- Home

- »

- Medical Devices

- »

-

India Health Insurance Market Size & Share Report, 2030GVR Report cover

![India Health Insurance Market Size, Share & Trends Report]()

India Health Insurance Market Size, Share & Trends Analysis Report By Duration (Life-Time Coverage, Term Insurance), By Type of Insurance Provider, By Distribution Channels, By Customer Type, By State, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-049-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The India health insurance market size was valued at USD 12.86 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 11.55% from 2023 to 2030. Health insurance coverage is rapidly increasing in India due to the rising costs of high-quality healthcare coupled with rising income levels, longer life expectancies, and an epidemiological change towards no communicable diseases. The outbreak of COVID-19 has made individuals more aware of life’s unpredictability and uncertainties and their lack of preparations in the occurrence of a medical emergency. As a result, over the past two years, the health insurance industry in India has undergone a significant shift. Customers' attitudes have changed considerably, as has their need for health insurance. The COVID-19 pandemic and rise in premium prices have contributed to the massive rush by people to insure themselves and their families against catastrophic out-of-pocket medical costs, as the total health insurance premium collected in India increased by a whopping around 25% in a year.

The outbreak of COVID-19 has made individuals more aware of life’s unpredictability and uncertainties and their lack of preparations in the occurrence of a medical emergency. As a result, over the past two years, the health insurance industry in India has undergone a significant shift. Customers' attitudes have changed considerably, as has their need for health insurance. The COVID-19 pandemic and rise in premium prices have contributed to the massive rush by people to insure themselves and their families against catastrophic out-of-pocket medical costs, as the total health insurance premium collected in India increased by a whopping around 25% in a year.

The health insurance market in India is expanding due to strong democratic factors, growing partnerships, dynamic distribution networks, and significant government initiatives. For instance, in November 2021, the Indian government and the World Bank entered into an agreement for a USD 40 million initiative to improve Meghalaya's health services, including its health insurance program. Moreover, in June 2021, the government of India extended a USD 66.85 thousand (Rs. 50 lakhs) insurance coverage program for healthcare professionals nationwide through the next year.

Furthermore, health planners in India have recently pushed for the expansion of health insurance as a crucial element of the nation's healthcare reform and poverty reduction goal. The goal of "universal healthcare for all by 2020" has been extended to 2022, making it one of the most ambitious schemes for healthcare reform in India. The implementation of universal health insurance, which has been suggested as a possible means of reducing health disparities and OOP health expenditure, would be a necessary step in achieving this objective.

The insurance industry in India is expected to introduce new trends including product innovation, multi-distribution, better claims management, and regulatory developments in the Indian market as a result of rising incomes, exponential expansion in purchasing power, and household savings.

Type of Insurance Provider Insights

The public sector insurers segment dominated the overall market with the largest revenue share of 59.08% in 2022. A decade ago, LIC was the only provider of life insurance in the whole history of the Indian insurance industry. However, in 2000, the insurance industry in India grew rapidly as a result of the entry of new private-sector businesses. In India, the insurance industry is currently dominated by 24 life insurance companies and 30 non-life insurance companies.LIC, New India, National Insurance, United Insurance, and Oriental are the only government-controlled companies that stand high in terms of both market share and contribution to the Indian insurance industry.

The private sector insurers segment is expected to grow at a lucrative CAGR of 15.50% over the forecast period. The private health insurance market in India is booming as more and more private health insurers enter the market to offer specialized healthcare coverage and high-quality services to a wider segment of the population. Furthermore, several private insurance companies have completed joint ventures with foreign insurance entities to initiate their insurance businesses in India.

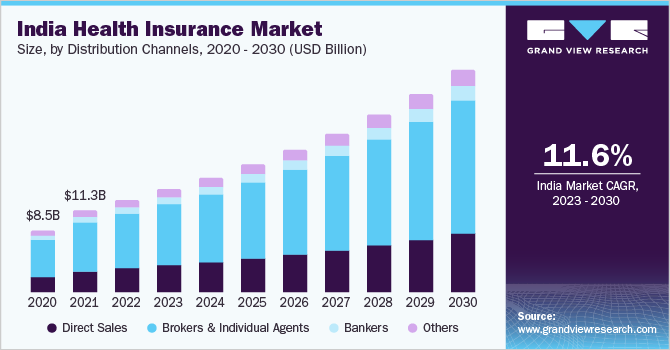

Distribution Channels Insights

The brokers and individual agents segment dominated the market with a revenue share in 2022. Traditionally, health insurance has been sold by brokers and individual agents with personal relationships with their customers. In terms of life and health insurance, in particular, there is a trusting relationship. In terms of premium distribution, the majority of health insurance policies are sold in person or through middlemen.

The direct sales segment is expected to grow at a significant pace over the forecast period. This is attributed to self-directed or direct insurance distribution channels that allow health insurance entities to sell their insurance without the interference of an intermediary. Operating through this channel has the benefit of requiring no commission payments to insurance agents. Hence, maximize profits. Insurance businesses use their own sales staff and direct channels for business, including the internet, telesales, and e-commerce. This channel also includes using a CRM and communication tool like CallHub to improve and streamline their procedure.

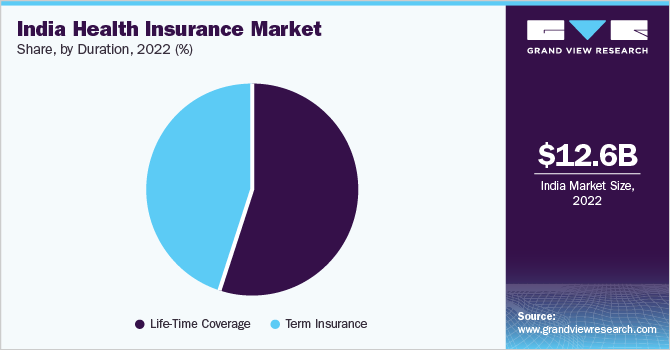

Duration Insights

The lifetime coverage segment dominated the market with a revenue share in 2022. A provision in the customer's health insurance policy allows for lifetime renewal. It enables customers to continue receiving insurance without having to apply for a new policy. This shortens the process of applying for a new policy and avoids the fees involved with reapplying. Moreover, the IRDAI states that there is no upper age limit for lifetime renewability benefits. Hence, the policy's advantages are available to all policyholders throughout the rest of their lives. Such factors are expected to boost segment growth.

The term insurance segment is projected to grow at a significant CAGR over the forecast period. This is attributed due to the term life insurance is more affordable than other types of health insurance policies and normally has lower premium prices. Furthermore, term life insurance provides low-cost, fixed-term financial protection for some time, often five to thirty years. The optimum use for this kind of life insurance is to cover short-term financial necessities including income replacement, debt repayment, and childcare expenses.

Customer Type Insights

The individual segment held a major market share in 2022. Individuals with health insurance have three options for health insurance: Affordable Care Act plans (ACA), temporary plans, and medical indemnity plans. There are numerous different individual health insurance plans available within these categories, and individual health insurance takes many different forms. The benefits of ACA plans cover a wide range of medical services, both inpatient and outpatient, and can help you save money on regular doctor visits, prescription medications, preventative care, hospital stays, and other expenses.

Corporate houses/business units are expected to hold a significant share during the forecast period. To give employees financial and medical security, corporate health insurance is made to offer them a flexible health insurance plan. As corporate insurance plans for employees are frequently less expensive than private ones, many people choose to use them. Risk insurers provide incentives like discounts and specialist items to assist cut total healthcare expenses.

State Insights

Maharashtra state dominated the India health insurance market in 2022. In India, Maharashtra accounts for the largest percentage of insurance premiums. Furthermore, the state government undertaking various initiatives to cover more population under health insurance. For instance, the Mahatma Jyotiba Phule Jan Arogya Yojana offers coverage for a variety of medical costs incurred as a result of the insured's hospitalization for a sum insured amount of USD1816.61 (INR 1.5 Lakh) annually. By cashless hospitalization, an individual or the complete family can obtain annual coverage of USD1816.61 (INR 1.5 lakh).

Tamil Nadu state is expected to showcase a lucrative growth rate during the forecast period. Untapped opportunities and rising health-related issues have been significant sources of worry for Tamil Nadu people. As a result, it opens up new growth opportunities for Tamil Nadu's health insurance industry.

Key Companies & Market Share Insights

The Indian health insurance market is becoming more competitive as a result of the need for high-quality, affordable health policies. Therefore, companies undertake various strategic initiatives such as partnerships, collaborations, and new service launches, to strengthen their regional presence. For Instance, in November 2022, Star Health and Allied Insurance declared the launch of the Star Patient Care Insurance Policy, which goals to offer customers comprehensive health and wellness benefits at a reasonable price. Moreover, the Policy was developed to close the gap between inpatient hospital costs, which are covered by the health insurance sector, and outpatient costs. Some prominent players in the India health insurance market include:

-

Star Health and Allied Insurance Co Ltd.

-

Aditya Birla Group

-

Niva Bupa Health Insurance Company Limited

-

Bajaj Allianz Health Insurance

-

Bharti AXA Life Insurance

-

New India Insurance

-

United India

-

ICICI Lombard

-

National Insurance Company

-

Tata AIG General Insurance Company Limited

India Health Insurance Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 14.09 billion

Revenue forecast in 2030

USD 30.29 billion

Growth rate

CAGR of 11.55% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Duration, distribution channels, type of insurance provider, customer type, state

Key companies profiled

Star Health and Allied Insurance Co Ltd.; Aditya Birla Group; Niva Bupa Health Insurance Company Limited; Bajaj Allianz Health Insurance; Bharti AXA Life Insurance; New India Insurance; United India; ICICI Lombard; National Insurance Company; Tata AIG General Insurance Company Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

India Health Insurance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India health insurance market report based on duration, type of insurance provider, distribution channel, customer type, and state:

-

Duration Outlook (Revenue, Million, 2018 - 2030)

-

Life-Time Coverage

-

Term Insurance

-

-

Type of Insurance Provider Outlook (Revenue, Million, 2018 - 2030)

-

Public Sector Insurers

-

Private Sector Insurers

-

Standalone Health Insurance Companies

-

-

Distribution Channels Outlook (Revenue, Million, 2018 - 2030)

-

Direct Sales

-

Brokers and Individual Agents

-

Bankers

-

Others

-

-

Customer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Individuals

-

Corporate houses/Business Units

-

Others

-

-

State Outlook (Revenue, USD Million, 2018 - 2030)

-

Maharashtra

-

Tamil Nadu

-

Karnataka

-

Delhi

-

Gujrat

-

Rest of state

-

Frequently Asked Questions About This Report

b. The India health insurance market size was estimated at USD 12.86 billion in 2022 and is expected to reach USD 14,094.0 million in 2023.

b. The India health insurance market is expected to grow at a compound annual growth rate of 11.55% from 2023 to 2030 to reach USD 30,291.2 million by 2030.

b. Maharashtra dominated the India health insurance market with a share of 29.00% in 2022. In India, Maharashtra accounts for the largest percentage of insurance premiums. Furthermore, the state government undertaking various initiatives to cover more population under health insurance.

b. Some key players operating in the India health insurance market includeStar Health and Allied Insurance Co Ltd., Aditya Birla Group, Niva Bupa Health Insurance Company Limited, Bajaj Allianz Health Insurance, Bharti AXA Life Insurance, New India Insurance, United India, ICICI Lombard, National Insurance Company, Tata AIG General Insurance Company Limited.

b. Key factors that are driving the market growth include the rising costs of high-quality healthcare and the rising demand for it as a result of rising income levels, longer life expectancies, and an epidemiological change towards no communicable diseases.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."