- Home

- »

- Medical Devices

- »

-

Hyaluronic Acid Market Size & Share, Industry Report, 2033GVR Report cover

![Hyaluronic Acid Market Size, Share & Trends Report]()

Hyaluronic Acid Market (2026 - 2033) Size, Share & Trends Analysis Report By Application (Dermal Fillers, Osteoarthritis, Ophthalmic, Vesicoureteral Reflux), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: 978-1-68038-333-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hyaluronic Acid Market Summary

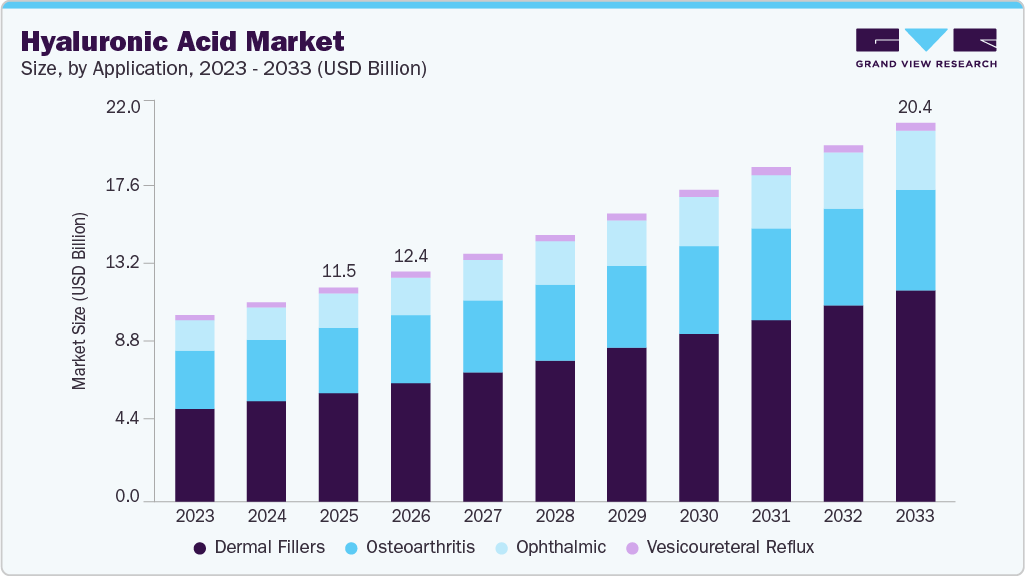

The global hyaluronic acid market size was estimated at USD 11.50 billion in 2025 and is projected to reach USD 20.36 billion by 2033, growing at a CAGR of 7.40% from 2026 to 2033. This growth is primarily driven by increasing demand for minimally invasive aesthetic procedures, rising awareness of anti-aging and skin health benefits, a growing geriatric population with joint and ophthalmic care needs, and expanding applications in pharmaceuticals and cosmetics.

Key Market Trends & Insights

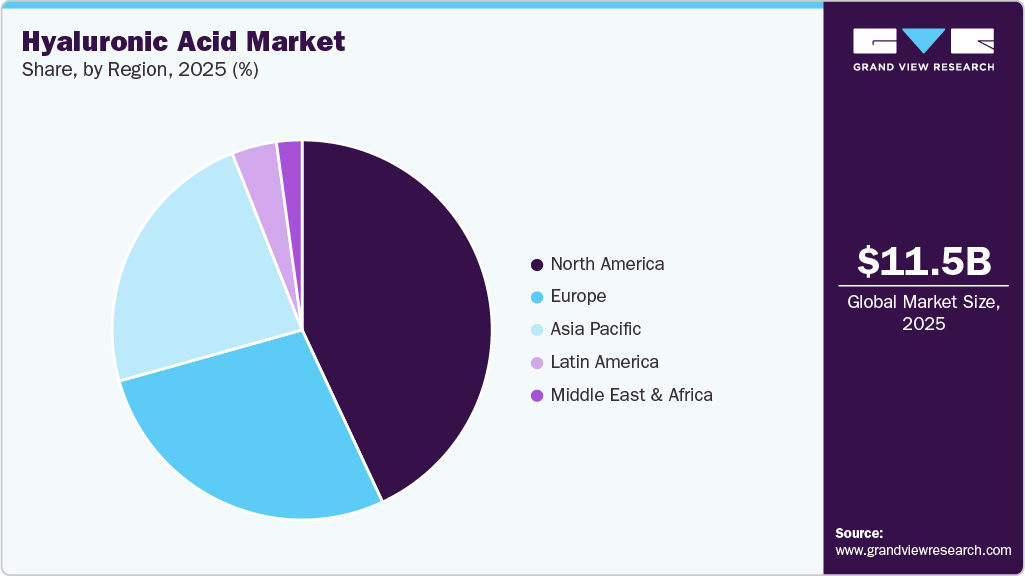

- The North America hyaluronic acid market held the largest share of 43.05% of the global market in 2025.

- The hyaluronic acid industry in the U.S. is expected to grow significantly over the forecast period.

- By application, the dermal fillers segment held the largest market share of 50.96% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.50 Billion

- 2033 Projected Market Size: USD 20.36 Billion

- CAGR (2026-2033): 7.40%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

The hyaluronic acid market has been growing rapidly because of its expanding use in aesthetic medicine and cosmetic treatments that consumers increasingly prefer over surgical options. More people are choosing minimally invasive injections to reduce wrinkles, restore facial volume, and improve hydration, because these treatments offer shorter recovery times and natural-looking results. In addition, social media and online platforms have amplified awareness of skincare ingredients, prompting consumers to seek products with proven efficacy. Dermatologists and plastic surgeons have also reported a rise in patient interest in hyaluronic acid injections, reinforcing clinicians' confidence in these procedures. For instance, in February 2025, the U.S. Food and Drug Administration approved two new injectable hyaluronic acid gels, Evolysse Form and Evolysse Smooth, marking a significant step forward in dermal filler availability and innovation.

Another reason the industry has grown is broader adoption in medical and therapeutic applications across healthcare, not just cosmetics. HA’s natural moisture-retaining and lubricating properties make it valuable for joint care, ophthalmology, and wound healing, thereby increasing its use in clinics and hospitals. Aging populations in many countries have driven demand for HA in treatments that support joint comfort and mobility, while improvements in HA-based medical devices have attracted clinician interest. In addition, professional education and high-profile clinical conferences highlighted new clinical data on HA products, contributing to broader understanding and acceptance among specialists. For instance, in November 2025, Obagi Medical shared new clinical data on its hyaluronic acid injectables at the American Society for Dermatologic Surgery Annual Meeting, demonstrating ongoing research and clinical engagement with HA technologies.

Consumer awareness of skincare and joint health has contributed to market growth, as more individuals actively seek products and treatments that support long-term wellness and aesthetic goals. Digital trends, social media, and influencer-driven beauty education have helped normalize the use of hyaluronic acid in daily skincare routines, increasing adoption across diverse age groups. At the same time, the aging global population has driven greater clinical interest in hyaluronic acid for therapeutic applications related to mobility, pain management, and ocular health. Continuous innovations in product technology have improved formulation stability, delivery efficiency, and patient outcomes. Enhanced accessibility through wider distribution channels has further expanded market penetration. Collectively, these factors have encouraged established companies to expand their product portfolios and scale up manufacturing, supporting sustained market momentum.

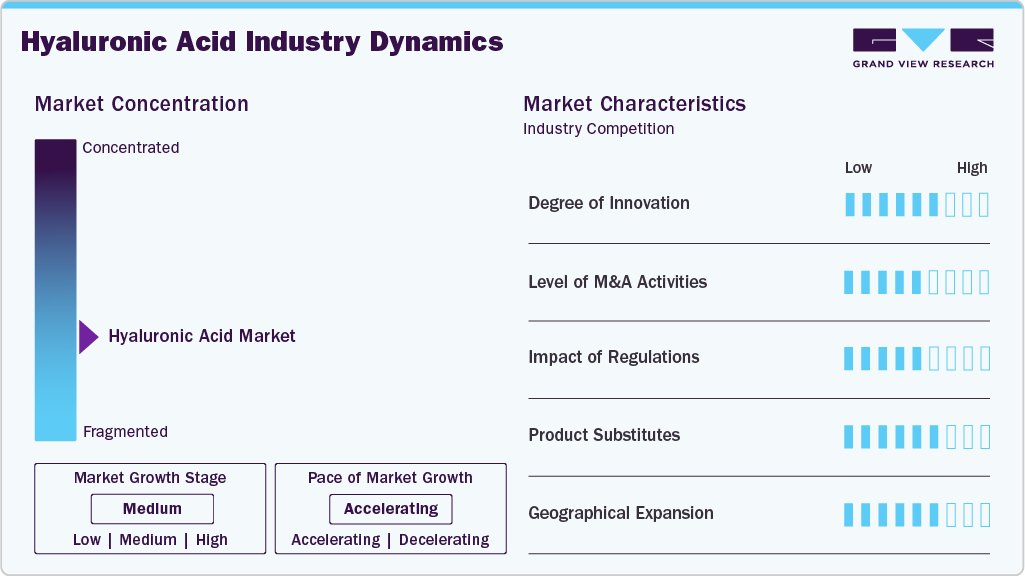

Market Concentration & Characteristics

The hyaluronic acid market shows a high degree of innovation, driven by advances in biotechnology, fermentation processes, and formulation science. Companies are actively developing differentiated molecular weights, cross-linking technologies, and combination products to improve performance and durability across medical and cosmetic uses. Innovation is particularly strong in dermal fillers, drug delivery systems, and advanced skincare formulations. Manufacturers also focus on improving purity, stability, and shelf life to meet stricter clinical and consumer expectations. Continuous product upgrades help companies maintain competitive positioning in a moderately concentrated market. As a result, R&D investment remains a key competitive lever across the value chain.

Barriers to entry in the industry are moderate to high, especially in the medical and injectable segments. New entrants face significant capital requirements for fermentation infrastructure, purification systems, and quality control. Regulatory approvals, clinical testing, and compliance costs further limit entry into pharmaceutical and aesthetic applications. Established players benefit from long-term relationships with healthcare providers and distributors. Intellectual property around cross-linking technologies and formulations also restricts competition. These factors collectively favor experienced manufacturers over new participants.

Regulation plays a critical role in shaping the market, particularly for injectables and medical devices. Products used in aesthetics, orthopedics, and ophthalmology must comply with stringent safety and efficacy standards set by authorities such as the U.S. Food and Drug Administration. Approval timelines and post-market surveillance requirements increase development costs and time-to-market. Regulatory scrutiny has intensified around practitioner training and product labeling. While regulations enhance patient safety and trust, they also limit rapid market entry. Compliance capability, therefore, acts as a competitive differentiator.

Product substitution is relatively limited but present in certain applications. In aesthetics, alternatives such as collagen stimulators, calcium-based fillers, and fat grafting compete with HA fillers. In skincare, glycerin, ceramides, and peptides can partially substitute HA for hydration benefits. However, hyaluronic acid’s biocompatibility and immediate volumizing effect make it difficult to fully replace, especially in injectables. In medical uses, synthetic lubricants and corticosteroids offer alternatives in joint care. Overall, substitutes exert moderate pressure but do not significantly erode HA demand.

Geographical expansion remains a defining characteristic as companies target high-growth regions. Asia-Pacific has emerged as a major focus due to strong beauty culture, expanding medical tourism, and rising healthcare spending. Manufacturers are also increasing their presence in Latin America and the Middle East through partnerships and local production. Regulatory harmonization efforts have supported cross-border expansion of approved products. Manufacturing localization helps reduce costs and improve supply security. As a result, global players increasingly pursue region-specific strategies to capture emerging demand.

Application Insights

The dermal fillers segment dominated the market with the largest revenue share of 50.96% in 2025, due to increasing demand for non-surgical aesthetic enhancements, widespread acceptance of hyaluronic acid as a safe and effective volumizing agent, and strong procedural uptake among both younger and older adults seeking wrinkle reduction and facial contouring. For instance, in February 2025, Business Wire reported that the U.S. FDA approved Evolysse Form and Evolysse Smooth hyaluronic acid dermal filler gels with expanded application for nasolabial folds, based on a pivotal clinical trial in 140 patients that showed statistically significant improvements over comparator products and supported long-lasting outcomes (Evolus Announces FDA Approval of Evolysse Form and Evolysse Smooth Injectable Hyaluronic Acid Gels). These approvals helped expand the HA-based aesthetic treatment portfolio and reinforced clinician confidence in dermal fillers.

The ophthalmic segment is projected to grow at the second-fastest CAGR of 6.96% over the forecast period. This growth is primarily driven by the rising prevalence of ocular surface diseases such as dry eye syndrome, the broader acceptance of hyaluronic acid in eye care formulations because of its superior lubrication and tissue-protective properties, an aging global population with increasing difficulties in tear production, and ongoing clinical innovations that enhance ocular drug delivery and comfort. For instance, in April 2025, Ophthalmology Times reported that Orasis Pharmaceuticals’ prescription pilocarpine hydrochloride ophthalmic solution 0.4% (Qlosi) became available in the U.S., a preservative-free eye drop including dual lubricants hyaluronic acid and hydroxypropyl methylcellulose that provided patient comfort with up to 8 hours of improved near vision per use (Orasis Pharmaceuticals’ prescription pilocarpine hydrochloride ophthalmic solution 0.4%). These product launches and positive clinical feedback have supported the wider adoption of HA-inclusive ophthalmic products.

Regional Insights

The hyaluronic acid industry in North America held the largest share in 2025, accounting for 43.05% of global revenue, due to high adoption of aesthetic procedures and advanced medical infrastructure. Strong demand for dermal fillers and anti-aging treatments has supported consistent consumption across clinics and specialty centers. The region has shown high awareness of ingredient efficacy in skincare and injectable treatments. Product innovation is likely to remain strong, driven by established manufacturers and frequent product upgrades. Besides, the presence of trained practitioners has improved procedural confidence and patient uptake. High spending capacity is expected to support premium-priced hyaluronic acid formulations.

U.S. Hyaluronic Acid Market Trends

The U.S. hyaluronic acid industry represented the largest share in North America in 2025. High volumes of minimally invasive cosmetic procedures have fueled the demand for injectable HA products. In addition, skincare brands have emphasized science-backed ingredients, reinforcing hyaluronic acid usage in daily routines. Medical applications in orthopedics and ophthalmology have expanded steadily across healthcare facilities. Product differentiation through molecular design will continue to improve clinical outcomes. Moreover, strong distribution networks have ensured wide availability across professional and retail channels.

Europe Hyaluronic Acid Market Trends

The hyaluronic acid industry in Europe has shown steady growth, driven by strong dermatology practices and the adoption of medical aesthetics. Consumers have favored clinically validated skincare products with proven hydration benefits. Medical use of hyaluronic acid in joint care and eye treatments has remained well established. Furthermore, manufacturers have focused on formulation quality and safety compliance. Cross-border trade continues to support wider product circulation within the region as demand stays stable across both cosmetic and therapeutic segments.

The UK hyaluronic acid industry has grown through rising interest in non-surgical facial treatments. A strong private aesthetics sector has increased demand for injectable fillers as skincare awareness has expanded through dermatologist-led product recommendations. Clinics have emphasized natural-looking results, aligning well with HA-based solutions. Retail availability of HA-infused products has boosted consumer access, while innovation in cosmetic formulations has strengthened market penetration.

The hyaluronic acid industry in Germany reflects the strong medical device and pharmaceutical ecosystem in the country. Hyaluronic acid has gained traction in orthopedic and ophthalmic applications. Precision-focused healthcare practices are supporting consistent clinical adoption. Cosmetic dermatology has maintained a steady demand for high-quality fillers. Manufacturers are prioritizing high-purity and bio-fermented HA production. Besides, technical expertise has strengthened domestic and export-oriented supply.

The France hyaluronic acid industry has benefited from its leadership in dermatology and cosmetic science. Hyaluronic acid use has expanded across both aesthetic medicine and premium skincare. Physicians are favoring HA fillers for their safety and reversibility profile. Luxury skincare brands have integrated HA into advanced formulations. Consumer preference is leaning towards clinically tested ingredients as product innovation aligns with high aesthetic standards.

Asia-Pacific Hyaluronic Acid Market Trends

The hyaluronic acid industry in the Asia Pacific is expected to register the significant CAGR of 8.46% over the forecast period, due to the rapid expansion of aesthetic clinics increased injectable HA demand. Beauty-focused consumer culture is driving widespread skincare usage. Manufacturing capacity has expanded significantly across the region. Product affordability is expected to improve access to a broader consumer base. Cross-border medical tourism will continue to support higher procedure volumes.

The Japan hyaluronic acid industry has shown strong adoption of hyaluronic acid in skincare and medical applications. Consumers are favoring hydration-focused products supported by ingredient transparency. HA usage in ophthalmology and joint care remained well established. Cosmetic formulations have emphasized lightweight and high-absorption properties. Innovation is focused on molecular refinement and skin compatibility. Long-standing trust in HA has reinforced sustained demand.

The hyaluronic acid industry in China has experienced rapid growth driven by expanding aesthetic medicine and skincare markets. Rising urban consumer awareness has increased demand for HA-based products. Domestic manufacturing has scaled production of bio-fermented hyaluronic acid. Injectable fillers are gaining traction across private clinics. Product diversity has widened across price tiers. In addition, distribution expansion has improved nationwide accessibility.

Latin America Hyaluronic Acid Market Trends

The hyaluronic acid industry in Latin America is witnessing a growing adoption of hyaluronic acid in aesthetic treatments. Medical spas and cosmetic clinics is expanding across major urban centers. Consumers have shown increasing interest in skin hydration and anti-aging care. Injectable procedures are gaining popularity due to shorter recovery periods. Skincare brands have introduced HA-focused product lines.

The Brazil hyaluronic acid industry represented the largest market in Latin America in 2025. High aesthetic procedure volumes have supported injectable filler demand. Skincare consumption continues to increase among younger demographics. Clinics are emphasizing facial contouring and skin rejuvenation. Local distributors have strengthened supply chains for HA products as competitive pricing improves market penetration.

Middle East & Africa Hyaluronic Acid Market Trends

The hyaluronic acid industry in the Middle East and Africa showed emerging demand across aesthetics and skincare. Rising disposable income has supported premium cosmetic procedures. Urban clinics are expanding non-surgical treatment offerings. Skincare awareness has improved through professional consultations. Medical use of HA has developed gradually across private healthcare facilities while market expansion remains concentrated in metropolitan areas.

The Saudi Arabia hyaluronic acid industry experienced growing demand for hyaluronic acid in aesthetic medicine. High interest in facial rejuvenation has supported filler adoption. Clinics are focusing on minimally invasive cosmetic solutions. Premium skincare products with HA have gained popularity. Moreover, professional training has improved treatment quality as market growth reflects rising lifestyle-driven aesthetic preferences.

Key Hyaluronic Acid Company Insights

Allergan maintains a strong presence in the hyaluronic acid market through its broad dermal filler portfolio and established footprint in aesthetic medicine. Sanofi and Genzyme Corporation support market participation through expertise in specialty care, biologics, and therapeutic applications involving hyaluronic acid. Salix Pharmaceuticals and F. Hoffmann-La Roche AG contribute through research-driven pharmaceutical development and global commercialization capabilities. Galderma Laboratories L.P. strengthens its position through a focused dermatology and aesthetics portfolio centered on hyaluronic acid injectables. Zimmer Biomet and Smith & Nephew Plc expand market participation through orthopedic and joint care applications. Ferring B.V., Lifecore Biomedical, LLC, and HTL Biotechnology contribute through specialized hyaluronic acid manufacturing, fermentation expertise, and supply partnerships across pharmaceutical and medical device segments.

Key Hyaluronic Acid Companies:

The following key companies have been profiled for this study on the hyaluronic acid market.

- Allergan

- Sanofi

- Genzyme Corporation

- Salix Pharmaceuticals

- F. Hoffmann-La Roche Ag

- Galderma Laboratories L.P.

- Zimmer Biomet

- Smith & Nephew Plc

- Ferring B.V.

- Lifecore Biomedical, Llc

- HTL Biotechnology

Recent Developments

-

In November 2025, Galderma reported that during the American Society for Dermatologic Surgery 2025 Annual Meeting held from November 13 to 16 in Chicago, it presented six posters highlighting new clinical data across its Injectable Aesthetics portfolio. The data showed patient satisfaction of at least 89 percent for Restylane Lyft, visible improvement in 84 percent of patients at Month 3 and 70 percent at Month 12, response rates of up to 92 percent for Restylane Contour at Month 12, and sustained efficacy of Relfydess for over six months.

-

In June 2025, HTL Biotechnology announced it inaugurated a new production line dedicated to sterile hyaluronic acid at its Javené site in France as part of National Biomanufacturing Day 2025, confirming expanded manufacturing capacity for pharmaceutical-grade HA products (HTL Biotechnology inaugurates a new production line dedicated to sterile hyaluronic acid).

-

In March 2024, The FDA approved Juvéderm Voluma XC, a hyaluronic acid injection by AbbVie and Allergan Aesthetics, to improve moderate to severe temple hollowing in adults aged 21 years and older, with results lasting up to 13 months. The approval was based on a study of 112 participants, where over 80 percent achieved at least a one-point improvement at 3 months, 73 percent maintained improvement beyond 1 year, and 59 percent reported treatment-specific reactions, mostly mild or moderate.

Hyaluronic Acid Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 12.36 billion

Revenue forecast in 2033

USD 20.36 billion

Growth rate

CAGR of 7.40% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key company profiled

Allergan; Sanofi; Genzyme Corporation; Salix Pharmaceuticals; F. Hoffmann-La Roche Ag; Galderma Laboratories L.P.; Zimmer Biomet; Smith & Nephew Plc; Ferring B.V.; Lifecore Biomedical, LLC; HTL Biotechnology

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hyaluronic Acid Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hyaluronic acid market report based on application and region:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Dermal Fillers

-

Osteoarthritis

-

Single Injection

-

Three Injection

-

Five Injection

-

-

Ophthalmic

-

Vesicoureteral Reflux

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Key factors that are driving the hyaluronic acid market growth include increasing aesthetic consciousness, the aging population, the introduction of cost-effective treatments and products, and technological advancements.

b. The global hyaluronic acid market size was estimated at USD 11.50 billion in 2025 and is expected to reach USD 12.36 billion in 2026.

b. The global hyaluronic acid market is expected to grow at a compound annual growth rate of 7.40% from 2026 to 2033 to reach USD 20.36 billion by 2033.

b. The dermal fillers segment dominated the market with the largest revenue share of 50.96% in 2025. This is attributable to the increasing demand for minimally invasive facial procedures with no side effects.

b. Some key players operating in the hyaluronic acid market include Allergan, Sanofi, Genzyme Corporation, Salix Pharmaceuticals, F. Hoffmann-La Roche Ag, Galderma Laboratories L.P., Zimmer Biomet, Smith & Nephew Plc, Ferring B.V., Lifecore Biomedical, Llc and HTL Biotechnology

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.