- Home

- »

- Clinical Diagnostics

- »

-

India Molecular Diagnostics Market, Industry Report, 2033GVR Report cover

![India Molecular Diagnostics Market Size, Share & Trends Report]()

India Molecular Diagnostics Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Instruments, Reagents & Consumables), By Test Location, By Technology, By Platform, By Application, By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-016-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

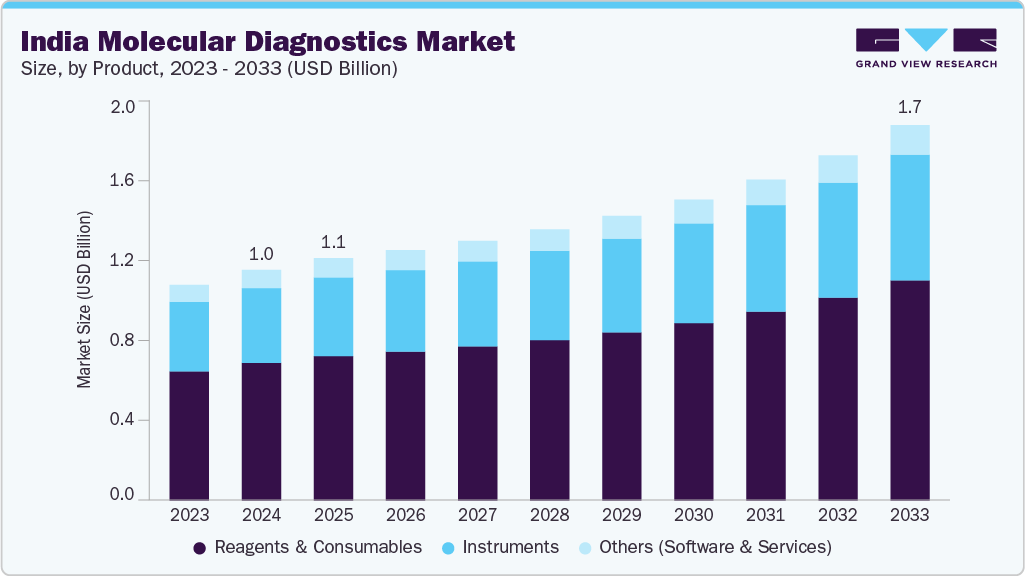

The India molecular diagnostics market size was estimated at USD 1,054.80 million in 2024 and is projected to reach USD 1,717.27 million by 2033, growing at a CAGR of 5.63% from 2025 to 2033. The growth is attributed to an ever-increasing burden of infectious diseases, heightened awareness of early disease detection, and greater access to advanced diagnostic technologies within healthcare settings. PCR-based assays and sample-to-answer platforms are quickly gaining market share due to their accuracy, speed, and usability in decentralized testing sites.

Moreover, the rising incidence of infectious diseases in India is one of the primary factors impacting the India molecular diagnostics industry, particularly for polymerase chain reaction (PCR) testing. Diseases, including tuberculosis (TB), hepatitis, HIV, and vector-borne diseases such as malaria and dengue, continue to be important public health problems. According to the National Tuberculosis Elimination Programme (NTEP), there were approximately 4.4 lakh deaths linked to TB in 2021, which was nearly 29% of TB-related deaths globally. The burden of these diseases necessitates the use of new diagnostic technologies, such as PCR, to ensure accurate detection in a timely manner, allowing patients to receive treatment and enabling control measures to be implemented. In India, roughly 10 million people die every year, and nearly one-fourth of these deaths-over 2.34 million deaths-are due to communicable diseases. Within this group, respiratory infections, specifically influenza and pneumonia, are the leading causes of death and represent the greatest risk to young children and elderly individuals. While respiratory infections have always accounted for the largest share of deaths due to communicable diseases, respiratory infections showed an increase in their impact in the time period of 2020 to 2022 during the COVID-19 pandemic.

The rapid expansion of personalized medicine, oncology, and genetic testing has propelled the growth of the molecular diagnostics market in India. Personalized medicine is a novel approach to medical treatment that considers individual characteristics, such as genetic information, lifestyle, and environment, to develop medicines that are more effective, precise, and targeted to the individual. Promising forces propelling the growth include the advancement of genomic technologies, an increase in the prevalence of chronic and genetic diseases, and rising awareness and demand for personalized medicine. PCR-based products, such as Truenat MTB/RIF, Roche Cobas EGFR Mutation Test, and Qiagen Therascreen KRAS/NRAS PCR kits, are helping clinicians make genomic testing a success, supporting precision treatment plans.

In oncology, the movement toward personalized treatment approaches has transformed cancer management in India. Common cancer therapy typically takes a uniform approach that is not always effective for the patient. Personalized treatment established through genomic profiling allows oncologists to choose therapies that are more likely to be effective based on the genetic profiles of the patient and the tumor. For example, targeted therapies such as Osimertinib for EGFR mutations or trastuzumab for HER2-positive breast cancer utilize specific PCR tests, including Roche Cobas (EGFR) and Qiagen (HER2) PCR kits, to identify suitable candidates. These PCR-based diagnostics enable the rapid and precise identification of mutations, facilitating timely and personalized therapy, which in turn leads to better outcomes and a lower likelihood of side effects in some patients.

Moreover, government initiatives and public-private partnerships (PPPs) have played a crucial role in developing laboratory infrastructure across India. For example, the Pradhan Mantri Jan Arogya Yojana (PMJAY) aims to provide more universal and affordable healthcare services to underprivileged populations, thereby increasing demand for diagnostic services. In partnerships like those in Rajasthan, private companies manage laboratories, install high-quality diagnostic machines, and provide online reporting using Laboratory Information Management Systems (LIMS). This results in more testing capacity, faster turnaround times, and higher accessibility in semi-urban and rural locations. The Ministry of Health and Family Welfare, Government of India highlights the massive scale-up of new TB laboratory capacity: There was an increase of 80% in Designated Microscopy Centers (DMCs) from 13,583 in 2014 to 24,573 in 2023, along with 6,496 new molecular diagnostic laboratories, and 81 Culture and Drug Susceptibility Testing (DST) laboratories by 2023, demonstrating remarkable growth of the molecular diagnostic infrastructure across India.

Additionally, the rise in the presence of private diagnostic chains has significantly contributed to the market's growth. Major players, such as Dr. Lal PathLabs, Metropolis Healthcare, and Thyrocare Technologies, are deliberately expanding their presence in towns classified as Tier 2, Tier 3, and even Tier 4, thereby providing more connection and access to urban as well as rural healthcare in India. Similarly, Co-Diagnostics, Inc. announced the opening of the oligonucleotide synthesis facility of CoSara Diagnostics Pvt. Ltd. in December 2024 in Ranoli, India. As part of the "Make in India" initiative, this facility will produce Co-Dx's patented Co-Primers chemistry used in their laboratory-based PCR tests, as well as at-home and point-of-care PCR testing platforms. Localizing production enables Co-Dx to have better access to India's large and expanding healthcare systems, while also supporting domestic manufacturing and ensuring regulatory compliance.

In conclusion, the molecular diagnostics market in India is rapidly evolving, driven by the push for personalized medicine, the introduction of new oncology therapies, and advancements in genomic technologies. Strong government support, the expansion of private diagnostic networks, and domestic manufacturing through the “Make in India” campaign are improving accessibility and infrastructure. All these factors are establishing an ecosystem positioning India as a destination for precision diagnostics and next-generation healthcare.

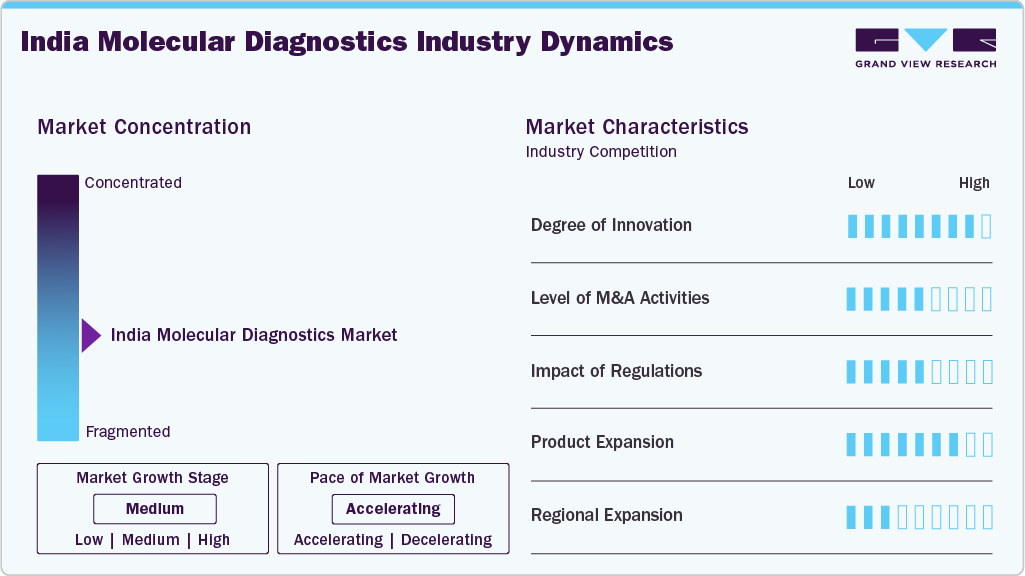

Market Concentration & Characteristics

There is a high level of innovation in the India molecular diagnostics market stemming from the ongoing progress in genomic technologies, automation, and bioinformatics. The realization of real-time PCR, next-generation sequencing (NGS), and point-of-care molecular testing has changed the precision and efficiency of testing. Ongoing innovation is also occurring due to the incorporation of artificial intelligence and digital platforms for data interpretation, which enables the creation of personalized and precision-based solutions in medicine across both public and private healthcare sectors.

The Indian molecular diagnostics sector has a medium level of mergers and acquisitions (M&A) activity. Although not numerous, the formation of strategic partnerships and collaborations between global players and local firms is increasing. These partnerships and collaborations typically involve technology transfer, capacity building, and size manufacturing, allowing companies to enhance their portfolios and market access in an increasingly advanced diagnostics demand.

The regulatory impact is moderate in the molecular diagnostics market as India continues to grow and develop in healthcare and diagnostics. Government initiatives, such as “Make in India” and Ministry of Health programs, are supporting growth through funding, standardization, and quality control. Nevertheless, launching a new product can pose a moderate challenge when the elaborate contracting and compliance process creates obstacles to new, innovative, and/or imported technologies.

The India molecular diagnostics market is experiencing considerable growth in product offerings, with an increasing number of tests available for various disease categories, including oncology, infectious diseases, genetic disorders, and women's health. Companies are expanding their offerings with multiplex PCR kits, rapid diagnostics, and home tests. These trends are driven by increased awareness of health, improvement in laboratory practices, and development of diagnostic networks in Tier 2 and Tier 3 cities.

Product Insights

The reagents & consumables segment held the largest revenue share of 59.75% in 2024, due to new diagnostic tests, government support, and regulatory approvals. Reagents and consumables, such as kits, probes, enzymes, and sample materials, are fundamental to performing precise and efficient molecular testing. The increasing prevalence of infectious diseases and genetic disorders, along with growing attention to early diagnosis, is generating interest in high-quality reagents and consumables among hospitals, diagnostic laboratories, and review centers in India.

In addition, the instrument segment of the India molecular diagnostics market is expected to grow the fastest during the forecast period. Government backing for entrepreneurship, accurate diagnostic testing systems, technological changes, and increased research, development, and innovation are fueling the trend in the Indian market for molecular diagnostic products. Moreover, increased awareness of the need for early detection, along with rising demand and a willingness to pay for precision-based diagnostics, is also driving the demand and adoption of these advanced instruments in hospitals, diagnostic laboratories, and research labs. For example, Abbott launched the Alinity m molecular diagnostics analyzer in April 2024, along with the GLP Systems Track automation platform, during its rollout across multiple regions, including India. This group of new diagnostic testing instrument platforms continues to enhance laboratory testing services and capabilities, offering increased efficiencies in throughput through high-throughput, automated workflows that feature multiple integrated assay options. The introduction of this innovative technology into molecular diagnostics will help optimize a laboratory's operational efficiencies while addressing the urgent need within the laboratory-testing marketplace for rapid molecular-based testing.

Test Location Insights

The Point of Care (POC) test location segment held the largest share of the India molecular diagnostics industry in 2024, propelled by the demand for rapid, on-site testing, technological innovations, and strategic expansions from major global players. POC testing allows timely and accurate diagnosis and treatment at or near the patient location, including hospitals, clinics, and primary care sites. This convenience reduces the turnaround time of testing, enhances patient outcomes, and supports national disease surveillance efforts in India, particularly in rural and semi-urban areas where access to central laboratories is limited. In July 2024, Roche completed the acquisition of LumiraDx’s point-of-care technology and received all necessary antitrust and regulatory clearances. The acquisition strengthened Roche’s diagnostics portfolio, representing all areas of diagnostic testing, including clinical chemistry, immunochemistry, coagulation, and molecular diagnostics, while also advancing its aim of increased access to POC testing in primary care settings. The inclusion of LumiraDx technology will allow Roche to support India’s heightened demand for decentralized testing solutions through the development of rapid, portable, and accurate molecular testing solutions.

Additionally, the self-test or OTC test location segment is expected to grow the fastest during the forecast period, driven by advances in technology, increased consumer awareness, and supportive regulations. This segment comprises laboratory-based diagnostics that individuals use to test themselves at home or in a non-clinical setting, facilitating early disease detection and health monitoring without the need for a laboratory or hospital visit. The convenience, rapidity, and privacy of self-testing have led to increased consumer popularity across urban and semi-urban populations in India. Various innovative self-test products have entered the market to meet the demand of this emerging segment. For example, Mylab Pathocatch, which is an antigen lateral flow test for COVID-19, allows the consumer to conduct testing in the home, without a professional's intervention. Meril Diagnostics COVID-19 Antigen Self-Test and Alere Panbio COVID-19 Antigen Self-Test by Abbott Diagnostics Korea Inc. are designed for consumer ease of use, providing rapid diagnostic results from nasal swab samples. Another one-step COVID-19 antigen test suitable for consumer use in the home is the SD Biosensor ULTRA Covi-Catch. These products use advanced technology, including but not limited to lateral flow immunoassays or enzyme-linked immunosorbent assay (ELISA) formats, to ensure accurate results.

Technology Insights

Polymerase Chain Reaction (PCR) held the largest share of the India molecular diagnostics market in 2024, due to its accuracy, cost-effectiveness, and accessibility. PCR-based methods are particularly effective for detecting known mutations in specific genes, making them a trusted tool in clinical genetics. According to a study published in June 2025, PCR testing demonstrates high detection rates for carriers of major genetic disorders, including over 99% for Fragile X syndrome, 95% for spinal muscular atrophy (SMA), and 90% for cystic fibrosis. These figures underscore PCR’s critical role in ensuring reliable identification of carriers for some of the most clinically significant inherited conditions.

Moreover, the others segment is expected to grow the fastest during the forecast period. Open PCR and other PCR formats remain important for smaller laboratories and research institutions that require open, flexible assay customizability for their systems. Open PCR-format systems enable the laboratory to adjust the protocol, observe the results when testing new primer sets, or locally validate a kit, a practice that is gaining traction as regulatory reform in India aims to support indigenous assay development.

Platform Insights

The sample-to-answer systems segment held the largest share of the India molecular diagnostics industry in 2024. The sample-to-answer approach integrates all elements of molecular testing, from nucleic acid extraction, amplification, and detection, into a single cartridge or consumable that requires limited technical expertise to operate. Indian businesses such as Molbio Diagnostics have led this approach in the form of the Truenat platform, which is a World Health Organization (WHO) approved test for tuberculosis diagnosis. Truenat's success in the national TB elimination program has paved the way for other battery-operated molecular systems that are portable enough to be used in peripheral health facilities. Disposable point-of-care PCR platforms developed by Indian companies Mylab Discovery Solutions and CoSara Diagnostics are similar innovations targeting the need to decentralize molecular testing to reach inadequately served areas. These sample-to-answer systems align with India's public health goals of conducting molecular testing quickly in situ for infectious diseases, maternal diseases, and antimicrobial resistance monitoring.

Moreover, the high-throughput closed systems segment is expected to grow at the fastest CAGR during the forecast. These systems, which automate sample processing and analysis, are becoming increasingly essential in clinical and research laboratories due to their efficiency, accuracy, and ability to handle large volumes of tests. By minimizing human error and reducing turnaround times, they significantly improve the reliability of diagnostic results.

Application Insights

The respiratory infections segment held the largest share of the India molecular diagnostics industry in 2024. Respiratory infections are a primary cause of morbidity and mortality in the Indian context, particularly in children. An observational study of severe acute respiratory infection (SARI) cases in rural West Bengal from June 2022 to 2023 revealed that 48.7% of SARI cases were caused by bacterial pathogens, 30% by viral pathogens, and 21.36% had a mixed etiological background. These results underscore the multifaceted etiologies of respiratory infections and the need for multiplex molecular diagnostic platforms that enable accurate identification of causative agents of respiratory infections.

Moreover, the sexually transmitted infections (STIs) and women's health is the fastest growing segment during the forecast, owing to its rising prevalence and increasing awareness, government-supported screening programs, and advancements in the design of assays. STIs remain a significant public health concern in India. A 2023 study reported that the prevalence of STIs among the general population ranges from 0% to 3.9% for four curable STIs. However, among the key populations, a higher prevalence of STIs was reported, with studies commissioned reporting a prevalence of 14-20%. In the field of women's health, a study by the Indian Council of Medical Research (ICMR) reported that 35% of Indian adult women show a presence of metabolic syndrome, which increases their risk of developing gynecological cancers such as ovarian, endometrial, cervical, vaginal, and vulvar cancer.

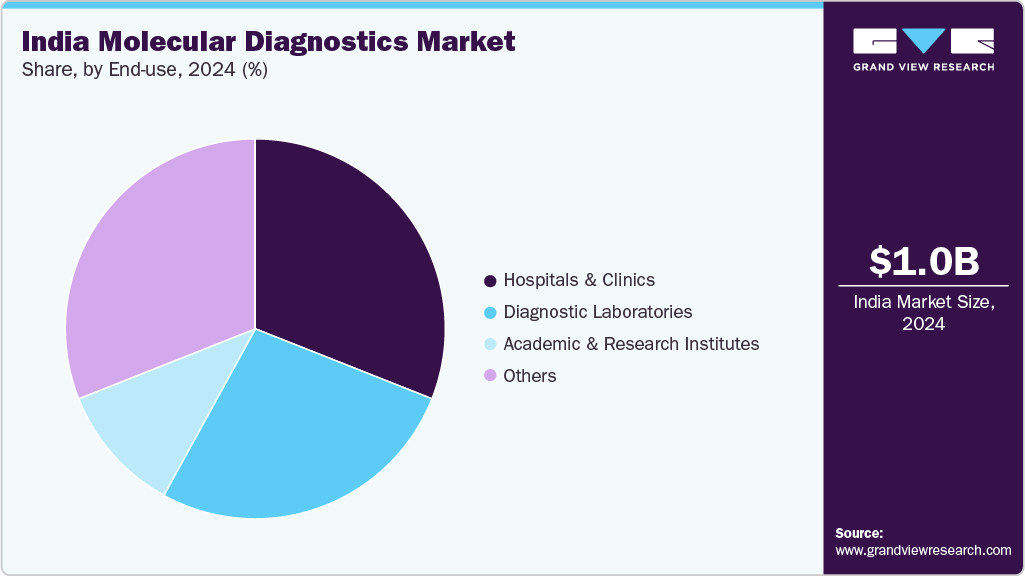

End-use Insights

Hospitals and clinics held the largest share of the India market for molecular diagnostics in 2024, due to their key role in diagnosis and treatment decisions for patients. Molecular testing is being rapidly adopted in tertiary care and multispecialty hospitals, given the need for faster and more accurate detection of infectious and chronic diseases. Hospitals in India are increasingly investing in the in-house capability for their molecular diagnostic platform to improve turnaround time and clinical care. For example, in 2024, Apollo Hospitals introduced next-generation sequencing (NGS)-based oncology testing to its molecular pathology services, enhancing access to precision medicine throughout the healthcare system. In addition, Fortis Healthcare has been partnering with diagnostic companies to offer a PCR-based or syndromic testing system for respiratory and gastrointestinal infections, aligning with India's increased efforts in hospital infection control and antimicrobial stewardship.

The others category encompasses a range of end-users, including public health agencies, pharmaceutical companies, contract research organizations (CROs), and point-of-care settings, and is the fastest growing segment during the forecast period. These entities are leveraging molecular diagnostics for disease surveillance, drug development, and population genomics. The National Centre for Disease Control (NCDC) and ICMR have been using molecular tools for epidemiological surveillance of emerging pathogens and antimicrobial resistance across India. Pharmaceutical companies are increasingly employing molecular diagnostics for companion testing during clinical trials, a trend strengthened by the expansion of precision oncology and targeted therapies in the country.

Key India Molecular Diagnostics Company Insights

In the India molecular diagnostics market, major players are undertaking various strategic initiatives to increase their market share. New product development, collaborations, and partnerships are some such endeavors.

Key India Molecular Diagnostics Companies:

- Cepheid (Danaher Corporation)

- BioFire Diagnostics (BIOMÉRIEUX)

- Abbott

- QIAGEN

- F.Hoffmann-La Roche Ltd

- Agilent Technologies

- Bio-Rad Laboratories, Inc.

- Sysmex Corporation

- Seegene Inc.

- 3B BlackBio Dx Ltd. (TRUPCR)

- Mylab Discovery Solutions Pvt. Ltd

- altona Diagnostics

Recent Developments

-

In September 2025, BioFire Diagnostics and Altesa BioSciences announced a collaboration to provide research sites with the BIOFIRE SPOTFIRE System. This collaboration aims to enable rapid diagnosis of rhinovirus infections, particularly in patients with chronic obstructive pulmonary disease (COPD)

-

In July 2025, TRUPCR Europe Ltd and parent 3B BlackBio Dx announced completion of the acquisition of Coris BioConcept, a Belgium-based rapid diagnostic / IVD company - a major step toward European footprint expansion.

-

In July 2025, Agilent opened a new Biopharma Capability Centre in Hyderabad. This strategic innovation and collaboration hub aims to accelerate the development of life-saving medicines by offering cutting-edge technologies in chromatography, mass spectrometry, cell analysis, and lab informatics. The center is designed to foster collaboration between industry and academia, simulate real lab environments, and support faster research and development while adhering to international regulatory standards.

-

In May 2025, Agilent inaugurated its first-ever India Solution Center at its LEED Platinum-certified office in Manesar, Haryana. This center is designed to deliver end-to-end, customized workflows across life sciences, diagnostics, and applied markets. It serves as a hub for innovation, providing comprehensive support for Indian scientists and laboratories.

-

In April 2024, Cepheid announced the World Health Organization (WHO) prequalification of the Xpert HIV-1 Qualitative Test, enhancing its global accessibility.

India Molecular Diagnostics Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1,108.03 million

Revenue forecast in 2033

USD 1,717.27 million

Growth rate

CAGR of 5.63% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Test Location, Technology, Platform, Application, End-use

Key companies profiled

Cepheid (Danaher Corporation), BioFire Diagnostics (BIOMÉRIEUX), Abbott, QIAGEN, F.Hoffmann-La Roche Ltd, Agilent Technologies, Bio-Rad Laboratories, Inc., Sysmex Corporation; Seegene Inc., 3B BlackBio Dx Ltd. (TRUPCR), Mylab Discovery Solutions Pvt. Ltd, altona Diagnostics

Customization scope

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to the segment scope.

India Molecular Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the India molecular diagnostics market report based on product, application, technology, test location, platform, and end use:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Instruments

-

Reagents and Consumables

-

Others

-

-

Test Location Outlook (Revenue, USD Million, 2021 - 2033)

-

Point of Care

-

Self-Test or OTC

-

Central Laboratories

-

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Polymerase Chain Reaction (PCR)

-

Multiplex PCR

-

Real-Time PCR

-

Open PCR

-

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Sample-to-answer

-

High-throughput Closed Systems

-

Open PCR / LDT Platforms

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Gastrointestinal Infections

-

Enteric Bacterial

-

Salmonella

-

Shigella

-

Campylobacter

-

E. Coli

-

Others

-

-

Enteric Viral

-

Norovirus

-

Rotavirus

-

Adenovirus

-

Astrovirus

-

Sapovirus

-

-

Enteric Parasitic

-

Giardia Lamblia

-

Cryptosporidium spp.

-

Entamoeba Histolytica

-

-

-

Respiratory Infections

-

Viral Respiratory Infections

-

Influenza A & B

-

SARS-CoV-2

-

RSV

-

Human Metapneumovirus

-

Parainfluenza

-

Adenovirus

-

Rhinovirus / Enterovirus

-

Others

-

-

Bacterial Respiratory Infections

-

Mycobacterium Tuberculosis

-

Bordetella Pertussis

-

Mycoplasma Pneumoniae

-

Chlamydophila Pneumoniae

-

Others

-

-

-

Healthcare-Associated Infections

-

MRSA

-

Clostridium Difficile

-

Carbapenemase-Producing Organisms (CPO)

-

Others

-

Sexually Transmitted Infections & Women’s Health

-

HIV

-

Neisseria Gonorrhoeae

-

Hepatitis B (HBV)

-

Hepatitis C (HCV)

-

Trichomonas Vaginalis

-

Mycoplasma Genitalium

-

HSV

-

HPV

-

Group B Streptococcus (GBS)

-

Chlamydia Trachomatis

-

Syphilis

-

Others

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Academic & Research Institutes

-

Others

-

Frequently Asked Questions About This Report

b. The India molecular diagnostics market size was valued at USD 1,054.80 million in 2024 and is anticipated to reach USD 1,108.03 million in 2025.

b. The Indian molecular diagnostics market is expected to witness a compound annual growth rate of 5.63% from 2025 to 2033 to reach USD 1,717.27 million by 2033.

b. Based on technology, the PCR segment accounted for the largest share of 75.42% in 2024, owing to its high usage for Covid testing.

b. Some of the key players in the India molecular diagnostics market are Mylab Discovery Solutions Private Limited; Biogenix Inc. Pvt. Ltd; Trivitron Healthcare; Abbott; Bd (Becton, Dickinson and Company); Biomérieux SA; Bio-Rad Laboratories, Inc.; Danaher Corporation.

b. The major factors driving the India molecular diagnostics market growth are the rising aging population, growing prevalence of target disease, increase in demand for point-of-care facilities and technological advancement in diagnostic products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.