- Home

- »

- Medical Devices

- »

-

Hydrotherapy Equipment Market Size, Industry Report, 2030GVR Report cover

![Hydrotherapy Equipment Market Size, Share & Trends Report]()

Hydrotherapy Equipment Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Application, Hydrotherapy Pools), By Application (Cardiology, Dermatology), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-682-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hydrotherapy Equipment Market Summary

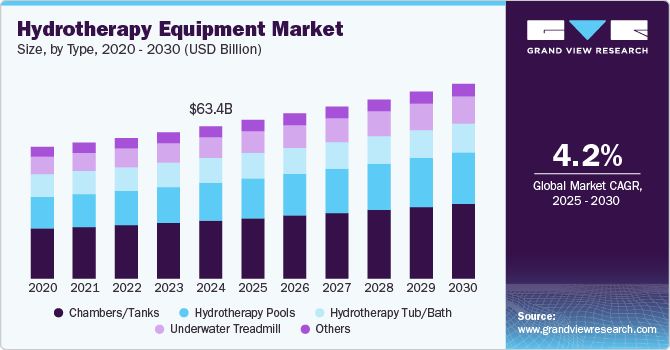

The global hydrotherapy equipment market size was estimated at USD 633.9 million in 2024 and is projected to reach USD 812.2 million by 2030, growing at a CAGR of 4.2% from 2025 to 2030. The increasing prevalence of chronic conditions such as arthritis, spinal cord injuries, and neurological disorders is enhancing awareness and driving the demand for effective rehabilitation methods.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, Japan is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, hydrotherapy pools accounted for a revenue of USD 241.0 million in 2024.

- Hydrotherapy Tub/Bath is the most lucrative type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 633.9 Million

- 2030 Projected Market Size: USD 812.2 Million

- CAGR (2025-2030): 4.2%

- North America: Largest market in 2024

Hydrotherapy has been proven to alleviate pain and improve mobility, making it an essential component of treatment plans in hospitals and rehabilitation centers. Moreover, patients recovering from surgeries often benefit from hydrotherapy pools that facilitate low-impact exercises, promoting quicker recovery.

Moreover, the growing awareness of chronic conditions, including spinal cord injuries and arthritis, is increasing the need for rehabilitation solutions, such as aquatic therapy and underwater treadmills. In addition, the growing awareness of mental health benefits associated with hydrotherapy has led to its integration into wellness programs across various healthcare facilities. Furthermore, as individuals seek holistic approaches to wellness, the demand for hydrotherapy treatments in spa and wellness centers has increased. This trend is further supported by the growing popularity of health tourism, where people travel specifically for therapeutic experiences, including hydrotherapy sessions. Integration of advanced technologies in hydrotherapy equipment, such as customizable jets and temperature controls, also enhances user experience and effectiveness, attracting more users.

Government initiatives promoting wellness and preventive healthcare contribute to market expansion. For instance, an article published by the Deccan Herald in March 2023 stated that Ayush Multi Specialty Hospital in Karnataka inaugurated a new hydrotherapy facility funded by Mangalore Chemicals and Fertilizers. The facility aims to provide treatments for in-patients, focusing on detoxification and relief from conditions such as joint pain, arthritis, and asthma. This is the only government hospital in the state offering such services, which will initially be provided free of charge, with plans to introduce a nominal fee to help maintain the facility.

Technological advancements such as integrating digital health solutions are becoming prominent, allowing clinicians to collect and analyze patient data for optimized treatment protocols. The use of wearable technology enables real-time monitoring of patient progress, enhancing the personalization of hydrotherapy treatments. In addition, innovations such as underwater treadmills and resistance therapy jets provide customized therapy options tailored to individual patient needs. These advances position hydrotherapy as a cutting-edge option in rehabilitation and wellness.

Type Insights

The hydrotherapy pools segment dominated the market with the largest revenue share of 38.0% in 2024, which can be attributed to technological advancements and the growing need for therapeutic benefits, such as rehabilitation and recovery. These pools provide a controlled and therapeutic environment that enhances the rehabilitation of individuals with orthopedic and neurological disorders. In addition, it also offers customizable features, such as adjustable water temperature and massage jets, which cater to individual patient needs. According to an article published by the Lancashire Telegraph in August 2024, Burnley Care Center received approval to construct a new hydrotherapy pool at the Charter House Resource Centre. It features advanced sensory equipment designed to assist individuals with physical ailments, such as musculoskeletal disorders and arthritis.

The hydrotherapy tub/bath segment is expected to grow at the fastest CAGR of 5.3% over the forecast period. This can be attributed to the development of healthcare infrastructure and the growing focus on wellness and self-care, which influences consumer behavior. The rise in the prevalence of chronic conditions, such as arthritis and spinal cord injuries, has led to a higher need for effective treatment options that hydrotherapy provides. The expansion of wellness and spa centers also supports this demand, as more facilities are incorporating hydrotherapy into their services. In addition, rising disposable incomes and changing lifestyles have encouraged consumers to prioritize self-care and wellness in their homes. As people become more health-conscious, they are willing to invest in high-quality hydrotherapy tubs that offer advanced features such as adjustable temperature controls and massage jets.

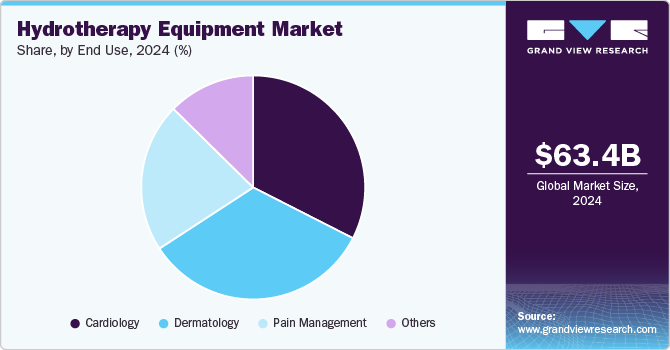

Application Insights

The cardiology segment dominated the market with the largest revenue share of 33.3% in 2024. This can be attributed to the rise in demand for effective rehabilitation methods and the growing preference for non-invasive treatments. The increasing prevalence of cardiovascular diseases has led to a higher demand for effective rehabilitation methods, with hydrotherapy recognized for its benefits in promoting heart health and aiding recovery after cardiac events. In addition, there is a growing preference for non-invasive treatments among patients, making hydrotherapy an appealing option for cardiologists. The integration of hydrotherapy into cardiac rehabilitation programs enhances patient outcomes, driving segment growth.

The dermatology segment is expected to grow at the fastest CAGR of 5.1% over the forecast period. As skin conditions such as eczema, psoriasis, and acne become more common, there is a growing demand for effective treatments that incorporate hydrotherapy. For instance, hydrotherapy is often used in dermatological treatments to soothe irritated skin and promote healing through controlled water temperature and mineral-rich environments. Advancements in hydrotherapy equipment, such as customizable jets and temperature control, enhance treatment effectiveness and accessibility.

End Use Insights

The spa and wellness centers dominated the market with the largest revenue share of 49.6% in 2024. This can be attributed to the increasing demand for holistic health and relaxation therapies, leading to a rise in spas offering hydrotherapy treatments, such as mineral baths and hydro massage. These facilities cater to consumers seeking stress relief and improved well-being, making hydrotherapy an attractive option. For instance, many wellness centers are being established globally, such as SIX28 Wellness Spa, which was established by Pamela James in Virginia. The spa was established to address the community’s lack of colon health facilities and provide recovery care. In addition, it also offers a range of services, such as IV hydration, colon hydrotherapy, halo therapy, and infrared sauna treatments.

The hospital and rehabilitation center segment is expected to grow at the fastest CAGR of 4.9% over the forecast period. Conditions requiring rehabilitation, such as spinal cord injuries and recovery post-surgery, have led to a higher demand for effective therapeutic solutions. According to an article published by The Hindu in April 2022, Ganga Hospital in Coimbatore opened a new rehabilitation facility specifically for stroke and head injury patients. The center has advanced hydrotherapy equipment and other therapeutic resources to enhance rehabilitation outcomes. Furthermore, healthcare providers increasingly recognize hydrotherapy's benefits in pain management and overall patient wellness, driving segment growth.

Regional Insights

The hydrotherapy equipment market in North America dominated the market with the largest revenue share of 37.9% in 2024. This is attributable to the rise of spinal cord injuries, which increases the demand for effective treatments. There is a growing trend of non-pharmacologic therapies for pain relief, leading to a shift away from opioids. The country is well known for its established healthcare infrastructure, including hospitals and rehabilitation centers, which support the integration of hydrotherapy into treatment programs. For instance, many hospitals are incorporating hydrotherapy pools, aquatic therapy, and underwater treadmills into their rehabilitation programs, which can help minimize joint stress while improving mobility and strength. Treatment such as aquatic therapy utilizes the buoyancy of water to facilitate movement, reduce spasticity, and enhance neuromuscular reeducation, making it particularly beneficial for individuals with restricted mobility. Clinical studies support these benefits, demonstrating that aquatic therapy can increase strength, improve gait patterns, and reduce muscle spasms.

U.S. Hydrotherapy Equipment Market Trends

The U.S. hydrotherapy equipment market dominated the North American market with the largest revenue share in 2024. This is attributable to the growing prevalence of health conditions such as arthritis and obesity, which necessitates rehabilitation solutions. Many healthcare facilities and wellness centers across the U.S. are adopting hydrotherapy treatments to improve patient outcomes and enhance recovery processes. In addition, the growing focus on wellness and self-care among consumers has led to a surge in demand for hydrotherapy services in spas and wellness centers, further boosting market growth.

Asia Pacific Hydrotherapy Equipment Market Trends

The hydrotherapy equipment market in Asia Pacific is expected to grow at the fastest CAGR of 6.6% over the forecast period, attributed to its increasing investment in healthcare infrastructure. Countries such as India and Vietnam have heavily invested in their public health system. Such investments enhance access to advanced therapeutic solutions such as hydrotherapy pools, particularly for rehabilitation following surgeries or cardiovascular procedures. Furthermore, there is a growing awareness and acceptance of hydrotherapy's benefits for recovery and wellness, leading to more facilities offering these treatments.

China equipment market dominated the market with the largest revenue share in 2024. Factors such as the rapidly aging population and increasing healthcare expenditures are promoting the growth in the market. Several cities, such as Beijing and Shanghai, incorporateadvanced hydrotherapy systems to enhance patient recovery processes, particularly for those recovering from surgeries or managing conditions such as arthritis. In addition, introducing innovative products, such as portable hydrotherapy pools, is making these therapies more accessible in both clinical and home settings. These trends reflect China's commitment to improving healthcare services and enhancing patient outcomes through hydrotherapy.

Europe Hydrotherapy Equipment Market Trends

The hydrotherapy equipment market in Europe is expected to witness significant growth over the forecast period, driven by innovative technologies and demand for hydrotherapy services in spas and wellness centers. The growing awareness of the therapeutic benefits of hydrotherapy, such as rehabilitation and pain management, has led to higher adoption rates in healthcare facilities and wellness centers. Countries such as Germany and the UK are integrating hydrotherapy into their healthcare systems to address chronic conditions such as arthritis and musculoskeletal disorders. For instance, Innova Care Concepts launched a new portable hydrotherapy pool called HydroSpace in September 2022, which is designed to enhance accessibility to aquatic therapy in care environments, improvingmuscle tone and pain management.

Key Hydrotherapy Equipment Company Insights

Some key players in the market are EWAC, HYDROWORX, Prime Pacific Health Innovations Corporation, and Hydro Physio. These companies employ various strategies to gain a competitive edge, such as launching new products to cater to diverse patient needs, developing personalized care services to enhance treatment efficacy, and leveraging emerging markets to tap into increasing awareness about chamber/tanks and hydrotherapy pools. Furthermore, these businesses engage in collaborative research initiatives with healthcare organizations to drive innovation while integrating digital health solutions for enhanced patient access and adherence.

-

EWAC specializes in manufacturing and supplying hydrotherapy equipment and water-based rehabilitation solutions. The company offers a comprehensive range of products, including movable swimming pool floors, modular pools, and underwater treadmills, designed to enhance therapeutic exercises and improve patient outcomes. In addition, its equipment provides services such as pool design, commissioning, training for hydrotherapy practices, and ongoing maintenance support.

-

Prime Pacific Health Innovations Corporation specializes in colon hydrotherapy equipment. The company is recognized for its innovative and high-quality products, including Aquanet EC-2000, which combines gravity and pressure treatments. In addition, it consists of other models, such as Aquanet APS-100 and GRY-500, that enhance patient safety and treatment effectiveness.

Key Hydrotherapy Equipment Companies:

The following are the leading companies in the hydrotherapy equipment market. These companies collectively hold the largest market share and dictate industry trends.

- EWAC

- HYDROWORX

- Prime Pacific Health Innovations Corporation

- Hydro Physio

- Sidmar Manufacturing, Inc.

- SwimEx Inc

- Kohler Co

- RMS, Co.

- Narang Medical Limited.

- Jacuzzi Inc.

- Accord Medical Products

Recent Developments

-

In January 2023, Hydro Physio showcased its innovative hydrotherapy system at the Arab Health 2022 exhibition in Dubai. The system was designed to enhance rehabilitation and recovery for patients, featuring advanced technology that allowed for customizable therapy sessions. Furthermore, it is also intended to assist in osteoarthritis, post-surgery recovery, and weight loss, improve overall well-being, and reduce the load on painful joints.

-

In December 2022, HYDROWORX introduced HydroWorx RISE, the first modular hydrotherapy system designed for easy delivery and accessibility. The innovative product can be delivered and installed in one to three pieces, making it suitable for various spaces with challenging access routes. Furthermore, RISE also offers customizable configurations, allowing more facilities to incorporate aquatic therapy solutions to enhance patient rehabilitation.

Hydrotherapy Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 66.0 billion

Revenue forecast in 2030

USD 81.2 billion

Growth Rate

CAGR of 4.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

EWAC; HYDROWORX; Prime Pacific Health Innovations Corporation; Hydro Physio; Sidmar Manufacturing, Inc.; SwimEx Inc; Kohler Co.; RMS, Co.; Narang Medical Limited.; Jacuzzi Inc.; Accord Medical Products

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hydrotherapy Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global hydrotherapy equipment market report based on type, application, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chambers/Tanks

-

Hydrotherapy Pools

-

Hydrotherapy Tub/Bath

-

Underwater Treadmill

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Dermatology

-

Pain Management

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Rehabilitation Centers

-

Spa & Wellness Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hydrotherapy equipment market was estimated at USD 63.4 billion in 2024 and is expected to reach USD 66.0 billion in 2025.

b. The global hydrotherapy equipment market is expected to grow at a compound annual growth rate of 4.2% from 2025 to 2030 to reach USD 81.2 billion by 2030.

b. North America dominated the hydrotherapy equipment market with a share of 37.9% in 2024. This is attributable to the positive reimbursement scenario and less hydrotherapy expenditure than other prevalent treatment options.

b. Some key players operating in the hydrotherapy equipment market are EWAC, HydroWorx, Prime Pacific Health Innovations, BTL, Hydro Physio, Technomex, Stas Doyer, Transcom, Sidmar Manufacturing Inc., SwimEx, Kohler Co., RMS, Co., Narang Medical Limited, Jacuzzi Inc., Accord Medical Products.

b. Key factors driving the hydrotherapy equipment market growth include the high number of spinal cord injuries, applications in rehabilitation services, and applications in sports training. The aquatic environment is ideal for athletic training as it imparts less fatigue and joint stress compared to land-based training.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.