- Home

- »

- Clothing, Footwear & Accessories

- »

-

Hunting Equipment & Accessories Market Size Report, 2030GVR Report cover

![Hunting Equipment & Accessories Market Size, Share & Trends Report]()

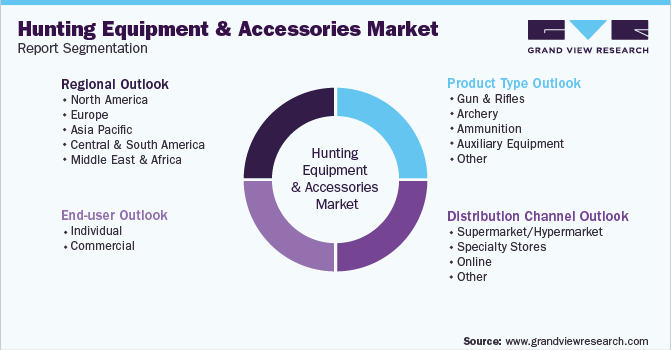

Hunting Equipment & Accessories Market Size, Share & Trends Analysis Report By End-user (Individual, Commercial), By Product Type (Guns & Rifles, Ammunition), By Region, By Distribution Channel, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-992-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

The global hunting equipment & accessories market size was valued at USD 19.90 billion in 2021 and is expected to register a compound annual growth rate (CAGR) of 7.5% from 2022 to 2030. Rising inclination towards hunting, increasing revenue from hunting license sales for wildlife conservation and forest management, and surging growth of the safari tourism industry are the factors that drive the growth of the industry. In addition, these products are easy to carry, set up, and wear. These benefits will also support the industry's growth. New ammunition designs and the rising need for environmental conservation would increase numerous chances, leading to an expansion of the market over the forecast period.

However, the high cost of accessories and regional restrictions regarding the hunting of any animal is expected to hamper the growth. Hunting is a vital socio-economic activity, mainly in rural areas. Hunters provide financial support by generating thousands of jobs directly associated with the production and sale of goods and services anticipated to meet their requirements. According to a report by the U.S. Fish and Wildlife Service in 2017, 101.6 million Americans (40% of the U.S. population aged 16 years and older) participated in wildlife-related activities in 2016, such as hunting, fishing, and wildlife-watching. The COVID-19 pandemic has had a positive impact on the industry. A surge in online distribution channels was seen by various companies operating in the industry.

However, owing to the interruption of logistics and transportation services, the supply chain was largely hampered. The drop in offline sales and the stoppage of manufacturing of these products had an adverse impact on hunting equipment & accessories sales for a couple of months in 2020. Hunting equipment & accessories are items that are normally used for hunting activities. They are built in a variety of ways to fulfill the requirements of the hunters. Consumers purchase these products based on their requirements and the nature of the animals. Gun & rifles, binoculars & camping equipment, bows, arrows & archery equipment, ammunition, and many other items are in demand due to their most recent developments to complement the hunting procedure.

Customers’ interest in hunting equipment & accessories is growing, prompting manufacturers to design new products. Companies are launching advanced hunting equipment & accessories to encounter consumers’ demands. Several major players are introducing smart hunting equipment & accessories. American Outdoor Brands Inc. offers an extensive range of hunting equipment & accessories, such as performance center TC LRR, TC compass II, and TC venture II, through its subsidiary Thompson Center Arms. In addition, Beretta Holding SA offers a varied range of hunting equipment & accessories that includes 686 silver pigeons I, ultralight classic, and ultralight gold among others.

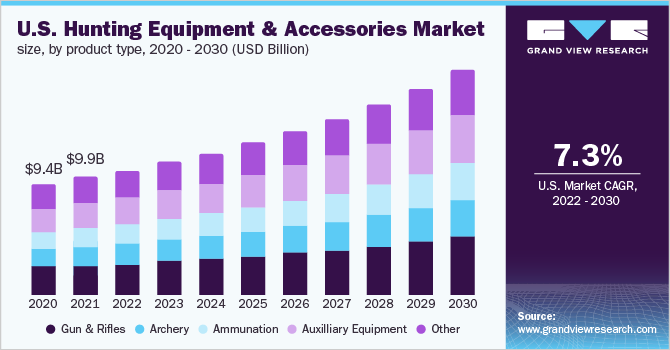

Product Type Insights

The ammunition segment is projected to grow at the fastest CAGR of more than 8.00% over the forecast period. A rise in the number of gun users in the commercial sector for hunting is expected to drive the demand for ammunition over the forecast period. The major ammunition companies are concentrating on the manufacturing of specialized ammunition for hunting. For instance, in October 2018, Hornady manufacturing company launched its new hunter line of ammo, which offers high accuracy as well as operational efficiency, for various hunting needs. According to the National Survey of Fishing, Hunting, and Wildlife-Associated Recreation, a large number of hunters are preferring ammunition for hunting activities and also increased spending on such hunting equipment & accessories.

Thus, it is likely to increase the growth of the segment over the forecast period. The gun & rifles segment dominated the industry in terms of share and is projected to grow at a considerable CAGR over the forecast period. Guns & rifles are typically used for firing at stationary targets. According to the National Survey of Fishing, Hunting, and Wildlife-Associated Recreation, American hunters spent around $2.3 billion on hunting equipment, such as guns & rifles. Guns & rifles are used for many different types of hunting, from varmint to big game all over the world. Therefore, it generated the maximum revenue in 2021.

End-user Insights

On the basis of end-users, the global industry has been further categorized into commercial and individual. The commercial end-user segment dominated the global industry in 2021, in terms of revenue share. The segment is projected to expand further at the fastest CAGR of more than 7.5% retaining the leading position throughout the forecast period. Commercial hunters are qualified and licensed to guide paying overseas clients on their hunting safari. In most African countries it is a legal requirement for a foreign hunter to be accompanied by a professional hunter. Commercial hunters regularly purchase hunting equipment & accessories.

Therefore, product demand has increased in this segment across the world and generated maximum revenue in 2021. The individual end-user segment is projected to register a steady growth rate during the forecast period. In recent years, wildlife officials in the U.S. have focused on recruiting non-traditional hunters. In a recent survey by Southwick Associates, in one year there has been a 25% increase in new hunters and a 5% spike in licensed hunters in 2020. Thus, it is likely to increase the growth of the segment over the forecast period.

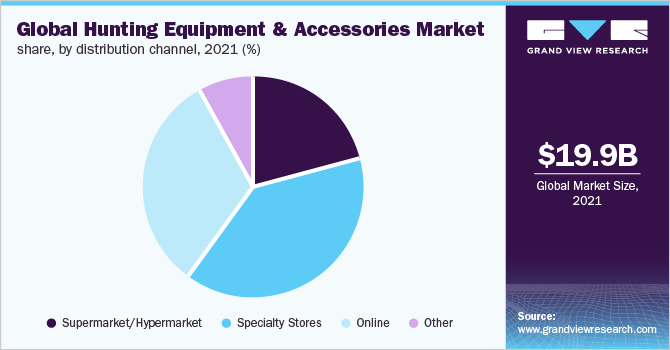

Distribution Channel Insights

In 2021, the specialty store segment held the maximum revenue share of more than 38.75% and is likely to grow at a considerable CAGR over the forecast period. Specialty stores mainly focus on selling a particular brand or a particular type of product. One advantage of specialty stores is that customers can be provided with detailed information about the product of their choice. Another advantage is that specialty stores provide their customers with special offers, promotions, and discounts. Thus, specialty stores are of substantive importance as people all over the world can access specific hunting equipment & accessories. Thus, the segment generated large revenue in 2021.

The online segment is estimated to witness a significant CAGR over the forecast period. Convenience and speed is the main advantage of indirect distribution to the customer. Online distribution channels allow companies to enter new markets quickly and easily, often at least initial risk and cost. The online segment is addressing customer queries in a well-organized way to increase customer satisfaction levels. The segment growth is due to the growing demand for hunting equipment & accessories through online distribution channels. Therefore, the segment is likely to grow at a significant CAGR over the forecast period.

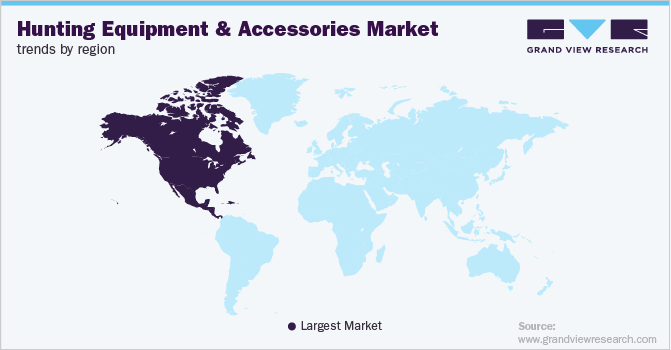

Regional Insights

On the basis of geographies, the global industry has been further categorized into North America, Europe, Asia Pacific, Middle East & Africa, and Central & South America. Europe is anticipated to grow at the fastest CAGR of 8.3% over the forecast period. France has the most hunters in the Europe region. Spain, the U.K., and Italy also have a considerable number of hunters. Nowadays, women play a significant part in European hunting. In the past, women contributed generally to the activities that followed the hunt. Hunting and fishing trade shows are held in various countries across Europe.

This is likely to increase product demand over the forecast period. North America was the largest region in 2021 and accounted for the highest revenue share in the same year. The growing popularity of outdoor recreational activities has fueled the growth of the market in this region. Outdoor leisure activities are largely popular in North America, particularly in the U.S. and Canada. Hunting is a popular pastime in most parts of North America, and the selling of hunting licenses contributes to wildlife conservation and habitat management. In 2020, there were around 15.2 million hunters in the USA, which increased the product demand.

Key Companies & Market Share Insights

Major companies have implemented business expansion and product launches as their key development strategies to increase their industry share and remain competitive. For instance,

-

In July 2022, Beretta Holding S.A. completed the acquisition of RUAG Ammotec Group. The acquisition added 16 companies in 12 different countries and 2,700 people to Beretta Holding Group. As a result of the acquisition, Beretta Holding will have the most complete offering of premium products, which includes small arms, ammunition, optics, clothing, accessories, and electro-optics

-

In December 2021, Vista Outdoor Inc. acquired backcountry hunting gear company Stone Glacier, giving Vista a foothold in the packs, camping equipment, and technical apparel categories

-

In July 2020, FORLOH, a new direct-to-consumer hunting, fishing, and outdoor brand, launched premium technical apparel with superior technology. In addition to unveiling FORLOH.com, the brand’s flagship retail store opened in Whitefish, Montana, the same city as its headquarters

Some of the key players operating in the global hunting equipment & accessories market include:

-

American Outdoor Brands Corp.

-

Beretta Holding SA

-

BPS Direct LLC

-

Buck Knives, Inc.

-

Dick’s Sporting Goods, Inc.

-

SPYPOINT

-

Under Armour, Inc.

-

Spyderco, Inc.

-

Sturm Ruger and Co. Inc.

-

Vista Outdoor Inc.

Hunting Equipment & Accessories Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 21.14 billion

Revenue forecast in 2030

USD 38.26 billion

Growth rate

CAGR of 7.5% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, distribution channel, end-user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; China; India; Japan; Argentina; South Africa

Key companies profiled

American Outdoor Brands Corp.; Beretta Holding SA; BPS Direct LLC; Buck Knives, Inc.; Dick’s Sporting Goods, Inc.; SPYPOINT; Under Armour, Inc.; Spyderco, Inc.; Sturm Ruger and Co. Inc.; Vista Outdoor Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hunting Equipment & Accessories Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segment from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global hunting equipment & accessories market report based on the product type, distribution channel, end-user, and region:

-

Product Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Gun & Rifles

-

Archery

-

Ammunition

-

Auxiliary Equipment

-

Other

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Supermarket/Hypermarket

-

Specialty Stores

-

Online

-

Other

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Individual

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 -2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

-

The Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hunting equipment & accessories market size was estimated at USD 19.90 billion in 2021 and is expected to reach USD 21.14 billion in 2022.

b. The global hunting equipment & accessories market is expected to grow at a compound annual growth rate of 7.5% from 2022 to 2030 to reach USD 38.26 billion by 2030.

b. North America accounted for the highest market share of above 55.0% in 2021. The large popularity of outdoor recreational activities has fueled the growth of the hunting equipment market in this region. Outdoor leisure activities are largely popular in North America, particularly in the U.S. and Canada.

b. Some of the key companies include American Outdoor Brands Corp., Beretta Holding SA, BPS Direct LLC, Buck Knives, Inc., Dick’s Sporting Goods, Inc., SPYPOINT, Under Armour, Inc., Spyderco, Inc., Sturm Ruger, and Co. Inc., and Vista Outdoor Inc.

b. Key factors that are driving the hunting equipment & accessories market growth include rising inclination towards hunting, increasing revenue from hunting license sales for wildlife conservation and forest management, and surging growth of the safari tourism industry are the factors that drive the growth of the hunting equipment & accessories market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."