- Home

- »

- Medical Devices

- »

-

Indonesia Medical Imaging Market, Industry Report, 2030GVR Report cover

![Indonesia Medical Imaging Market Size, Share & Trends Report]()

Indonesia Medical Imaging Market Size, Share & Trends Analysis Report By Technology (X-ray, Ultrasound, Computed Tomography), By End-use (Hospitals, Diagnostic Imaging Centers), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-276-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Indonesia Medical Imaging Market Trends

The Indonesia medical imaging market size was estimated at USD 375.8 million in 2023 and is projected to grow at a CAGR of 6.12% from 2024 to 2030. Increasing technological advancements, increased healthcare expenditure, government reimbursement initiatives, and the establishment of new facilities by market players in the country are major driving factors for the market growth.

The increasing prevalence of chronic disease and increasing hospital visits are expected to drive market growth in Indonesia. For instance, the RSJPD Harapan Kita Hospital, a national referral health facility for treating cardiovascular diseases in Indonesia, experiences a substantial patient influx, with approximately 124,000 outpatient visits recorded annually. In addition, the facility accommodates around 35,000 inpatient cases per year, which includes about 3,500 patients undergoing heart surgery during their hospital stay.

The Hospitals Management Asia (HMA) reported in March 2023 that the Harapan Kita was committed to enhancing its healthcare services by incorporating advanced and cutting-edge technology and equipment. The hospital also acquired dual source Multi Slice Computed Tomography (MSCT) diagnostic tool, featuring the CT Somatom Drive model, which is further expected to support the hospital in providing efficient and innovative medical care.

In addition, the continuous increase in the number of patients is driving the demand for better healthcare infrastructure in the country, which is expected to drive further demand in the market. For instance,according to Hospitals Management Asia (HMA), in November 2022, Harapan Kita expanded its facilities with the inauguration of the ventricle building, which involved an investment of approximately USD 43.1 billion. The hospital is also aiming to construct ten additional catheterization laboratories to enhance its medical services and capabilities in the future.

The adoption of artificial intelligence to advance medical imaging services is also expected to boost market growth. For instance, in March 2021, the JLK Inspection, specializing in AI-based medical solutions, received approval from the Indonesia Ministry of Health to market its three medical imaging solutions in the country. This is expected to help in bringing advanced technology to the country and add to the overall improvement in the healthcare infrastructure.

Moreover, despite the technical improvements and increased adoption of advanced imaging tools, Indonesia faces a significant challenge with its physician-to-population ratio being three times lower than that of East Asia and the Pacific, particularly affecting 42 percent of the population residing in rural areas. By integrating Indonesia's comprehensive demographic and health data with AI's analytical prowess, doctors are expected to potentially enhance their diagnostic and treatment capabilities. This collaboration is expected to lead to improved overall healthcare quality across Indonesia.

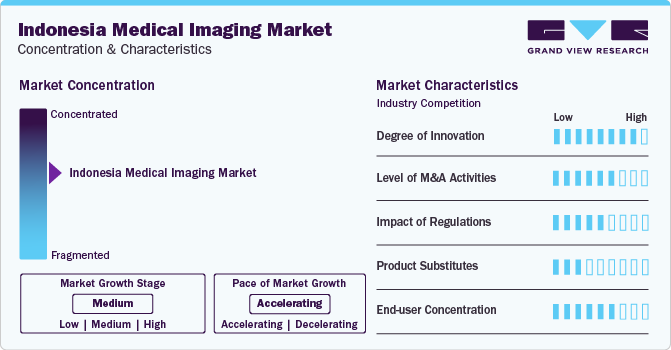

Market Concentration & Characteristics

The industry growth stage is medium, and the pace is accelerating. The Indonesia market is characterized by a high degree of innovation owing to the advancement in in imaging technology and its increasing adoption the market growth. The availability of various imaging technologies into Indonesian market is increasing the demand for the products.

The merger and acquisition activity in the Indonesian market is medium, owing to the factors such as diversification. This is due to several factors, including the desire to gain a new customer base and strengthening their medical imaging product portfolio and increasing market presence. For instance, according to BritCham Indonesia, in October 2023, the Siloam Hospitals Group (SHG) strengthens its long-term collaboration with Philips Indonesia, aiming to consistently deliver excellent healthcare services with continuous quality care

The Indonesian market is also subject to increasing regulatory scrutiny. The Indonesian government has placed strict regulations to ensure the safety and efficiency of various medical devices. For instance, according to the article published by the International Trade Administration in January 2024, the government prohibits the import of used or refurbished medical equipment in the country, which helps in ensuring the safety for patients and professionals in the country.

There are a limited number of product substitutes for medical imaging, which may not offer results as detailed results. This is expected to drive the market growth of Indonesia, with increasing prevalence of various diseases.

End-user concentration is a significant factor in the global medical imaging market. Since there is an increasing number of chronic diseases, which is driving the need for medical imaging among end users such as hospitals and diagnostic laboratories.

Technology Insights

Based on technology, the ultrasound segment led the market with the largest revenue the revenue share of 23.97% in 2023. The rising number of ultrasound applications is driving the segment growth in the country. The increasing developments of advanced ultrasound transducers have created new opportunities for the use of ultrasound devices in biomedical and cardiovascular imaging.

Moreover, an emphasis on the development of portable ultrasound devices and government initiatives to improve healthcare infrastructure in the country are expected to further add to the segment growth. For instance, in February 2024, the Indonesian health ministry started affordable cancer detection services at every public health center to support early detection. The initiative uses linear ultrasound probes to detect cancer, which is expected to drive its demand in the country.

The computed tomography segment is expected to witness at the fastest CAGR during the forecast period. CT systems were also one of the primary diagnostic tools for COVID-19 patients. High demand for point-of-care CT devices and the development of a high-precision CT scanner by the integration of AI & ML and advanced visualization systems are the principal factors driving the segment.

End-use Insights

Based on end-use, the hospitals segment led the market with the largest revenue share of 42.04% in 2023. Increasing demand for advanced medical imaging solutions and the integrating surgical suits with imaging technologies for better efficiency are key driving factors for segment growth. Some of the urban areas in the country have shown a sharp increase in demand for these solutions to teach hospitals compared to other general or special hospitals.

The diagnostic imaging segment is projected to exhibit at the fastest CAGR from 2024 to 2030. The entry of global service providers, increasing emphasis on improving infrastructure, adoption of new and advanced technologies, and increased funding are major growth drivers for this segment. Private players dominate healthcare services in the country. New hospitals also provide space for imaging modalities. The increasing competition in the country and demand for more efficient healthcare services are further expected to drive the segment's growth over the forecast period.

Key Indonesia Medical Imaging Company Insights

Some of the key players operating in the market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation.

-

GE Healthcare is a global company that specializes in providing innovative medical technologies involvingCT, MRI, X-ray, ultrasound, PET and mammography

-

Koninklijke Philips N.V., a Dutch technology company, offers various medical imaging brands under its Healthcare division including CT, MRI, X-ray, ultrasound, andimage-guided therapy

Mindray Medical International, Esaote, PerkinElmer Inc. are some of the other market participants in the Indonesia market.

-

Mindray Medical International offers a range of medical imaging products through its Medical Imaging Division including portable X-ray systems, ultrasound systems, digital radiography (DR) systems, MRI systems, CT and PACS

-

Esaote medical equipment company specializes in the development and production of medical imaging productsproviding innovative and high-quality solutions for improved patient care and diagnostic accuracy

Key Indonesia Medical Imaging Companies:

- GE Healthcare

- Koninklijke Philips N.V.

- Siemens Healthineers

- Canon Medical Systems Corporation

- Mindray Medical International

- Esaote

- Samsung Medison Co., Ltd.

- PerkinElmer Inc.

- FUJIFILM VisualSonics Inc.

Recent Developments

-

In January 2023, GE HealthCare aided expansion of healthcare access in Indonesia through a partnership with the Indonesia Ministry of Health and the U.S. Trade and Development Agency (USTDA). This partnership focused on digitizing healthcare delivery, enabling remote diagnosis and treatment of underserved communities across Indonesia

-

In December 2023, Siemens Healthineers signed a collaboration agreement with Dharmais Cancer Center Hospital, Dr. M. Mardjono (Brain Center Hospital), Harapan Kita National Cardiovascular Center Hospital and Dr. H. Sadikin Hospital in Indonesia

-

In January 2022, Philips participated in the Indonesia Hospital Expo 2022, demonstrating their innovative solutions promoting their innovative products to the healthcare facilities and hospitals in Indonesia

Indonesia Medical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 397.4 million

Revenue forecast in 2030

USD 567.5 million

Growth rate

CAGR of 6.12% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, end-use

Country scope

Indonesia

Key companies profiled

GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation; Mindray Medical International; Esaote; Samsung Medison Co., Ltd.; PerkinElmer Inc.; FUJIFILM VisualSonics Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Indonesia Medical Imaging Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest vertical trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the Indonesia medical imaging market research report based on the technology, and end use:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray

-

Radiography

-

Fluoroscopy

-

Mammography

-

-

Magnetic Resonance Imaging

-

Closed System

-

Open System

-

-

Ultrasound

-

Handheld

-

Compact

-

Cart/trolley

-

-

Computed Tomography

-

High-end Slice

-

Mid-end Slice

-

Low-end Slice

-

Cone beam CT

-

-

Nuclear Imaging

-

SPECT

-

PET

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Diagnostic Imaging Centers

-

Others

-

Frequently Asked Questions About This Report

b. The Indonesia medical imaging market size was estimated at USD 375.8 million in 2023 and is expected to reach USD 397.4.million in 2024.

b. The Indonesia medical imaging market is projected to grow at a compound annual growth rate (CAGR) of 6.12% from 2024 to 2030 to reach USD 567.5 million by 2030.

b. The ultrasound segment dominated the market and accounted for the revenue share of 23.2% in 2023 owing to the rising number of ultrasound applications is driving the segment growth in the country. The increasing developments of advanced ultrasound transducers have created new opportunities for the use of ultrasound devices in biomedical and cardiovascular imaging.

b. Some of the key players operating in the market include GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Canon Medical Systems Corporation.

b. Increasing technological advancements, increased healthcare expenditure, government reimbursement initiatives, and the establishment of new facilities by market players in the country are major driving factors for the growth of this market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."