- Home

- »

- Pharmaceuticals

- »

-

Idiopathic Pulmonary Fibrosis Treatment Market Report, 2030GVR Report cover

![Idiopathic Pulmonary Fibrosis Treatment Market Size, Share & Trends Report]()

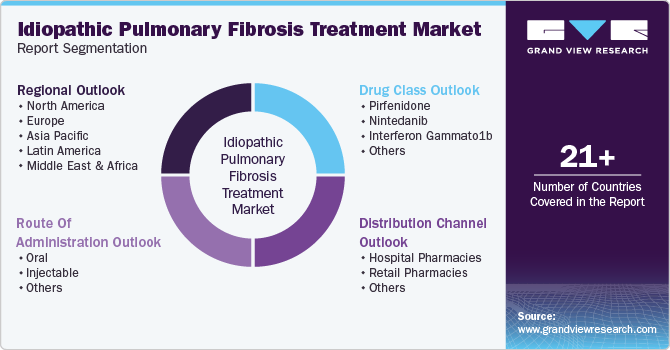

Idiopathic Pulmonary Fibrosis Treatment Market Size, Share & Trends Analysis Report By Drug Class (Pirfenidone, Nintedanib), By Route of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-119-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

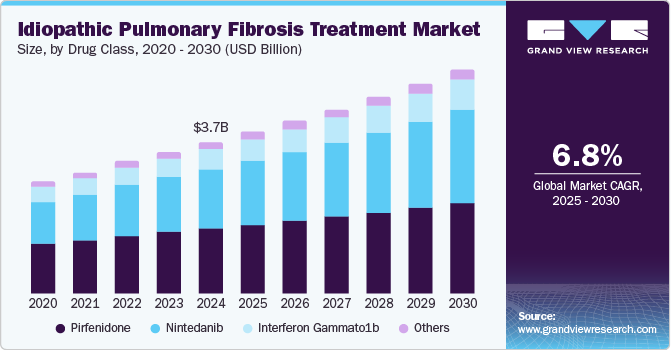

The global idiopathic pulmonary fibrosis treatment market size was estimated at USD 3.68 billion in 2024 and is projected to grow at a CAGR of 6.8% from 2025 to 2030. As healthcare professionals encounter a rising number of idiopathic pulmonary fibrosis (IPF) cases, there is an escalating demand for effective therapeutic interventions. The debilitating nature of IPF necessitates management strategies that enhance patient quality of life, thereby driving market demand for innovative treatment options. This demographic shift underscores the urgent need to scale healthcare services and address this challenging disease's growing incidence.

Older individuals are inherently more susceptible to developing chronic diseases, including IPF. As the global demographic landscape evolves, there is a concomitant rise in healthcare needs and the demand for targeted IPF treatments. This trend is further compounded by the increasing life expectancy of populations worldwide, which heightens the proportion of individuals at risk for IPF. The intersection of these factors highlights the critical role of strategic planning in healthcare resource allocation and treatment development.

Enhanced understanding among healthcare professionals and the public leads to improved diagnosis rates and proactive treatment-seeking behavior. Public health campaigns and educational initiatives are essential for raising awareness about IPF and its management options, ultimately fostering a supportive environment for patients. As diagnosis rates rise, so does the demand for therapeutic solutions, creating a positive feedback loop that catalyzes market expansion.

The advent of effective pharmacological treatments (e.g., antifibrotic agents such as pirfenidone and nintedanib) has revolutionized IPF management by offering new avenues to slow disease progression. Furthermore, ongoing investments by pharmaceutical companies in clinical trials and novel therapeutic pathways reflect a commitment to addressing unmet medical needs within this sector. These innovations are expected to significantly broaden the array of treatment options available, ultimately driving the IPF treatment market toward substantial growth.

Drug Class Insights

Pirfenidone dominated the market and accounted for a share of 43.0% in 2024. Regulatory authorities approve pirfenidone as a standard treatment option, offering a unique combination of anti-fibrotic, anti-inflammatory, and antioxidant properties. Its proven efficacy in clinical trials and continued research and development initiatives significantly increase its value and attractiveness to healthcare providers and patients.

The nintedanib segment is expected to grow at the fastest CAGR of 8.0% over the forecast period. Clinical trials, such as the INPULSIS studies, demonstrate that nintedanib significantly reduces the annual decline in FVC by approximately 50% compared to placebo, positively impacting patients at different disease stages. Moreover, nintedanib has a favorable safety profile, with side effects primarily associated with gastrointestinal concerns.

Route of Administration Insights

Orally administered medications led the market with a revenue share of 69.3% in 2024. Pirfenidone and nintedanib enhance patient compliance compared to injectable therapies. Their documented effectiveness in slowing disease progression and improving lung function, combined with favorable safety profiles, facilitates easy integration into daily routines, promoting their adoption by healthcare providers and patients.

Injectable medications are expected to register a steady growth rate over the forecast period. Injectable therapies are advantageous for patients who struggle with oral medication adherence or exhibit severe disease progression. Ongoing research into innovative injectable options, including combination treatments, enhances treatment efficacy, while targeted dosing improves patient outcomes and safety in managing IPF effectively.

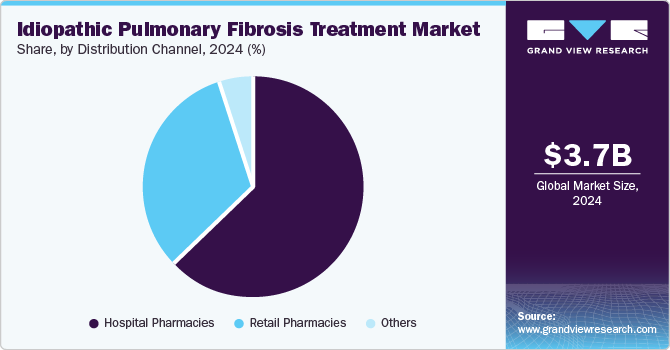

Distribution Channel Insights

Hospital pharmacies held the largest revenue share 62.9% in 2024, as hospitals are equipped with advanced diagnostic tools for accurate IPF diagnosis and monitoring, facilitating timely treatment initiation. Moreover, hospital pharmacies provide expert guidance on medication usage and administration, ensuring optimal patient care amidst the increasing prevalence of IPF and management needs.

Retail pharmacies are expected to register the fastest growth of 7.4% over the forecast period. Retail pharmacies provide an extensive selection of prescription and over-the-counter medications, facilitating convenient access to essential treatments for patients with chronic conditions such as IPF. Favorable reimbursement policies and competitive pricing further enhance affordability, increasing patient preference for retail pharmacy services.

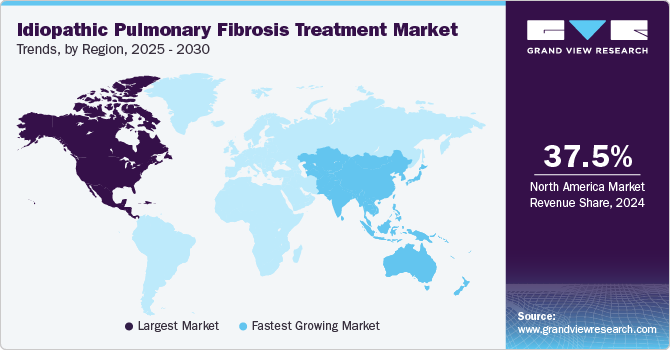

Regional Insights

North America idiopathic pulmonary fibrosis treatment market dominated the global market with a revenue share of 37.5% in 2024. The region features advanced healthcare infrastructure, well-equipped hospitals, and specialized IPF diagnosis and management expertise, enabling timely and effective treatment. Furthermore, strong research and development efforts, complemented by favorable reimbursement policies, improve access to approved therapies, including pirfenidone and nintedanib.

U.S. Idiopathic Pulmonary Fibrosis Treatment Market Trends

The idiopathic pulmonary fibrosis treatment market in the U.S. dominated North America, with a significant revenue share in 2024. The country is supported by advanced healthcare infrastructure, facilitating timely diagnosis and effective treatment options. Accelerated drug approvals for the drugs pirfenidone and nintedanib have enhanced patient access, while ongoing U.S. research and development efforts promote innovative treatment approaches.

Europe Idiopathic Pulmonary Fibrosis Treatment Market Trends

Europe idiopathic pulmonary fibrosis treatment market held substantial market share in 2024. Countries such as Germany and the UK exhibit high prevalence rates, driving the demand for effective treatment options. Established pharmaceutical companies, ongoing clinical trials for innovative therapies, and favorable regulatory environments collectively promote market growth and expedite access to new treatments, enhancing patient care.

The idiopathic pulmonary fibrosis treatment market in Germany is expected to grow rapidly between 2025 and 2030. Germany’s robust healthcare system facilitates early diagnosis and effective management of IPF, improving patient outcomes. A strong pharmaceutical presence focuses on innovative therapies, while heightened awareness among healthcare professionals and patients drives demand for effective treatments and new therapeutic options through ongoing clinical trials and research initiatives.

Asia Pacific Idiopathic Pulmonary Fibrosis Treatment Market Trends

Asia Pacific idiopathic pulmonary fibrosis treatment market is expected to register the fastest CAGR of 7.8% in the forecast period. Heightened awareness of the disease and improved access to healthcare services drive demand for effective treatment options. Moreover, advancements in diagnostic technologies and pharmaceutical innovations, along with a strengthening healthcare infrastructure, enhance the management of chronic conditions such as IPF through collaborative efforts between research institutions and pharmaceutical companies.

The idiopathic pulmonary fibrosis treatment market in China held a substantial share of the Asia Pacific market in 2024. Enhanced healthcare access and growing IPF awareness fuel demand for effective treatment options. The Chinese government’s commitment to improving healthcare infrastructure and expanding insurance coverage for chronic diseases supports market expansion, while ongoing research fosters the development of patient-centric therapies.-

Key Idiopathic Pulmonary Fibrosis Treatment Company Insights

Some key companies operating in the market include F. Hoffmann-La Roche Ltd, Boehringer Ingelheim International GmbH, and Bristol-Myers Squibb Company. Companies are undertaking strategic initiatives, such as R&D, product innovation, and partnerships, to strengthen their market position and expand their portfolios.

-

MediciNova, Inc., is dedicated to advancing MN-166 (ibudilast). This investigational compound targets inflammatory pathways, primarily for treating neurodegenerative diseases such as ALS. Potential applications in IPF are being explored in ongoing clinical trials.

Key Idiopathic Pulmonary Fibrosis Treatment Companies:

The following are the leading companies in the idiopathic pulmonary fibrosis treatment market. These companies collectively hold the largest market share and dictate industry trends.

- F. Hoffmann-La Roche Ltd

- Boehringer Ingelheim International GmbH

- Bristol-Myers Squibb Company

- Medicinova, Inc

- Merck & Co., Inc.

- Galapagos NV

- Novartis AG

- Fibrogen, Inc.

Recent Developments

-

In September 2024, Boehringer Ingelheim announced that its FIBRONEER-IPF study of nerandomilast successfully met its primary endpoint, prompting plans for a new drug application for IPF treatment.

-

In May 2024, Ferrer expanded its distribution agreement with United Therapeutics to obtain worldwide rights for treprostinil inhalation solution, targeting potential indications for Idiopathic and Progressive Pulmonary Fibrosis.

Idiopathic Pulmonary Fibrosis Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.93 billion

Revenue forecast in 2030

USD 5.46 billion

Growth rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Medicinova, Inc; Merck & Co., Inc.; Galapagos NV; Novartis AG; Fibrogen, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Idiopathic Pulmonary Fibrosis Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global idiopathic pulmonary fibrosis treatment market report based on drug class, route of administration, distribution channel, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Pirfenidone

-

Nintedanib

-

Interferon Gammato1b

-

Others

-

-

Route Of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."