- Home

- »

- Medical Devices

- »

-

Incontinence And Ostomy Care Products Market Report 2030GVR Report cover

![Incontinence And Ostomy Care Products Market Size, Share & Trends Report]()

Incontinence And Ostomy Care Products Market Size, Share & Trends Analysis Report By Type (Incontinence Care Products, Ostomy Care Products), By Region (North America, Asia Pacific, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-001-9

- Number of Report Pages: 111

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

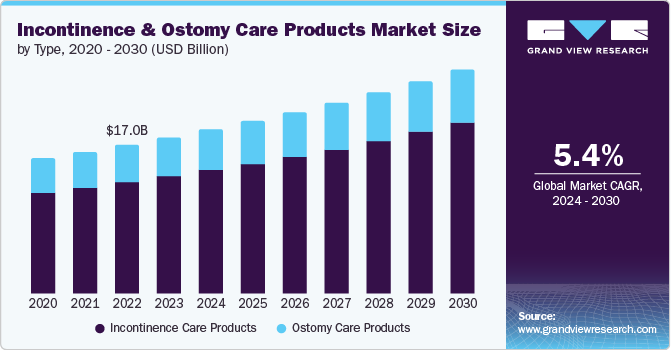

The global incontinence and ostomy care products market size was valued at USD 17.9 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. The rising incidence of Inflammatory Bowel Disease (IBD) and colorectal cancer, technological advancements in ostomy care products and the growing awareness about ostomy are expected to contribute to the market growth. Moreover, the increase in the geriatric population is another significant driver of the ostomy care products market. An increasing predisposition to colorectal & urinary bladder cancers is predicted to surge the demand for ostomy care products and accessories. As per a study published by NCBI, colorectal cancer is identified as the second main cause of cancer-related deaths and the fourth most common cancer across the U.S. The risk of colorectal cancer increases with age, as it is usually diagnosed in people aged 65 to 74 years. For instance, as per the WHO reports, around 80% of elderly people are expected to live in low or middle income countries by 2050. In addition, the number of people aged 80 or older is anticipated to reach around 426 million by 2050.

Among the three types of ostomies, colostomy is the most common procedure in North America. People living with ostomy are mostly above the age of 50. The U.S. is expected to experience a significant shift in its population demographics, with the Association of America (UOAA) predicting that the number of elderly individuals will increase to 24% of the overall population by 2050. This growth is likely to lead to an increase in ostomy cases across the country. Furthermore, according to the National Center for Biotechnology Information (NCBI), patients aged 70 and above are more likely to undergo permanent ostomy procedures compared to younger individuals. These procedures often result in extended hospital stays and higher mortality rates, which is anticipated to drive demand for incontinence and ostomy care products.

Moreover, the rising number of initiatives being undertaken by various private players and nonprofit organizations to raise awareness regarding ostomy care and incontinence care across the globe are anticipated to drive the demand for incontinence and ostomy care products. For instance, the European Ostomy Association arranges World Ostomy Day (WOD) every year. It aims to educate the global population about the rehabilitation of ostomates by bringing them together. Furthermore, in Australia, the government implemented the Stoma Appliance Scheme that offers subsidized ostomy supplies to eligible individuals. The government also supports awareness and education campaigns to ensure individuals receive proper information and support for ostomy care. These initiatives are expected to streamline the management of ostomy care.

Innovations in ostomy care products have greatly enhanced their functionality, comfort, and user-friendliness, thereby driving market growth. Technological advancements include the development of skin-friendly adhesives, odor control mechanisms, and more discreet and ergonomic pouch designs. For instance, companies such as Hollister Incorporated and Coloplast Corp. have introduced products with advanced features such as filter technology for odor control and skin barriers that protect against leakage and skin irritation. In September 2022, Convatec announced the launch of “My Ostomy Journey” app for patients living with an ostomy. Some key features of this app are daily tracking of fluid intake, logging pouch changes, identification of new products, and direct access to ostomy product experts along with certified Wound, Ostomy, and Continence (WOC) nurses through the app.

Market Concentration & Characteristics

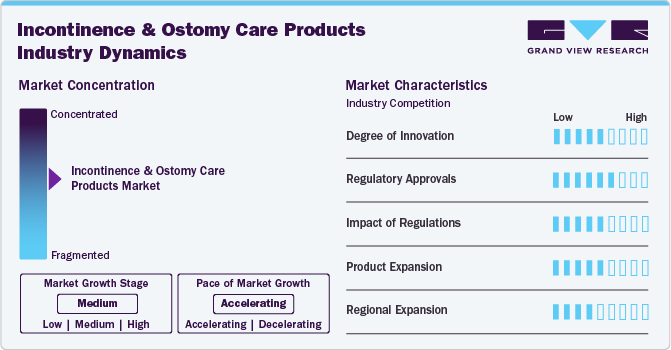

The market is characterized by a high degree of innovation, driven by the need to enhance patient comfort, improve functionality, and ensure better health outcomes. Incontinence products have seen significant advancements in materials and design, including the development of superabsorbent polymers, breathable fabrics, and discreet, anatomically shaped products that reduce bulkiness while increasing absorbency. For instance, in May 2023, Friends, an adult diaper brand of Nobel Hygiene Pvt. Ltd in India, announced the launch of UltraThinz, India’s first ‘slim’ disposable absorbent underpants for people with light incontinence, with separate variants for men and women.

In various regions worldwide, including the U.S., Europe, and Asia-Pacific, incontinence and ostomy care devices must undergo rigorous evaluations by regulatory bodies such as the FDA, CE, and CFDA. Incontinence products, such as adults pads/diapers, are typically classified as Class I devices, which are subject to general controls. These products do not require premarket approval but must comply with FDA guidelines for labeling and good manufacturing practices. Ostomy care products, such as ostomy pouches and accessories, are classified as Class II devices, which require 510(k) clearance. This clearance requires the manufacturer to demonstrate that the product is substantially equivalent to a legally marketed device.

Regulations significantly impact the incontinence and ostomy care products market, influencing product safety, quality, and market access. Regulatory bodies like the FDA in the U.S. and the European Medicines Agency (EMA) in the EU impose stringent standards for product approval, ensuring that products are safe, effective, and of high quality. These regulations necessitate rigorous testing and clinical trials, which can be time-consuming and costly but are essential for maintaining consumer trust and safety.

Regional expansion is a critical strategy for growth in the incontinence and ostomy care products market, driven by the varying prevalence of conditions requiring these products and the differing levels of healthcare infrastructure across regions. In developed regions like North America and Europe, market growth is driven by high awareness, advanced healthcare systems, and favorable reimbursement policies. Companies are focusing on these regions to introduce innovative products and capture a significant market share. For instance, in May 2024, Coloplast Corp. announced the expansion of its Luja portfolio with a catheter designed for women. This catheter follows the successful launch of the Luja catheter for men, which utilizes Micro-hole Zone Technology. Further, in November 2023, it announced a new manufacturing site in Portugal, where the company invested USD 107.34 million. The expansion aims to increase the production of intermittent catheters to meet growing global demand, focusing on Europe. The facility is under construction, with an expected completion date of early 2026.

Type Insights

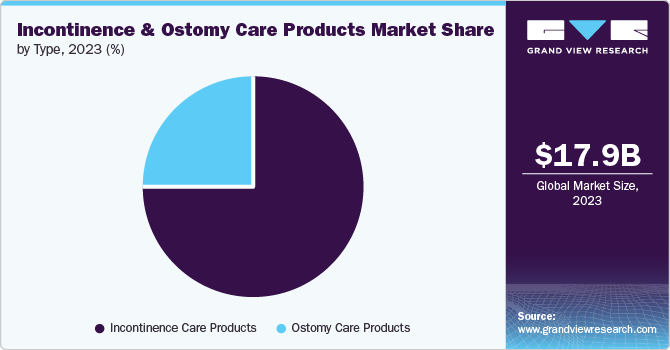

Incontinence care products accounted for the largest share of over 75.0% in 2023 and are also expected to grow at the fastest CAGR of 5.6% over the forecast period due to the increasing awareness and acceptance of incontinence as a common medical condition. Technological innovations in incontinence care products have significantly enhanced their effectiveness, comfort, and convenience, making them more appealing to users. Moreover, the growing geriatric population and increasing prevalence of bladder-related conditions are expected to drive growth of this segment over the forecast period.Incontinence care products include adult diapers, pads, underwear, and guards designed for patients with bladder & bowel control problems.

The growing prevalence of Urinary Incontinence (UI), especially among the geriatric population, is driving the demand for absorbents and incontinence bags. For instance, as per the Continence Foundation of Australia, around 5 million Australians i.e. approximately 1 in 4 people aged 15 years or over experience bowel control problems. This number is projected to increase to around 6.5 million by the year 2030. Absorbent products are the most widely used incontinence care products, designed to absorb and manage urine and fecal incontinence. These products are available in various forms, including pads, underwear, and adult diapers. Absorbent products are made from a variety of materials, including superabsorbent polymers, fluff pulp, and other breathable materials. They are designed to provide comfort, protection, and leakage protection for individuals with urinary or fecal incontinence.

Regional Insights

North America incontinence and ostomy care products market held a significant share driven by the increasing prevalence of Urinary Incontinence (UI), advanced healthcare infrastructure, and growing awareness about available treatment options. According to the Government of Canada, bladder cancer is the fifth most prevalent cancer in the country, ranking fourth among the most common cancers diagnosed in men and tenth among the most common cancers diagnosed in women. Hence, rising cases of bladder cancer and the increasing number of benign prostatic hyperplasia (BPH)-related surgical procedures and are expected to boost the North America market.

U.S. Incontinence And Ostomy Care Products Market Trends

The incontinence and ostomy care products market in the U.S. is driven by the increasing geriatric population, vulnerable to conditions like colorectal cancer, bladder obstruction, UI, and urinary retention. In addition, the growing development in the medical devices market is expected to contribute to market growth. According toUrology Care Foundation report, a staggering one in four men and one in three women in the U.S. are affected by urinary incontinence, equating to a massive number of millions of Americans. Specifically, approximately 33 million individuals suffer from overactive bladder (OAB), characterized by symptoms of urgency, frequency, and sometimes accompanied by urge incontinence. This widespread condition highlights the significant need for effective solutions and increased awareness about this common health issue. Furthermore, according to Johns Hopkins University, around 200,000 procedures for Benign Prostatic Hyperplasia (BPH) are conducted in the U.S. annually. As a result, the growing number overactive bladder cases and BPH procedures are boosting the market growth in the U.S.

Europe Incontinence And Ostomy Care Products Market Trends

The incontinence and ostomy care products market in Europe held a revenue share of over 43% in 2023. The increasing number of stoma patients due to Crohn’s disease and ulcerative colitis or inflammatory bowel disease (IBD) is expected to drive the incontinence & ostomy care products market growth across Europe. According to a research article published in National Cancer for Biotechnology Information, IBD comprises Crohn’s disease or ulcerative colitis, and its occurrence in European countries is steadily rising. According to the Journal of Crohn’s and Colitis, the incidence of ulcerative colitis and Crohn’s disease in Europe is increasing annually. The highest number of people diagnosed with these diseases was witnessed in the UK, while the lowest was in eastern and southern Europe.

UK incontinence and ostomy care products market is significantly driven by the increasing cases of stoma or ostomy and growing government initiatives to promote the awareness about ostomy care. Several campaigns have been run in the country to improve awareness about stoma surgery, which may contribute to market growth. For instance, in September 2023, Colostomy UK started a “Stoma Aware” campaign to increase the population’s understanding and acceptance of stomas. This is expected to increase the demand for ostomy care & accessories as more people feel comfortable seeking and using these products.

The incontinence and ostomy care products market in Germany is significantly driven by the increasing number of elderly people with colorectal cancer and established regulatory framework in the region. The healthcare system in Germany is primarily based on Statutory Health Insurance (SHI), with most of the population covered by SHI funds. The German statutory health insurance (SHI) system is comprised of 110 sickness funds, which act as third-party payers and cover approximately 88% of the population. Those who are self-employed or exceed a certain income threshold have the option to either remain within the SHI system or opt for private health insurance (PHI) offered by 41 private insurance companies. Moreover, individuals also have the choice to supplement their SHI coverage with private health insurance. Such initiatives are expected to propel the regional market expansion.

Asia Pacific Incontinence And Ostomy Care Products Market Trends

The incontinence and ostomy care products Asia Pacific are expected to witness the fastest CAGR during the forecast period due to the presence of numerous organizations creating awareness about ostomy. For instance, the Australian Council of Stoma Associations provides support services to stoma patients across the country. In addition, in September 2022, the Continence Foundation of Australia received around USD 3.3 million in funding from the Commonwealth Government to implement Continence SMART Care, a program to deliver evidence-based and dignified continence care in aged care settings.

Japan Incontinence and ostomy care products market is driven by the quality-of-life issues and promotion of the welfare of ostomates. For instance, the Yokohama Ostomy Association provides education, information, and support to ostomates, especially to those with intestinal & urinary diversions. The association is focused on improving the quality of life of stoma patients through mutual support & encouragement, education, and training.

The incontinence and ostomy care products market in China is significantly driven by the rising incidence of Crohn’s disease. According to China Crohn’s and Colitis Foundation (CCCF), numerous people suffer from IBD in China. This foundation has been established to provide these people with a quality of life and conduct motivational programs to boost their morale. Hence, the increasing awareness among people suffering from IBD is expected to drive market growth in China.

Latin America Incontinence And Ostomy Care Products Market Trends

The incontinence and ostomy care products market in Latin America held a substantial share due to the rising geriatric population and the increasing prevalence of incontinence. According to the Latin American & Caribbean Demographic Centre (CELADE), the geriatric population in Latin America was 88.6 million in 2022, which represents 13.4% of the overall population and is expected to increase to 16.5% by 2030. Moreover, the growing healthcare expenditure in most Latin American countries is expected to create lucrative opportunities for players in the global market.

Argentina incontinence and ostomy care products market is anticipated to be driven by rising production capacities in neighborhood markets that supply continence products in Argentina. For instance, in May 2022, Kimberly-Clark announced its investment and expanded its diaper production in Suzano, Brazil. The Kimberly-Clark’s Suzano, Brazil plant, can produce 200 million diapers monthly. This plant in Brazil supplies diapers to the Argentina market. Such expansions in the production capacities of neighboring countries can help increase the accessibility of products in Argentina’s market, which is expected to boost the market in the coming decade.

Further, the country has also been witnessing a growth in its aging population for a decade. This growing elderly population is expected to contribute to the expansion of Argentina's continence care market.

MEA Incontinence And Ostomy Care Products Market Trends

The incontinence and ostomy care products market in the MEA is growing slowly due to the technological advancements in the healthcare system and growing partnerships to expand the distribution of incontinence care products. For instance, in February 2023,ProvenMed, a pioneering UAE-based medical technology company, entered into an exclusive partnership with Gulf Medical Company, Ltd., in the Kingdom of Saudi Arabia (KSA). The partnership aims to bring the world's first infection-preventative urinary incontinence management medical device, ActivGo for men, to the Saudi market. Furthermore, high-income countries such as UAE, Saudi Arabia and South Africa are focused on adopting the latest devices for their healthcare setup. The increasing healthcare expenditure and the gradual adoption of technologically advanced products in these countries are expected to propel market growth. Hence, supportive government efforts and developing healthcare infrastructure in the Middle East & Africa are expected to fuel market growth.

The UAE incontinence and ostomy care products market is expected to witness significant growth over the forecast period due to the increasing government spending on developing smart hospitals, expanding IT & telecommunications infrastructure, rising number of multispecialty hospitals, growing spending on the digitalization of the healthcare industry, and expanding patient base. The UAE federal government, which monitors the healthcare sector and funds most of the nonprivate healthcare organizations in the northern emirates, has developed strategic plans to meet the growing demand for healthcare services. The growing awareness about urological disorders among UAE residents is anticipated to boost the market. Various organizations are undertaking initiatives to increase awareness about urology diseases. For instance, in June 2022, the Arab School of Urology (ASU) and the Arab Association of Urology (AAU) partnered with the Saudi-based SAJA Pharmaceuticals to increase public awareness about urinary Incontinence and Overactive Bladder (OAB) at Khorfakkan Hospital, UAE.

Key Incontinence And Ostomy Care Products Company Insights:

The market is highly competitive, various companies across the globe are investing in enhancing product portfolios, expanding market reach, and gaining access to new technologies. Collaborations with healthcare providers and patient advocacy groups also help companies improve product adoption and customer loyalty.

Key Incontinence And Ostomy Care Products Companies:

The following are the leading companies in the incontinence and ostomy care products market. These companies collectively hold the largest market share and dictate industry trends.

- Essity

- Kimberly-Clark Corporation

- Attends Healthcare Products, Inc.

- ABENA A/S

- Coloplast Corp

- Ontex Group

- PAUL HARTMANN AG

- First Quality Enterprises, Inc.

- Hollister Incorporated

- Cardinal Health

- Unicharm Corporation

- Convatec Group PLC

- B. Braun SE

- BD

- Medline

- Welland Medical Limited

- Salts Healthcare

Recent Developments

-

In May 2024, Coloplast Corp. announced the expansion to its Luja Portfolio by introducing a next-generation catheter designed specifically for women. Compared to Coloplast's existing SpeediCath Compact Eve, Luja Female features 28% less plastic and a 22% reduced carbon footprint. Additionally, the product's container material is fully recyclable, further aligning with Coloplast's commitment to sustainability.

-

In May 2024, Coloplast Corp. announced the two key developments. Firstly, the company received reimbursement approval in the UK for Heylo, a groundbreaking digital leakage notification system that is the world's first of its kind. This innovative technology aims to improve the lives of individuals living with ostomies. Additionally, Coloplast expanded its SenSura Mio ostomy range with the introduction of two new products, further enhancing its offerings in this area.

-

In April 2024, Medline and Consure Medical announced a strategic partnership, under which Medline will exclusively distribute the QiVi MEC male external urine management device. This innovative solution is designed to help prevent catheter-associated urinary tract infections (CAUTI) and incontinence-associated dermatitis (IAD), improving the health and well-being of individuals who rely on the device.

-

In January 2023, Hollister Incorporated was awarded a sole-source contract for its enterostomal therapy products through Premier's SURPASS program. This agreement, which aims to drive clinical outcomes, maximize cost savings, and ensure excellent supply chain performance, will grant Premier SURPASS members access to Hollister's full portfolio of Ostomy products, at their discretion. The comprehensive portfolio includes CeraPlus Ostomy Products, the only U.S. brand infused with ceramide to protect healthy skin.

Incontinence And Ostomy Care Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.8 billion

Revenue forecast in 2030

USD 25.7 billion

Growth Rate

CAGR of 5.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Report updated

July 2024

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Type, Region

Regional Scope

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden Denmark; Norway; Japan; China, India; South Korea; Singapore; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Essity; Kimberly-Clark Corporation, Attends Healthcare Products, Inc.; ABENA A/S; Coloplast Corp.; Ontex Group; PAUL HARTMANN AG; First Quality Enterprises, Inc.; Hollister Incorporated, Cardinal Health; Unicharm Corporation; Convatec Group PLC; B. Braun SE; BD; Medline; Welland Medical Limited

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Incontinence And Ostomy Care Products Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global incontinence and ostomy care products market report on the basis of type, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Incontinence Care Products

-

Absorbents

-

Incontinence Bags

-

Others

-

-

Ostomy Care Products

-

Ostomy Bags

-

Colostomy Bags

-

Ileostomy Bags

-

-

Urostomy Bags

-

Deodorants

-

Skin Barriers

-

Irrigation Products

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global incontinence and ostomy care products market size was estimated at USD 17.9 billion in 2023 and is expected to reach USD 18.8 billion in 2024.

b. The global incontinence and ostomy care products market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 25.7 billion by 2030.

b. The adsorbents segment dominated the market for incontinence and ostomy care products and accounted for a revenue share of 75.5% in 2023. The segment is expected to expand at the highest CAGR of 5.8% from 2024 to 2030.

b. Europe dominated the incontinence and ostomy care products market in 2023 with the largest revenue share of around 42.5%. Factors such as an increase in the number of stoma patients due to Crohn’s disease, ulcerative colitis, or IBD are expected to drive the market in Europe during the forecast period.

b. Some key players operating in the incontinence & ostomy care products market include Kimberly-Clark Corporation, Coloplast Corp, Unicharm Corporation, Convatec Group PLC, Hollister Incorporated, B. Braun SE, among others.

b. Key factors that are driving the incontinence & ostomy care products market growth include high prevalence rates of diseases such as inflammatory bowel disease, ulcerative colitis, Crohn’s disease, increasing awareness levels, and growing patient affordability globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."