.7.3. Product Benchmarking

8.4.7.4. Strategic Initiatives

8.4.8. Teva Pharmaceutical Industries, Ltd

8.4.8.1. Overview

8.4.8.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.8.3. Product Benchmarking

8.4.8.4. Strategic Initiatives

8.4.9. Ipsen

8.4.9.1. Overview

8.4.9.2. Financial Performance (Net Revenue/Sales/EBITDA/Gross Profit)

8.4.9.3. Product Benchmarking

8.4.9.4. Strategic Initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviation

Table 3 Global Human Growth Hormone Market, By Region, 2018 - 2030 (USD Million)

Table 4 Global Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 5 Global Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 6 Global Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 7 North America Human Growth Hormone Market, By Country, 2018 - 2030 (USD Million)

Table 8 North America Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 9 North America Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 10 North America Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 11 U.S. Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 12 U.S. Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 13 U.S. Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 14 Canada Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 15 Canada Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 16 Canada Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 17 Europe Human Growth Hormone Market, By Country, 2018 - 2030 (USD Million)

Table 18 Europe Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 19 Europe Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 20 Europe Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 21 UK Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 22 UK Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 23 UK Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 24 Germany Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 25 Germany Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 26 Germany Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 27 France Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 28 France Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 29 France Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 30 Italy Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 31 Italy Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 32 Italy Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 33 Spain Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 34 Spain Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 35 Spain Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 36 Russia Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 37 Russia Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 38 Russia Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 39 Denmark Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 40 Denmark Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 41 Denmark Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 42 Sweden Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 43 Sweden Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 44 Sweden Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 45 Norway Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 46 Norway Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 47 Norway Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 48 Asia Pacific Human Growth Hormone Market, By Country, 2018 - 2030 (USD Million)

Table 49 Asia Pacific Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 50 Asia Pacific Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 51 Asia Pacific Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 52 China Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 53 China Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 54 China Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 55 India Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 56 India Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 57 India Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 58 South Korea Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 59 South Korea Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 60 South Korea Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 61 Japan Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 62 Japan Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 63 Japan Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 64 Singapore Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 65 Singapore Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 66 Singapore Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 67 Australia Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 68 Australia Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 69 Australia Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 70 Thailand Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 71 Thailand Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 72 Thailand Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 73 Latin America Human Growth Hormone Market, By Country, 2018 - 2030 (USD Million)

Table 74 Latin America Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 75 Latin America Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 76 Latin America Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 77 Brazil Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 78 Brazil Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 79 Brazil Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 80 Mexico Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 81 Mexico Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 82 Mexico Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 83 Argentina Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 84 Argentina Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 85 Argentina Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 86 Middle East & Africa Human Growth Hormone Market, By Country, 2018 - 2030 (USD Million)

Table 87 Middle East & Africa Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 88 Middle East & Africa Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 89 Middle East & Africa Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 90 South Africa Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 91 South Africa Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 92 South Africa Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 93 Saudi Arabia Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 94 Saudi Arabia Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 95 Saudi Arabia Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 96 UAE Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 97 UAE Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 98 UAE Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

Table 99 Kuwait Human Growth Hormone Market, By Product, 2018 - 2030 (USD Million)

Table 100 Kuwait Human Growth Hormone Market, By Application, 2018 - 2030 (USD Million)

Table 101 Kuwait Human Growth Hormone Market, By Distribution Channel, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market Research Process

Fig. 2 Information Procurement

Fig. 3 Primary Research Pattern

Fig. 4 Market Research Approaches

Fig. 5 Value Chain-Based Sizing & Forecasting

Fig. 6 Market Formulation & Validation

Fig. 7 Human Growth Hormone Market Segmentation

Fig. 8 Market Driver Relevance Analysis (Current & Future Impact)

Fig. 9 Market Restraint Relevance Analysis (Current & Future Impact)

Fig. 10 Market Challenge Relevance Analysis (Current & Future Impact)

Fig. 11 Penetration & Growth Prospect Mapping

Fig. 12 SWOT Analysis, By Factor (Political & Legal, Economic and Technological)

Fig. 13 Porter’s Five Forces Analysis

Fig. 14 Human growth hormone market: Product outlook and key takeaways

Fig. 15 Human growth hormone market: Product movement analysis & market share 2023 & 2030

Fig. 16 Long acting market, 2018 - 2030 (USD Million)

Fig. 17 Others market, 2018 - 2030 (USD Million)

Fig. 18 Human growth hormone market: Application outlook and key takeaways

Fig. 19 Human growth hormone market: Application movement analysis & market share 2023 & 2030

Fig. 20 Growth hormone deficiency market, 2018 - 2030 (USD Million)

Fig. 21 Adult growth hormone deficiency market, 2018 - 2030 (USD Million)

Fig. 22 Paediatric growth hormone deficiency market, 2018 - 2030 (USD Million)

Fig. 23 Turner syndrome market, 2018 - 2030 (USD Million)

Fig. 24 Idiopathic short stature market, 2018 - 2030 (USD Million)

Fig. 25 Prader-Willi syndrome market, 2018 - 2030 (USD Million)

Fig. 26 Small for gestational age market, 2018 - 2030 (USD Million)

Fig. 27 Other market, 2018 - 2030 (USD Million)

Fig. 28 Human growth hormone market: Distribution channel method outlook and key takeaways

Fig. 29 Human growth hormone market: Distribution channel method movement analysis & market share 2023 & 2030

Fig. 30 Hospital pharmacy market, 2018 - 2030 (USD Million)

Fig. 31 Retail pharmacy market, 2018 - 2030 (USD Million)

Fig. 32 Online pharmacy market, 2018 - 2030 (USD Million)

Fig. 33 Specialty pharmacy market, 2018 - 2030 (USD Million)

Fig. 34 Regional Marketplace: Key Takeaways

Fig. 35 Regional Outlook, 2022 & 2030

Fig. 36 Regional Market Dashboard

Fig. 37 Regional Market Place: Key Takeaways

Fig. 38 North America

Fig. 39 North America Market Estimates and Forecast, 2018 - 2030 (USD Million)

Fig. 40 U.S. Key Country Dynamics

Fig. 41 U.S. America Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 42 Canada Key Country Dynamics

Fig. 43 Canada Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 44 Europe Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 45 UK Key Country Dynamics

Fig. 46 UK Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 47 Germany Key Country Dynamics

Fig. 48 Germany Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 49 France Key Country Dynamics

Fig. 50 France Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 51 Italy Key Country Dynamics

Fig. 52 Italy Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 53 Spain Key Country Dynamics

Fig. 54 Spain Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 55 Sweden Key Country Dynamics

Fig. 56 Sweden Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 57 Norway Key Country Dynamics

Fig. 58 Norway Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 59 Denmark Key Country Dynamics

Fig. 60 Denmark Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 61 Russia Key Country Dynamics

Fig. 62 Russia Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 63 Turkey Key Country Dynamics

Fig. 64 Turkey Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 65 Asia Pacific America Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 66 Japan Key Country Dynamics

Fig. 67 Japan Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 68 China Key Country Dynamics

Fig. 69 China Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 70 India Key Country Dynamics

Fig. 71 India Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 72 Australia Key Country Dynamics

Fig. 73 Australia Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 74 Thailand Key Country Dynamics

Fig. 75 Thailand Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 76 South Korea Key Country Dynamics

Fig. 77 South Korea Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 78 Indonesia Key Country Dynamics

Fig. 79 Indonesia Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 80 Latin America Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 81 Brazil Key Country Dynamics

Fig. 82 Brazil Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 83 Mexico Key Country Dynamics

Fig. 84 Mexico Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 85 Argentina Key Country Dynamics

Fig. 86 Argentina Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 87 Middle East and Africa America Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 88 South Africa Key Country Dynamics

Fig. 89 South Africa Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 90 Saudi Arabia Key Country Dynamics

Fig. 91 Saudi Arabia Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 92 UAE Key Country Dynamics

Fig. 93 UAE Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 94 Kuwait Key Country Dynamics

Fig. 95 Kuwait Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 96 Nigeria

Fig. 97 Nigeria Human Growth Hormone Market, 2018 - 2030 (USD Million)

Fig. 98 Strategy MappingWhat questions do you have? Get quick response from our industry experts. Request a Free ConsultationMarket Segmentation

- Human Growth Hormone: Product Outlook (Revenue, USD Million, 2018 - 2030)

- Long Acting

- Others

- Human Growth Hormone: Application Outlook (Revenue, USD Million, 2018 - 2030)

- Growth Hormone (GH) Deficiency

- Adult GH Deficiency

- Pediatric GH Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Human Growth Hormone: Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Human Growth Hormone: Regional Outlook (Revenue, USD Million, 2018- 2030)

- North America

- North America Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- North America Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- North America Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- U.S

- U.S. Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- U.S. Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- U.S. Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- U.S. Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Canada

- Canada Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Canada Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Canada Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Canada Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- North America Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Europe

- Europe Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Europe Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Europe Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- UK

- UK Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- UK Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- UK Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- UK Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Germany

- Germany Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Germany Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Germany Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Germany Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- France

- France Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- France Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- France Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- France Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Italy

- Italy Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Italy Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Italy Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Italy Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Spain

- Spain Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Spain Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Spain Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Spain Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Russia

- Russia Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Russia Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Russia Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Russia Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Denmark

- Denmark Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Denmark Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Denmark Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Denmark Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Sweden

- Sweden Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Sweden Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Sweden Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Sweden Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Norway

- Norway Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Norway Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Norway Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Norway Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Europe Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Asia Pacific

- Asia Pacific Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Asia Pacific Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Asia Pacific Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Japan

- Japan Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Japan Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Japan Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Japan Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- China

- China Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- China Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- China Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- China Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- India

- India Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- India Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- India Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- India Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- South Korea

- South Korea Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- South Korea Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- South Korea Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- South Korea Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Singapore

- Singapore Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Singapore Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Singapore Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Singapore Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Australia

- Australia Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Australia Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Australia Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Australia Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Thailand

- Thailand Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Thailand Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Thailand Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Home Healthcare

- Thailand Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Asia Pacific Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Latin America

- Latin America Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Latin America Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Latin America Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Brazil

- Brazil Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Brazil Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Brazil Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Brazil Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Mexico

- Mexico Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Mexico Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Mexico Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Mexico Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Argentina

- Argentina Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Argentina Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Argentina Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Argentina Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Latin America Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- MEA

- MEA Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- MEA Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- MEA Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- South Africa

- South Africa Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- South Africa Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- South Africa Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- South Africa Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Saudi Arabia

- Saudi Arabia Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Saudi Arabia Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Saudi Arabia Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Saudi Arabia Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- UAE

- UAE Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- UAE Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- UAE Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- UAE Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Kuwait

- Kuwait Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- Long Acting

- Others

- Kuwait Human Growth Hormone Market, by Application (Revenue, USD Million; 2018 - 2030)

- Growth Hormone Deficiency

- Adult Growth Hormone Deficiency

- Pediatric Growth Hormone Deficiency

- Turner Syndrome

- Idiopathic Short Stature

- Prader-Willi Syndrome

- Small for Gestational Age

- Other

- Kuwait Human Growth Hormone Market, by Distribution channel (Revenue, USD Million; 2018 - 2030)

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

- Specialty Pharmacy

- Kuwait Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- MEA Human Growth Hormone Market, by Product (Revenue, USD Million; 2018 - 2030)

- North America

Smart Home Market Dynamics

Driver: Rising investments in R&D activities

Robust product pipeline and extensive R&D investments for the development of novel growth hormone therapies are expected to be major factors driving the market over the forecast period. For instance, in October 2021, Pfizer, Inc. and OPKO Health, Inc. submitted additional data to the U.S. FDA on their Biologics License Application for their investigational drug, somatrogon, for the treatment of growth hormone deficiency. Various key players, including Teva Pharmaceutical, OPKO Health, Eli Lilly and Company, Ferring Pharmaceuticals, Sanofi, and LG Life Sciences are involved in R&D activities for developing novel HGH therapies. Increase in investments and collaborations for the development of novel HGH therapies is anticipated boost market growth. Moreover, companies are investing in delivery and monitoring of HGH therapy to improve efficacy and scale for future enhancements. For instance, in September 2021, Merck KGaA collaborated with Biocorp to develop and supply a specific version of Mallya device to monitor treatment of HGH disorders. Moreover, in April 2021, the company selected the remote patient monitoring platform of PRA Health Sciences to deliver a better product experience.

Driver: Rising awareness regarding Growth Hormone Deficiency

Increasing awareness about growth hormone deficiency and associated disorders is expected to propel market growth. Both government and non-government organizations, such as the National Organization for Rare Disorders, the Pituitary Foundation, the Child Growth Foundation, the MAGIC Foundation, Turner Syndrome Foundation, are continuously raising awareness about growth hormone deficiency globally. The Child Growth Foundation is a UK-based nongovernment organization dedicated to support people living with rare growth hormone disorders. This organization provides information and support to patients, caregivers, & healthcare professionals to improve the quality of life of patients.

The International Child Growth Awareness Day is observed on September 20 each year to drive awareness among people and health professionals regarding children’s growth & the importance of understanding child growth rate. Global organizations unite to promote awareness about children’s growth. Many countries also celebrate Children’s Growth Awareness Week in second or third week of September. In July 2014, the U.S. passed the Growth Awareness Resolution, acknowledging children's Growth Awareness Week in September. Promotion of such awareness programs and involvement of number of organizations promoting awareness campaigns are further expected to propel market growth.

Restraint: Adverse effects of hormone therapies

As per Harvard Health Publishing, many people using HGH face a risk of experiencing adverse effects. Long-term use of HGH can result in joint pains, soft tissue swelling, carpal tunnel syndrome, edema, and higher blood sugar levels. Excessive secretion of HGH causes diseases such as acromegaly, which leads to high blood pressure, diabetes, and arthritis. In female patients, the side effects are often worse during the early phase of treatment. These side effects depend upon the type of hormone therapy being used. Common side-effects include tiredness, digestive system problems, hair thinning, menopausal symptoms, headaches, and blood clots, among others.

Synthetic growth hormones can lead to water retention, which is characterized by painful swelling of the limbs as well as skin lesions & wounds. Moreover, in some cases, introduction of synthetic growth hormones in the system can restart the bone growth process, which can be extremely painful. Acromegaly is one such condition that results in enlargement of hands, feet, jawbone, and brow ridges. Other adverse effects include HGH gut and gynecomastia. HGH gut is the enlargement of internal organs, while gynecomastia is excessive development of breasts in men.

What Does This Report Include?

This section will provide insights into the contents included in this human growth hormone market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

Human growth hormone market qualitative analysis

-

Industry overview

-

Industry trends

-

Market drivers and restraints

-

Market size

-

Growth prospects

-

Porter’s analysis

-

PESTEL analysis

-

Key market opportunities prioritized

-

Competitive landscape

-

Company overview

-

Financial performance

-

Product benchmarking

-

Latest strategic developments

-

Human growth hormone market quantitative analysis

-

Market size, estimates, and forecast from 2018 to 2030

-

Market estimates and forecast for product segments up to 2030

-

Regional market size and forecast for product segments up to 2030

-

Market estimates and forecast for application segments up to 2030

-

Regional market size and forecast for application segments up to 2030

-

Company financial performance

What questions do you have? Get quick response from our industry experts. Request a Free ConsultationResearch Methodology

A three-pronged approach was followed for deducing the human growth hormone market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for human growth hormone market to gather the most reliable and current information possible.

- We buy access to paid databases such as Hoover’s and Factiva for company financials, industry information, white papers, industry journals, SME journals, and more.

- We tap into Grand View’s proprietary database of data points and insights from active and archived monitoring and reporting.

- We conduct primary research with industry experts through questionnaires and one-on-one phone interviews.

- We pull from reliable secondary sources such as white papers and government statistics, published by organizations like WHO, NGOs, World Bank, etc., Key Opinion Leaders (KoL) publications, company filings, investor documents, and more.

- We purchase and review investor analyst reports, broker reports, academic commentary, government quotes, and wealth management publications for insightful third-party perspectives.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of human growth hormone market data depending on the type of information we’re trying to uncover in our research.

-

Market Research Efforts: Bottom-up Approach for estimating and forecasting demand size and opportunity, top-down Approach for new product forecasting and penetration, and combined approach of both Bottom-up and Top-down for full coverage analysis.

-

Value-Chain-Based Sizing & Forecasting: Supply-side estimates for understanding potential revenue through competitive benchmarking, forecasting, and penetration modeling.

-

Demand-side estimates for identifying parent and ancillary markets, segment modeling, and heuristic forecasting.

-

Qualitative Functional Deployment (QFD) Modelling for market share assessment.

Market formulation and validation: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

-

Market Formulation: This step involves the finalization of market numbers. This step on an internal level is designed to manage outputs from the Data Analysis step.

-

Data Normalization: The final market estimates and forecasts are then aligned and sent to industry experts, in-panel quality control managers for validation.

-

This step also entails the finalization of the report scope and data representation pattern.

-

Validation: The process entails multiple levels of validation. All these steps run in parallel, and the study is forwarded for publishing only if all three levels render validated results.

Human Growth Hormone Market Categorization:

The human growth hormone market was categorized into four segments, namely product (Long Acting), application (Growth Hormone (GH) Deficiency, Turner Syndrome, Idiopathic Short Stature, Prader-Willi Syndrome, Small for Gestational Age), distribution channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy, Specialty Pharmacy), and region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa).

Segment Market Methodology:

The human growth hormone market was segmented into product, application, distribution channel, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

Market research approaches: Bottom-up

-

Demand estimation of each product across countries/regions summed up to from the total market.

-

Variable analysis for demand forecast.

-