- Home

- »

- Communication Services

- »

-

In-flight Entertainment And Connectivity Market Report, 2030GVR Report cover

![In-flight Entertainment And Connectivity Market Size, Share & Trends Report]()

In-flight Entertainment And Connectivity Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering Type (IFE, IFC), By Component (Hardware, Connectivity), By Aircraft Type (NBA, WBA), By Region, And Segment Forecasts

- Report ID: 978-1-68038-842-8

- Number of Report Pages: 115

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

In-flight Entertainment And Connectivity Market Summary

The global in-flight entertainment and connectivity market size was valued at USD 5.96 billion in 2022 and is is estimated to reach USD 11.79 billion by 2030, growing at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. Technological advancements in terms of wireless connectivity have enabled passengers to use personal electronic devices in airlines, consequently driving the growth of the industry.

Key Market Trends & Insights

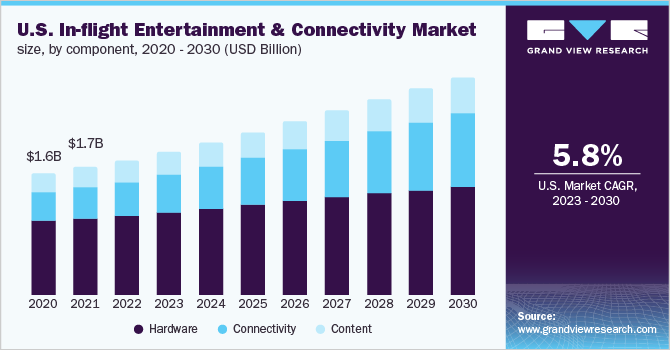

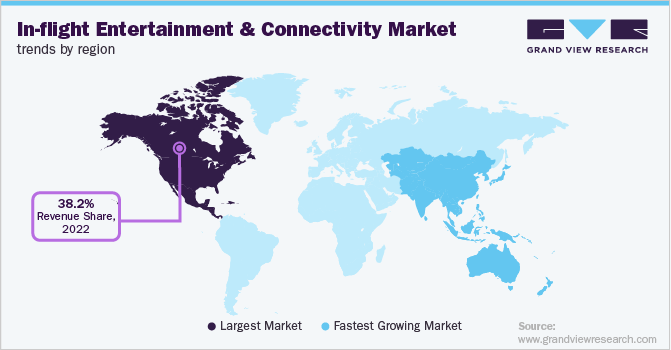

- North America dominated the industry in 2022 and accounted for the maximum share of more than 38.20%.

- Based on components, the hardware component segment accounted for the highest share of more than 58.65% of the overall revenue in 2022.

- Based on aircraft types, the NBA-type segment accounted for the maximum share of more than 52.70% of the total revenue in 2022.

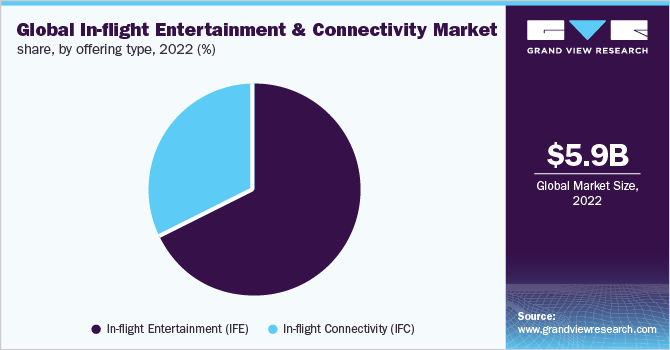

- Based on offering types, the IFE segment accounted for the largest share of more than 68.40% of the overall revenue in 2022.

Market Size & Forecast

- 2022 Market Size: USD 5.96 Billion

- 2030 Projected Market Size: USD 11.79 Billion

- CAGR (2023-2030): 8.4%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The ever-increasing customers’ need for bug-free connectivity onboard is one of the important factors driving the growth. In-flight entertainment and connectivity (IFEC) systems play an important role in delivering customers onboard wireless connectivity solutions and services.

This has substituted the traditional seatback screens that offered a restricted entertainment range with a moderately personalized model catering to individual passenger needs. Furthermore, advancements in seat design, connectivity, and real-time data positively influence the industry. Major players are concentrating on improvising the broad range of delivery services to further increase the industry demand. For instance, Moment, in November 2022, launched the Flymingo Jet solution, which offers jet operators smart, connected cabins. Diverse networking technologies have been successfully combined into more versatile and resilient in-flight entertainment and communication systems aboard modern airplanes.

Over the last several years, these systems have seen significant advancements in terms of technical achievements. During the projected period, the market is expected to rise due to an increase in demand from market players to improve the passenger experience. Because of the surge in the use of intelligent devices and the migration of consumer electronics into the onboard ecosystem, a rising number of industry players involved in in-flight Wi-Fi and commodity hardware demands are projected to see significant development. For instance, AirAsia India and Sugarbox came into a partnership for offering Wi-Fi services onboard for all AirAsia aircraft. Airlines’ greater emphasis on addressing customer requirements for in-flight entertainment and internet services is expected to promote industry change.

IFEC services continue to be a strong foundation for the airline industry’s long-term viability and, in most cases, generate revenue. Regulatory disruption of onboard connectivity possibilities is projected to remain significant during the next eight years. The IFEC sector is predicted to continue to develop as a result of innovation. In-flight entertainment and communication’s most crucial system fabricators are increasingly embracing the Bring-Your-Own-Device (BYOD) trend and incorporating advanced connectivity technologies into their systems. Furthermore, because of the rising use of digital devices in everyday life, passengers demand more reliable connectivity during the journey.

Social media is one of the key drivers of growing internet usage, and people are spending more time online. Major airline businesses worldwide are adapting to changing customer behavior and experimenting with different digital options to provide a seamless and personalized travel experience. Furthermore, to improve the entire passenger experience, the optimized IFEC solution should be completely compliant with an airline’s business standards and commercial objectives, allowing for a customized marketing strategy. For instance, Southwest Airlines chose Anuvu’s inflight connectivity services, which provide users with the option of in-flight payment, live TV, WhatsApp, and others.

In-flight Entertainment And Connectivity Market - COVID-19 Impact Analysis

The industry has been severely impacted and is estimated to face challenges. Governments across the globe had enforced lockdown restrictions to curb the spread of coronavirus, resulting in a sharp decline in airline flights. The airline industry has seen significant losses in revenue throughout 2020 and 2021. The companies operating in the industry were adversely affected by weak markets and unstable economic conditions in the global market owing to the COVID-19 scenario in 2020 and 2021. Nationwide lockdowns and enforced restrictions on air transportation continued in 2021 due to the high number of COVID-19 cases.

The weaker market and economic conditions in conjunction with low demand for air travel hampered the growth of the market in 2020 and 2021. However, following the invention of vaccines to curb the spread of the coronavirus, the air travel restrictions were lifted in the latter half of 2021 globally. As market players are recovering from financial losses and looking forward to growth in the coming years, they have prioritized strategies that will help them achieve the same. According to a research document, the airline industry is likely to take more than three years to recover economically to pre-COVID levels.

Component Insights

Based on components, the global industry has been further classified into hardware, connectivity, and content. The hardware component segment accounted for the highest share of more than 58.65% of the overall revenue in 2022. The BYOD trend and wireless mobile electronic gadgets are expected to drive category development. Due to continual product outcomes in the quest to manufacture lightweight and cutting-edge IFEC systems, the part is expected to be represented by a high degree of energy. Due to the increased passenger desire to stay connected during the trip, the connectivity segment is expected to develop significantly over the projected period.

Wireless and wired connectivity are the two types of connectivity available. As airlines are increasingly accepting wireless onboard communication and entertainment service offers to improve the passenger travel experience, wireless connection services are expected to increase significantly in the years to come. With the introduction of onboard Wi-Fi, passengers may use their own devices, such as phones and tablets, to stream movies, live content, and TV shows, eliminating the need to install hardware at each seat.

Aircraft Type Insights

Based on aircraft types, the global industry has been further categorized into Narrow-body Aircraft (NBA), Wide-body Aircraft (WBA), and Very Large Aircraft (VLA). The NBA-type segment dominated the industry in 2022 and accounted for the maximum share of more than 52.70% of the total revenue. The segment is likely to expand further at the fastest growth rate retaining its leading position throughout the forecast period. The increased demand for short-haul flights and the creation of new travel routes and airports fueled this segment’s significant rise.

NBAs also have better fuel efficiency and ergonomics than their counterparts, which increases their appeal. Some of the major airlines are currently changing their aging NBA aircraft with the newer, more fuel-efficient fleet to provide significant expansion opportunities during the forecast period. The WBA type segment is predicted to register a significant CAGR over the projection period. Long-haul and intercontinental flights include IFEC systems, which are fueling this segment’s growth. While traveling on long routes, the demand for onboard IFEC services is critical to keep passengers engaged and provide a better travel experience.

Offering Type Insights

Based on offering types, the industry has been classified into In-flight Entertainment (IFE) and In-flight Connectivity (IFC). In 2022, the IFE segment accounted for the largest share of more than 68.40% of the overall revenue. The segment is likely to expand further at a steady CAGR during the projection period. IFE is one of the most important services provided by airlines to improve their customers’ travel experience, particularly on long-haul flights. IFE systems, which were recently developed, provide a variety of advantages to airline operators and passengers, including less cabling infrastructure, reduced flight weight, and the ability for customers to use their own devices.

Over the forecast years, the IFC segment is likely to increase significantly. Airlines have adequately handled the growing demand for live media streaming and Wi-Fi support onboard, due to significant expenditures by industry participants in strengthening wireless connectivity infrastructure. Customers should expect a digital environment comparable to their homes or office due to the expansion initiatives. Major airline businesses worldwide are continually seeking to improve their connection service offerings to provide customers with better speed and capacity, resulting in more ancillary profits.

The IFC segment is anticipated to foresee considerable growth over the forecast years. Due to major investments by industry partners in strengthening wireless connectivity infrastructure, airlines have met the rising demand for live media streaming and Wi-Fi services onboard. Due to these growth activities, passengers may anticipate a digital environment similar to their home or business. Leading airline businesses worldwide are working to improve their connection services to provide consumers with more speed and capacity, resulting in more ancillary revenue.

Regional Insights

North America dominated the industry in 2022 and accounted for the maximum share of more than 38.20% of the overall revenue. Regional airlines in wealthy countries are expected to increase their usage of such systems, which is expected to keep the regional industry expanding. Some of the region’s most well-known airlines, such as United Airlines, Inc. and Delta Air Lines, Inc., are continually working to deliver compensating material over Wi-Fi or supply pills to passengers. Furthermore, the growing popularity of the BYOD trend is likely to free airlines from the requirement to nest back-seat screens, lowering total aircraft weight.

Asia Pacific is expected to register the fastest growth rate during the forecast period. The rising passenger traffic is boosting the need for airplanes equipped with next-gen entertainment and communication technology. This is driving regional market growth. Several prominent airlines in the region provide contemporary IFEC facilities for their first-class customers. For example, Garuda Indonesia, Indonesia’s flag airline, offers premium travel class customers a variety of onboard entertainment options, such as live TV streaming, in-flight shopping, and games.

Key Companies & Market Share Insights

The rivalry among the industry participants is crucial, with several competitors capturing the largest market share. The players are focused on properly managing the airlines’ particular requirements, allowing them to boost passenger engagement, efficiency, and their ability to develop new revenue streams by supplying cutting-edge technology and novel connectivity solutions. Industry players’ innovations will likely remain a bedrock in developing the industry. Panasonic unveiled its eXO IFE/wIFE mix IFE solution, which allows carriers to adapt their aircraft composition for aloft IFE, wireless IFE, embedded IFE, or all three services presenting a flexible solution to the airlines.

Airlines should be able to upgrade their present IFE equipment easily with modern systems using such technologies. Firms like ViaSat Inc. and Gogo LLC have started selling plans with high-speed Wi-Fi access, driving the customer demand for wireless IFE and networking services on short-haul flights. The following are some of the major players in the global in-flight entertainment and connectivity market are:

-

BAE Systems

-

Cobham plc.

-

Collins Aerospace

-

Eutelsat Communications

-

Global Eagle Entertainment Inc.

-

Gogo LLC

-

Honeywell International Inc.

-

Inmarsat plc.

-

Iridium Communications Inc.

-

Panasonic Corporation

-

Safran (Zodiac Aerospace SA)

-

SITAONAIR

-

Thales SA

-

ViaSat Inc.

In-flight Entertainment And Connectivity Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 6.70 billion

Revenue forecast in 2030

USD 11.79 billion

Growth Rate

CAGR of 8.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, aircraft type, offering type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; China; Japan

Key companies profiled

BAE Systems; Cobham plc; Collins Aerospace; Eutelsat Communications; Global Eagle Entertainment Inc.; Gogo LLC; Honeywell International Inc.; Inmarsat plc; Iridium Communications Inc.; Panasonic Corp.; Safran (Zodiac Aerospace SA); SITAONAIR; Thales SA; ViaSat Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

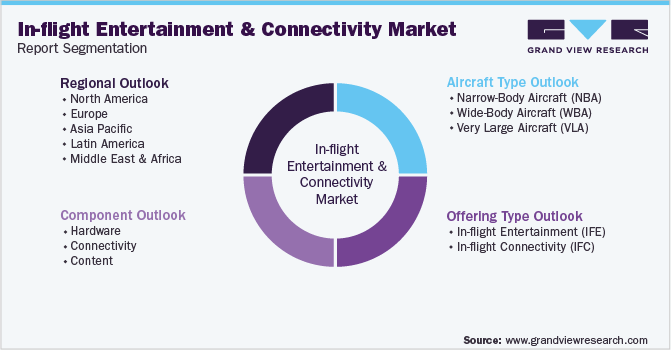

Global In-flight Entertainment And Connectivity Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global in-flight entertainment and connectivity market report based on component, aircraft type, offering type, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Non-portable

-

Portable

-

-

Connectivity

-

Wired

-

Wireless

-

-

Content

-

Stored

-

Streamed

-

-

-

Aircraft Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Narrow-Body Aircraft (NBA)

-

Wide-Body Aircraft (WBA)

-

Very Large Aircraft (VLA)

-

-

Offering Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-flight Entertainment (IFE)

-

In-flight Connectivity (IFC)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

-

Latin America

-

Middle East & Africa (MEA)

-

Frequently Asked Questions About This Report

b. The global in-flight entertainment and connectivity market size was estimated at USD 5.96 billion in 2022 and is expected to reach USD 6.70 billion in 2023.

b. The global in-flight entertainment and connectivity market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 11.79 billion by 2030.

Which aircraft type accounted for the largest in-flight entertainment and connectivity market share?b. The Narrow-Body Aircraft (NBA) type dominated the In-flight entertainment & connectivity market with a share of 52.74% in 2022. The significant growth in this segment can be attributed to increased demand for short-haul flights as well as the expansion of new travel routes and airports.

b. Some key players operating in the in-flight entertainment and connectivity market include BAE Systems; Cobham plc; Collins Aerospace; Eutelsat Communications; Global Eagle Entertainment Inc.; Gogo LLC; Honeywell International Inc; Inmarsat plc.; Iridium Communications Inc.; Panasonic Corporation; Safran (Zodiac Aerospace SA); SITAONAIR, Thales SA and ViaSat Inc.

b. Factors such as diverse networking technologies have been successfully combined into more versatile and resilient in-flight entertainment and communication systems aboard modern airplanes. Also, the surge in the use of intelligent devices and the migration of consumer electronics into the onboard ecosystem, a rising number of industry players involved in in-flight Wi-Fi and commodity hardware demands are projected to see significant development for in-flight entertainment & connectivity market

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.