- Home

- »

- Automotive & Transportation

- »

-

India Electric Vehicle Market Size, Industry Report, 2030GVR Report cover

![India Electric Vehicle Market Size, Share & Trends Report]()

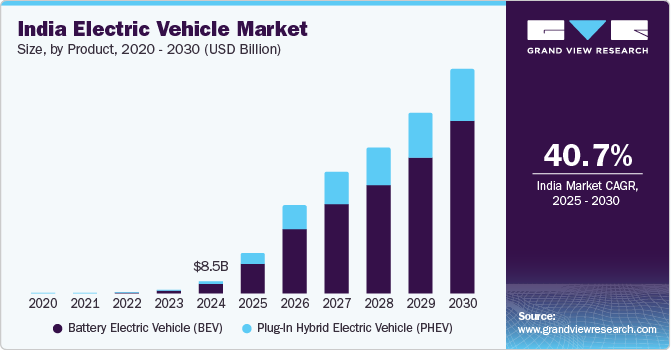

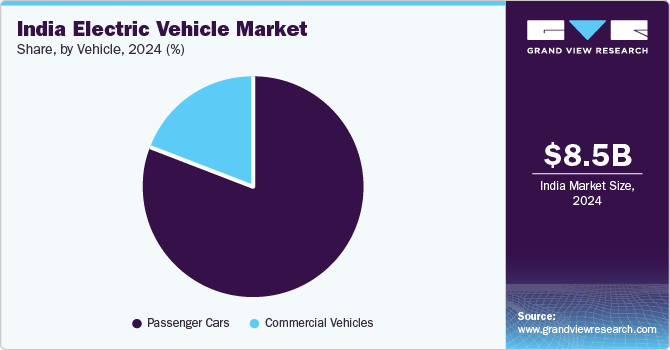

India Electric Vehicle Market Size, Share & Trends Analysis Report By Product (Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle), By Vehicle (Passenger Cars, Commercial Vehicles), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-640-4

- Number of Report Pages: 60

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

India Electric Vehicle Market Size & Trends

The India electric vehicle market size was valued at USD 8.49 billion in 2024 and is projected to grow at a CAGR of 40.7% from 2025 to 2030. This growth is fueled by government initiatives, such as subsidies and infrastructure development, designed to encourage the adoption of Electric Vehicles (EVs). Moreover, rising consumer awareness about environmental sustainability and the increasing cost-effectiveness of EVs further drive market growth, positioning India as a key player in the global EV landscape.

The Indian government has introduced various schemes and policies aimed at promoting EV adoption. For instance, The FAME India Scheme is a pivotal initiative for incentivizing advanced battery and registered vehicles. It is focused on providing affordable & environment-friendly public transportation and would be applicable to vehicles used for public transport or those registered for commercial purposes in e-3W, e-4W, and e-bus segments. Privately owned registered e-2Ws would also be covered under the scheme as a mass segment. The India electric vehicle industry is significantly impacted by these initiatives, driving growth in EV sales.

Environmental concerns also play a significant role in shaping the market landscape. With growing awareness of climate change and air pollution, electric vehicles are being viewed as a cleaner alternative to traditional fossil fuel-powered cars. Furthermore, innovations in battery technology have led to improved energy density and reduced production costs, enhancing the overall performance and range of electric vehicles. These developments help address common consumer apprehensions regarding usability and make EVs more accessible to a wider audience.

In addition, growing fuel prices have prompted many consumers to consider EVs as a cost-effective alternative. The economic burden of fluctuating fuel costs, combined with the long-term savings associated with EV ownership, such as lower fuel and maintenance expenses, makes EVs an attractive option for a growing number of buyers. Together, these drivers are transforming the Indian automotive landscape and positioning EVs as a pivotal component of the country's future transportation.

Product Insights

The Battery Electric Vehicle (BEV) segment dominated the market with a 75.6% share in 2024. Increasing awareness of environmental issues has significantly driven the demand for BEVs in India. These vehicles produce zero tailpipe emissions, aligning with government initiatives such as the FAME India scheme, which incentivizes electric mobility. Moreover, advancements in battery technology have significantly boosted the performance and affordability of BEVs, effectively addressing consumer concerns regarding range and usability. For instance, traditional automakers such as Tata Motors are increasingly focusing on EV offerings to cater to a wide array of consumer preferences. The Tata Punch EV has gained popularity due to its competitive pricing and strong safety ratings, making it a smart option for buyers.

The Plug-In Hybrid Electric Vehicle (PHEV) segment is expected to grow at a significant CAGR over the forecast period. As awareness of climate change and air pollution increases, a growing number of Indian consumers are gravitating toward PHEVs, which combine the benefits of both electric and gasoline power. This dual capability enables drivers to reduce emissions while alleviating concerns about range anxiety, as they can seamlessly switch to gasoline when necessary. In addition, automakers in India are responding to this demand by launching models specifically designed for the hybrid market, incorporating features that enhance both performance and fuel efficiency.

Vehicle Insights

The passenger cars segment dominated the market with the highest revenue share in 2024. The growing urbanization in India has led to increased congestion and pollution in metropolitan areas. As city dwellers seek cleaner alternatives to traditional vehicles, electric passenger cars are becoming a preferred choice. For instance, cities such as Delhi and Mumbai have implemented stricter emissions regulations, prompting consumers to consider EVs as a viable option. Moreover, various automakers, such as Hyundai and Kia, are launching new electric models, such as the Hyundai Kona Electric and Kia EV6, which have received positive responses from consumers due to their performance and features.

The commercial vehicle segment is expected to grow at a significant CAGR over the forecast period. The government has been actively promoting electric mobility through various initiatives, which has led to a surge in the registration of electric heavy passenger vehicles. For instance, the Ministry of Heavy Industry introduced the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) scheme. This initiative aims to accelerate India's transition to electric mobility by providing targeted incentives and developing necessary infrastructure with a budget of USD 1.3 billion. Moreover, the replacement demand for older vehicles is contributing to the growth of the commercial vehicle segment. The mandatory Vehicle Scrappage Policy for older government vehicles also supports this trend, encouraging fleet renewal.

Key India Electric Vehicle Company Insights

The India electric vehicle industry is rapidly expanding, with key players such as Tata Motors, Mahindra Electric, Ola Electric, and Hero Electric driving its growth. Tata Motors dominates the electric passenger vehicle segment, mainly due to the success of models such as the Nexon EV. Mahindra Electric is focused on electric three-wheelers and commercial EVs but plans to expand its passenger EV portfolio. Ola Electric and Hero Electric lead the two-wheeler market, while new entrants and startups such as Ather Energy and BYD are also making their mark.

-

Tata Motors has established a comprehensive ecosystem through Tata UniEVerse, which offers a range of e-mobility solutions, including charging infrastructure and innovative retail experiences. Tata Motors has gained significant traction with its electric models, such as the Nexon EV and Tiago EV, and is focused on expanding its presence across various cities to enhance accessibility.

-

Ather Energy specializes in electric scooters. The company is recognized for its innovative approach to design and technology, offering features such as smart connectivity and efficient charging solutions. Ather Energy has made strides in building a robust charging network, which is crucial for addressing range anxiety among potential buyers. As part of the India electric vehicle industry, Ather Energy's initiatives support the growing adoption of electric mobility in the country, with models like the Ather 450X gaining popularity due to their competitive pricing and advanced features.

Key India Electric Vehicle Companies:

- Audi AG

- BMW AG

- Hyundai Motor India

- Jaguar Land Rover Limited

- Mahindra&Mahindra Ltd.

- Mercedes-Benz Group AG

- JSW MG Motor India Pvt. Ltd.

- Olectra Greentech Limited

- Tata Motors Limited

- Toyota Motor Corporation

Recent Development

-

In August 2024, JSW MG Motor India launched several initiatives to enhance the EV ecosystem, including the eHUB app, which streamlines the charging process by providing a unified platform that allows users to locate, reserve, and pay for charging stations across various networks. The company introduced Project REVIVE, aimed at repurposing used EV batteries in collaboration with organizations such as TERI and Lohum. Furthermore, all future MG vehicles will feature the MG-Jio Innovative Connectivity Platform.

-

In June 2024, the Bureau of Indian Standards (BIS) introduced new safety standards for EVs in India. These standards address critical aspects such as battery safety, vehicle performance, and electromagnetic compatibility. The initiative results from the growing concerns about EV safety following incidents of battery fires.

India Electric Vehicle Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 152.21 billion

Growth rate

CAGR of 40.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

November 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Vehicle

Key companies profiled

Audi AG; BMW AG; Hyundai Motor India; Jaguar Land Rover Limited; Mahindra&Mahindra Ltd.; Mercedes-Benz Group AG; JSW MG Motor India Pvt. Ltd.; Olectra Greentech Limited; Tata Motors Limited; Toyota Motor Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Electric Vehicle Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India electric vehicle market report based on product and vehicle:

-

Product Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Battery Electric Vehicle (BEV)

-

Plug-In Hybrid Electric Vehicle (PHEV)

-

-

Vehicle Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Passenger Cars

-

Commercial Vehicles

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."