Market Size & Trends

India polyurethane synthetic leather market size was valued at USD 7.06 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. The market growth is due to the rising demand for artificial leather in the automotive, furnishing, and footwear industries. The rising adoption of artificial leather over genuine leather has led to market growth. Synthetic leather substitutes genuine leather in upholstery, footwear, clothing, vehicle interiors, and more. Furthermore, the rising adoption of artificial leather over genuine leather due to increased awareness regarding animal cruelty and veganism has also led to the growth of the Indian polyurethane (PU) synthetic leather (artificial leather) market.

Major textile and automotive companies have increased the usage of synthetic leather as it offers easy availability and low manufacturing costs. Procedures such as tanning while manufacturing natural leather can pollute the environment. The rising emphasis on eco-friendly procedures due to government regulations has increased the demand for synthetic leather. Increased adoption of artificial leather for the manufacturing of footwear products has also led to market growth as it offers softness and resistance against wear and tear. Footwear manufactured from synthetic leather offers durability, soft texture, water, and chemical resistance. Increased usage of boots made from synthetic leather due to their chemical resistance property has also aided in market growth.

Major manufacturing companies produce synthetic leather using raw materials such as polyvinyl chloride (PVC) and polyurethane (PU). Due to rising awareness regarding eco-friendly practices, companies are integrating natural raw materials such as agricultural wastes, cacti, peels, stems, and waste of various fruits and trees. This shift to sustainability has increased demand for synthetic leather products made from eco-friendly raw materials. Furthermore, the low cost of footwear made from synthetic leather has increased its demand. Therefore, these factors aid in the market growth of India’s PU synthetic leather market.

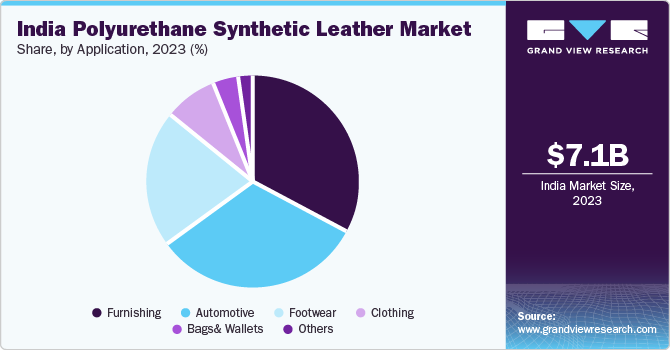

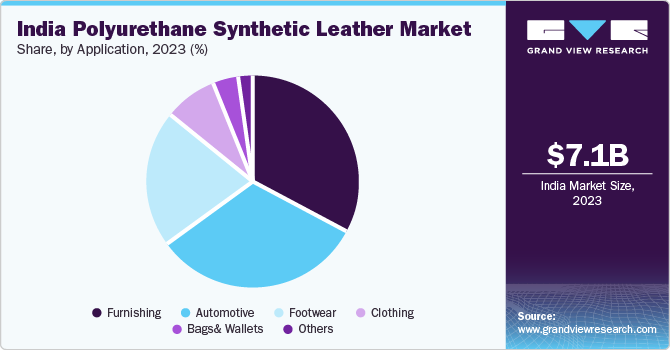

Application Insights

The furnishing segment dominated the market in 2023 with a share of 32.9% owing to the rising usage of synthetic leathers for manufacturing furniture. Synthetic leather has properties such as water resistance, easy cleaning, low cost, and the availability of various patterns and textures. Companies use synthetic leather to cover furniture such as sofas, chairs, stools, etc. Furthermore, rising awareness regarding animal cruelty and the high cost of genuine leather has led to customers shifting to furniture manufactured from synthetic leather.

The automotive segment is expected to grow at a CAGR of 9.3% over the forecast period attributed to rising demand for synthetic leather for manufacturing of automotive parts such as seats, steering wheel covers, armrests, door knobs, and more. The easy availability and low manufacturing cost of synthetic leather have made automotive companies shift from genuine leather to artificial leather. Furthermore, the availability of synthetic leather in various designs and textures and the water resistance properties of the leather have also led to the market growth of this segment.

Key India Polyurethane Synthetic Leather Company Insights

One of the major companies in the Indian polyurethane (PU) synthetic leather (artificial leather) market is Giriraj Coated Fab PVT. LTD., Knitwell Industries, Natroyal Industries Pvt. Ltd., Nirmal Fibres (P) Ltd., and others. Companies are focusing on improving their portfolio by launching new products with various designs and textures. Companies are also integrating natural raw materials for manufacturing synthetic leather to promote sustainability.

- Giriraj Coated Fab PVT. LTD. is a company specializing in manufacturing and distributing artificial, PVC, and synthetic leather. The company also sells PVC leather cloth, faux leather, rexine leather, and more.

-

Knitwell Industries is a company that manufactures and exports PVC and rexine leather used in industries such as furniture, automotive, garments, and more.

Key India Polyurethane Synthetic Leather Companies:

- Giriraj Coated Fab PVT. LTD.

- Knitwell Industries

- Natroyal Industries Pvt. Ltd.

- Nirmal Fibres (P) Ltd.

- DAMAN Textiles

- Shakti Tex Coaters Pvt. Ltd

- Response Fabrics

- Ventura Indi

- Jasch Industries Limited

- United Decoratives Private Limited

India Polyurethane Synthetic Leather Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 7.81 billion

|

|

Revenue forecast in 2030

|

USD 12.32 billion

|

|

Growth rate

|

CAGR of 7.9% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Application

|

|

Key companies profiled

|

Giriraj Coated Fab PVT. LTD.; Knitwell Industries; Natroyal Industries Pvt. Ltd.; Nirmal Fibres (P) Ltd.; DAMAN Textiles; Shakti Tex Coaters Pvt. Ltd; Response Fabrics; Ventura Indi; Jasch Industries Limited; United Decoratives Private Limited

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

India Polyurethane Synthetic Leather Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the India polyurethane synthetic leather market report based on application: