- Home

- »

- Pharmaceuticals

- »

-

Inflammatory Bowel Disease Treatment Market Report, 2030GVR Report cover

![Inflammatory Bowel Disease Treatment Market Size, Share & Trends Report]()

Inflammatory Bowel Disease Treatment Market Size, Share & Trends Analysis Report By Type (Crohn's Disease, Ulcerative Colitis), By Drug Class, By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-114-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

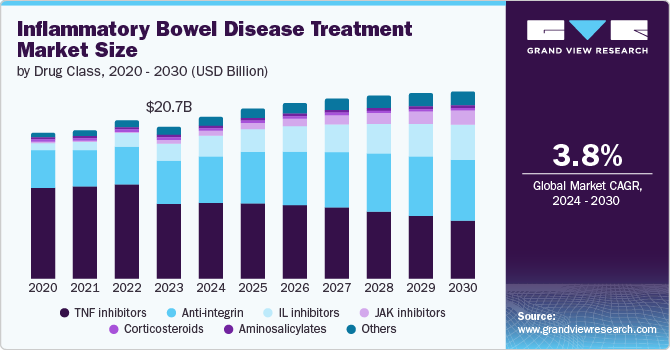

The global inflammatory bowel disease treatment market size was estimated at USD 20.74 billion in 2023 and is projected to grow at a CAGR of 3.8% from 2024 to 2030. The rising prevalence of ulcerative colitis and Crohn's disease across the globe and increasing approval of novel therapeutics are anticipated to drive the market during the forecast period. Moreover, an increase in the adoption of biological drugs and a surge in government initiatives to improve healthcare services for patients with inflammatory bowel disease (IBD), as these patients are more susceptible to acquiring infections owing to immunosuppressive therapies, further support the market expansion.

The rising prevalence of ulcerative colitis and Crohn's disease is anticipated to fuel the growth of the inflammatory bowel disease treatment market. According to EFCCA, around 10 million people are living with inflammatory bowel diseases worldwide, and the incidence of the disease is expected to increase over the forecast period. Similarly, a study published by the Crohn's & Colitis Foundation in July 2023 estimated that 721 per 100,000 Americans were diagnosed with inflammatory bowel disease. Moreover, in September 2023, NCBI published that more than 320,000 people in Canada will have IBD in 2023, and it is expected to reach 470,000 IBD patients by 2035 in the country.

The upcoming product launches and a strong product pipeline will drive market growth. For instance, in April 2023, AbbVie Inc. received the European Commission (EC) approval for Rinvoq (upadacitinib) to treat moderate to severe Crohn's disease in adult patients. Current therapies focus on reducing inflammation, risks of complications, and long-term remission. Moreover, hospitals & healthcare institutes are working closely with pharmaceutical companies to conduct clinical trials and ensure the safety of patients. Such initiatives are expected to increase research activities and develop a novel treatment for IBD.

The leading participants in the IBD treatment market emphasize adopting advanced technologies like AI for drug discovery and offering new treatments for Crohn's disease and ulcerative colitis. For instance, in December 2023, Insilico Medicine dosed the first patients with its ISM5411, an investigational IBD drug candidate designed using generative artificial intelligence. Moreover, leading companies and tech innovators are collaborating to leverage each other's technologies and competencies to innovate novel regimens and strengthen their position. For instance, in May 2021, CytoReason, an Israel-based tech company, announced a partnership with Ferring Pharmaceuticals to accelerate the drug development process and innovate novel therapeutics for IBD using AI technology.

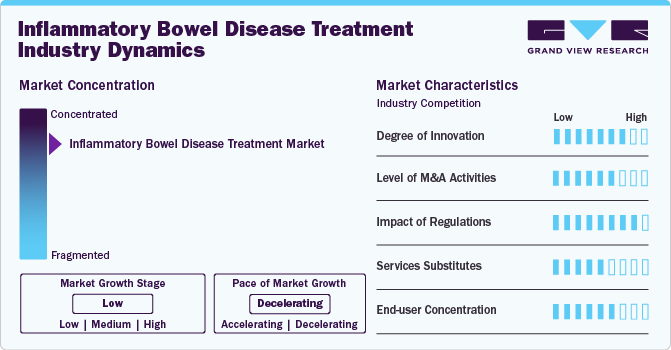

Market Concentration & Characteristics

The market growth stage is low, and the pace of market growth is decelerating due to the increasing introduction of biosimilars for key therapeutic products. The IBD treatment market is characterized by a high degree of innovation due to the increasing research activities to introduce novel therapeutic drugs such as biologics, JAK inhibitors, and S1P modulators.

The market is also characterized by the leading players' high level of merger and acquisition (M&A) activity. Market players are adopting these strategies due to several factors, including increased expertise in IBD and geographical expansion for a larger market for their existing products.

The stringent regulatory framework for therapeutic product approvals has always been one of the major restraining factors in the pharmaceutical industry. Such a discrete and uncertain regulatory scenario reduces manufacturers' confidence in commercialization. Moreover, the longer approval time required for product launches also hampers market growth.

Substitute treatment options such as surgery, alterations in diet and nutrition, and adoption of Ayurvedic products for IBD management moderately affect the market uptake. People are using Andrographis paniculata extracts & probiotics and making lifestyle changes to reduce the symptoms of IBD.

End-user concentration is a significant factor in the market. A number of end-users, such as hospitals, clinics, physicians, and patients, are driving demand for IBD treatment drugs. Moreover, the increasing adoption of biological and novel drugs for the treatment of IBD creates new market opportunities for market players.

Drug Class Insights

TNF inhibitors accounted for the largest market revenue share of 36.94% in 2023. This can be attributed to the increased prescription rate of TNF inhibitors for treating IBD and rising consumer awareness about TNF inhibitors. Some key TNF inhibitors are Humira, Remicade, Simponi, and Cimzia, which are used to treat inflammatory diseases. However, the loss of patent protection for branded drugs is anticipated to hamper the market growth in the coming years. Pharmaceutical companies are introducing biosimilars for existing TNF inhibitors to increase global market penetration. For instance, in July 2023, Samsung Bioepis and Organon launched Hadlima, a biosimilar equivalent to Humira in the U.S. market.

JAK inhibitors segment is expected to expand at the fastest growth rate in the forecast period. The segment's growth can be attributed to the increasing approval of novel JAK inhibitors and strong pipeline drugs, which are expected to be commercialized in the coming years. For instance, in March 2022, the U.S. FDA approved Rinvoq (upadacitinib) for treating adult patients with active ulcerative colitis. Moreover, in May 2023, the U.S. FDA expanded the use of Rinvoq for moderate to severe Crohn's disease in adults. Such initiatives are expected to boost the segment growth over the forecast period.

Type Insights

Crohn's disease led the market and accounted for 60.59% of global revenue in 2023. This can be attributed to the high prevalence of the disease, the high cost associated with Crohn's disease treatment, and the surge in prescription rates of biologics. Moreover, recent approvals of novel therapies and the presence of strong pipeline candidates are expected to facilitate segment growth. For instance, in October 2023, AbbVie, Inc. received market approval for Rinvoq from Health Canada to treat Crohn's disease in adult patients. Moreover, in November 2022, the European Commission approved Skyrizi IV for treating moderate to severe Crohn's disease.

Ulcerative colitis is likely to expand at the fastest CAGR during the projected period, owing to increasing approval of biologics for the treatment of disease and a high patient base. According to the Elsevier Ltd. report published in August 2023, the prevalence of UC is estimated to be around 5 million cases worldwide in 2023, and the incidence is expected to increase in the coming years. Moreover, companies are adopting various strategies to address the increased demand for therapeutic drugs for UC. For instance, in October 2023, Lilly received the U.S. FDA approval for Omvoh (mirikizumab) to treat ulcerative colitis. Similarly, in July 2022, Athos Therapeutics announced plans for research collaboration with Lahey Hospital and Medical Center in Burlington, Massachusetts, to develop precision medicine in IBD and ulcerative colitis.

Route of Administration Insights

Injectable accounted for the largest market revenue share in 2023 and is expected to grow at a CAGR of 3.4% over the forecast period. The high share of the segment can be attributed to the high adoption rate of biologics and biosimilar preparations, coupled with higher prices, rapid onset of action of injectable drugs, and higher bioavailability of injectable drugs. The higher prescription rate of injectable formulations such as Humira, Remicade, Stelara, Cimzia, Entyvio, and others supports the large market share of injectable drugs. Moreover, recent approvals of Skyrizi and Omvoh for inflammatory bowel disease treatment are expected to support the segment growth.

The oral route of administration of drugs is projected to witness the highest CAGR over the forecast period. Rising demand for novel oral formulations, coupled with growing efforts from drug makers to develop oral preparations for inflammatory bowel disease treatment. Moreover, the rising regulatory approvals of JAK inhibitors & S1P modulators and increasing research activities in oral drug developments are projected to support segment expansion in the coming years. For instance, in October 2023, the U.S. FDA approved Pfizer's Velsipity (etrasimod) for treating ulcerative colitis.

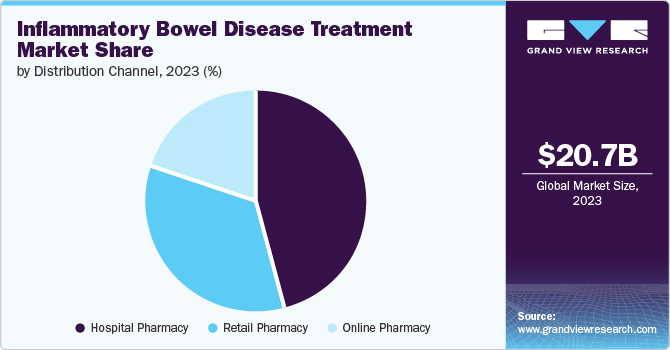

Distribution Channel Insights

Hospital pharmacy dominated the market in 2023. Factors such as high hospitalization rates due to the increasing severity of IBD, high adoption rates of injectable drugs, and a surge in the aged population are expected to drive the segment growth. Moreover, better reimbursement policies in developed and developing economies, which cover high-priced IBD therapeutic products, are expected to fuel the segment growth. On the other hand, the retail pharmacy segment held the second-largest share in the market.

The online pharmacies segment will likely be the fastest-growing segment during the forecast period. The increasing trend of online pharmacies, rising internet penetration, and various discounts offered by online pharmacy players are key factors contributing to the segment expansion. Moreover, increased adoption of telemedicine, approval of oral drugs, and availability of self-administered prefilled syringes & prefilled pens for IBD are increasing the shift of consumers toward online pharmacies.

Regional Insights

North America inflammatory bowel disease treatment dominated the market and accounted for a 57.59% share in 2023. The presence of many strong market players, coupled with various strategic initiatives they undertake in the region, supports the regional market growth. In 2023, novel therapeutic drugs such as upadacitinib, mirikizumab, etrasimod, and others received regulatory approval or application expansion for IBD treatment in the U.S. and Canada. In addition, ongoing research activities to develop novel therapeutics and supportive government policies are anticipated to drive the region's growth. For instance, the Crohn's & Colitis Foundation is a key organization supporting various clinical and translational research to find cures for colitis and Crohn's disease.

U.S. Inflammatory Bowel Disease Treatment Market Trends

The inflammatory bowel disease treatment market in the U.S. is observing a major shift in dynamics, wherein doctors increasingly prefer using newly launched products by companies such as AbbVie and Bristol Myers Squibb over other conventional therapies. The prescription patterns are witnessing a considerable shift with the entry of Skyrizi (in June 2022) and Zeposia (in May 2022). U.S.-based companies, such as Prometheus Biosciences and Pfizer, provide positive Phase II stage clinical trial results for their products PRA023 (results announced in December 2022) and RVT-3101 (results announced in January 2023), respectively. The growing competition between the two companies is anticipated to provide better treatment options to patients in the upcoming years and boost IBD market growth.

Europe Inflammatory Bowel Disease Treatment Market Trends

The inflammatory bowel disease treatment market in Europe held the second-largest market share in 2023 and is poised for significant growth in the coming years. The presence of well-established healthcare infrastructure in this region is anticipated to contribute to market growth in the coming years. According to the EFCCA, the direct healthcare cost of IBD is around USD 6.62 billion annually. The EFCCA also works to improve the lives of people living with IBD across the globe. Initiatives by government and non-government organizations help increase the treatment rate of IBD in Europe.

The UK inflammatory bowel disease treatment market is driven by increasing awareness about IBD and the presence of nonprofit organizations that support patients & healthcare professionals in the diagnosis & treatment of IBD.

The inflammatory bowel disease treatment market in France is projected to witness significant growth during the forecast period. The increasing approval of cost-effective biosimilars in the country is anticipated to increase the prescription rate of biosimilars for treating IBD.

Germany inflammatory bowel disease treatment market dominated the regional market in 2023 owing to the rising prevalence of ulcerative colitis and Crohn’s disease. Moreover, company collaborations to innovate treatment approaches for IBD are fueling the market. For instance, in June 2022, Boehringer Ingelheim collaborated with BiomX to identify biomarkers for the disease using BiomX's XMarker discovery platform.

Asia Pacific Inflammatory Bowel Disease Treatment Market

The inflammatory bowel disease treatment market in the Asia Pacific is anticipated to witness the fastest growth rate over the forecast period. The increasing geriatric population, which has a high risk of developing inflammatory diseases, the increasing prevalence of inflammatory bowel diseases, and the improvement in healthcare policies in the region are some of the primary factors driving market growth. In addition, the increasing approval of biosimilar & biologics and rising investments by leading regional participants are projected to propel market growth in the near future. For instance, in March 2023, Lilly's Omvoh received market approval in Japan for treating UC in adults with inadequate responses to conventional treatments.

China inflammatory bowel disease treatment market is expected to grow over the forecast period due to the growing focus on the launch of new products and the increasing involvement of local Chinese players in the development of biosimilars

The inflammatory bowel disease treatment market in Japan is expected to grow over the forecast period due to several key factors. Intestinal organoid transplants for IBD are likely pioneered in Asian countries like Japan. In July 2022, the Tokyo Medical and Dental University (TMDU) research team announced the world’s first organoid transplant into a patient with UC. Under this clinical program, a total of eight transplants were to be performed. Organoid transplants are expected to grow at a lucrative rate in the coming years.

Latin America Bowel Disease Treatment Market Trends

The inflammatory bowel disease treatment market in Latin America was identified as a lucrative region in this industry. Market growth in Latin America can be attributed to the increasing prevalence of IBD, improving healthcare facilities in emerging economies, and growing healthcare expenditure.

Brazil inflammatory bowel disease treatment market is dominated by global players. Most of the key players operate in the country and hold a significant share of the market. Currently, the drugs infliximab, sulfasalazine, mesalazine, prednisone, azathioprine, and cyclosporine are mostly prescribed for treating IBD.

MEA Inflammatory Bowel Disease Treatment Market Trends

The inflammatory bowel disease treatment market in MEA is primarily driven by rapid economic development in emerging markets like South Africa, high unmet medical needs, and the rise in disease prevalence. Moreover, the increased prevalence of ulcerative colitis and Crohn’s disease is boosting market growth in the region.

Saudi Arabia inflammatory bowel disease treatment market is witnessing an increased incidence of IBD. According to Karger International, the incidence of IBD in Arab countries is high. Patients with IBD from Arab countries may present different characteristics as compared to people in European countries. In addition, favorable regulatory regulations to foster IBD care in the kingdom are expected to drive the market.

Key Inflammatory Bowel Disease Treatment Company Insights

Some of the key players operating in the market include AbbVie Inc., Johnson & Johnson Services, Inc., Takeda Pharmaceutical Company Limited, and Biogen. Major players are focusing on collaborations to expand their product portfolio and geographical reach. Launching novel products and product enhancements are also some of the major strategies adopted by established players.

Emerging players are focusing on partnerships to combine clinical trial expertise with technological advancements. For instance, in October 2022, Virgo Surgical Video Solutions, Inc., Satisfai Health, Inc., and Alimentiv, Inc. announced a partnership to enhance clinical trials for IBD by using AI for decision support and patient selection.

Key Inflammatory Bowel Disease Treatment Companies:

The following are the leading companies in the inflammatory bowel disease treatment market. These companies collectively hold the largest market share and dictate industry trends.

- AbbVie Inc.

- Takeda Pharmaceutical Company Limited

- Pfizer Inc.

- Biogen

- Novartis AG

- Lilly

- UCB S.A.

- CELLTRION INC.

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc

Recent Developments

-

In May 2024, Johnson and Johnson Services Inc., announced the first phase 3 results for Tremfya’s Crohn’s disease program. The data from phase 3 trial demonstrated that Tremfya is superior to Stelara in all the endoscopic patients in the trial pool.

-

In April 2024, Takeda Pharmaceutical Company Limited received FDA approval for subcutaneous administration of Entyvio post-induction therapy with IV Entyvio. The drugs are used to treat patients with severely active Crohn’s Disease.

-

In October 2023, Johnson & Johnson Services, Inc. announced the data from a phase 3 clinical trial of Tremfya (guselkumab), studying the safety and efficacy of the drug for active ulcerative colitis. The study showed a 77% overall clinical response rate and early symptom improvement in UC patients.

-

In June 2023, Lilly's Omvoh (mirikizumab) received market authorization from UK's Medicines and Healthcare Products Regulatory Agency (MHRA) for the treatment of ulcerative colitis.

-

In February 2023, AbbVie announced that the UK's MHRA approved RINVOQ, a JAK inhibitor, for treating patients with moderate to severe Crohn's disease who had an inadequate response to conventional therapy.

-

In January 2023, Inotrem, a clinical-stage biotechnology company, received funding from the Crohn's & Colitis Foundation to help develop novel therapeutic approaches in Crohn's disease and ulcerative colitis.

Inflammatory Bowel Disease Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.14 billion

Revenue forecast in 2030

USD 27.73 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, drug class, route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Singapore; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Takeda Pharmaceutical Company Limited; Pfizer Inc.; Biogen; Novartis AG; Lilly; UCB S.A.; CELLTRION INC.; Merck & Co., Inc.; Johnson & Johnson Services, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inflammatory Bowel Disease Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inflammatory bowel disease treatment market report based on type, drug class, route of administration, distribution channel, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Crohn's Disease

-

Ulcerative Colitis

-

-

Drug Class Outlook (Revenue, USD Billion, 2018 - 2030)

-

Aminosalicylates

-

Corticosteroids

-

TNF inhibitors

-

IL inhibitors

-

Anti-integrin

-

JAK inhibitors

-

Others

-

-

Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Injectable

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

- Europe

-

Germany

-

UK

-

Spain

-

France

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Singapore

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global inflammatory bowel disease treatment market size was estimated at USD 20.74 billion in 2023 and is expected to reach USD 22.14 billion in 2024.

b. The global IBD treatment market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 27.73 billion by 2030.

b. Crohn's disease dominated the inflammatory bowel disease treatment market with a share of 60.59% in 2023. This is attributable to the increasing prevalence of the condition. Moreover, the increasing involvement of key players in product development is anticipated to drive segment growth.

b. Some key players operating in the IBD treatment market include Johnson & Johnson Services Inc.; Pfizer Inc.; Takeda Pharmaceutical Company Limited; AbbVie Inc.; Celltrion Healthcare Co., Ltd.; CELGENE CORPORATION; COSMO PHARMACEUTICALS; Innovate Biopharmaceuticals; UCB S.A.; and Gilead Sciences among others.

b. Key factors that are driving the IBD treatment market growth include the increasing prevalence of Crohn's disease & ulcerative colitis, presence of strong pipeline products, and increasing adoption of biological products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."