Hydroxyzine Market Size & Trends

The global hydroxyzine market size is expected to grow at a compound annual growth rate (CAGR) of over 6.0% from 2024 to 2030. The growing prevalence of anxiety disorders and atopic contact dermatitis has created immense opportunities for key market players. In addition, some of the other factors driving the market growth are the rising geriatric population, growing patient awareness for antihistamine drugs, technological advancements, and increasing R&D investments.

Hydroxyzine compound is commonly used as an intermediate in the synthesis of antihistamine drugs such as cetirizine and hydroxyzine. It is a drug that attenuates activity in the central nervous system to treat anxiety and helps boost serotonin levels in the brain. For instance, according to the European Medicine Agency, hydroxyzine medicines are approved and available in EU countries for treating anxiety disorders & relieving pruritus (itching) and the treatment of sleep disorders, as well as for use as premedication before surgery. In addition, the use of hydroxyzine medicines for various indications may vary from country to country.

Moreover, there is a high unmet need for products due to increasing prevalence of allergic reactions, investments, and awareness campaigns. For instance, according to Asthma and Allergy Foundation of America, in April 2022, in the U.S., various types of allergies are experienced every year by more than 100 million people, and allergies are the sixth major cause of chronic illnesses in the country. This factor drives market demand.

The COVID-19 pandemic significantly impacted the hydroxyzine market. The pandemic initially disrupted global supply chains, affecting the production and distribution of various products, including tablets, capsules, injections, and syrups, which led to shortages in the market. However, the pandemic enhanced awareness of hydroxyzine clinical safety, effectiveness, and tolerability across various indications: histamine-mediated pruritus, urticaria, and atopic contact dermatitis. The growing importance of hydroxyzine imine as an antihistamine drug has contributed to increased demand for products postpandemic.

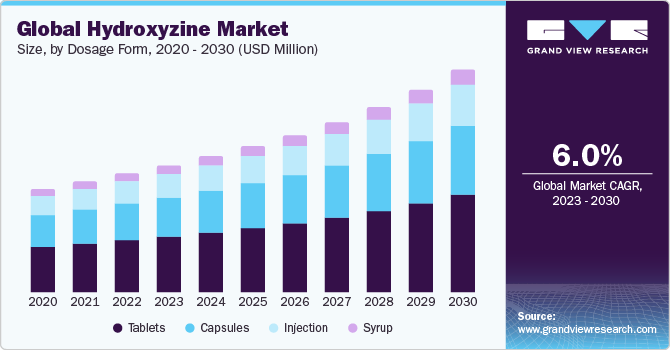

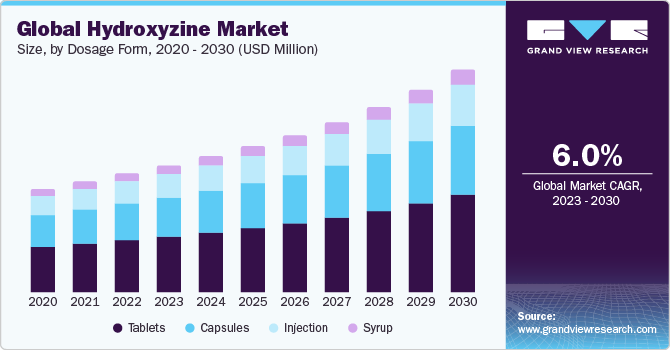

Dosage Form Insights

On the basis of dosage form, the hydroxyzine market is segmented into tablets, capsules, injections, and syrup. The tablet segment held the largest market share in 2023. Hydroxyzine tablets are antihistamine drugs rapidly absorbed from the gastrointestinal tract, and their clinical effects are noted within 15 to 30 minutes after oral administration. These are designed to control anxiety & tension caused by nervous and emotional conditions. It helps induce sleep prior to surgery.

Furthermore, the rising utilization of tablet dosage forms for anxiety control and relieving symptoms of allergic conditions, coupled with a rise in the incidence of nervous conditions, drives the segment growth. The injections segment is expected to witness the fastest growth rate over the forecast period 2024 to 2030. The growth of this segment is majorly driven by its chemotherapeutic clinical effectiveness in the management of neuroses and emotional disturbances caused by tension, anxiety, apprehension, or confusion.

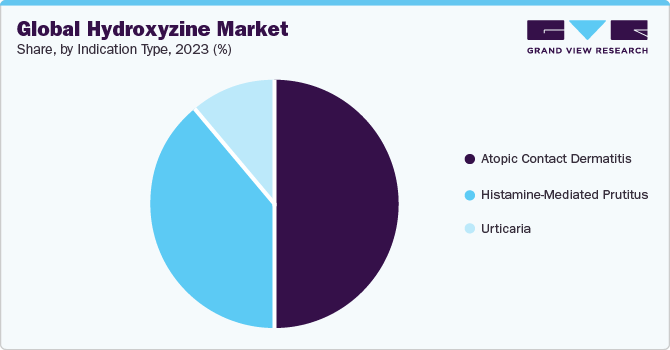

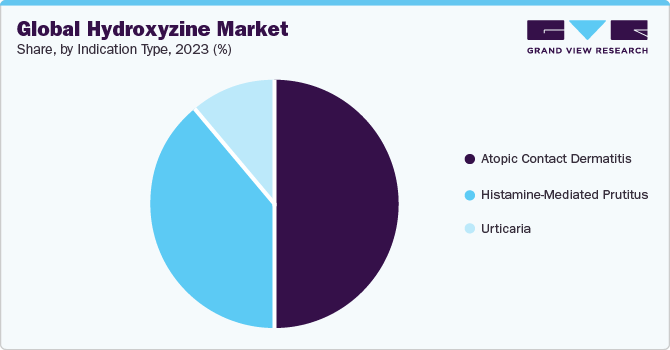

Indication Type Insights

On the basis of indication type, the market is segmented into histamine-mediated pruritus, urticaria, and atopic contact dermatitis. Atopic contact dermatitis dominated the indication type segment in 2023. The rising prevalence of atopic dermatitis and demand for hydroxyzine dosage form has led to the growth of the market revenue. For instance, according to International Eczema Council 2022, the prevalence of atopic dermatitis is high, affecting up to 10% of adults and 20% of children. In addition, the disease burden ranks 15th globally under nonfatal conditions and is number one for skin conditions that are measured in disability-adjusted life years.

The demand for prescribed hydroxyzine to treat atopic contact dermatitis has increased the market revenue. For instance, in June 2022, BC Children's Hospital Research Institute highlighted that hydroxyzine, an antihistamine, is prescribed in syrup form to infants and young children with skin conditions such as eczema and atopic dermatitis. However, research has also shown that excess hydroxyzine prescription among children leads to an increased risk of developing a tic, anxiety, or conduct disorder. Thus, the segment is expected to witness growth.

Regional Insights

North America dominated the market in 2023, which can be attributed to the high prevalence of atopic contact dermatitis, growing awareness of treatments for anxiety & nervous conditions, the presence of well-established infrastructure, and an increase in partnerships between pharmaceutical companies & contract research organizations. The CDC mentioned that the percentage of adults receiving mental health treatment had increased between 2019 and 2021 from 19.2% – 21.6% among adults of all ages and from 18.5% – 23.2% in those aged 18 to 44. In addition, among adults aged 18–44, women were more likely to receive mental health treatment.

Competitive Insights

Some of the key players operating in the market are Pfizer Inc.; GlaxoSmithKline plc; Teva Pharmaceutical Industries; Piramal Healthcare UK Limited; Alliance Pharma PLC; Shanghai Ruizheng Chemical Technology Co., Ltd; Lupin Pharmaceuticals, Inc.; OAK PHARMS INC.; Changzhou ComWin Fine Chemicals Co., Ltd; Novartis International AG; and Impax Laboratories, Inc.

The key players in the market undertake various strategic initiatives, such as new product launches, partnerships, and mergers & acquisitions. In December 2022, Brillpharma (Ireland) gained HPRA marketing authorization for Hydroxyzine hydrochloride 25mg film-coated tablets. These are licensed for anxiety management in adults.