- Home

- »

- Pharmaceuticals

- »

-

Idiopathic Thrombocytopenic Purpura Therapeutics Market Report, 2030GVR Report cover

![Idiopathic Thrombocytopenic Purpura Therapeutics Market Size, Share & Trends Report]()

Idiopathic Thrombocytopenic Purpura Therapeutics Market Size, Share & Trends Analysis Report By Disease Type (Corticosteroids, IVIG, Anti-D Immunoglobulins, TPO-RA, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-289-1

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

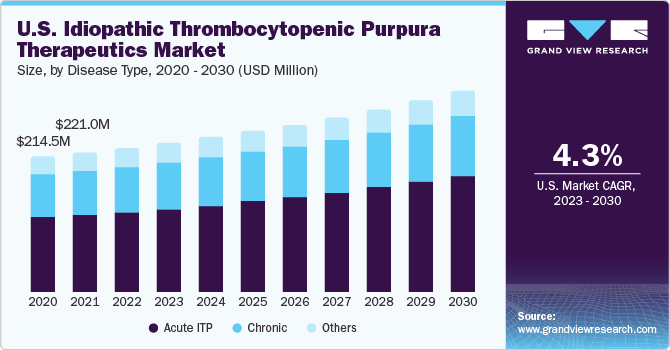

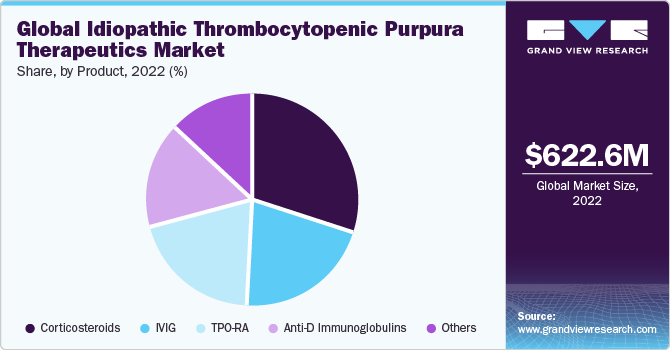

The global idiopathic thrombocytopenic purpura therapeutics market size was valued at USD 622.6 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.0% from 2023 to 2030. The prevalence of idiopathic thrombocytopenic purpura (ITP) has been rising, leading to a growing patient population. This has increased the demand for effective treatments, driving the growth of the ITP therapeutics market. According to WebMD LLC, in 2022, ITP affected adults at roughly 66 cases per 1,000,000 per year. Children's incidence is estimated to be 50 cases per 1,000,000 per year on average, and about 10 new instances of chronic refractory ITP are reported each year per million people. The advancements in the understanding and management of ITP introduction of new treatment options, such as thrombopoietin receptor agonists (TPO-RAs) and immunosuppressants, have been developed, providing more choices for physicians and patients. Thereby driving market growth.

Future expansion of the ITP therapeutics market is anticipated to be fueled by rising demand for combination therapies. Clinical research indicates that combination medicines have higher patient response rates, cost-effectiveness, and fewer side effects. Corticosteroids and IVIG, rituximab, and dexamethasone, TPO-RA (eltrombopag), and dexamethasone are some common combinations of treatments. Splenectomy is also essential in influencing the evolution of the ITP treatments market. In order to lower the level of anti-platelet antibodies, the spleen is removed during the treatment. TPO-RA and anti-D are the two therapeutic subclasses most impacted by splenectomy.

Pharmaceutical companies and research institutions continue to invest in developing innovative therapies for ITP. Ongoing research studies and clinical trials aim to identify novel treatment approaches, which may further drive market growth in the future. For instance, in July 2020, Rigel Pharmaceuticals, Inc. and its joint venture partner Grifols S.A. announced the introduction of TAVLESSE in Europe. The product was introduced in the UK and Germany. The European Commission authorized it in January 2020 to treat adult patients with persistent immune thrombocytopenia resistant to conventional therapies. Market participants are implementing strategies for medication development and an affordable treatment strategy. These benefits are anticipated to greatly boost the ITP therapeutics market over the forecast year. In addition, in October 2021, HUTCHMED started the trial of ESLIM-01, a Phase III Trial of HMPL-523 in China, on patients with immune thrombocytopenia.

Increased healthcare expenditure, particularly in developing countries, has contributed to the growth of the ITP therapeutics market. Improved access to healthcare facilities and a greater focus on rare diseases have increased diagnosis and treatment rates, driving market growth.

The COVID-19 pandemic had a negative impact on the market due to the disruptions in healthcare services globally. Many hospitals and clinics have had to reallocate resources to manage COVID-19 patients, reducing access to routine healthcare services for non-emergency conditions like ITP. This may have affected the diagnosis and treatment rates of ITP patients. Due to lockdowns, social distancing measures, and fear of infection, individuals may have delayed seeking medical attention for their symptoms, including ITP. Delayed diagnosis and treatment could impact the demand for ITP therapeutics during the pandemic. The COVID-19 pandemic has shifted the focus of many pharmaceutical companies and research institutions toward developing treatments and vaccines for COVID-19. This may have impacted the allocation of resources and attention that would otherwise be directed toward developing new ITP therapeutics. In 2022, the market recovered, and market players started the implementation of healthcare strategies to address delayed diagnoses and treatment.

Product Insights

Based on product, the corticosteroids segment dominated the idiopathic thrombocytopenic purpura therapeutics market in terms of revenue and captured the highest revenue share of 30.5% in 2022. Because they are usually employed as the first line of treatment for patients with ITP, corticosteroids have a high utilization rate. Additionally, these medicines' lower pricing and patients' generally positive responses have helped this market sector grow in utilization rates, particularly in developing and emerging markets.

The TPO-RA segment is expected to grow at a faster CAGR of 6.6% over the forecast period. The TPO-RA segment is the most promising. One of the main drivers of this market is the higher response rates seen in patients treated with Romiplostim and Eltrombopag. In individuals experiencing post-splenectomy relapses, TPO-RA is regarded as a feasible therapy option and is typically used when splenectomy fails.

Disease Type Insights

Based on disease type, the market is segmented into acute ITP, chronic, and others. Acute ITP is a self-limiting form of the condition typically seen in children. It is characterized by a sudden onset of low platelet counts and resolves within six months in the majority of cases. The management of acute ITP often focuses on supportive care and close monitoring. Given its self-resolving nature, the market for acute ITP therapeutics may be relatively smaller compared to chronic ITP.

Chronic ITP refers to a persistent or recurrent condition that lasts more than six months. It can affect both children and adults. The management of chronic ITP aims to increase platelet counts and prevent bleeding episodes. Therapeutic options for chronic ITP include corticosteroids, thrombopoietin receptor agonists (TPO-RAs), immunosuppressants, and splenectomy (surgical spleen removal). The chronic ITP therapeutics market is likely to have a larger share than acute ITP due to the longer duration of treatment and a higher prevalence of chronic cases.

Regional Insights

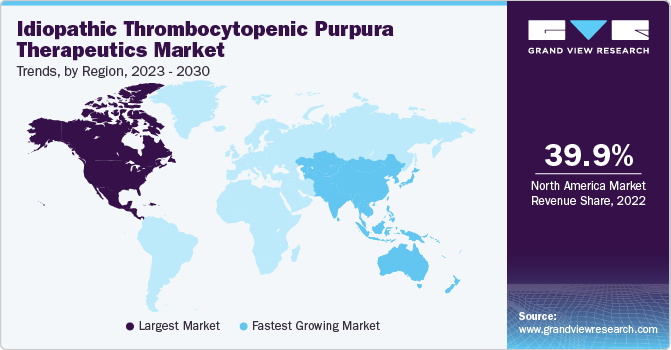

North America dominated the market and accounted for the largest revenue share of 39.9% in 2022. The ITP therapeutics market's growth in North America was influenced by factors such as advancements in treatment options, increasing awareness and diagnosis of ITP, and the prevalence of the condition.

Asia Pacific is expected to grow at the fastest CAGR of 6.2% over the forecast period. This is attributed to several causes, including rising ITP therapeutic market penetration rates in emerging markets like South Korea, China, Taiwan, and India and the abundance of undiscovered business prospects in these nations. It is also anticipated that the availability of supportive government initiatives in Australia and Japan will fuel regional market expansion.

Key Companies & Market Share Insights

Key players in the market are now concentrating on implementing strategies such as product innovations, adopting new technology, joint venture, mergers & acquisitions, partnerships, and alliances to improve their market position. For instance, in December 2022, Amgen Inc. acquired Horizon Therapeutics plc. The acquisition is expected to strengthen Amgen Inc.’s unique therapeutics portfolio. The agreement also makes it easier to use Amgen Inc.’s two decades of experience in nephrology and inflammation, as well as its global reach. In addition, the key players also take advantage of the incentives made available under pertinent government regulations and make rigorous R&D investments aimed at new product development.

Key Idiopathic Thrombocytopenic Purpura Therapeutics Companies:

- Amgen Inc.

- F. Hoffmann-La Roche Ltd

- Grifols, S.A.

- GSK plc.

- Shangxian Minimal Invassive Inc.

- INTROMEDIC

- Medtronic

- FUJIFILM Holdings Corporation

- Olympus Corporation

- JINSHAN Science & Technology (Group) Co., Ltd.

Idiopathic Thrombocytopenic Purpura Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 649.1 million

Revenue forecast in 2030

USD 914.9 million

Growth Rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Disease type, product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan,; India; Australia; South Korea; Thailand; Brazil; Mexico, Argentina,; Saudi Arabia; South Africa; UAE,; Kuwait

Key companies profiled

Amgen Inc.; F. Hoffmann-La Roche Ltd; Grifols, S.A.;

GSK plc.; Shangxian Minimal Invassive Inc.; INTROMEDIC; Medtronic; FUJIFILM Holdings Corporation; Olympus Corporation; JINSHAN Science & Technology (Group) Co., Ltd

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Idiopathic Thrombocytopenic Purpura Therapeutics Market Report Segmentation

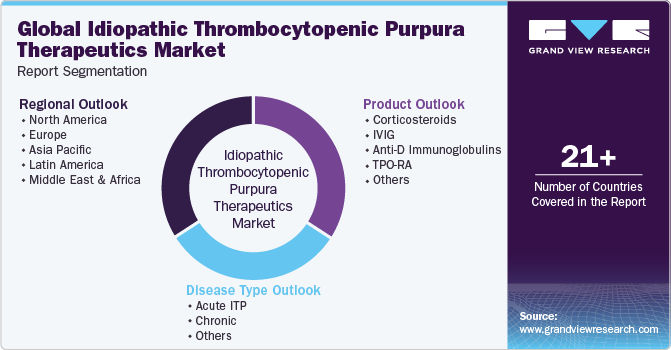

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global idiopathic thrombocytopenic purpura therapeutics market based on disease type, product, and region:

-

Disease Type Outlook (Revenue in USD Million, 2018 - 2030)

-

Acute ITP

-

Chronic

-

Others

-

-

Product Outlook (Revenue in USD Million, 2018 - 2030)

-

Corticosteroids

-

IVIG

-

Anti-D Immunoglobulins

-

TPO-RA

-

Others

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global idiopathic thrombocytopenic purpura therapeutics market size was estimated at USD 4.07 billion in 2022 and is expected to reach USD 4.39 billion in 2023.

b. The global idiopathic thrombocytopenic purpura therapeutics market is expected to grow at a compound annual growth rate of 7.2% from 2023 to 2030 to reach USD 7.16 billion by 2030.

b. Europe dominated the idiopathic thrombocytopenic purpura therapeutics market with a share of 34.26% in 2022. This is attributable to rising healthcare awareness coupled, increasing prevalence, and constant research and development initiatives.

b. Some key players operating in the idiopathic thrombocytopenic purpura therapeutics market include Hoffman-L Roche, Amgen Inc, Grifols Biologicals Inc., and GlaxoSmithKline Plc.

b. Key factors that are driving the market growth include potential commercialization of new products such as avatrombopag by Eisai and IVIG3I 10% by Grifols, increasing prevalence, and presence of favorable government initiatives and regulations such as the Orphan drug act, U.S., the Orphan Drug Policy Therapeutic Goods Act and Regulations, Australia and the Orphan Drug Regulation, Japan.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."