- Home

- »

- Petrochemicals

- »

-

Hydraulic Fluids Market Size & Share, Industry Report, 2033GVR Report cover

![Hydraulic Fluids Market Size, Share & Trends Report]()

Hydraulic Fluids Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Mineral Oil, Synthetic Oil, Bio Oil), By End Use (Construction, Metal & Mining, Oil & Gas, Agriculture, Aerospace & Defense, Automotive), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-953-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2026 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydraulic Fluids Market Summary

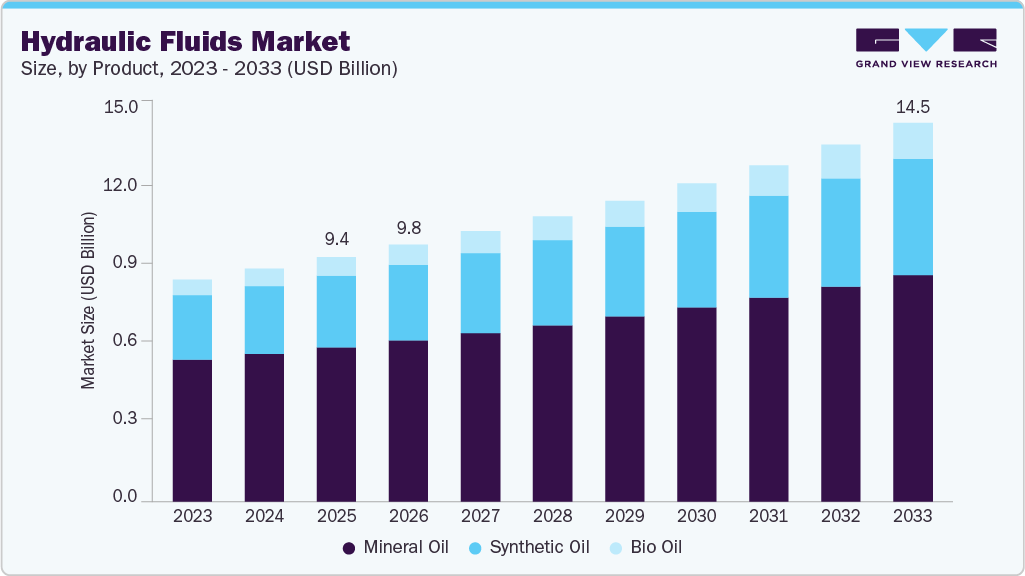

The global hydraulic fluids market size was estimated at USD 9,351.8 million in 2025 and is expected to reach USD 14,481.6 million by 2033, growing at a CAGR of 5.7% from 2026 to 2033. The increasing demand for hydraulic fluids across construction, manufacturing, mining, and agricultural equipment is driving market growth.

Key Market Trends & Insights

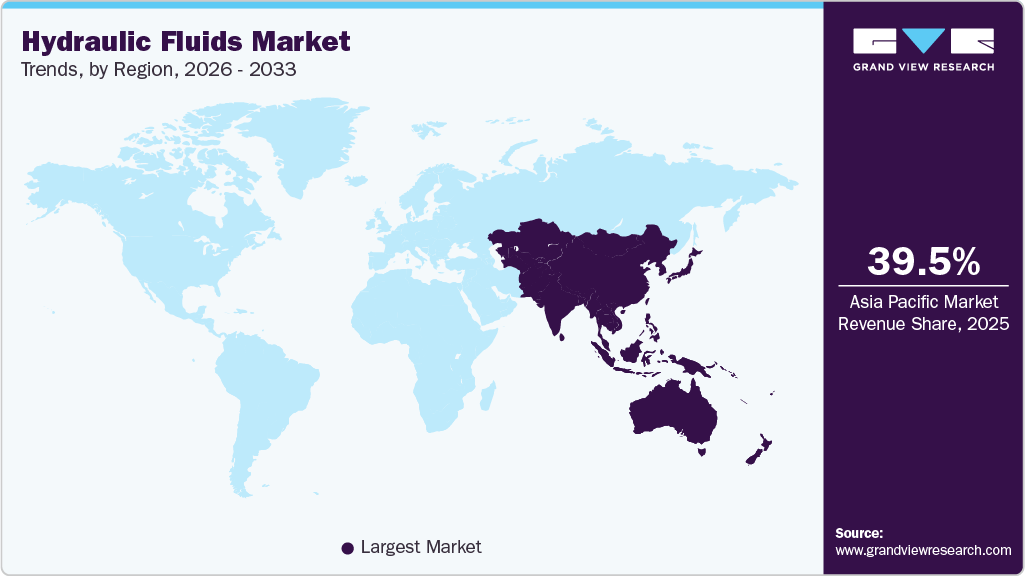

- Asia Pacific dominated the hydraulic fluids market with the largest revenue share of 39.5% in 2025.

- By product, the bio oil segment is expected to grow at the highest CAGR of 8.7% from 2026 to 2033 in terms of revenue.

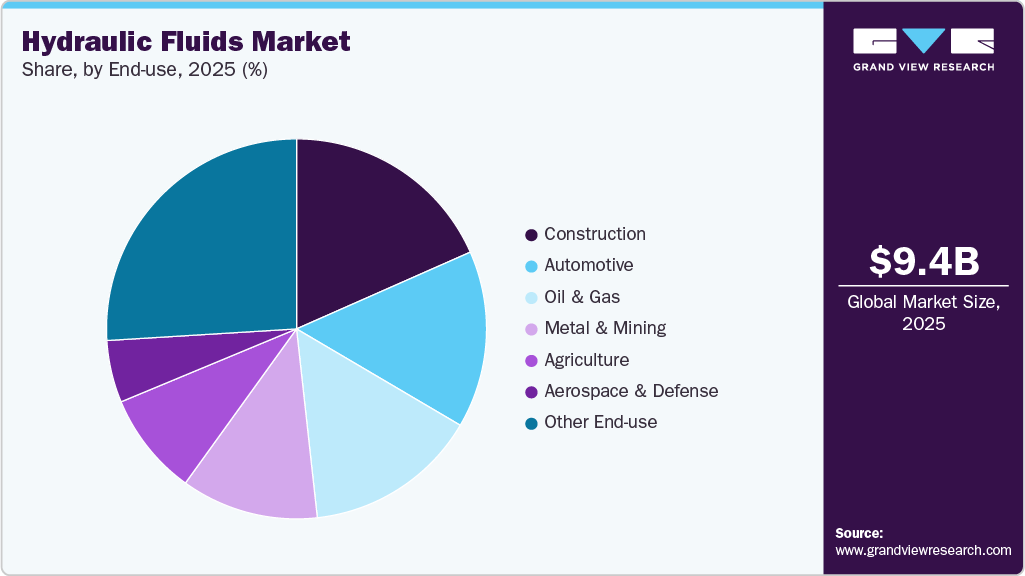

- By end use, the construction segment held the largest revenue share of 18.4% in 2025 in terms of value.

Market Size & Forecast

- 2025 Market Size: USD 9,351.8 Million

- 2033 Projected Market Size: USD 14,481.6 Million

- CAGR (2026-2033): 5.7%

- Asia Pacific: Largest market in 2025

Rising industrial automation, expanding infrastructure development activities, growing equipment replacement cycles, and ongoing product innovation in high-performance and environmentally acceptable hydraulic fluids are contributing to the market’s steady expansion.

Hydraulic fluids are specialized industrial fluids designed to transmit power, lubricate components, and protect hydraulic systems from wear, corrosion, and thermal degradation. Hydraulic fluids are primarily formulated using mineral oil, synthetic, or bio-based base stocks and are widely used across construction machinery, industrial equipment, agricultural machinery, and mining applications. The rising demand for hydraulic fluids is largely driven by increasing industrialization, infrastructure development, and equipment modernization, along with advancements in fluid formulations that enhance performance, efficiency, and equipment life.

According to industry and manufacturing-focused sources, the growing adoption of automation and heavy machinery across industrial sectors is supporting hydraulic fluid consumption. Rising investments in construction and infrastructure projects, coupled with increasing focus on operational efficiency, equipment reliability, and compliance with environmental regulations, continue to encourage the use of high-performance hydraulic fluids, further strengthening demand across global markets.

Market Concentration & Characteristics

The market is moderately fragmented, with the presence of a mix of global lubricant manufacturers and regional fluid blenders dominating the competitive landscape. These companies benefit from established distribution networks, strong OEM relationships, and diversified product portfolios. Key participants are increasingly focusing on expanding production capacities, investing in advanced formulation technologies and product standardization, and developing environmentally acceptable and high-performance hydraulic fluids to strengthen their competitive positioning in the global hydraulic fluids industry.

Leading players in the global hydraulic fluids industry are adopting a mix of capacity expansion, product innovation, strategic collaborations, and sustainability-focused initiatives to enhance their market presence. Companies operating across base oil refining, additive development, and finished lubricant manufacturing are investing in advanced formulation technologies, performance additives, and next-generation hydraulic fluid solutions to improve efficiency, equipment protection, and operational reliability across end-use industries. To address rising demand across Asia Pacific and Latin America, several market participants are expanding their manufacturing footprints, strengthening regional distribution networks, and collaborating with OEMs and industrial customers to support localized supply and technical requirements.

Product Insights

The mineral oil segment accounted for a significant revenue share of 63.1% in 2025 and is expected to witness steady growth during the forecast period. Demand for mineral oil-based hydraulic fluids is driven by their cost-effectiveness, wide availability, and reliable performance across a broad range of industrial and mobile equipment. These fluids are widely used in construction machinery, manufacturing equipment, agricultural machinery, and material handling systems, supporting their strong adoption across both OEM and aftermarket segments. Other product types, including synthetic and bio-based hydraulic fluids, are also gaining traction due to their superior thermal stability, extended service life, and lower environmental impact, and are analyzed in the report. Rising industrial activity, infrastructure development, and ongoing equipment replacement cycles are further boosting the consumption of hydraulic fluids globally.

Mineral oil-based hydraulic fluids are valued for their good lubricity, thermal stability, and compatibility with a wide range of hydraulic systems, making them suitable for diverse operating conditions. Synthetic fluids are preferred in high-temperature or extreme-pressure environments due to enhanced performance properties, while bio-based fluids are increasingly adopted for environmentally sensitive applications, contributing to the overall growth of the market. Continued advancements in additive technologies, growing focus on extending fluid life and improving equipment efficiency, and sustained demand from price-sensitive end-use industries are expected to support continued segment growth over the forecast period.

End Use Insights

The construction segment dominated the industry with a revenue share of 18.4% in 2025. The segment is witnessing robust growth as hydraulic fluids are extensively used across a wide range of construction equipment, including excavators, loaders, cranes, bulldozers, and concrete machinery. These fluids play a critical role in power transmission, equipment lubrication, and system protection, supporting efficient operation under demanding and high-load conditions. Rising infrastructure development, urbanization, and large-scale construction projects are driving strong demand for hydraulic fluids within this segment, while other end uses such as metal & mining, oil & gas, agriculture, aerospace & defense, automotive, and other industrial applications are also analyzed in the report.

Hydraulic fluids used in construction and other heavy-duty equipment are required to offer high thermal stability, wear protection, and reliable performance under harsh operating environments. Increasing adoption of advanced machinery, growing focus on equipment uptime and maintenance efficiency, and sustained investments in public and private infrastructure projects are expected to drive continued growth of the construction segment and other end-use industries globally.

The agriculture segment is expected to emerge as one of the fastest-growing end uses in the hydraulic fluids market, registering a CAGR of 6.3% during the forecast period. Growth is driven by the increasing use of hydraulic systems across modern agricultural machinery, including tractors, harvesters, sprayers, and irrigation equipment, where hydraulic fluids are essential for power transmission, equipment control, and operational efficiency. Expanding mechanization of farming practices, rising adoption of precision agriculture, and growing demand for high-performance fluids that support reliable operation under variable field conditions are contributing to increased hydraulic fluid consumption within the segment.

Rising investments in agricultural modernization, coupled with increasing focus on improving farm productivity and reducing equipment downtime, are further accelerating adoption, particularly across developing economies. Ongoing advancements in hydraulic fluid formulations, including improved wear protection, oxidation stability, and environmentally acceptable fluid options, are expected to support the sustained growth of the agriculture segment over the forecast period.

Regional Insights

Asia Pacific dominated the hydraulic fluids market with a revenue share of 39.5% in 2025, driven by rapid industrialization, expanding infrastructure development, and rising construction and manufacturing activities across the region. Strong demand for hydraulic fluids from construction equipment, industrial machinery, and agricultural applications is supporting market growth. Increasing investments in transportation, energy, and urban infrastructure, along with the expansion of manufacturing bases across China, India, Japan, and Southeast Asia, are expected to sustain regional growth.

The hydraulic fluids market in China is witnessing strong growth, driven by rapid industrial expansion, large-scale infrastructure development, and rising demand from construction, manufacturing, and agricultural sectors. Increasing use of hydraulic equipment across heavy machinery, material handling systems, and industrial automation is supporting steady consumption of hydraulic fluids. Expansion of domestic manufacturing capacities, investments in modern construction equipment, and ongoing infrastructure projects are further supporting market growth, positioning China as a key contributor to the Asia Pacific market.

Europe Hydraulic Fluids Market Trends

The hydraulic fluids market in Europe is witnessing steady growth, driven by consistent demand from construction, manufacturing, and industrial automation sectors across the region. Countries such as Germany, France, the UK, and other European economies continue to invest in infrastructure modernization, advanced manufacturing, and energy-efficient industrial operations, supporting sustained consumption of hydraulic fluids. The market is further supported by stringent equipment performance standards, increasing focus on operational efficiency, and regulatory emphasis on environmentally acceptable hydraulic fluids. Growing adoption of bio-based and low-toxicity hydraulic fluids, along with ongoing product innovation by regional and global lubricant manufacturers, is strengthening Europe’s position as a key regional market and contributing significantly to overall global growth.

Germany hydraulic fluids market is growing steadily, driven by strong demand from the country’s advanced manufacturing, automotive, and industrial machinery sectors. Widespread use of hydraulic systems across production equipment, material handling systems, and industrial automation applications is supporting consistent consumption of hydraulic fluids. Rising focus on equipment efficiency, reliability, and compliance with stringent environmental and performance regulations is encouraging manufacturers and end users to adopt high-quality and environmentally acceptable hydraulic fluids. Continued investments in industrial modernization and engineering excellence are further supporting market growth.

North America Hydraulic Fluids Market Trends

The hydraulic fluids market in North America is witnessing steady growth, supported by sustained demand from construction, manufacturing, and oil & gas sectors across the region. Widespread use of hydraulic equipment in infrastructure projects, industrial machinery, and material handling applications is driving consistent consumption of hydraulic fluids. The market is further supported by a strong aftermarket, ongoing equipment replacement cycles, and increasing focus on improving equipment performance and operational efficiency. Continued investments in infrastructure development and industrial activity across the United States, Canada, and Mexico are contributing to regional market expansion.

U.S. Hydraulic Fluids Market Trends

The hydraulic fluids market in the U.S. is growing steadily, driven by sustained demand from construction, manufacturing, agriculture, and oil & gas sectors. Extensive use of hydraulic systems across heavy machinery, industrial equipment, and material handling applications is supporting consistent consumption of hydraulic fluids. Rising focus on equipment reliability, maintenance efficiency, and compliance with performance and environmental standards is encouraging the adoption of high-quality hydraulic fluids. Ongoing infrastructure investments, equipment replacement cycles, and a strong aftermarket are further supporting market growth.

Latin America Hydraulic Fluids Market Trends

The hydraulic fluids market in Latin America is witnessing steady growth, driven by increasing demand from construction, mining, agriculture, and industrial manufacturing sectors. Hydraulic systems in heavy machinery, material handling equipment, and industrial operations support consistent consumption of hydraulic fluids. Rising focus on equipment reliability, operational efficiency, and adherence to environmental regulations is encouraging the adoption of high-performance and environmentally acceptable fluids. Expansion of industrial infrastructure, modernization of machinery, and growing investments in key markets such as Brazil, Mexico, and Argentina are further supporting regional market growth.

Middle East & Africa Hydraulic Fluids Market Trends

The hydraulic fluids market in the Middle East & Africa is growing steadily, supported by increasing demand from construction, oil & gas, mining, and industrial manufacturing sectors. Hydraulic systems in heavy machinery, industrial equipment, and material handling applications are driving steady consumption of hydraulic fluids. Growing focus on equipment reliability, operational efficiency, and compliance with environmental and performance standards is encouraging the adoption of high-performance and environmentally acceptable fluids. Expansion of industrial infrastructure and modernization of machinery across key markets, including the UAE, Saudi Arabia, and South Africa, further support regional market growth.

Key Hydraulic Fluids Company Insights

Key players operating in the hydraulic fluids market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

- Shell PLC is emerging as a key player in the global hydraulic fluids market, focusing on the production, formulation, and supply of high-performance hydraulic fluids for industrial, construction, and mobile equipment applications. The company leverages its extensive global manufacturing network, advanced R&D capabilities, and strong technical expertise to develop innovative and environmentally acceptable fluid solutions. Shell’s commitment to sustainability, product quality, and continuous innovation supports its growing presence across domestic and international hydraulic fluids markets.

Key Hydraulic Fluids Companies:

The following are the leading companies in the hydraulic fluids market. These companies collectively hold the largest market share and dictate industry trends.

- Exxonmobil Corporation

- Chevron Corporation

- TotalEnergies

- PetroChina Company Limited

- China Petrochemical Corporation (SINOPEC)

- Eastman Chemical Company

- BP p.l.c.

- FUCHS

- Valvoline Global Operations

Recent Developments

- In January 2025, TotalEnergies completed the acquisition of fire-resistant hydraulic fluid product lines from the German specialty manufacturer, Fluid Competence. The addition of these mineral oil-free fluids strengthens TotalEnergies’ commitment to sustainable solutions. This move expands the company’s portfolio in eco-friendly and high-performance hydraulic fluids. It reinforces TotalEnergies’ strategy to provide safer and more environmentally responsible products for industrial applications.

Hydraulic Fluids Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 9,831.3 million

Revenue forecast in 2033

USD 14,481.6 million

Growth rate

CAGR of 5.7% from 2026 to 2033

Base year for estimation

2025

Historical data

2018 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Russia; Netherlands; China; India; Japan; Australia; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

Shell PLC; Exxonmobil Corporation; Chevron Corporation; TotalEnergies; PetroChina Company Limited; China Petrochemical Corporation (SINOPEC); Eastman Chemical Company; BP p.l.c.; FUCHS; Valvoline Global Operations

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydraulic Fluids Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global hydraulic fluids market report based on product, end use and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Mineral Oil

-

Synthetic Oil

-

Bio Oil

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

Construction

-

Metal & Mining

-

Oil & Gas

-

Agriculture

-

Aerospace & Defense

-

Automotive

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The Hydraulic Fluids market size was estimated at USD 9,351.8 million in 2025 and is expected to reach USD 9,831.3 million in 2026

b. The Hydraulic Fluids market is expected to grow at a compound annual growth rate of 5.7% from 2026 to 2033 to reach USD 14,481.6 million by 2033

b. The mineral oil dominated the global hydraulic fluids market by product type in 2025, accounting for a significant share of 63.1% of overall consumption, driven by its reliability, cost-effectiveness, and broad applicability across industrial and mobile equipment. Mineral oil–based hydraulic fluids are widely used in construction machinery, manufacturing equipment, agricultural systems, and material handling applications due to their good lubricity, thermal stability, and compatibility with a variety of hydraulic systems. Key advantages such as ease of availability, consistent performance under varying operating conditions, and suitability for both OEM and aftermarket applications continue to strengthen the market position of mineral oil hydraulic fluids globally.

b. Some of the key players operating in the market include Shell PLC, Exxonmobil Corporation, Chevron Corporation, TotalEnergies, PetroChina Company Limited, China Petrochemical Corporation (SINOPEC), Eastman Chemical Company, BP p.l.c., FUCHS, and Valvoline Global Operations

b. The global hydraulic fluids market is primarily driven by rising demand from construction, manufacturing, agriculture, and material handling sectors, supported by increasing industrialization and infrastructure development. Growing adoption of advanced hydraulic systems, continuous product innovation, and expanding use of high-performance and environmentally acceptable fluids are accelerating market growth. The deployment of hydraulic fluids across heavy machinery, industrial equipment, and mobile systems, driven by the need for equipment reliability, operational efficiency, and compliance with performance standards, continues to support steady global market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.