- Home

- »

- Medical Devices

- »

-

Implantable Drug Delivery Devices Market Size Report, 2030GVR Report cover

![Implantable Drug Delivery Devices Market Size, Share & Trends Report]()

Implantable Drug Delivery Devices Market Size, Share & Trends Analysis Report By Product, By Type (Biodegradable, Nonbiodegradable), By Technology, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-497-0

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

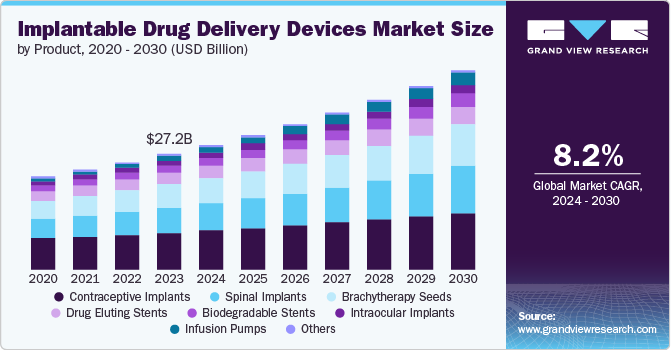

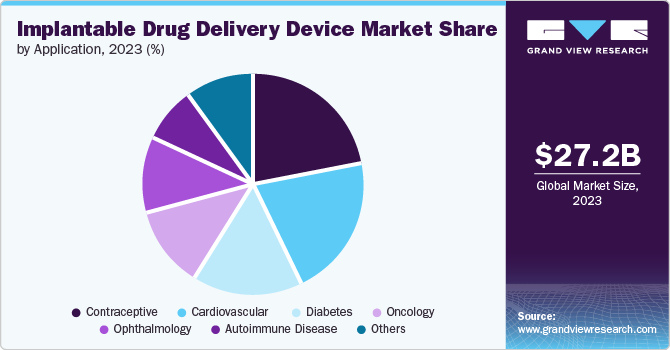

The global implantable drug delivery devices market size was valued at USD 27.20 billion in 2023 and is projected to grow at a CAGR of 8.2% from 2024 to 2030. An increase in incidences of chronic diseases, such as infectious and noninfectious diseases, is the primary factor driving the market growth. According to the World Health Organization (WHO), rising deaths caused by cancer have raised the urgency in healthcare to adopt advanced treatment options such as implantable drug delivery devices.

The rising prevalence of chronic diseases, also known as non-communicable diseases (NCD), is a growing health concern worldwide. According to a World Health Organization (WHO) report published in September 2023, chronic diseases account for 74% of global deaths. These include cardiovascular diseases, cancers, and diabetes. Rising chronic disease concerns drive the market growth for implantable drug delivery devices.

In addition, the need to provide advanced solutions to curb the impact of non-communicable diseases is driving the technological innovations in implantable drug delivery devices. The rising prevalence of diseases requires advanced solutions for improved diagnosis and treatment. For instance, AngioDynamics’s SmartPort implantable vortex technology enables access to the central venous system for blood specimen withdrawal and fluid administration. Such innovations are driving the growth of the market.

The U.S. Food and Drug Administration (FDA) has developed guidelines related to the manufacturing and commercialization of medical devices that ensure their safety and quality. Manufacturers are required to submit form 510(k) for implantable devices to ensure the safety and effectiveness of these devices. FDA approvals enhance accuracy, and the approvals benefit patients, and play a key role in driving the market growth. For instance, Medtronic plc received FDA approval in May 2023 for Micra AV2 and Micra VR2, next-generation pacemakers, the world’s smallest pacemakers.

Product Insights

Drug eluting stents accounted for the largest market revenue share of 31.9% in 2023.The drug-eluting stents are vascular prostheses used by cardiologists. They are commonly used to treat the blockages of heart arteries. Cardiovascular diseases are the leading cause of death, responsible for 32% of deaths globally, according to the World Health Organization (WHO). The increasing demand to treat this critical health issue is driving companies to develop innovative and advanced technological products. For instance, with CE Mark approval, Medtronic launched the latest generation drug eluting coronary stent, Onyx Frontier, in August 2022. Such innovations are driving market growth.Some key players offering drug eluting stent solutions include Medtronic, Abbott, Boston Scientific Corporation, and Biotronik.

Bio-absorbable stents are expected to register the fastest CAGR over the forecast period. The factors contributing to the growth of the segments are the growing occurrences of coronary artery diseases and the increasing adoption of these by patients and healthcare professionals. The need for safe and effective treatment is driving companies and healthcare institutes to research and innovate effective systems. For instance, Mount Sinai announced that coronary bioresorbables are safe and just as effective as drug eluting metallic stents in May 2023. The key companies involved in the segment are Boston Scientific Corporation,Biotronik, and others.

Type Insights

Non-biodegradables accounted for the largest market revenue share in 2023. The most used non-biodegradables are matrix materials. The slow medication diffusion facilitates the sustained release of medication via a delivery system. The wide range of applications of non-biodegradables is further expected to drive segmental growth. For instance, according to a study published by ScienceDirect in August 2023, non-biodegradable polymers have been extensively used to develop contraceptive implants. These are considered robust and are also less likely to cause damage. These benefits of non-biodegradables are driving segmental growth in the market.

The biodegradable segment is expected to register the fastest CAGR during the forecast period. According to a report published in January 2023, out of 63 FDA-approved drugs available in the market, 22 products are based on biodegradable formulations. In addition, technological innovations are expected to add further growth to the market. For instance, the University of Connecticut’s biomedical and mechanical engineers are developing new technology. A biodegradable ultrasound implant could improve the treatment of brain tumors.

Technology Insights

Diffusion accounted for the largest market revenue share in 2023. Diffusion technology is used to deliver therapeutics for treating chronic diseases that require high therapy administration rates. The diffusion technology is used in advanced MRI systems, which changes how nerve axons can be detected. For instance, diffusion MRI was used in studying the effects of COVID-19 on the human brain by the Linköping University, which other technologies, such as imaging technology, could not detect.

The magnetic segment of technology is expected to register significant growth over the forecast period. According to the World Health Organization (WHO), 20 million new cancer cases were recorded in 2022. This encourages companies and research institutes to innovate new technologies for treating underlying causes. For instance, in February 2022, some scientists at University College London (UCL) developed a cancer therapy. The therapy uses an MRI scanner that leads magnetic seeds through the brain, which can heat and destroy tumors.

Application Insights

The contraception segment accounted for the largest market revenue share in 2023. The growing incidences of unintended pregnancies and rise in unsafe abortions promote the growth of the contraceptive market in implantable drug delivery devices. According to the World Health Organization (WHO), six out of ten unintended pregnancies end in unsafe abortion. Such incidences are driving companies to innovate new forms of contraception to solve this issue. For instance, Teva Pharmaceutical Industries Ltd launched a generic version of NuvaRing, an etonogestrel and ethinyl estradiol vaginal ring, in January 2021. Some implantable contraceptives in the market available are Merck & Co.’s NuvaRing and Implanon NXT and Bayer Pharmaceutical’s Jadelle.

Auto-immune diseases are projected to grow at the fastest CAGR over the forecast period. Increasing incidences of autoimmune diseases such as hepatitis and diabetes drive the growth of this segment. According to the National Institute of Biomedical Imaging and Bioengineering, an implantable device could revolutionize the treatment of diabetes free from insulation injections. For instance, Massachusetts Institute of Technology (MIT) engineers designed an implantable device in September 2023 to treat diabetes, which can free patients from insulin injections. Such innovations are strengthening market growth.

Regional Insights

North America’s implantable drug delivery device dominated the market in 2023. The growth is attributed to the rise in chronic diseases and healthcare initiatives taken by the government. For instance, the Public Health Agency of Canada’s World Health Organization (WHO) is collaborating on chronic non-communicable diseases. This collaborating center is designed by WHO dedicated to chronic disease such as cancer, diabetes, cardiovascular diseases, and mental illness. Such rising incidences are helping the growth of implantable drug delivery devices in the market.

U.S. Implantable Drug Delivery Device Market Trends

The U.S. implantable drug delivery device dominated the North American market with a share of 29.1% in 2023. This growth can be attributed to government initiatives overlooking the rising cases of chronic diseases, technological innovations, and collaborations. For instance, Orchestra BioMed collaborated with Medtronic in April 2024 for AVIM therapy in hypertensive pacemaker patients. Such collaborations are driving forces for growth of implantable devices.

Europe Implantable Drug Delivery Device Market Trends

Europe accounted for the significant market share in 2023 in the implantable drug delivery devices market. The European Union (EU) guidelines and medical device regulations on active implantable medical devices are widening the growth prospects. For instance, Medtronic received the CE (Conformité Européenne) Mark in January 2024 for its next-generation Micra leadless pacemakers.

Germany’s geriatric population and rising chronic diseases are attributed to the growth of the implantable drug delivery devices market. Various companies and institutes contribute to the growth by innovating technologies and product launches. For instance, in April 2023, a 5G Pacemaker project was launched which is funded by the German Federal Ministry of Digital Affairs and Transport. Some key players in the region, such as Heinz Kurz GmbH, Biotronik, and Biedermann Motech, to name a few, are driving the market growth through innovations. For instance, Biotronik announced the latest generation of pacemakers and CRT-P devices in August 2023. Such activities in the region are strengthening the market.

The market growth is attributed to the UK regulations for implantable devices, and the government has put forth the legislation for accepting CE Mark for devices in Great Britain beyond June 2023. According to University College London (UCL), the number of unintended pregnancies increased during the pandemic lockdown in October 2021. To reduce unintended pregnancies, the government named contraceptive implants (Nexplanon). According to Patient, part of Egton Medical Information Systems Limited (EMIS), the only contraceptive implant available in market is Nexplanon.

Asia Pacific Implantable Drug Delivery Devices Market Trends

The Asia Pacific implantable drug delivery devices market is expected to grow at the fastest CAGR over the forecast period. The rising prevalence of chronic diseases in the region poses health challenges. According to the World Health Organization (WHO), about 62% of deaths are caused by non-communicable diseases such as cancer, diabetes, and cardiovascular disease. Various companies in the region are innovating new technologies and launching new products to drive market growth. For instance, Biotronik, an implantable pacemaker, opened a new Asia Pacific manufacturing and research hub in December 2023 in Singapore to improve the nation’s MedTech ecosystem. Such activities are expected to foster growth in the market.

The rising chronic diseases such as cardiovascular disease are the leading cause of death in the nation. The underlying factors most commonly are lifestyle changes, indulgence in alcohol, and lack of physical activity. The growth of implantable drug delivery devices is attributed to technological innovation, government initiatives, and programs to raise awareness. For instance, the government signed a memorandum of understanding (MoU) in January 2024 with the medical device manufacturer’s body- the Association of Indian Manufacturers of Medical Devices (AiMED), to sell directly to the government. In addition, Wipro, GE Healthcare collaborated with Boston Scientific in August 2022 to provide innovative interventional cardiac care in India.

The rising prevalence of cardiovascular disease in China affected an estimated 330 million individuals, as per the National Library of Medicine report published in April 2024. In addition, government initiatives, strategic collaborations, and partnerships are strengthening the market for implantable devices. For instance, LifeTech Scientific Corporation entered a strategic collaboration with Medtronic in December 2021 for the HeartTone domestic pacemaker project and domestically made MRI-conditional pacemakers. Such strategies are contributing to market growth.

Key Implantable Drug Delivery Devices Company Insights

Some key companies in implantable drug delivery devices include, Medtronic, Boston Scientific Corporation, Merck & Co., Inc., and Abbott. Key companies are involved taking strategic initiatives such as in innovating new products, collaborating with institutions and other industries, and establishing partnerships.

-

Medtronic is a medical technology, services, and solutions provider company. The company leads in offering an array of products in advanced surgical technology, cardiovascular products, diabetes general surgery, and neurological products. The company’s cardiac implantable devices include Micra, the smallest pacemaker; Azure pacemaker, equipped with BlueSync technology; Advisa MRI pacemakers, FDA FDA-approved second-generation pacing system; Adapta pacemaker, and Attesta pacemakers.

-

Boston Scientific Corporation is a global biomedical and bioengineering firm based in the U.S. offering wide medical services and products. The company’s array of implantable products includes implantable defibrillators, implantable cardioverter defibrillators, INGEVITY pacemakers, and ACCOLADE pacemakers with extended longevity batteries.

Key Implantable Drug Delivery Devices Companies:

The following are the leading companies in the implantable drug delivery devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Boston Scientific Corporation

- Allergan

- Merck & Co., Inc.

- Bausch and Lomb Incorporated

- Bayer AG

- Abbott

- Teleflex Incorporated

- Varian Medical Systems, Inc.

Recent Developments

-

MicroPort Scientific Corporation announced their first implantation of ALIZEA bluetooth enabled pacemaker system in the U.S in March 2024.

-

MicroPort Scientific Corporation Cardiac Rhythm Management (CRM) received approval for the ENO pacing system in China in February 2024.

-

Biotronik announced the first implant of Amvia Sky, the first pacemaker approved for left bundle branch area pacing (LBBAP), in August 2023.

-

Abbott announced the FDA approval for their AVEIR dual chamber leadless pacemaker system in July 2023.

Implantable Drug Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 29.32 billion

Revenue forecast in 2030

USD 47.01 billion

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

Medtronic; Boston Scientific Corporation; Allergan; Merck & Co. Inc.; Bausch and Lomb Incorporated; Bayer AG; Abbott; Teleflex Incorporated; Varian Medical Systems, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Implantable Drug Delivery Devices Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global implantable drug delivery devices market report based on product, type, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Contraceptive Implants

-

Spinal Implants

-

Brachytherapy Seeds

-

Drug Eluting Stents

-

Biodegradable Stents

-

Intraocular Implants

-

Infusion pumps

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Biodegradable

-

Non-biodegradable

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Diffusion

-

Osmotic

-

Magnetic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Contraceptive

-

Ophthalmology

-

Cardiovascular

-

Diabetes

-

Oncology

-

Autoimmune Disease

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."