Indonesia Precast Concrete Market Trends

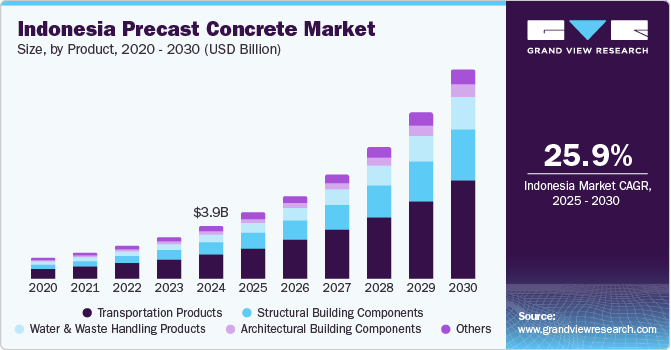

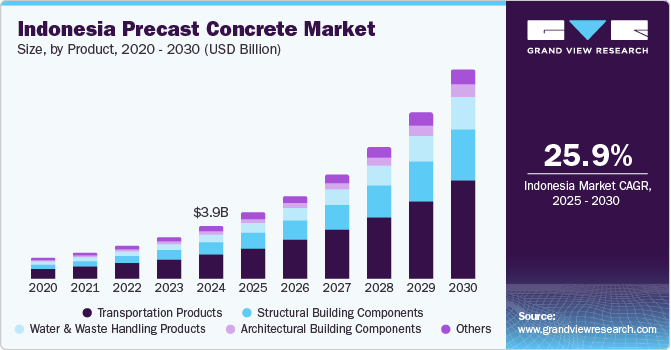

The Indonesia precast concrete market size was valued at USD 3.97 billion in 2024 and is expected to grow at a CAGR of 25.9% from 2025 to 2030. The growth of this market is primarily driven by the increasing prominence of offsite construction in Indonesia, coupled with growing awareness regarding the product's advantages. The precast concrete products are sold mainly through supply contractors and construction companies. Top construction companies own in-house production capacities and subsidiaries for precast concrete production. Thus, market participants are highly inclined toward integration across the supply chain.

The market is gaining greater significance owing to a slow recovery from the economic downturn. It is also expected to exhibit growth with a rise in non-residential and residential construction due to rising urbanization. This growth can be attributed to the increasing awareness amongst builders, architects, constructors, and end-users regarding the advantages of using precast concrete.

Precast concrete construction technology is one of the most promising solutions to deal with the rising demand for housing and infrastructure construction. However, the industry faces several challenges, including a lack of standardization, testing and certification facilities, non-availability of technology, tools, and equipment, and limited knowledge, which is expected to limit its growth.

The Indonesia precast concrete market has witnessed the presence of a large number of suppliers, resulting in low switching costs. Owing to intense competition, the market is expected to put pricing pressure on the suppliers, thereby diminishing their bargaining power. This is expected to lead to the suppliers adopting a cost leadership strategy to gain a competitive edge over other players.

Product Insights

The transportation products segment dominated the Indonesia precast concrete industry with a revenue share of 46.6% in 2024. This segment is primarily influenced by the increasing construction of public buildings and commercial spaces such as hotels, hospitals, restaurants, shopping malls, and industrial establishments. The manufacturers have adopted strategies such as enhanced capacities and improved distribution to address this growing demand.

The structural building components segment is projected to experience the highest CAGR during the forecast period. The construction of hotels, malls, and hospitals, as well as a rising need for affordable housing due to a growing middle-class population, are contributing to this trend. Government initiatives aimed at enhancing infrastructure and promoting private investment are also contributing to this trend, as they facilitate the construction of residential and commercial buildings. Furthermore, the advantages of precast concrete, such as improved efficiency, cost-effectiveness, and durability, further fuel the segment's growth.

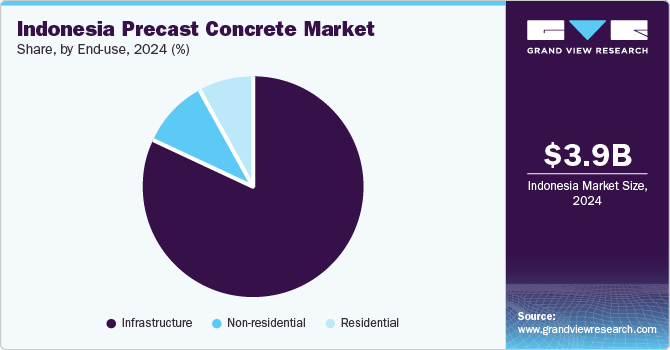

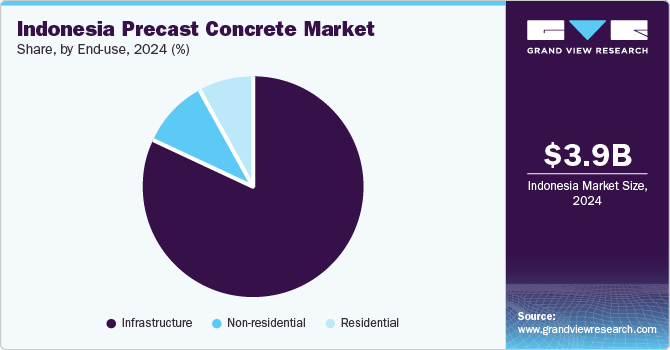

End-use Insights

The infrastructure segment held the largest revenue share of Indonesia precast concrete industry in 2024. This is attributed to factors such as increasing utilization by commercial construction companies operating in the infrastructure development and enhancement industry. This includes public hospitals, public parking facilities, government buildings, water management infrastructure facilities, train networks, and road developments. In the state budget for the 2025 fiscal year, the government allocated nearly USD 25.5 billion for infrastructure developments with a focus on health, connectivity, education, food, and energy.

The residential use segment is anticipated to experience the highest CAGR during the forecast period. This is attributed to factors such as growing disposable income levels, the large number of residential construction projects initiated in the country, and the increase in home redevelopments. Precast concretes are often preferred by residential developers for ease of installation, cost affordability, and convenience. The growth in availability and increasing tie ups among supply contractors and constructors are expected to add lucrative growth opportunities for Indonesia precast concrete industry.

Key Indonesia Precast Concrete Company Insights

Key companies in the Indonesia precast concrete industry include PT. REKAGUNATEK PERSADA, PT. Duta Sarana Perkasa, PT GRIYATON INDONESIA, G&W Group, Bonna Indonesia and others. Companies have adopted strategies such as enhanced portfolio offerings, focusing on supplier tie-ups, and adopting advanced technologies to address the growing demand for precast concrete and increasing competition in the domestic market.

-

PT. Duta Sarana Perkasa specializes in constructions associated with infrastructure, architecture, environment, and structural developments. Its primary offerings include concrete pipes, U-ditch, box culverts, maintenance hole components, drain lines, arch culverts, side entry pits, façade panels, tilt panels, barriers, fence panels, and planter boxes. It also provides mini piles, sheet piles, girders, and other building components such as stairs, half beams, half slabs, columns, concrete mattresses, and more.

-

PT Wijaya Karya Beton Tbk. (WIKA Beton) offers a wide variety of products, including prestressed concrete poles, railway concrete products, bridge concrete products, concrete products for ground retaining, concrete products for water construction, marine concrete products, and more. It also provides other offerings such as pipe racks for oil companies, water storage and cooling towers for power plants, concrete fences, concrete road medians, stadium stands, etc.

Key Indonesia Precast Concrete Companies:

- PT. Rekagunatek Persada

- PT. Duta Sarana Perkasa

- PT GRIYATON INDONESIA

- PT Wijaya Karya Beton Tbk. (WIKA Beton)

- Sika AG

- G&W Group

- PT. Bonna Indonesia

- Nippon Concrete Industries Co., Ltd.

- PT Beton Prima Indonesia

- PT. Jaya Beton Indonesia

- PT Waskita Beton Precast Tbk

- PT Adhimix Precast Indonesia

- ADHI BETON

- PT PP Pracetak

Recent Development

-

In August 2024, Sika AG announced the expansion of production capacity for its Bekasi plant in Indonesia. The enhancement of product capacity for grouts, façade systems, and other products aims to meet the increasing demand from residential, commercial, and infrastructure projects.

-

In August 2024, WIKA Beton announced that it is collaborating with Larsen & Toubro Limited on constructing Jakarta Mass Rapid Transit (MRT) Phase 2A. WIKA Beton has various responsibilities in the project, including providing ready mix, installing trackwork and substation systems, providing railroad sleepers, and providing power distribution.

Indonesia Precast Concrete Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2025

|

USD 4.99 billion

|

|

Revenue forecast in 2030

|

USD 15.80 billion

|

|

Growth Rate

|

CAGR of 25.9% from 2025 to 2030

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2018 - 2023

|

|

Forecast period

|

2025 - 2030

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, end-use, region

|

|

Key companies profiled

|

PT. Rekagunatek Persada; PT. Duta Sarana Perkasa; PT GRIYATON INDONESIA; PT Wijaya Karya Beton Tbk. (WIKA Beton); Sika AG; G&W Group; PT. Bonna Indonesia; Nippon Concrete Industries Co., Ltd.; PT Beton Prima Indonesia; PT. Jaya Beton Indonesia; PT Waskita Beton Precast Tbk; PT Adhimix Precast Indonesia; ADHI BETON; PT PP Pracetak

|

|

Customization scope

|

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Indonesia Precast Concrete Market Report Segmentation

This report forecasts revenue growth at Indonesia, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the Indonesia precast concrete market report based on product, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Structural Building Components

-

Architectural Building Components

-

Transportation Products

-

Water & Waste Handling Products

-

Others

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Non-residential

-

Infrastructure