- Home

- »

- Advanced Interior Materials

- »

-

Ilmenite Market Size, Share & Trends Analysis Report, 2030GVR Report cover

![Ilmenite Market Size, Share & Trends Report]()

Ilmenite Market (2023 - 2030) Size, Share & Trends Analysis Report By Application (Titanium Dioxide, Titanium Metal), By End-use (Paint & Coating, Plastic, Cosmetics, Paper & Pulp) By Region, And Segment Forecasts

- Report ID: GVR-4-68040-142-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ilmenite Market Size & Trends

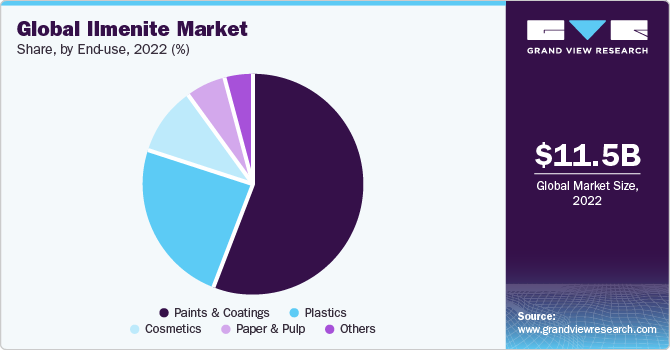

The global ilmenite market size was estimated at USD 11.48 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 3.9% from 2023 to 2030. The growing use of titanium dioxide products in several industries such as paints & coatings, paper & pulp, plastics, and cosmetics has created a strong demand for ilmenite. The product demand is increasing in titanium metal applications on account of the rapid expansion of the aerospace and defense sectors. The growth of the travel & tourism industry has also led to an expansion of the civil aviation segment, propelling the demand for titanium metal. The rise in defense expenditure for modernized equipment, systems, and aircraft on account of growing territorial disputes has further contributed to market growth.

The U.S. is among the largest consumers of ilmenite in North America and holds a significant position in the global industry share. The product penetration in the country is expected to increase owing to its rising consumption of paints & coatings and the manufacturing of aircraft. According to the U.S. Census Bureau, the total construction spending in the country was estimated at USD 1,972.61 billion in July 2023 compared to USD 1,869.26 billion in July 2022. Consequently, the growth in construction activities is anticipated to fuel the consumption of paints & coatings and benefit ilmenite’s demand.

The rising consumption of titanium dioxide in paints & coatings worldwide drives the market. The global construction business is experiencing significant growth owing to several key factors. The increasing urbanization and industrialization in the emerging economies of the Asia Pacific region, such as China and India, the growing housing sector, and investments in the infrastructure sector are fueling the growth of the construction industry and thereby expected to boost the demand for paints & coatings over the forecast period.

Ilmenite mining is rising at a significant rate and can harm the ecosystem, similar to that of any other mining activity, as it results in the generation of tailings and removal of topsoil. Improper management of mining activities can result in an adverse socio-economic impact on human & animal health and the environment. As a result, mining activities need to be done while adhering to the regulations, which leads to slow quarry establishments and processing plants.

Application Insights

Based on application, the titanium dioxide segment accounted for the largest revenue share of over 90.0% in 2022, and the trend is anticipated to continue over the forecast period. Ilmenite is used in titanium dioxide pigment for the formulations of paints & coatings to provide soluble white pigment particulate. Governments worldwide are taking initiatives to provide the population with better infrastructure and new houses, which in turn are anticipated to boost the consumption of paints & coatings, and further benefit the market growth.

Ilmenite is used for manufacturing titanium metal and has an extensive application in several industries due to its unique properties, such as corrosion resistance, lightweight, durability, and optimum weight-to-strength ratio. It is majorly used in aircraft to improve endurance and strength while maintaining the aircraft's weight to a minimum. Boeing, a leading aircraft manufacturer, has predicted that airline operators worldwide will need approximately 41,170 new airplanes in the next 20 years, considering the substantial rise in global air passengers and cargo. This is anticipated to result in a surged demand for titanium metal for use in airplanes.

In July 2023, ATI, Inc., a U.S.-based manufacturing company, announced the expansion of its titanium melting operations at Richland, Washington, to increase the production capacity owing to rising demand for titanium metal in the aerospace & defense industry. Owing to the surge in demand, the company is in the process of increasing its titanium melting capacity by 35% over 2022 levels and plans to start operations by the end of 2024.

End-use Insights

In terms of end-use, the cosmetics segment held the largest revenue share of approximately 11.0% in 2022 and is expected to continue to expand over the forecast period. The segment growth can be attributed to ilmenite's primary properties such as brightness, UV protection, higher color intensity, and absorption of oil from the skin.

Ilmenite is suitable for manufacturing personal care products such as sunscreens, powders, and whitening agents, among others. The rising expenditure by the middle class, increasing disposable income, and changing lifestyles are fueling the growth of the global cosmetics industry. In addition, the increasing popularity of skin care products owing to the awareness of skin maintenance propels the growth of cosmetic products and, thus, the growth of the ilmenite industry.

Paints & coatings is the largest end-use segment and it is anticipated to continue its dominance over the forecast period. The rising urbanization across the globe has increased the demand for paints & coatings for industrial, commercial, and residential buildings. Ilmenite is majorly consumed in paints & coating owing to its scattering efficiency, intense whiteness, performance ratio, and enhanced durability.

Regional Insights

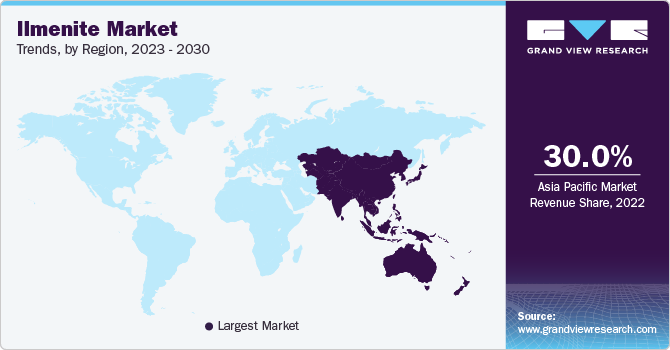

Asia Pacific dominated the market and accounted for over 30.0% share of the global revenue in 2022. The high consumption of ilmenite in the region is attributed to the rising production of titanium dioxide owing to the rise in demand for paints & coatings. The expansion of commercial, residential, and industrial sectors in Asia Pacific due to its sustainable economic growth is expected to boost the paints & coating industry. This, in turn, is anticipated to drive the demand for ilmenite in Asia Pacific in the coming years.

The rapidly growing demand for paints & coatings in different regional economies due to initiatives undertaken by governments to boost infrastructural projects is anticipated to drive the demand for ilmenite during the forecast period. As per the World Bank, by 2040, the global population is expected to increase by around 2 billion, a 25% growth. This will be accompanied by a constant shift from rural to urban areas, resulting in an increase of 46% in the urban population. Thus, there will be a significant need for infrastructure development to support the growing urban centers.

The Middle East & Africa region is expected to register a CAGR of 4.3% over the forecast period. The region is witnessing surged investments in tourism and hotel development projects, resorts, artificial islands, and luxury residential projects to support the growth of its construction industry. In April 2022, Oman Tourism Development Company and Diamond Developers agreed to invest approximately USD 1 billion to form a joint venture called Sustainable Development & Investment Company (SAOC). The increase in tourist resorts is expected to surge the investment in construction activities in Oman, which is expected to boost the consumption of plastics, paints & coatings and thus lead to the growth of the ilmenite industry.

Key Companies & Market Share Insights

To keep pace with their competitors, major ilmenite manufacturers are implementing expansion strategies, partnerships, mergers & acquisitions, and R&D activities. According to the press release by Largo Inc. in August 2023, the company anticipated the commissioning of the ilmenite concentration plant by Q3, 2023. It further plans to steadily improve the production of ilmenite concentrates, a by-product of its vanadium operations located in Brazil, from the last quarter of 2023.

Key Ilmenite Companies:

- Abbott Blackstone

- China Vanadium Titano-Magnetite Mining

- Illuka Resources Limited

- Jiangxi Jingshibao Mining Manufacturing Co., Ltd

- Kenmare Resources

- PT Monokem Surya

- Rio Tinto

- V.V Mineral

- Yucheng Jinhe Industrial Co., Ltd.

Ilmenite Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 11.36 billion

Revenue forecast in 2030

USD 15.61 billion

Growth rate

CAGR of 3.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2022

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South Africa; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Ukraine; Russia; China; India; Japan; Australia; Brazil; Saudi Arabia; South Africa

Key companies profiled

Abbott Blackstone; China Vanadium Titano-Magnetite Mining; Illuka Resources Limited; Jiangxi Jingshibao Mining Manufacturing Co., Ltd; Kenmare Resources; PT Monokem Surya; Rio Tinto; V.V Mineral; Yucheng Jinhe Industrial Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ilmenite Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ilmenite market report based on application, end-use, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Titanium Dioxide

-

Titanium Metal

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Plastics

-

Cosmetics

-

Paper & Pulp

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Ukraine

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ilmenite market size was estimated at USD 11.48 billion in 2022 and is expected to reach USD 11.36 billion in 2023.

b. The global ilmenite market is expected to grow at a compound annual growth rate of 3.9% from 2023 to 2030 to reach USD 15.61 billion by 2030.

b. The titanium dioxide segment dominated the market with a revenue share of over 90.0% in 2022.

b. Some of the key vendors of the global Ilmenite market are Abbott Blackstone, China Vanadium Titano-Magnetite Mining, Illuka Resources Limited, Jiangxi Jingshibao Mining Manufacturing Co., Ltd, Kenmare Resources, PT Monokem Surya among others.

b. The key factor that is driving the growth of the global ilmenite market is the rising use of titanium dioxide owing to the surge in demand for paints & coatings worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.