- Home

- »

- Conventional Energy

- »

-

Hydraulic Fracturing Market Size, Share, Industry Report, 2033GVR Report cover

![Hydraulic Fracturing Market Size, Share & Trends Report]()

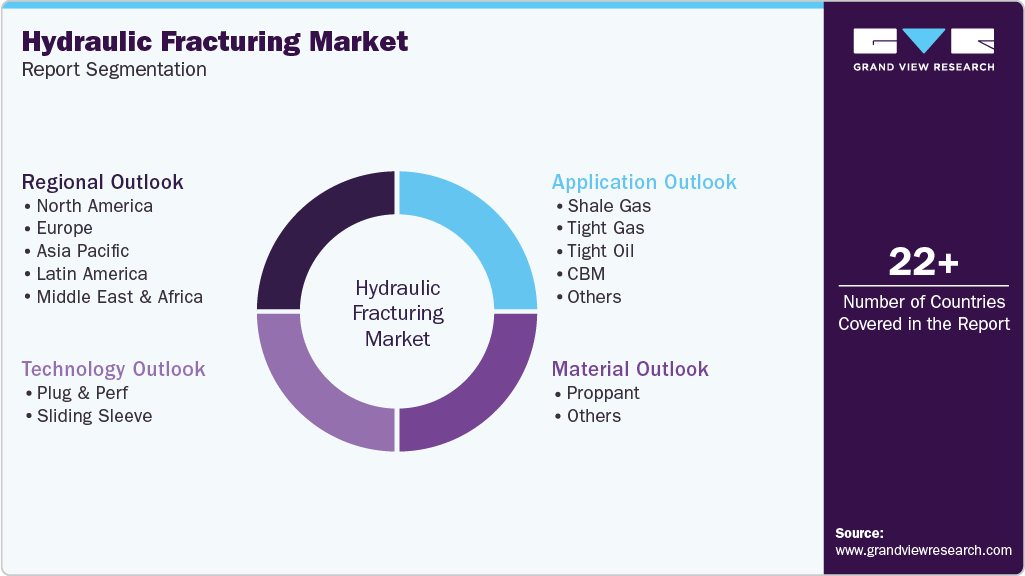

Hydraulic Fracturing Market (2026 - 2033) Size, Share & Trends Analysis Report By Technology (Plug and Perf, Sliding Sleeve), By Material, By Application (Shale gas, Tight gas, Tight oil), By Region (North America, Europe, Asia Pacific, Middle East & Africa), And Segment Forecasts

- Report ID: 978-1-68038-249-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydraulic Fracturing Market Summary

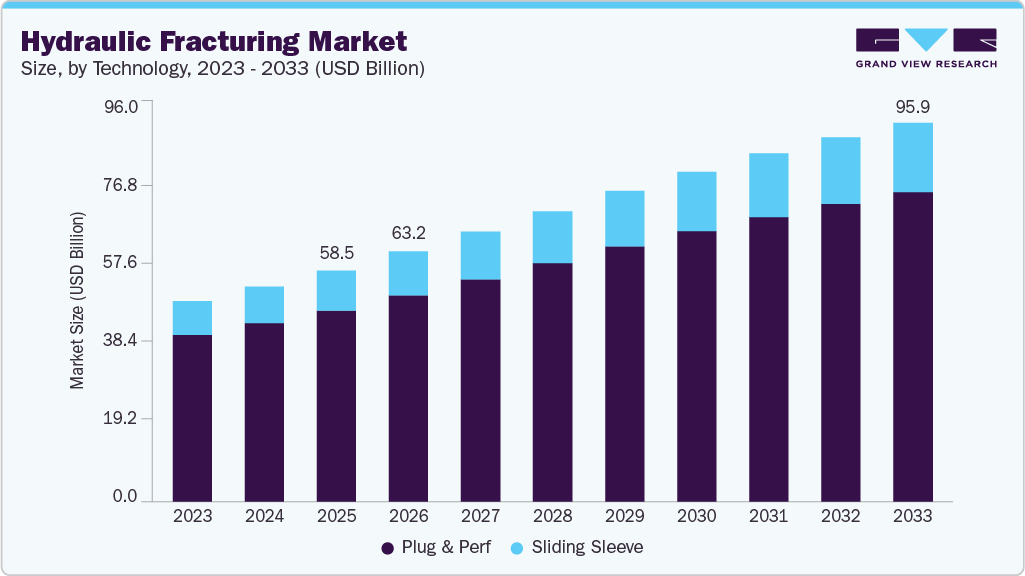

The global hydraulic fracturing market size was estimated at approximately USD 58.49 billion in 2025 and is projected to reach USD 95.92 billion by 2033, growing at a CAGR of 6.2% from 2026 to 2033. The market is experiencing robust growth, primarily driven by the increasing development of unconventional oil and gas resources such as shale gas, tight oil, and coalbed methane.

Key Market Trends & Insights

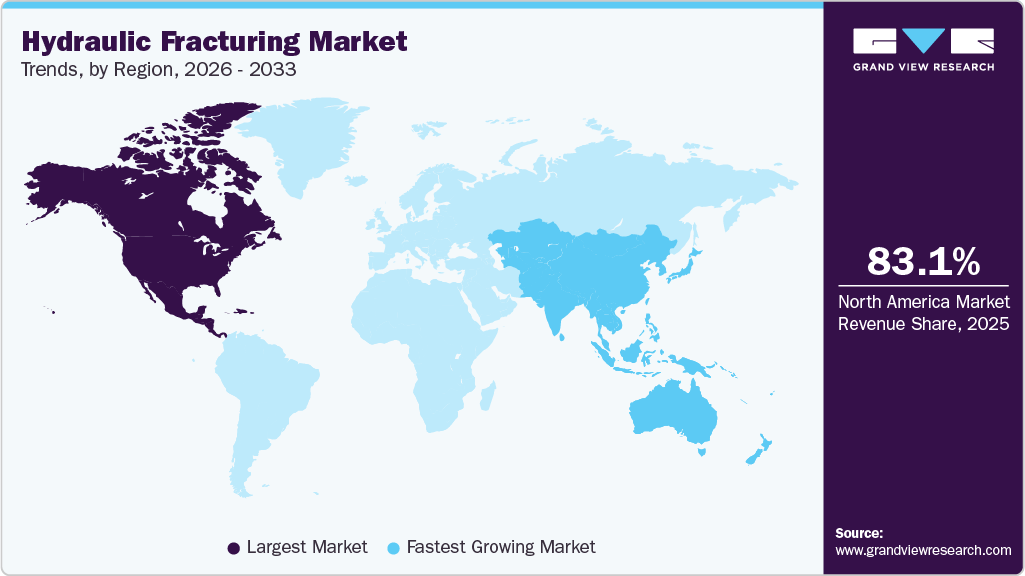

- North America hydraulic fracturing industry held the largest share of 83.1% of the global market in 2025.

- By technology, plug and perf segment held the revenue share of over 82% in 2025.

- By material, other materials (additives, solvents, surfactants, acids, etc.) segment held the largest revenue share of over 82% in 2025.

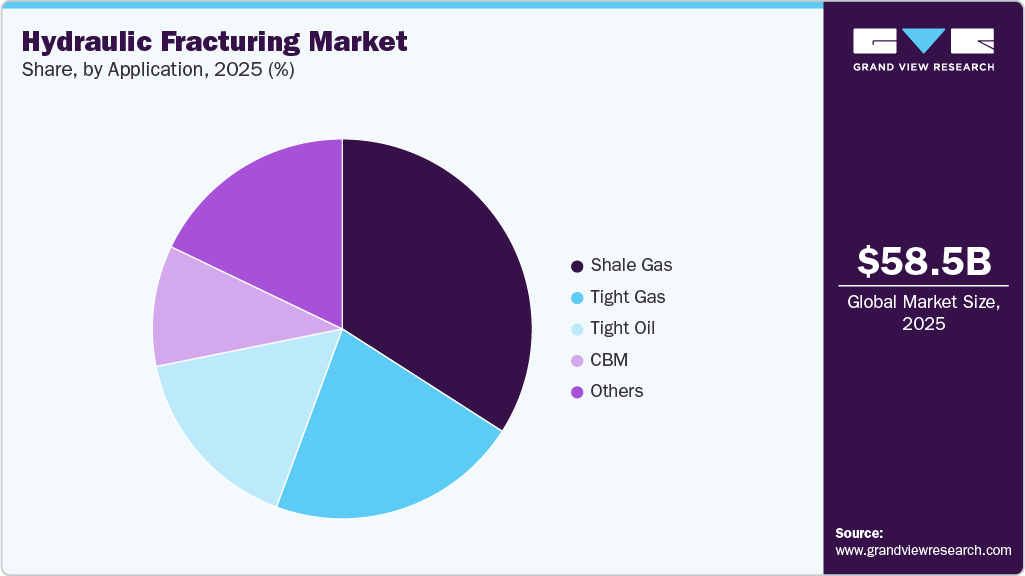

- By application, shale gas segment held the largest revenue share of over 34% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 58.49 Billion

- 2033 Projected Market Size: USD 95.92 Billion

- CAGR (2026-2033): 6.2%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

Declining output from mature conventional reservoirs and rising global energy demand are compelling operators to intensify drilling and completion activities, directly increasing the demand for hydraulic fracturing services and technologies. Hydraulic fracturing has become a core well-stimulation technique for enhancing hydrocarbon recovery from low-permeability formations. The expansion of horizontal drilling and multi-stage fracturing across major basins, particularly in North America, South America, and parts of the Asia-Pacific, is significantly improving well productivity and recovery factors. Beyond shale plays, fracturing is also being increasingly applied in mature fields and deep reservoirs to maximize asset life, broadening the market’s application base.

Technological innovation plays a critical role in improving the efficiency and economics of hydraulic fracturing operations. Advancements in high-pressure pumping systems, engineered fracturing fluids, and advanced proppant materials are enabling deeper, longer, and more complex fracture networks. At the same time, digital well monitoring, real-time pressure diagnostics, and automation are improving fracture placement accuracy while reducing non-productive time and operational risks.

Environmental considerations and cost optimization are reshaping hydraulic fracturing practices. Operators are increasingly adopting water-efficient fracturing techniques, recycled produced water, and environmentally friendly fluid formulations to address regulatory scrutiny and social concerns. These innovations, combined with standardized equipment, pad drilling, and integrated service models, are lowering per-well completion costs and improving scalability. Major oilfield service companies and energy producers are leveraging partnerships, technology integration, and operational expertise to sustain hydraulic fracturing activity while aligning with evolving environmental and regulatory frameworks.

Drivers, Opportunities & Restraints

The primary driver of the hydraulic fracturing industry is the combined impact of rising global energy demand and technological advancement in unconventional resource extraction. Increasing reliance on shale gas, tight oil, and low-permeability reservoirs, particularly in North America and emerging shale regions, is compelling operators to deploy advanced hydraulic fracturing techniques to sustain production growth. This industry push is reinforced by energy security priorities and favorable upstream policies, which are accelerating drilling activity and well completions where hydraulic fracturing remains essential for economic hydrocarbon recovery.

Significant opportunities for market expansion lie in the continued evolution of fracturing technologies and the extension of hydraulic fracturing beyond traditional shale applications. The adoption of multi-stage horizontal fracturing, advanced proppant designs, and digitally optimized pumping operations is improving recovery rates while reducing per-well costs. In addition, the application of hydraulic fracturing in mature fields, tight sandstone reservoirs, and enhanced oil recovery (EOR) projects presents a substantial growth frontier, particularly in regions seeking to maximize output from existing assets.

However, the market faces notable restraints, with high capital intensity and environmental challenges remaining the most significant barriers. Hydraulic fracturing requires substantial investment in high-pressure pumping equipment, water management systems, proppants, and supporting infrastructure, making project economics sensitive to oil and gas price volatility. Furthermore, regulatory scrutiny related to water usage, induced seismicity, and environmental impact has led to permitting complexities and operational restrictions in certain regions, which may limit the pace of market expansion.

Technology Insights

The plug and perforation (plug & perf) technology dominated the market, accounting for around 82.7% of total market revenue in 2025, due to its effectiveness in stimulating long horizontal wells with complex reservoir characteristics. This method allows operators to isolate individual stages sequentially, providing greater flexibility in fracture design and enabling precise control over fluid and proppant placement. Its widespread adoption across shale oil and gas developments has positioned plug & perf as the preferred completion technology, particularly in formations where maximizing reservoir contact and production efficiency is critical.

The plug & perf segment is also projected to register the fastest CAGR of approximately 6.9% over the forecast period, supported by continuous improvements in completion tools and operational practices. The growing use of dissolvable plugs, reduced drill-out time systems, and advanced perforation strategies is enhancing operational efficiency and lowering completion costs. As operators increase lateral lengths and stage density to improve recovery economics, the scalability and performance advantages of plug & perf technology are expected to reinforce its strong revenue contribution and sustained growth within the global hydraulic fracturing industry.

Material Insights

The dominance of the other materials segment, which includes chemical additives, solvents, surfactants, acids, friction reducers, and crosslinkers, reflects their essential role across every stage of the hydraulic fracturing process. These materials are critical for controlling fluid viscosity, reducing friction during high-pressure pumping, enhancing proppant transport, and improving fracture conductivity. Their extensive and repeated usage across multi-stage fracturing operations has resulted in other materials contributing around 82.4% of total market revenue in 2025, making them the most commercially significant material category in the hydraulic fracturing industry.

The other materials segment is also expected to register the fastest CAGR of approximately 6.6% over the forecast period, driven by increasing formulation complexity and performance requirements in modern well completions. As operators drill longer laterals and design higher stage densities, demand for advanced chemical systems that perform under extreme pressure, temperature, and salinity conditions is rising. Continuous innovation in low-dosage, high-performance additives and environmentally compliant formulations is further accelerating adoption, reinforcing both the growth rate and long-term revenue contribution of this segment.

Application Insights

The shale gas application held the largest share of the market, contributing around 34.1% of total revenue in 2025, driven by sustained development of gas-rich unconventional formations. Hydraulic fracturing remains essential for unlocking commercially viable production from shale gas reservoirs characterized by ultra-low permeability and complex geological structures. High well density, repeated fracturing stages, and continuous drilling activity across major shale basins have resulted in consistent demand for fracturing services and materials, positioning shale gas as the leading application segment within the market.

The shale gas segment is also projected to register the fastest CAGR of approximately 7.3% during the forecast period, supported by expanding gas utilization across power generation, industrial processes, and LNG supply chains. Ongoing optimization of completion designs and increased drilling efficiency are encouraging operators to advance shale gas development in both mature and emerging plays. As natural gas continues to be favored for its flexibility and lower carbon intensity relative to other fossil fuels, hydraulic fracturing activity associated with shale gas is expected to maintain strong momentum, reinforcing its dominant and fastest-growing position in the global market.

Regional Insights

North America Hydraulic Fracturing Market Trends

North America hydraulic fracturing industry dominated the global market, accounting for around 83.1% of total revenue share in 2025, due to the region’s highly mature unconventional oil and gas industry and sustained drilling intensity across shale formations. The widespread presence of prolific basins such as the Permian, Eagle Ford, Bakken, and Marcellus has resulted in continuous demand for high-volume, multi-stage hydraulic fracturing operations. Well-established service infrastructure, advanced completion practices, and a large base of experienced oilfield service providers further reinforce North America’s leading position in the global market.

U.S. Hydraulic Fracturing Market Trends

The United States hydraulic fracturing industry represents the largest contributor within North America, driven by its scale of shale development and operational efficiency in unconventional resource extraction. High lateral lengths, increasing stage counts per well, and frequent re-fracturing activity are sustaining strong demand for fracturing services, materials, and technologies. In addition, private mineral ownership, flexible leasing structures, and rapid deployment of drilling programs enable operators to respond quickly to commodity price movements, maintaining consistent hydraulic fracturing activity across both oil and gas-focused basins.

Asia Pacific Hydraulic Fracturing Market Trends

The Asia Pacific hydraulic fracturing industry is expected to register the fastest CAGR of approximately 8.8% during the forecast period, supported by growing exploration of unconventional hydrocarbon resources and increasing energy security initiatives. Countries such as China, Australia, and India are intensifying efforts to evaluate and develop shale gas and tight oil reserves to reduce reliance on imports. While the market remains at an earlier stage of maturity compared to North America, rising investment in domestic upstream capabilities, pilot shale developments, and technology transfer partnerships is accelerating hydraulic fracturing adoption across the region.

Europe Hydraulic Fracturing Market Trends

The hydraulic fracturing industry in Europe is witnessing limited but strategically important hydraulic fracturing activity, primarily focused on resource assessment and selective development of unconventional reserves. Market growth is constrained by regulatory restrictions and public opposition in several countries; however, interest persists in regions seeking to enhance domestic gas supply resilience. Technological advancements aimed at minimizing environmental impact and water usage are shaping pilot-scale projects, positioning Europe as a niche but technically evolving market for hydraulic fracturing services.

Latin America Hydraulic Fracturing Market Trends

Latin America hydraulic fracturing industry presents emerging opportunities for hydraulic fracturing, driven by the development of unconventional resources in select countries. Argentina’s Vaca Muerta formation stands out as a key growth engine, where large-scale shale development is supporting increased fracturing activity. Improving infrastructure, foreign investment participation, and gradual optimization of drilling and completion techniques are strengthening the region’s long-term market potential, although activity levels remain below those of North America.

Key Hydraulic Fracturing Company Insights

Some of the key players operating in the global hydraulic fracturing industry include Halliburton Energy Services Inc. and Baker Hughes Company, among others.

-

Halliburton Energy Services Inc. is one of the world’s largest oilfield service companies, headquartered in the United States, with operations spanning North America, Latin America, the Middle East, and Asia-Pacific. Founded in 1919, Halliburton provides a comprehensive portfolio of services across the upstream oil and gas value chain, with hydraulic fracturing representing a core business segment. The company is a global leader in pressure pumping, fracturing fluids, proppant technologies, and plug-and-perforation systems. Halliburton’s advanced completion technologies, digital fracture diagnostics, and large-scale service capacity position as a dominant provider for unconventional oil and gas development, particularly in shale basins.

-

Baker Hughes Company is a global energy technology company headquartered in the United States, offering a broad range of solutions for oilfield services, equipment, and digital applications. Baker Hughes has a strong presence in hydraulic fracturing through its well completion services, pressure pumping technologies, and engineered fracturing fluids designed for complex reservoir conditions. The company emphasizes technology-driven efficiency, integrating real-time data analytics, automation, and advanced materials to enhance fracture performance and reduce operational risk. Its global footprint and technical expertise support hydraulic fracturing activity across both mature and emerging unconventional resource plays.

Key Hydraulic Fracturing Companies:

The following are the leading companies in the hydraulic fracturing market. These companies collectively hold the largest market share and dictate industry trends.

- Baker Hughes Company

- Basic Energy Services Inc.

- Calfrac Well Services Ltd.

- FTS International Inc.

- Halliburton Energy Services Inc.

- Liberty Oilfield Services LLC

- NexTier Oilfield Solutions Inc.

- ProPetro Holding Corp.

- Schlumberger Limited

- Weatherford International plc

Recent Developments

- In June 2025, Chevron U.S.A. Inc. and Halliburton collaborated to develop an intelligent hydraulic fracturing system that enables closed-loop, feedback-driven completions in Colorado, enhancing operational efficiency and reducing human intervention. The technology integrates automated stage sequencing and real-time performance feedback to optimize fracture placement and improve overall well productivity.

Hydraulic Fracturing Market Report Scope

Report Attribute

Details

Market Definition

The hydraulic fracturing market size represents the global revenue generated from the provision of hydraulic fracturing services and technologies, including pressure pumping, fracturing fluids, proppants, well stimulation equipment, and associated completion solutions, across unconventional and conventional oil and gas extraction applications.

Market size value in 2026

USD 63.18 billion

Revenue forecast in 2033

USD 95.92 billion

Growth rate

CAGR of 6.2% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026-2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; Italy; Netherlands; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Baker Hughes Company; Basic Energy Services Inc.; Calfrac Well Services Ltd.; FTS International Inc.; Halliburton Energy Services Inc.; Liberty Oilfield Services LLC; NexTier Oilfield Solutions Inc.; ProPetro Holding Corp.; Schlumberger Limited; Weatherford International plc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Hydraulic Fracturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global hydraulic fracturing market report based on technology, material, application, and region.

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Plug and Perf

-

Sliding Sleeve

-

-

Material Outlook (Revenue, USD Million, 2021 - 2033)

-

Proppant

-

Sand

-

Ceramic

-

Resin coated sand

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Shale gas

-

Tight gas

-

Tight oil

-

CBM

-

Other

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hydraulic fracturing market size was estimated at USD 58.49 billion in 2025 and is expected to reach USD 63.18 billion in 2026.

b. The global hydraulic fracturing market is expected to grow at a compound annual growth rate of 6.2% from 2026 to 2033 to reach USD 95.92 billion by 2033.

b. Based on the technology segment, plug & perf held the largest revenue share of more than 82% in 2025.

b. Some of the key players operating in the global hydraulic fracturing market include Baker Hughes Company, Basic Energy Services Inc., Calfrac Well Services Ltd., FTS International Inc., Halliburton Energy Services Inc., Liberty Oilfield Services LLC, NexTier Oilfield Solutions Inc., ProPetro Holding Corp., Schlumberger Limited, and Weatherford International plc, among others.

b. The hydraulic fracturing market is primarily driven by increasing development of unconventional oil and gas resources, supported by higher drilling and completion activity in shale formations and tight reservoirs. Continued advancements in fracturing technologies and sustained upstream investment are further strengthening market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.