- Home

- »

- Pharmaceuticals

- »

-

Hyperlipidemia Drugs Market Size & Share Report, 2030GVR Report cover

![Hyperlipidemia Drugs Market Size, Share & Trends Report]()

Hyperlipidemia Drugs Market (2024 - 2030) Size, Share & Trends Analysis Report By Drug Class (Statins, Bile Acid Sequestrants, PCSK9 Inhibitors), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-525-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hyperlipidemia Drugs Market Size & Trends

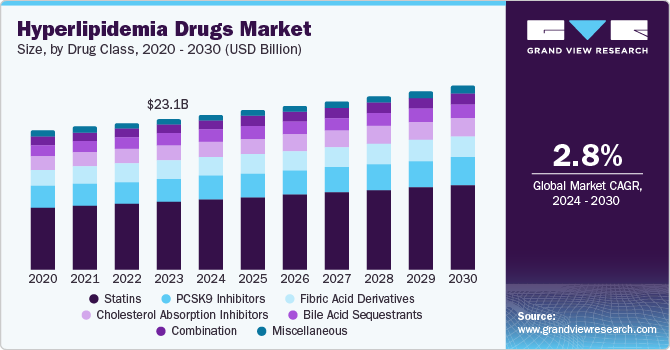

The global hyperlipidemia drugs market size was valued at USD 23.1 billion in 2023 and is projected to grow at a CAGR of 2.8% from 2024 to 2030. The key factors include the increasing prevalence of cardiovascular diseases, and technological advancements that have resulted in the formation of new drugs. In addition, the rise in the geriatric population with a higher prevalence of hyperlipidemia and associated cardiovascular risks has created a need for potent drugs and novel therapies.

The growing awareness about the risks associated with high cholesterol levels, the significance of managing lipid profiles, and competition among the market players have encouraged market developments. The increasing incidences of hyperlipidemia, sedentary lifestyles, and poor diets have resulted in higher lipid levels in the global population. Furthermore, the awareness about high cholesterol and its impact on cardiovascular diseases and increasing healthcare expenditure for better treatment for conditions such as hyperlipidemia further help the market growth. Additionally, disposable incomes have resulted in patients opting for better treatment, further propelling the market growth.

Hyperlipidemia is one of the causes of cardiovascular diseases. Under such conditions, elevated levels of lipoprotein can lead to stroke. Second to smoking, hyperlipidemia is a major cause of heart disease resulting in stroke or cardiac arrest. The research initiatives for developing novel drug classes create novel opportunities for drug development. For instance, PCSK9 inhibitors such as alirocumab (Praulent), and evolocumab (Repatha) are gaining popularity based on their performance in such cases. These drugs have exhibited efficacy in helping cardiovascular patients with low-density lipoprotein (LDL) or bad cholesterol. Moreover, advances in gene therapy present long-term treatment opportunities in patients. These therapies are efficient in targeting genetic mutations that trigger hypercholesterolemia.

Drug Class Insights

The statins segment held the largest market share of 45.2% in 2023. Factors such as the increasing prevalence of cardiovascular diseases such as heart attacks and strokes, increasing awareness about regular health checkups especially in the geriatric population, and guidelines by various healthcare organizations have helped in the growth of the market. In addition, the rise in the geriatric population and increasing investments in research and development are poised to create new avenues in the industry. The development of new statins has enhanced tolerability. Statins are often used in treatment strategies such as lifestyle modifications, diet, and exercise further enlarging the market developments.

The PCSK9 inhibitors segment is likely to witness a fastest CAGR of 2.7% over the forecast period. Factors such as the clinical efficacy in reducing low-density lipoprotein cholesterol levels and reducing cardiovascular problems, increasing approvals by the regulatory bodies, and the increasing prevalence of hyperlipidemia particularly due to the rising levels of cholesterol, and advances in research and developments primarily drive the segment growth. In addition, the growing investments in developing better PCSK9 inhibitors and the adaptability of these inhibitors in treatment have been more appealing.

Route of Administration Insights

The oral segment held the largest market share of 64.8% in 2023. Oral medications are available in a wide range of products in capsule or tablet form, and their combination with other agents such as liquid or gel enhances their efficiency resulting in a fast patient recovery. Mostly, oral medications are available at lower prices to result in sustainable treatment.

The parenteral segment is expected to witness the fastest CAGR of 3.5% over the forecast period. Factors such as efficacy and rapid action, adherence rates and patient compliance, and the innovations in a parenteral segment have resulted in advancements in drug formulation and targeted therapy options, primarily driving the market's growth. In addition, the increasing presence of hyperlipidemia and the significance of parenteral therapies has further driven the growth of the market.

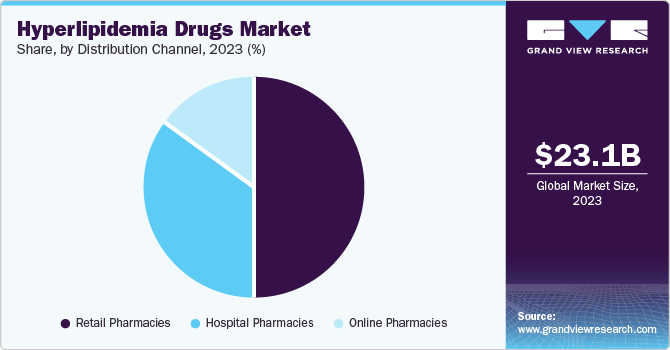

Distribution Channel Insights

The retail pharmacies segment held the largest market share of 49.8% in 2023 pertaining to the factors such as wide accessibility for the general public, additional services enhance the patient's experiences, and e-commerce integration have played vital roles in the market growth. In addition, collaboration with healthcare providers to manage patient care and trust within patients regarding retail pharmacies as they operate under strict regulations set by agencies or government bodies further drive market growth.

Online pharmacies are expected to witness the fastest CAGR of 2.8% over the forecast period. Factors such as patient convenience, competitive pricing, and increasing internet penetration catalyze the segment growth. In addition, online pharmacies have grown substantially in the past few years. The growing popularity, customer-centric treatment options, and other value additions ensemble the segment's growth.

Regional Insights

North America held the largest market share of 39.4% in 2023 owing to the factors such as the increasing presence of hyperlipidemia, the rise in geriatric population, the presence of well-established healthcare infrastructure that provides better treatment which leads to patients opting for treatment, and increasing expenditure on research and development are primarily driving the market growth. In addition, the rise in disposable income and the increasing health awareness about cholesterol levels further help market growth.

U.S. Hyperlipidemia Drugs Market Trends

The U.S. hyperlipidemia drugs market is expected to witness a significant growth over the forecast period. The incidences of hyperlipidemia are growing in the population. Besides, the availability of advanced healthcare infrastructure has resulted in patients having better access to treatments and increasing awareness about cardiovascular health mainly due to media coverage, awareness campaigns, and reimbursement policies. In addition, the expanding reach of the internet and increasing competition by the major players further drive the regional market growth.

Asia Pacific Hyperlipidemia Drugs Market Trends

Asia Pacific hyperlipidemia drugs market is expected to witness the fastest CAGR over the forecast period. Factors such as the growth of hyperlipidemia, the increase in geriatric population especially in countries such as China, India, and Japan, and the economic growth of the region which has increased expenditure on healthcare infrastructure played a vital role in the market developments. In addition, technological advancements and an increased awareness about cholesterol levels and their effect on cardiovascular health have further propelled the market growth.

Europe Hyperlipidemia Drugs Market Trends

Europe hyperlipidemia drugs market is expected to grow steadily in the forecast period. The increasing cases of hyperlipidemia driven by genetic factors are expected to propel the need for effective drugs. The proactive government policies aimed at providing better health, and increasing medical tourism play an important role. In addition, the diverse treatments and funding for research and development for better treatment procedures has further helped in the growth of the market.

Key Hyperlipidemia Drugs Company Insights

Some key companies in the market are AstraZeneca, Merck & Co., Inc. and others. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

AstraZeneca is a British-Swedish company with a broad portfolio in medical science. It has produced innovative drugs for hyperlipidemia that are widely accepted. AZD0780 is the first small oral molecule, PCSK9 inhibitor developed by Astra Zeneca for patients with hyperlipidemia.

-

Merck & Co. is a U.S.-based company with expertise in hyperlipidemic medications that focus on lowering low-density lipoprotein cholesterol. In 2023, it clinically tested MK-0616, an oral PCSK9 inhibitor in adults. The conclusions from the studies were presented at the 72nd Annual Scientific Session along with the World Congress of Cardiology at the American College of Cardiology. The findings were published in The Journal of the American College of Cardiology.

Key Hyperlipidemia Drugs Companies:

The following are the leading companies in the hyperlipidemia drugs market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca

- Merck & Co., Inc.

- Pfizer Inc.

- Daiichi Sankyo Company Limited

- Amgen Inc.

- Sanofi

- Viatris Inc.

- Esperion Therapeutics, Inc.

Recent Developments

-

In May 2024, research from the Baylor College of Medicine showed the effect of drug (Plozasiran) therapy on hyperlipidemia. Plozasiran targets ApoC3, which regulates lipoprotein particles that carry triglycerides and cholesterol.

-

In March 2024, Prauluent (Alirocumab) injections were approved by the FDA to be used in pediatrics with high cholesterol which helps the patients to reduce and manage LDL-C levels much earlier in their life.

Hyperlipidemia Drugs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.7 billion

Revenue forecast in 2030

USD 28.0 billion

Growth Rate

CAGR of 2.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, route of administration, distribution channel and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; UAE; Kuwait, South Africa

Key companies profiled

AstraZeneca; Merck & Co., Inc.; Pfizer Inc.; Daiichi Sankyo Company, Limited.; Amgen Inc.; Sanofi; Viatris Inc.; Esperion Therapeutics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hyperlipidemia Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hyperlipidemia drugs market report based on drug class, route of administration, distribution channel, and region.

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Statins

-

Bile Acid Sequestrants

-

Cholesterol Absorption Inhibitors

-

Fibric Acid Derivatives

-

PCSK9 Inhibitors

-

Combination

-

Miscellaneous

-

-

By Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Parenteral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Online Pharmacies

-

Retail Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

Kuwait

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.