- Home

- »

- Pharmaceuticals

- »

-

Immunotherapy Drugs Market Size, Industry Report, 2033GVR Report cover

![Immunotherapy Drugs Market Size, Share & Trends Report]()

Immunotherapy Drugs Market (2026 - 2033) Size, Share & Trends Analysis Report By Drug Type (Monoclonal Antibodies, Immunomodulators, Vaccine), By Indication (Cancer, Infectious Diseases, Autoimmune Diseases), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-961-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Immunotherapy Drugs Market Summary

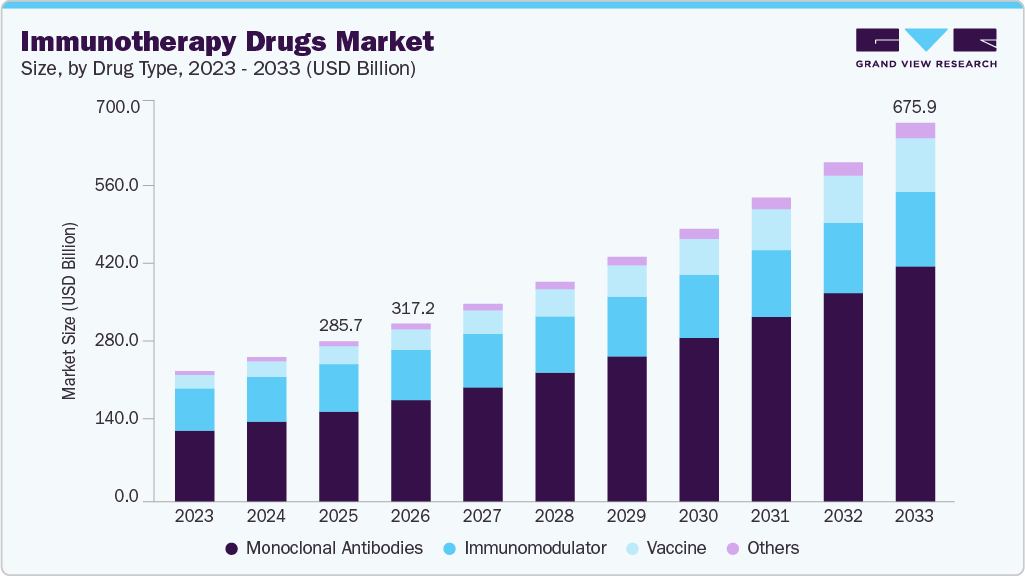

The global immunotherapy drugs market size was estimated at USD 285.73 billion in 2025 and is expected to reach USD 675.98 billion by 2033, growing at a CAGR of 11.41% from 2026 to 2033. This market is primarily driven by the rising incidence of chronic diseases globally.

Key Market Trends & Insights

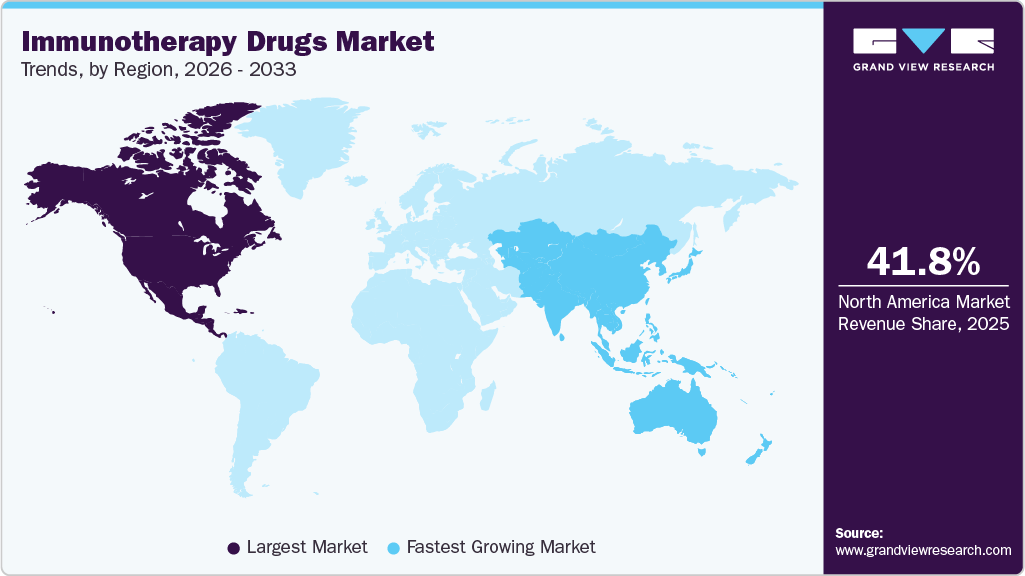

- The North America immunotherapy drugs market dominated the global market, with a revenue share of 41.80% in 2025.

- The immunotherapy drugs industry in the U.S. is expected to grow significantly over the forecast period.

- By drug type, the monoclonal antibodies segment accounted for the largest share of 56.16% in 2025.

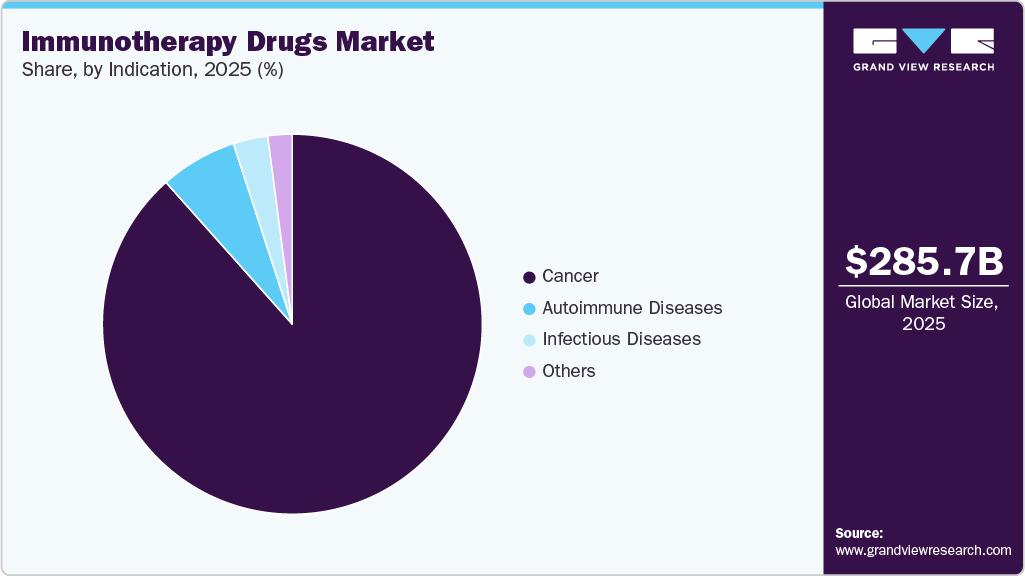

- By indication, the cancer segment dominated the market, accounting for 88.42% of the revenue in 2025.

Market Size & Forecast

- 2025 Market Size: USD 285.73 Billion

- 2033 Projected Market Size: USD 675.98 Billion

- CAGR (2026-2033): 11.41%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

This market was driven by the rising global burden of cancer and chronic diseases, including autoimmune and inflammatory disorders, alongside the growing limitations of conventional treatments such as chemotherapy and radiation therapy. These constraints had accelerated the shift toward immunotherapy because of its targeted mechanism of action and improved patient outcomes. For instance, February 2025, the World Health Organization reported that cancer was responsible for nearly 10 million deaths in 2020, accounting for almost one in six deaths globally. Breast cancer recorded 2.26 million cases, lung cancer 2.21 million, and colorectal cancer 1.93 million, while lung cancer caused 1.80 million deaths. The organization also estimated around 400,000 childhood cancer cases annually and noted that 30 percent of cancers in low and lower middle income countries were infection related, reinforcing demand for advanced immunotherapies.

Technological advancements and robust research activity play a critical role in driving the immunotherapy drugs market forward. Significant progress in immuno-oncology, particularly in immune checkpoint inhibitors, monoclonal antibodies, and cell-based therapies such as CAR-T, has transformed cancer treatment paradigms. These therapies have demonstrated strong efficacy across multiple solid tumors and hematological malignancies, leading to expanding clinical indications. Pharmaceutical and biotechnology companies are investing heavily in research and development to improve therapeutic effectiveness, reduce adverse effects, and develop next-generation immunotherapies. Strategic collaborations, mergers, and acquisitions are also accelerating innovation and pipeline expansion. Moreover, favorable regulatory frameworks, fast-track approvals, and orphan drug designations in major markets are enabling faster commercialization of novel immunotherapy drugs, thereby contributing significantly to market growth.

Beyond oncology, the immunotherapy drugs market was supported by expanding applications and improving healthcare infrastructure worldwide, which broadened overall market potential. Immunotherapies were increasingly explored for autoimmune diseases, infectious diseases, and rare genetic disorders, enabling wider clinical adoption. In developed regions, strong reimbursement systems, higher healthcare spending, and access to advanced diagnostic facilities facilitated routine use of immunotherapy drugs. At the same time, emerging economies experienced steady growth due to improvements in healthcare systems, rising medical tourism, and government initiatives aimed at strengthening cancer care delivery. Growing awareness among patients and healthcare providers, coupled with gradual improvements in the affordability of biologic therapies, further supported uptake. Together, these interconnected factors sustained long term growth prospects and continued innovation in the global immunotherapy drugs market.

Market Concentration & Characteristics

The immunotherapy drugs market demonstrates a high degree of innovation driven by continuous scientific advancements and complex biologic development. Companies focus on novel immune targets, combination therapies, and next-generation platforms such as cell and gene-based treatments. Rapid progress in biomarker identification supports more precise patient selection and improved treatment outcomes. Ongoing clinical trials across multiple disease indications sustain a strong innovation pipeline. High investment intensity in research and development differentiates market leaders from smaller participants. This innovation-driven environment results in frequent product advancements and lifecycle expansions.

Barriers to entry in the immunotherapy drugs market remain high due to complex development processes and significant capital requirements. Biologic drug manufacturing demands advanced infrastructure, specialized expertise, and stringent quality control. Lengthy clinical development timelines increase financial risk for new entrants. Strong intellectual property portfolios held by established players limit competitive entry. High regulatory compliance requirements add operational complexity. These factors collectively restrict market participation to well-funded and experienced companies.

Regulatory frameworks strongly influence the immunotherapy drugs market by shaping development timelines and commercialization strategies. Stringent safety and efficacy standards require extensive clinical validation for biologic therapies. Approval pathways for immunotherapies often involve complex review processes due to novel mechanisms of action. Regulatory scrutiny increases development costs and extends time to market. Post-approval monitoring requirements influence product lifecycle management. These regulatory dynamics significantly affect market structure and competitive positioning.

Product substitution in the immunotherapy drugs market remains limited due to the unique mechanisms of immune-based treatments. Conventional therapies such as chemotherapy and radiation offer alternative options but differ significantly in clinical outcomes. Targeted therapies may serve as partial substitutes in select indications. Treatment selection often depends on disease stage, biomarker status, and patient response. High clinical differentiation reduces direct substitution risk for immunotherapies. This characteristic supports sustained demand for immune-based treatments.

Geographical expansion plays a key role in shaping competition within the immunotherapy drugs market. Companies are increasingly extending their presence into emerging regions to access new patient populations. Expansion strategies focus on establishing distribution networks and partnerships with regional healthcare providers. Growing diagnosis rates in developing markets support long-term demand growth. Localization of manufacturing and clinical research improves regional accessibility. These expansion efforts contribute to gradual market concentration across global regions.

Drug Type Insights

The monoclonal antibodies segment accounted for the largest share of 56.16% in 2025. This growth is driven by their clinical efficacy, high target specificity, and broad applicability across cancer and autoimmune indications. Widespread adoption of immune checkpoint inhibitors such as PD‑1, PD‑L1, and CTLA‑4 therapies boosted oncology treatment uptake. For instance, in September 2024, Elsevier reported a real‑world study on pembrolizumab in advanced non‑small cell lung cancer with PD‑L1 ≥50 percent, including 804 patients (404 women, median age 72 years, 310 aged ≥75 years). Median overall survival was 19.2 months, 5‑year survival 25.1 percent, 549 (68 percent) had died, and 266 (33 percent) received subsequent therapy, confirming long‑term efficacy. Strong pipelines, label expansions, favorable reimbursements, and investments in antibody engineering further supported market growth.

The vaccines segment is projected to grow at the fastest CAGR over the forecast period, due to. This growth can be attributed to the increasing focus on therapeutic and preventive vaccines that enhance immune response against cancer and infectious diseases. This growth can be attributed to rising research activity in cancer vaccines, growing demand for long-term disease management solutions, and expanding clinical pipelines targeting personalized immunization strategies. Advancements in antigen identification and delivery platforms are improving vaccine efficacy and safety profiles. Increasing adoption of immunotherapy vaccines in combination with other immune-based treatments is supporting broader clinical acceptance. Higher awareness of preventive healthcare and immune-based disease prevention further strengthens segment expansion. Together, these factors are expected to drive steady growth of the vaccines segment within the immunotherapy drugs market.

Indication Insights

The cancer segment dominated the market, accounting for 88.42% of the revenue in 2025, driven by high cancer prevalence and widespread adoption of immune-based therapies. Immunotherapy has gained clinical acceptance by delivering durable responses, improved survival, and targeted treatment across diverse tumor types. Increasing use of immune checkpoint inhibitors, monoclonal antibodies, and cell-based therapies has expanded options for solid tumors and hematological malignancies. For instance, October to December 2024, Cancer Research Catalyst reported that the FDA issued 15 oncology approvals, including nine new therapies, bringing total annual approvals to over 60, with 11 first‑in‑class. Key approvals included Revumenib for acute leukemia, zolbetuximab for gastric cancer, inavolisib for HR-positive breast cancer, CAR T-cell therapy Aucatzyl, cosibelimab, and zanidatamab. Expansion of indications and combination therapies further strengthened growth.

On the other hand, the infectious diseases segment is anticipated to register the CAGR of 9.74% over the forecast period. This growth can be attributed to the increasing need for immune-based therapies that enhance host defense mechanisms against complex and emerging infections. Rising interest in therapeutic vaccines and immunomodulatory treatments is supporting broader clinical application within this segment. Advancements in immune response targeting and antigen-specific therapies are improving treatment effectiveness and safety. Expanding research activity focused on chronic and treatment-resistant infections is driving pipeline development. Growing integration of immunotherapy with conventional antimicrobial treatments is further supporting segment expansion within the global immunotherapy drugs market.

Regional Insights

The North America immunotherapy drugs market dominated the global market, with a revenue share of 41.80% in 2025. This strong position is attributable to the high incidence of cancer and autoimmune diseases, which drives the need for effective treatments. The region benefits from advanced healthcare infrastructure and significant investments in research and development, leading to innovative therapies that enhance immune responses. In addition, favorable healthcare policies and increased spending on health services support the adoption of immunotherapy drugs. As a result, this market is expected to grow rapidly, reflecting the ongoing demand for safer and more effective cancer treatments.

U.S. Immunotherapy Drugs Market Trends

The U.S. immunotherapy drugs market is expected to witness a significant CAGR during the forecast period. High healthcare spending enables broad patient access to premium immunotherapy treatments. Strong oncology research infrastructure supports rapid innovation and clinical validation. Widespread use of precision medicine enhances treatment outcomes and adoption rates. A large pool of eligible patients sustains continuous demand for immune checkpoint inhibitors and cell-based therapies. The country remains a key hub for new immunotherapy drug launches and lifecycle expansions.

Europe Immunotherapy Drugs Market Trends

Europe immunotherapy drugs market is expected to experience significant growth, due to its well-established pharmaceutical sector. The region demonstrates steady uptake of immunotherapy across oncology and autoimmune indications. Increasing focus on personalized medicine supports clinical acceptance of immune-based treatments. Strong hospital networks enable efficient administration of advanced biologics. Continuous expansion of approved therapies across multiple cancers drives sustained growth. Europe maintains consistent market performance with balanced innovation and adoption.

The UK immunotherapy drugs market shows stable growth supported by strong clinical expertise. High prevalence of cancer encourages early adoption of advanced immunotherapy regimens. Robust research collaborations enhance the development of novel immune-based therapies. Increasing integration of immunotherapy in first-line cancer treatment boosts demand. Well-structured oncology care pathways support consistent patient access. The UK remains an important contributor to Europe’s immunotherapy landscape.

Germany immunotherapy drug market is growing due to its advanced medical infrastructure. The country demonstrates high utilization of monoclonal antibodies and checkpoint inhibitors. Strong pharmaceutical manufacturing capabilities support steady product availability. Increasing cancer screening rates expands the treated patient population. High physician confidence in biologic therapies drives prescribing volumes. Germany continues to be a key market for both established and emerging immunotherapy drugs.

France immunotherapy drug market contributes significantly through strong clinical adoption. Growing focus on innovative oncology treatments enhances immunotherapy uptake. Expansion of hospital-based cancer centers supports administration of complex biologics. Increasing use of combination therapies strengthens market demand. Continuous clinical research activity expands therapeutic applications. France maintains steady growth within the European immunotherapy market.

Asia Pacific Immunotherapy Drugs Market Trends

Asia Pacific immunotherapy drugs market is projected to grow at a CAGR of 12.45% over the forecast period. This growth can be attributed to the increasing prevalence of cancer and autoimmune diseases, leading to a rising demand for effective treatment options. The region is witnessing significant investments in healthcare infrastructure, research, and development, resulting in innovative therapies that enhance immune responses. In addition, there is a growing focus on personalized medicine, which helps customize treatments to individual patient needs, further boosting market growth. As awareness of immunotherapy options increases among healthcare providers and patients, the Asia Pacific immunotherapy drugs industry is expected to play a crucial role in shaping the future of cancer treatment in the region. Factors such as rising healthcare expenditure and government support for research initiatives also contribute to this market's positive outlook.

Japan immunotherapy drugs industry represents a mature and innovation-driven market. High adoption of novel oncology treatments supports consistent demand. Strong emphasis on precision diagnostics improves immunotherapy treatment selection. Aging population increases the prevalence of cancer and immune-related disorders. Domestic pharmaceutical innovation strengthens availability of advanced biologics. Japan remains a key contributor to Asia Pacific’s immunotherapy growth.

China immunotherapy drugs market is experiencing rapid expansion driven by a large patient population. Rising cancer burden increases demand for effective immune-based treatments. Accelerated clinical development improves access to new immunotherapy drugs. Expanding healthcare facilities support broader treatment delivery. Growing acceptance of biologic therapies enhances market penetration. China is a major growth engine within the Asia Pacific region.

Latin America Immunotherapy Drugs Market Trends

Latin America immunotherapy drugs market shows moderate growth with improving adoption trends. Increasing awareness of advanced cancer therapies supports market expansion. Growth of private healthcare facilities enhances access to immunotherapy treatments. Rising diagnosis rates expand the addressable patient population. Gradual introduction of innovative biologics strengthens treatment options. The region continues to evolve as an emerging immunotherapy market.

Brazil immunotherapy drugs market leads the Latin America market in terms of adoption. Growing cancer prevalence sustains demand for immune-based therapies. Expansion of oncology centers improves treatment accessibility. Increasing use of monoclonal antibodies supports revenue growth. Strong participation in clinical research enhances therapeutic availability. Brazil remains a focal point for immunotherapy growth in Latin America.

Middle East And Africa Immunotherapy Drugs Market Trends

The MEA immunotherapy drugs market is at a developing stage with steady progress. Rising incidence of cancer drives interest in advanced treatment options. Expansion of specialty hospitals supports immunotherapy administration. Growing physician exposure to biologic therapies improves adoption. Increasing availability of branded immunotherapy drugs strengthens market presence. The region shows long-term growth potential as access continues to improve.

Saudi Arabia immunotherapy drugs landscape represents a key market within the Middle East. Increasing investment in advanced oncology care drives therapy adoption. Expansion of specialized cancer treatment centers supports biologic drug usage. Growing awareness of immunotherapy benefits enhances prescribing trends. Rising demand for targeted cancer treatments sustains market growth. Saudi Arabia continues to emerge as a regional hub for immunotherapy utilization.

Key Immunotherapy Drugs Company Insights

Amgen Inc. and Novartis AG play a critical role in shaping the immunotherapy drugs market through strong biologics portfolios and continuous innovation in immune-based therapies. AbbVie Inc. and Pfizer Inc. maintain competitive positions by expanding immuno-oncology pipelines and advancing monoclonal antibody and combination therapy development. F. Hoffmann-La Roche Ltd and Johnson & Johnson Services, Inc. strengthen market presence through precision medicine approaches and broad clinical trial programs across multiple cancer indications. AstraZeneca and GSK plc focus on immune checkpoint inhibitors and next-generation biologics to enhance treatment efficacy. Sanofi and Bayer AG contribute through diversified immunology research, strategic partnerships, and expansion of therapeutic indications, collectively intensifying competition and innovation in the global immunotherapy drugs market.

Key Immunotherapy Drugs Companies:

The following are the leading companies in the immunotherapy drugs market. These companies collectively hold the largest market share and dictate industry trends.

- Amgen Inc.

- Novartis AG

- AbbVie Inc.

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd

- Johnson & Johnson Services, Inc.

- AstraZeneca

- GSK plc.

- Sanofi

- Bayer AG

Recent Developments

-

In November 2025, Amgen Inc. reported that the U.S. Food and Drug Administration granted full approval to Imdelltra (tarlatamab‑dlle) for adult patients with extensive stage small cell lung cancer who had disease progression on or after platinum‑based chemotherapy, based on data from the global Phase 3 DeLLphi‑304 study that showed a 40% reduction in the risk of death and extended median overall survival to 13.6 months versus 8.3 months with standard chemotherapy (hazard ratio 0.60, 95% CI 0.47-0.77, P < 0.001) and significantly better outcomes in a trial of 509 patients. The approval followed evidence of fewer Grade 3 or greater adverse events in the Imdelltra arm (54% vs 80%) and updated NCCN Guidelines naming it a Category 1 preferred option.

-

In February 2024, AbbVie acquired ImmunoGen, significantly enhancing its oncology portfolio. ImmunoGen's lead product, ELAHERE, specifically targets folate receptor-alpha-positive ovarian cancers. This strategic acquisition aligned with AbbVie's focus on expanding its capabilities in immunotherapy and oncology.

-

In December 2023, F. Hoffmann-La Roche completed the acquisition of Telavant Holdings, Inc., owned by Roivant Sciences and Pfizer. This deal was expected to allow Roche to develop a new therapy-RVT-3101-to treat inflammatory bowel diseases such as ulcerative colitis and Crohn's disease. The acquisition was a part of Roche's strategy to strengthen its focus on gastrointestinal health and to bring innovative treatments to patients with these conditions.

Immunotherapy Drugs Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 317.23 billion

Revenue forecast in 2033

USD 675.98 billion

Growth rate

CAGR of 11.41% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, indication, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Amgen Inc.; Novartis AG; AbbVie Inc.; Pfizer, Inc.; F. Hoffmann-La Roche Ltd; Johnson & Johnson Services, Inc.; AstraZeneca; GSK plc.; Sanofi; Bayer AG

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Immunotherapy Drugs Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the global immunotherapy drugs market report based on drug type, indication, and region:

-

Drug Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Monoclonal Antibodies

-

Immunomodulator

-

Vaccine

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2021 - 2033)

-

Cancer

-

Autoimmune Diseases

-

Infectious Diseases

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global immunotherapy drugs market size was estimated at USD 285.73 billion in 2025 and is expected to reach USD 675.98 billion in 2033.

b. The global immunotherapy drugs market is expected to grow at a compound annual growth rate of 11.41% from 2026 to 2033 to reach USD 675.98 billion by 2033.

b. The monoclonal antibodies segment dominated the immunotherapy drugs market with a share of 56.16% in 2025 owing to increasing R&D in therapeutic monoclonal antibodies coupled with supportive government initiatives

b. Some key players operating in the immunotherapy drugs market include Novartis AG, AbbVie, Inc., Pfizer, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson Services, Inc., AstraZeneca, GSK, Sanofi, Bayer AG.

b. Key factors that are driving the immunotherapy drugs market growth include the rising incidence of chronic diseases globally, high adoption of biosimilar drugs in immunotherapy, launch and regulatory approval of new immunotherapy drugs & favorable reimbursement policies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.