- Home

- »

- Next Generation Technologies

- »

-

In-app Advertising Market Size, Share & Trends Report, 2030GVR Report cover

![In-app Advertising Market Size, Share & Trends Report]()

In-app Advertising Market Size, Share & Trends Analysis Report By Type, By Platform, By Application (Entertainment, Gaming, Social, Online Shopping, Payment & Ticketing, News, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-3-68038-408-6

- Number of Report Pages: 171

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

In-app Advertising Market Size & Trends

The global in-app advertising market size was valued at USD 151.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 13.2% from 2023 to 2030. The rising adoption of smartphones and increased preference for mobile advertisements for brand promotion and product sales to optimize return on investments and profitability by advertisers is offering enormous growth opportunities for the global in-app advertising industry. Mobile advertising contains banners, videos, and interstitials, which support advertisers in promoting various products and brands. In-app advertisements help marketers generate more user engagement than mobile web advertising. Furthermore, in-app advertisement enables market players to target potential customers effectively based on several attributes relating to usage patterns, age, interests, and location. Consumers are increasingly becoming mobile-oriented; thus, advertisers and marketers focus on mobile advertising to increase brand awareness and reach potential customers.

Incorporating the latest technologies is constantly developing the ability of marketers to deliver relevant advertisements to the customers; the ongoing improvements will allow marketers to improve their effectiveness and provide a better advertising experience to the users. Even though customers in some countries are reluctant to shop on mobile, they use mobile devices to find more product information before making a purchase decision. Furthermore, according to the research, smartphone users spend more than 90% of their time on various applications, making it an ideal choice for marketers for advertising.

The rapidly rising trend of online gaming and the increased popularity of e-commerce platforms and applications is expected to propel the further growth of the in-app advertising industry. The companies are increasing their spending on in-app advertisements considering their higher click-through rate than mobile web advertising. Additionally, in-app advertising allows application developers to build an effective revenue generation strategy by displaying advertisements on mobile applications.

Type Insights

Banner Ads captured a revenue share of over 37. 0% in 2022 and is expected to record significant growth over the coming years. The growth is attributed to various benefits, such as being affordable, easy to implement, and supporting all types of applications and mobile devices. Banner Ads help marketers increase traffic, brand awareness, and product sales. The banner ads offer high returns on investments resulting in numerous growth opportunities for the banner ads segment over the forecast period.

Interstitial Ads are full-page advertisements provided in the middle of screens during mobile app navigation. The interstitial ads are gaining popularity and are expected to gain a significant CAGR of over 14% from 2023 to 2030. Interstitial ads enable advertisers to offer the best creatives as they are displayed full-screen and create user engagement better than native or banner ads. The higher return on investment and better click rate drive the market growth for interstitial advertisements.

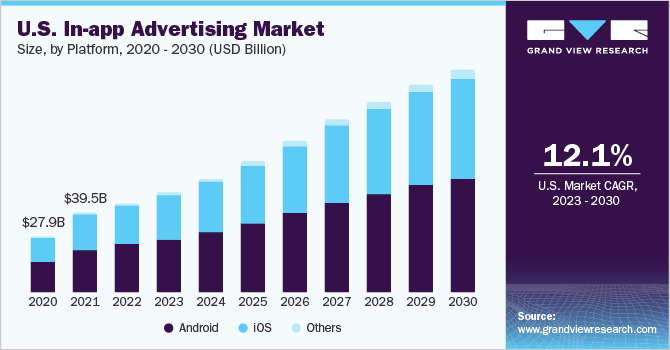

Platform Insights

The iOS segment is anticipated to witness the highest CAGR growth by 2030. The recent iOS updates have empowered users to decide whether to share their IDFA data (Identification for Advertisers). The users need to provide permission for applications to share and collect data which allows them to protect their data. The better features, user interface, and user friendly of iOS platform-based devices resulting in increased adoption of iOS devices in developing countries such as South Korea, China, and Japan are driving the growth of the iOS platform

The Android platform accounted for a revenue share of over 64.0% in 2022 and is projected to maintain its dominance over the forecast period. Android is an open-source operating system that allows different devices to run on the Android platform, unlike iOS, which runs only on Apple devices. The advertisers usually target high-end Android devices based on device models to target high-quality users. The increasing focus on data privacy and developing enhanced advertising solutions is offering numerous growth opportunities for the Android platform segment in the future.

Application Insights

The gaming segment is anticipated to register a CAGR of over 14.05% from 2023 to 2030. Technological innovations in the hardware and software of smartphones and increased accessibility of mobile games are driving the growth of mobile gaming globally. Advertisers invest in different advertising formats to create and deliver appealing advertisements on gaming applications. The advertising on gaming applications has enabled marketers to reach out to a specific audience and has high eCPM rates. The ability to create a more engaging experience through video and banner ads is driving the growth of the gaming segment during the forecast period.

The entertainment segment captured the highest revenue share of approximately 24% in 2022 and is expected to maintain its dominance during the forecast period. The entertainment applications such as OTT platforms are becoming increasingly popular. Advertisers are utilizing these platforms to reach their targeted audience by utilizing information such as viewing habits, age, location, gender, and other demographics to utilize the performance of their advertising campaigns. The ability to reach out to targeted audiences effectively and offer advanced analytics to optimize future advertising campaigns offers lucrative growth opportunities for the entertainment segment in the in-app advertising industry.

Regional Insights

The Asia Pacific region accounted for the highest market share of nearly 35.0% in 2022 and is expected to continue its dominance over the forecast period. The growing internet penetration and pervasiveness of smartphones in developing countries such as China, South Korea, and Japan are ensuing significant growth for in-app advertising marketing in the region. Furthermore, marketers are incorporating advanced analytics solutions supported by machine learning and artificial intelligence to study consumer behavior and effectively advertise on various mobile applications.

North America is anticipated to witness a significant market share of more than 31% by 2030. The growth is attributed to the large number of smartphone users coupled with the rising popularity of mobile streaming services such as Hulu, Amazon Prime, Netflix, and other popular video streaming services has increased the potential for in-app advertising industry in the region. Furthermore, the rapidly growing gaming market and substantial growth in mobile shopping, owing to its ability to offer a better shopping experience, are expected to fuel the growth of in-app advertising industry in North America.

Key Companies & Market Share Insights

The major players in the market are focusing on mergers and acquisitions to incorporate advanced analytics solutions such as machine learning to collect information related to changing consumer behavior. Advanced data collection and analytics solutions have helped marketer to target the customer effectively. For instance, in July 2022, Tremor International Ltd. acquired Amobee, Inc., a provider of digital marketing technology, for USD 239 million. The acquisition has helped Tremor International Ltd. to enhance its data-driven offerings, expand its market presence and focus on core areas, including data, video, and CTV. The increasing number of such mergers and acquisitions to expand market presence and enhance service offerings is expected to favor the growth of the in-app advertising industry over the forecast period. Some of the prominent players in the global in-app advertising market are:

-

ironSource (Unity Software Inc.)

-

Google AdMob (Google LLC)

-

BYYD Inc

-

Flurry (Yahoo Inc.)

-

TUNE, Inc.

-

Amobee, Inc.

-

InMobi

-

Glispa GmbH

-

AppLovin

-

Chartboost, Inc

-

Smaato, Inc.

-

Leadbolt

In-app Advertising Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 171.8 billion

Revenue forecast in 2030

USD 410.4 billion

Growth rate

CAGR of 13.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, platform, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Russia; Netherlands; China; India; Japan; South Korea; Australia; Argentina; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

ironSource (Unity Software Inc.); Google AdMob (Google LLC); BYYD Inc.; Flurry (Yahoo Inc.); TUNE, Inc.; Amobee, Inc.; InMobi; Glispa GmbH; AppLovin; Chartboost, Inc; Smaato., Inc.; Leadbolt

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

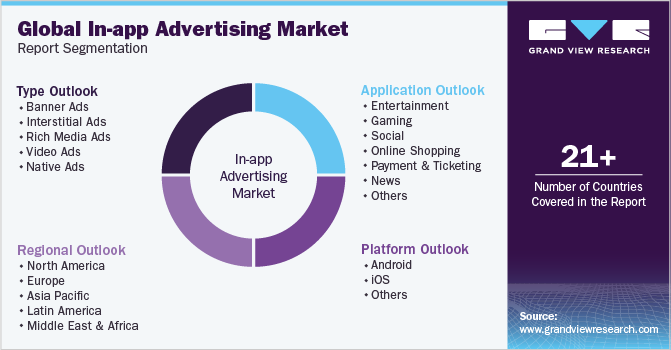

Global In-app Advertising Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-app advertising market report based on type, platform, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banner Ads

-

Interstitial Ads

-

Rich Media Ads

-

Video Ads

-

Native Ads

-

-

Platform Outlook (Revenue, USD Billion, 2018 - 2030)

-

Android

-

iOS

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Entertainment

-

Gaming

-

Social

-

Online Shopping

-

Payment & Ticketing

-

News

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global in-app advertising market size was estimated at USD 151.1 billion in 2022 and is expected to reach USD 171.8 billion in 2023.

b. The global in-app advertising market is expected to grow at a compound annual growth rate of 13.2% from 2023 to 2030 to reach USD 410.4 billion by 2030.

b. Some key players operating in the in-app advertising market include ironSource (Unity Software Inc.), Google AdMob (Google LLC), BYYD Inc., Flurry (Yahoo Inc.), TUNE, Inc., Amobee, Inc.

b. Key factors that are driving the in-app advertising market growth include rising adoption of smartphones and increased preference to the mobile advertisements for brand promotion and product sales.

b. The Asia Pacific dominated the in-app advertising market with a share of around 35% in 2022. This is attributable to rapidly increasing smartphone penetration combined with developing internet infrastructure, expansion of global businesses in developing markets due to rapid urbanization, and growing preference for online shopping.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."