- Home

- »

- Clinical Diagnostics

- »

-

Immunoassay for Neurological Biomarkers Market Report 2030GVR Report cover

![Immunoassay for Neurological Biomarkers Market Size, Share & Trends Report]()

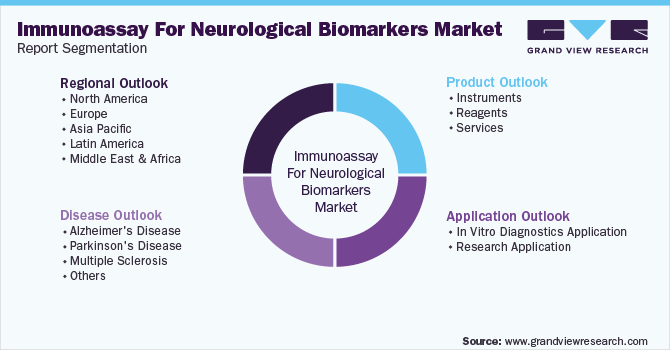

Immunoassay for Neurological Biomarkers Market Size, Share & Trends Analysis Report By Product, By Disease (Alzheimer's Disease, Parkinson's Disease, Multiple Sclerosis), By Application, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-039-6

- Number of Report Pages: 134

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global immunoassay for neurological biomarkers market size was valued at USD 601.52 million in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 17.8% % from 2023 to 2030. Immunoassays are protein-based tests that work by quantification and detection of antigen–antibodies interactions. These assays play a crucial role in diagnosis and treatment planning for a variety of neurological diseases. In recent years, there has been a significant rise in investments in the R&D of treatments for neurological diseases, which is expected to accelerate the market growth during the forecast period.

Furthermore, rising prevalence of neurological diseases such as Parkinson's disease, Alzheimer's Disease (AD), dementia, brain tumors, epilepsy, and others present significant unmet needs. AD is a global epidemic. According to Alzheimer's Association, approximately 55.0 million individuals globally have dementia, which is anticipated to rise to 98.0 million by 2030 and around 139.0 million by 2050. Furthermore, approximately 6.5 million individuals in the U.S., will be living with AD in 2022. Therefore, the demand for biomarkers is increasing for drug development, diagnosis, disease progression and research in neurological diseases.

The development of therapeutics used for neurological diseases has been challenging, mostly due to the blood-brain barrier. The key players are focusing on new therapies to prevent, defer, slow, or improve the symptoms of neurological diseases. Companies such as Biogen, AbbVie, AC Immune, Novartis AG, TauRx, Eli Lilly & Co., and others are highly active in developing novel therapies for the treatment of AD. Many market players have their candidate drugs in phase lll, which may be launched during the forecast period. Thus, increasing focus on the development of therapeutics for neurological diseases is expected to boost the demand of immunoassays for neurological biomarkers.

Moreover, key players engaged in the development of neurological biomarkers and partnerships between international companies are expected to fuel the market growth. Government initiatives such as investments in R&D of high-quality, cost-effective & standardized products for diagnosis and treatment of neurodegenerative disease research is also expected to drive market growth. For instance, in November 2021, the Department of Health and Social Care announced an investment of USD 456.62 million in neurodegenerative research in the UK. Moreover, the use of clinical data informatics platforms by productive research organizations is anticipated to propel market growth in the coming years.

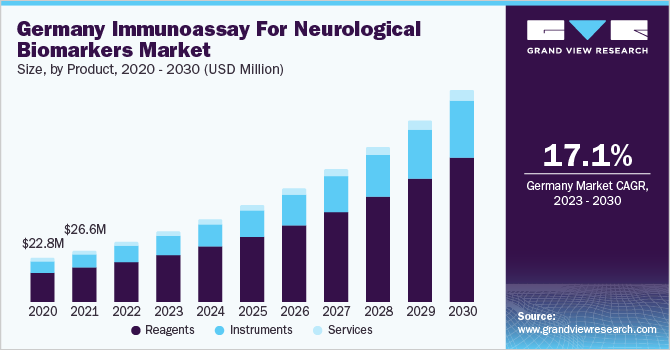

Product Insights

The reagents segment held the largest share of 66.78% in 2022 in the immunoassays for neurological biomarkers. The market is witnessing a shift from traditional reagents to ultrasensitive reagents, which is driving the segment. For instance, the use of single-molecule counting assay kits for detecting neurological conditions such as multiple sclerosis and Alzheimer’s disease is significantly increasing. Furthermore, the approval and launch of novel immunoassay reagents are expected to fuel segment growth.

For instance, in December 2022, Sysmex Corporation obtained marketing approval of HISCL β-Amyloid Assay Kits in the Japanese market. This product detects and quantifies blood samples for amyloid beta, which is used for diagnosing AD.

The instruments segment is anticipated at a CAGR of 17.6% during the forecast period. Increasing approval and the launch of immunoassay instruments are expected to fuel the segment's growth. For instance, in December 2022, the FDA approved Roche’s AD assay employing cobas immunoassay analyzer. Similarly, in July 2022, FDA designated Elecsys Amyloid Plasma Panel as a breakthrough device that allows the measurement of Alzheimer’s disease biomarkers from a blood sample.

Disease Insights

The Alzheimer’s disease segment held the largest share of 38.04% in 2022. A rise in the prevalence of AD is expected to drive the market. The percentage of people with Alzheimer's dementia increases with age. Thus, this disease mostly occurs in people aged 65 and above. According to Alzheimer’s Association, globally, approximately 6.5 million individuals are living with Alzheimer’s disease in the U.S. as of 2022. Owing to the increasing prevalence of AD, government and nonprofit organizations are providing a plethora of research opportunities, which may fuel market growth.

In September 2020, National Institutes of Health (NIH) granted research funding of USD 45.5 million to the University Of North Texas Health Science Center for developing additional biomarkers for understanding the pathology of brain aging in Mexican Americans and non-Latino Whites population.

The Alzheimer’s disease segment is expected to expand at the highest CAGR of 18.4% during the forecast period. Key players are strategically undertaking initiatives to increase their share with the development of advanced biomarker technology for diagnostics and treatment research. For instance, in March 2022, Quanterix signed a licensing agreement with Eli Lilly and Company to use pTau 217 for near-term clinical research and in long term for IVD applications.

The FDA granted breakthrough device designation to Quanterix’s Simoa pTau-181 assay for the diagnosis of Alzheimer’s disease. Thus, such developments are expected to govern the future of Simoa assay development across diseases like Alzheimer’s disease and drive the immunoassay for neurological biomarkers market.

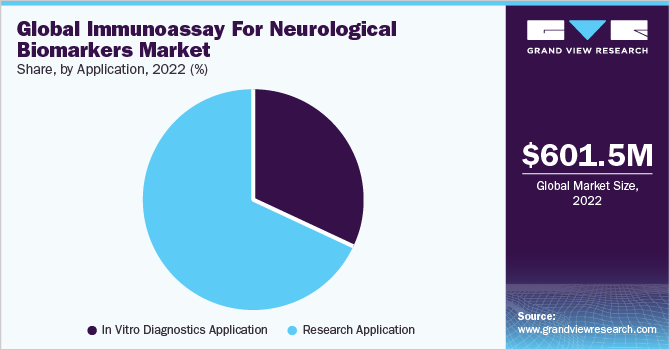

Application Insights

The research application segment captured the highest revenue share of 68.17% in 2022. Immunoassay plays a crucial role in neurological R&D; it is being used to determine pharmacokinetics of biologics and measure biomarkers & the levels of host cell proteins. Moreover, researchers are involved in identifying key biomarkers in serum and plasma to develop assays that are highly sensitive for determining the low levels of biomarkers.

Merck’s Single Molecule Counting, an immunoassay kit, is one such example, which is highly sensitive in measuring neurological proteins in samples. All these factors are increasing the number of research organizations working on biomarker research & validation; pharmaceutical companies that are using biomarkers for drug discovery & development; and ambulatory surgery centers, thereby driving market growth.

Furthermore, in vitro diagnostics application segment is anticipated to expand at rapid pace with a CAGR of 23.9% during the forecast period. The rising number of disease-modifying therapies for neurological disorders is boosting the demand for biomarker testing in the market. For instance, in June 2021, FDA granted accelerated approval to Aduhelm indicated for Alzheimer’s disease. Furthermore, the government is undertaking various initiatives to provide better facilities, such as reimbursement for neurological diagnostic tests, which is likely to drive the market. Many healthcare institutions are working with laboratories to integrate different tests.

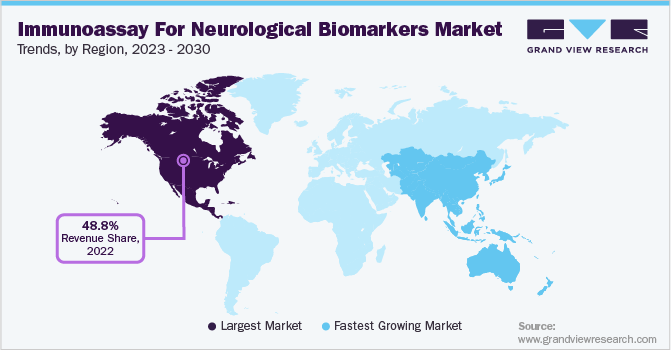

Regional Insights

North America held the largest share of 48.81% in the immunoassay for neurological biomarkers market in 2022. Owing to the increased healthcare expenditure, rise in customer awareness about the use of biomarkers in diagnosing neurological disorders, availability of technologically advanced products, proactive government initiatives, and improved healthcare infrastructure. Moreover, key players are focusing on new product launches of novel immunoassays for the identification of neurological biomarkers.

For instance, in December 2022, the U.S. FDA approved two immunoassays, Elecsys Phospho-Tau (181P) CSF (pTau181) and Elecsys beta-Amyloid (1-42) CSF II (Abeta42), developed by F. Hoffmann-La Roche Ltd. in the U.S. These two assays measure two important biomarkers-tau proteins and beta-amyloid-in adult patients to confirm the diagnosis of Alzheimer’s disease.

Asia Pacific is estimated to expand at the fastest CAGR of 18.6% from 2023-2030. This high growth can be attributed to the rising prevalence of neurological diseases and increasing number of clinical trials. The need for early diagnosis of neurological diseases to reduce treatment costs & mortality and abundance of raw materials for manufacturing immunoassay products can increase manufacturer interest. These factors are expected to fuel the market demand in Asia Pacific. In addition, increasing healthcare investments in countries, such as China and India, is also positively influencing market growth.

Key Companies & Market Share Insights

The immunoassay for neurological biomarkers market is growing at a rapid pace due to the several strategic initiatives implemented by the operating players involved. For instance, in September 2022, QIAGEN partnered with Neuron23 to develop an assay that can detect biomarkers discovered by Neuron23 and predict the responsiveness of Parkinson’s disease to the LRRK2 inhibitor. Thus, the development of novel assays used for the identification of neurological biomarkers is anticipated to drive market growth. Some of the prominent players in the global immunoassay for neurological biomarkers market include:

-

QIAGEN

-

Abbott

-

Merck & Co., Inc.

-

Johnson & Johnson Services, Inc.

-

Thermo Fisher Scientific, Inc.

-

Bio-Rad Laboratories, Inc.

-

Sysmex Corporation

-

Merck KGaA

-

F. Hoffmann La-Roche Ltd.

-

Nimble Therapeutics

Immunoassay for Neurological Biomarkers Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 712.04 million

Revenue forecast in 2030

USD 2.24 billion

Growth rate

CAGR of 17.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, disease, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

QIAGEN; Abbott; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Sysmex Corporation; Merck KGaA; F. Hoffmann La-Roche Ltd.; Nimble Therapeutics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunoassay for Neurological Biomarkers Market Segmentation

This report forecasts revenue growth at global, regional, and country levels in addition to provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global immunoassay for neurological biomarkers market report based on the product, disease, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Reagents

-

Services

-

-

Disease Outlook (Revenue, USD Million, 2018 - 2030)

-

Alzheimer's Disease

-

Parkinson's Disease

-

Multiple Sclerosis

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

In Vitro Diagnostics Application

-

Research Application

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global immunoassays for neurological biomarkers market size was estimated at USD 601.52 million in 2022 and is expected to reach USD 712.04 million in 2023.

b. The global immunoassays for neurological biomarkers market is expected to grow at a compound annual growth rate of 17.8% from 2023 to 2030 to reach USD 2.24 billion by 2030.

b. Based on application, Alzheimer’s disease accounted for the largest share owing to the large number of approved products and multiple clinical trials conducted using biomarkers.

b. Some key players in space include QIAGEN; Abbott; Merck & Co., Inc.; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific, Inc.; Bio-Rad Laboratories, Inc.; Sysmex Corporation; Merck KGaA; and F. Hoffmann La-Roche Ltd amongst others.

b. Key factors that are driving the immunoassays for neurological biomarkers market growth include rising disease prevalence, increasing need for biomarker-based diagnostics, and rising number of product approvals.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."