- Home

- »

- Next Generation Technologies

- »

-

Industrial Computed Tomography Market Size Report, 2030GVR Report cover

![Industrial Computed Tomography Market Size, Share & Trends Report]()

Industrial Computed Tomography Market (2023 - 2030) Size, Share & Trends Analysis Report By Offering (Equipment, Services), By Type, By Scanning Technique, By Application, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-392-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global industrial computed tomography market size was valued at USD 645.3 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2023 to 2030. The increasing use of additive manufacturing techniques in the production processes across industries, such as automotive, aerospace, defense, and electronics, among others, has contributed to the market growth. Additive manufacturing, also known as 3D printing, involves the production of complex designs and structures that are expensive and difficult to produce using traditional manufacturing methods.

These structures are made by depositing material layer upon layer, creating a single-piece structure. Hence, industrial CT scanners test the strength and capabilities of the structures/designs formed using the additive manufacturing process. These scanners help the manufacturers to test & evaluate the capabilities/characteristics of the complex structures without damaging the product.

The benefits of industrial computed tomography, including the precise scanning of micro and large parts of the structure, enable the manufacturer to reduce the product development cost. Also, various types of inspection capabilities offered by this scanning technology, such as failure analysis, flaw detection, assembly analysis, and others, help improve the overall product quality, thereby reducing the product recall risk. Therefore, the pre-and post-production benefits computed tomography offers for the industrial sector are anticipated to bolster market growth in the coming years.

The increasing demand for high precision and reliability requirements for evaluating complex parts at high temperatures has pushed the aerospace computed tomography business forward. Computed tomography can also be used to inspect tiny and moderate components such as welded tubes, aluminum castings, turbine blades, and others. Furthermore, the industrial computed tomography market is being driven by the high adoption of techniques in the aerospace sector.

COVID-19 Impact

The COVID-19 pandemic has created various challenges for the evolution of the market. The supply chain disruptions, coupled with the reduction in manufacturing capabilities of various organizations, resulted in the reduced demand for industrial computed tomography scanners. The global industrial volume and trade saw a significant dip due to the pandemic.

According to Organisation for Economic Co-operation and Development (OECD), the volume index for industrial production and trade dipped below 100 from over 120 levels post the COVID-19 pandemic. Materials such as plastic and aluminum are examined using the industrial computed tomography method. However, the demand for market offerings was lower due to the reduced trade of such materials.

According to Organization for Economic Co-operation and Development (OECD), the trade of aluminum & its articles and plastics & its articles witnessed a decline from 2019 to 2020. Moreover, end-use industries such as automotive and electronics were also negatively affected. However, the gradual easing of the restrictions across the globe and the growing dissemination of coronavirus vaccines are anticipated to set the market on a growth trajectory. Moreover, companies are mounting strategic changes in their operations to prepare for similar future uncertainties, which are expected to revive the market in the coming years.

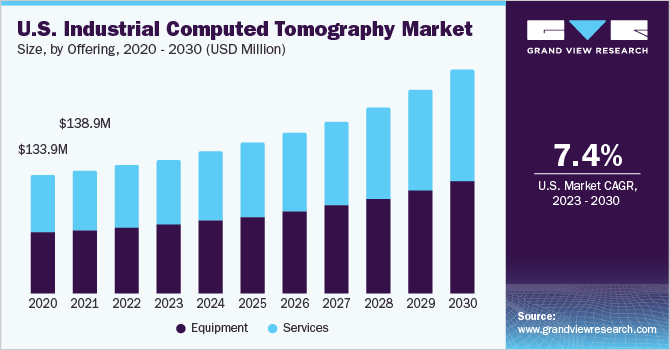

Offering Insights

In terms of offering, the market is classified into services and equipment. The equipment segment dominated the overall market, gaining a revenue share of 51.8% in 2022. It is expected to grow at a CAGR of 7.1% throughout the forecast period. Market players offer various types of equipment to customers. Software for computed image reconstruction is generally included in the system price. Growing innovation in industrial computed tomography software will likely drive innovation in the market. For instance, ZEISS Group’s ZEISS Automated Defect Detection (ZADD) is compatible with its CT systems and uses Artificial Intelligence (AI) for automated defect analysis. This is likely to boost the equipment segment.

The services segment is anticipated to grow at the fastest CAGR of 7.7% throughout the forecast period. Services include computed tomography inspection services, support, maintenance, and consulting services. The capital-intensive nature of industrial computed tomography scanners has paved the way for the high growth of the services segment in the market. Companies are increasingly outsourcing CT services to third-party service providers due to the low cost, which helps them significantly reduce their capital investment.

Type Insights

In terms of type, the market is classified into high-voltage CT, micro CT, and others. The high-voltage CT segment dominated the overall market, gaining a revenue share of 42.7% in 2022. It is expected to grow at a CAGR of 7.5% throughout the forecast period. High-voltage CT scanners are used to scan dense and large objects such as car engines.

For instance, for scanning a piece of steel with a thickness of 30 mm, a high-voltage X-ray source of above 200 kV would be required. High-voltage CT scanners are relatively costly in comparison to micro CT scanners. Market players offer high-voltage CT equipment and services. For instance, U.S.-based North Star Imaging Inc. (Illinois Tool Works Inc.) provides high-energy industrial CT X-ray systems, and Canada-based Jesse Garant Metrology Center offers high-energy CT scanning services.

The micro CT segment is expected to grow at the fastest CAGR of 8.7% during the forecast period. Micro CT scanners are among the most affordable industrial CT scanners, with the price of research-grade variants ranging from USD 200,000 to USD 1 million. Standard micro CT scanners generally use X-ray sources of voltage ranging from 60 kV to 160 kV. Small to medium-sized components such as plastic, ceramics, and aluminum can be inspected using a standard X-ray voltage source of 60 kV to 160 kV. The availability and affordability of micro CT scanners are expected to drive the segment's growth.

Scanning Technique Insights

In terms of scanning technique, the market is classified into fan-beam CT, cone-beam CT, and others. The fan-beam CT segment has dominated the market with a revenue share of 44.1% in 2022 and is expected to witness a CAGR of 7.3% during the forecast period. Fan-beam CT scanning technique is generally used to scan dense and large components, requiring high-energy scanning of over 450 kV of the X-ray voltage source. Fan-beam CT scanning produces higher-quality images, and the scan is focused on a single area of interest. The ability to scan large objects and high image quality are likely to contribute to segment growth.

The cone-beam CT segment is anticipated to witness the fastest CAGR of 7.9% throughout the forecast period. Cone-beam CT scanning technique is suitable for scanning electronic components and medium-sized cast elements. Cone-beam CT requires lower scan times, recording a typical data set within a quarter of an hour. According to U.S.-based Baker Hughes Company, a typical fan-beam CT scan needs 1,000 minutes to scan 1,000 slices, whereas a cone-beam CT scan requires 10 minutes. Cone-beam CT applications in electronics and shorter scan times are expected to drive segment growth.

Application Insights

In terms of application, the market is classified into failure analysis, assembly analysis, flaw detection and inspection, dimensioning and tolerancing analysis, and others. The flaw detection and inspection segment held the maximum share in the market, with a share of 25.0% in 2022, and is expected to witness the highest CAGR of 8.6% throughout the forecast period.

The increasing need for inspection of the products to detect any flaw, crack, damage, or variation from the designed product has been the key driver for the high share of this segment. Using industrial CT systems for product inspections helps the manufacturer considerably reduce production/manufacturing costs. In addition, industrial CT scanners can quickly test and analyze minor defects that are not efficiently and effectively traceable using traditional inspection methods.

The assembly analysis segment is anticipated to grow at a CAGR of 7.2% throughout the forecast period. Assembly analysis is increasingly being used in industries such as automotive, aerospace, and electronics, which require the inspection and analysis of the assembled products to gain insights into the placement and condition of smaller/minor internal components without disassembling or destroying the product. Computed tomography can help in detecting incorrectly assembled or missing components.

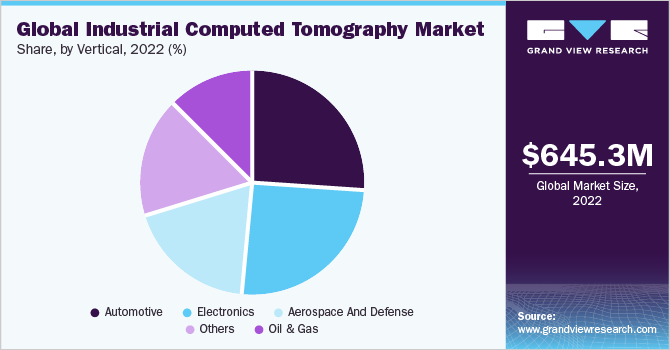

Vertical Insights

In terms of vertical, the industrial computer tomography market is classified into oil & gas, aerospace and defense, automotive, electronics, and others. The automotive segment dominated the overall market with a revenue share of 26.6% in 2022. The segment is expected to witness a CAGR of 7.8% during the forecast period.

Industrial CT systems are used in the automotive industry at various stages of the production process that, include pre-production inspection, production inspection, parts sorting, as well as failure investigation. The scanners generate precise metrology data that enables the user to validate the conformity of the parts with the original CAD designs, which, in turn, helps improve the overall product quality. In addition, dimensioning analysis is also conducted at various intervals during the production process, along with the tolerance analysis of the produced parts.

The electronics segment is anticipated to witness the fastest CAGR of 8.5% throughout the forecast period. CT scanning, as a non-destructive testing method for inspection, is increasingly used in the electronics industry to investigate internal parts & assemblies, molded circuits, and verify the optimal functioning of the electronic components. In addition, the increasing demand for electronic devices and the resultant rise in their manufacturing, coupled with the growing focus on quality control, are anticipated to drive the segment’s growth during the forecasted period.

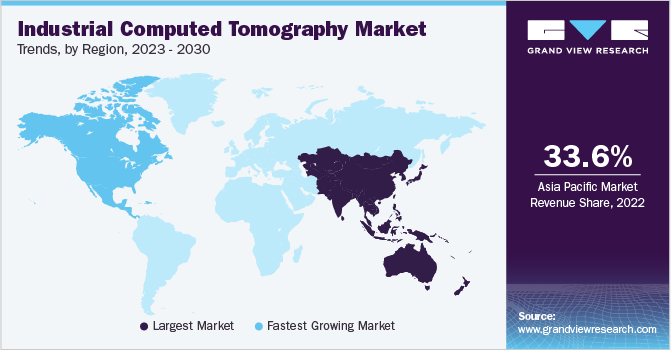

Regional Insights

Asia Pacific dominated the overall market in 2022, with a revenue share of 33.6%. It is expected to grow at the fastest CAGR of 8.2% throughout the forecast period. Asia Pacific has prominent market players such as Japan-based Nikon Corporation, OMRON Corporation, and Shimadzu Corporation. High manufacturing activities, especially in countries such as China, Japan, and India, are driving market growth in the region. According to United Nations Industrial Development Organization (UNIDO)’s world manufacturing production quarterly report, in the fourth quarter of 2022, Asia & Oceania held a share of 51% in global Manufacturing Value Added (MVA).

North America is expected to grow at a considerable CAGR of 7.6% during the forecast period. North America has a developed technology infrastructure and presence of industrial CT market players such as U.S.-based Baker Hughes Company and North Star Imaging Inc. (Illinois Tool Works Inc.). The increasing number of investments in the adoption of new & advanced technologies by key industry players is expected to drive the regional market growth. Moreover, North America has a presence of several industrial CT inspection services providers, such as Canada-based Jesse Garant Metrology Center and U.S.-based Exact Metrology.

Key Companies & Market Share Insights

The market is moderately consolidated and is likely to witness high competition in the market due to the presence of several industrial CT equipment and service providers. The prominent players in the market are adopting strategies such as innovation and product development to gain a competitive edge. For instance, in May 2022, Japan-based Shimadzu Corporation announced the launch of XSeeker 8000, a small and lightweight X-ray CT system. It provides images of various samples, including aluminum die-cast and resin-molded parts. With this launch, the company aimed to provide improved CT offerings to customers. Some prominent players in the global industrial computer tomography market include:

-

Nikon Corporation

-

OMRON Corporation

-

Baker Hughes Company

-

Comet Group

-

ZEISS Group

-

Shimadzu Corporation

-

North Star Imaging Inc. (Illinois Tool Works Inc.)

-

Werth Inc.

-

Rigaku Corporation

-

VJ Technologies

Industrial Computed Tomography Market Report Scope

Report Attributes

Details

Market size value in 2023

USD 675.9 million

Revenue forecast in 2030

USD 1,116.5 million

Growth rate

CAGR of 7.4% from 2023 to 2030

Base year for estimation

2022

Historic year

2017 - 2021

Report updated

June 2023

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, type, scanning technique, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Brazil; Mexico

Key companies profiled

Nikon Corporation; OMRON Corporation; Baker Hughes Company; Comet Group; ZEISS Group; Shimadzu Corporation; North Star Imaging Inc. (Illinois Tool Works Inc.); Werth Inc.; Rigaku Corporation; VJ Technologies

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Industrial Computed Tomography Market Report Segmentation

This report forecasts revenue growths at global, regional, as well as at country levels and offers a qualitative and quantitative analysis of the latest industry trends for each of the segments and sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global industrial computed tomography market report based on offering, type, scanning technique, application, vertical, and region:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Services

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

High-voltage CT

-

Micro CT

-

Others

-

-

Scanning Technique Outlook (Revenue, USD Million, 2017 - 2030)

-

Fan-beam CT

-

Cone-beam CT

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Flaw Detection and Inspection

-

Failure Analysis

-

Assembly Analysis

-

Dimensioning and Tolerancing Analysis

-

Others

-

-

Vertical Outlook (Revenue, USD Million, 2017 - 2030)

-

Oil & Gas

-

Aerospace and Defense

-

Automotive

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global industrial computed tomography market size was estimated at USD 645.3 million in 2022 and is expected to reach USD 675.9 million in 2023.

b. The global industrial computed tomography market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 1,116.5 million by 2030.

b. The equipment segment accounted for the highest revenue share of more than 51% in 2022. This is attributable to the growing availability of innovative industrial CT equipment.

b. Some prominent players in the market include Nikon Corporation, OMRON Corporation, Baker Hughes Company, Comet Group, ZEISS Group, Shimadzu Corporation, North Star Imaging Inc. (Illinois Tool Works Inc.), Werth Inc, Rigaku Corporation, and VJ Technologies.

b. Key factors that are driving the industrial CT market growth include the increasing use of additive manufacturing techniques in the production processes across industries such as automotive, aerospace, defense, electronics, among others.

b. The flaw detection and inspection segment accounted for the highest revenue share of more than 25% in 2022 in the industrial CT market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.