- Home

- »

- Pharmaceuticals

- »

-

Influenza Treatment Market Size And Share Report, 2030GVR Report cover

![Influenza Treatment Market Size, Share & Trends Report]()

Influenza Treatment Market Size, Share & Trends Analysis Report By Treatment (Peramivir, Zanamivir, Baloxavir Marboxil, Oseltamivir Phosphate), By Route Of Administration, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-168-6

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Influenza Treatment Market Size & Trends

The global influenza treatment market size was estimated at USD 5.91 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 1.18% from 2024 to 2030. The growth of the market is attributed to factors such as emerging seasonal flu, increased prevalence of contagious respiratory illness, and growing patient populations at greater risk for seasonal flu-related complications drives the market growth. According to CDC, it is estimated that the burden of flu in the U.S. has resulted in 27 to 54 million illnesses, 300,000 - 650,000 hospitalizations and 19,000 - 58,000 deaths yearly between 2022 and 2023. Similarly, according to preliminary results around 9 million were symptomatic illnesses, 4 million medical visits, 100,000 hospitalizations, and 5 thousand deaths from 2021 to 2022.

Furthermore, increasing approval of drugs that show high efficacy and are highly adopted for prevention and treatment, aided by the rising prevalence of the condition, is driving the market's growth. For instance, in 2022 - 2023, CDC recommended using FDA-approved antiviral drugs for influenza treatment, including zanamivir, oseltamivir, peramivir, and baloxavir marboxil. These drugs can lessen symptoms, reduce the duration of illness, and prevent influenza-related complications.

COVID-19 pandemic has positively impacted the market. The outbreak of the COVID-19 pandemic has created requirements for influenza treatment. There has been an increased number of both infections and the potential severity of infection, which has created the potential need for drugs, both for treating infected people and preventing infection. Since both COVID-19 & flu are infectious respiratory diseases, these diseases share similar symptoms, leading to an increased infection rate during the pandemic. The growing safety and effectiveness of different formulations of drugs are expected to create rising requirements for treatment over the forecast period.

Increasing prevalence is driving the demand for drugs over the forecast period. The onset of fever, cough, body pain, and sore throat characterizes influenza. A cough can last more than two weeks. According to WHO, in 2022, the annual epidemic resulted in an estimated 3 million to 5 million cases of severe illness across the globe accounting for about 650,000 deaths. The mortality of influenza is higher in developing countries compared to developed countries. According to WHO, 99% of deaths in children under the age of five years occur in developing countries due to influenza-related lower respiratory tract infections. Increasing reported cases and a rise in mortality rate are boosting the adoption of drugs worldwide.

Furthermore, several players are focusing on new product launches, FDA approvals, and other innovations owing to the increased emphasis on offering various medications for flu or contagious respiratory illness. Companies rising focus on expanding product offerings through retail pharmacies or hospital pharmacies are further propelling growth. For instance, in August 2022, F. Hoffmann-La Roche Ltd announced approval of Xofluza i.e., baloxavir marboxil for the acute uncomplicated influenza treatment in children aged 5 to 12 years of age being symptomatic for 48 hours. The rising approval of influenza drugs demonstrates the efforts of key players to reduce the burden of the condition by providing effective therapeutics, further propelling market growth.

Treatment Insights

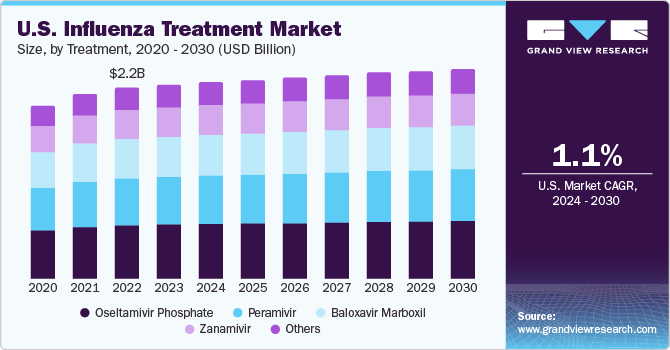

In 2023, the oseltamivir phosphate segment held the largest share accounting for about 27.60% of the market. Oseltamivir Phosphate is an antiviral drug used to treat acute influenza in patients who are 2 weeks of age and older and is approved for the treatment of Type A and B influenza. This medication may also be used to prevent the flu or outbreak in the community. For instance, in July 2020, Novadoz received FDA approval for Tamiflu generic and launched its generic Tykosin. TheTamiflu (oseltamivir phosphate capsules) has been approved in different dosages of 30 mg, 40 mg, & 75 mg. The medication works by inhibiting the replication of the influenza virus and can help reduce the severity & duration of flu symptoms if taken early in the course of the illness. Therefore, these factors are driving the growth of the segment.

Baloxavir marboxil is anticipated to grow at the fastest growth rate during the forecast period. The drug is an antiviral drug approved in 2018, by the U.S. FDA. The growing demand for baloxavir marboxil to treat influenza through the oral route is likely to fuel the market over the forecast period. The medication inhibits a different viral protein, the cap-dependent endonuclease, and has shown efficacy against influenza A & B viruses. Moreover, the drug is highly adopted for the treatment of influenza and has opened new possibilities for combination therapies that combine medications with diverse mechanisms of action.

Route Of Administration Insights

Based on route of administration, the oral route segment dominated the market with a share of 69.73% in 2023. The oral route is the common route of drug administration due to the convenience of drug administration, non-invasiveness, and patient compliance. According to NCBI, about 60% of established drug products are commercially administered via the oral route and it represents a majority of share for all pharmaceutical formulations for human medication. Moreover, oral drugs are constantly evolving, further bringing potential positive patient outcomes. Furthermore, the presence and availability of different drugs such as Peramivir, Zanamivir, Baloxavir Marboxil, Oseltamivir Phosphate in oral route form have led to the increased demand for the oral route of administration.

Furthermore, the other segment is expected to grow at the fastest growth rate over the forecast period. The growth of the segment is attributed to an increased demand for parenteral and intravenous route of administration. These routes provide an increased safety and effectiveness of medication against flu. According to NCBI, Peramivir offers a single-dose intravenous (IV) treatment option for influenza treatment that is generally used for the treatment of patients with complicated and high risk for influenza. Thus, these factors are driving the growth of the other route of administration segment.

Distribution Channel Insights

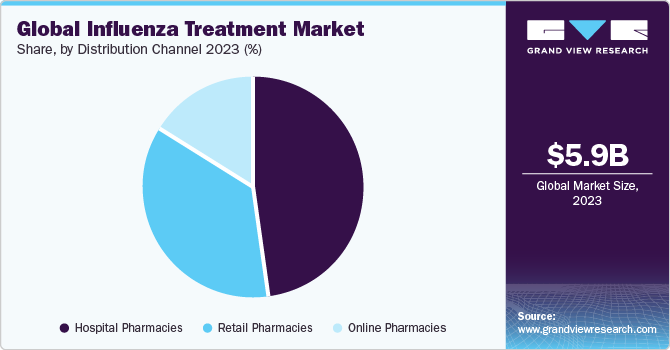

The hospital pharmacies segment dominated the market with the largest revenue share of 47.48% in 2023. The dominance is primarily due to the increased hospitalization rates and the rising demand for prescribed drugs for flu treatment. Besides, most of the hospital provides drugs at a discounted price which enhances the adoption of the medications. Furthermore, the expansion of pharmacies within hospitals and clinics has accelerated the growth of revenue for sales and distribution of products with the rising adoption of over-the-counter drugs. Therefore, the segment is anticipated to witness rising demand for products over the forecast period.

The online pharmacies segment is anticipated to grow at the fastest growth rate over the forecast period owing to the rapid access to medical products, privacy, cost efficiency, and a wide range of medicine availability at home. Online pharmacies provide an efficient distribution mode for the elderly, disabled people, and those living in remote locations, and act as an easy and fast method of obtaining medicines. Moreover, the pandemic has enhanced the adoption of online pharmacies as there were restrictions on movement globally. Rising internet penetration and the rising need for providing medication in remote locations fuel the growth of the overall market.

Regional Insights

North America dominated the market with a revenue share of 41.49% in 2023. The growing population exposed to respiratory illness, rising seasonal flu, growing hospitalization due to the condition, and well-established healthcare facilities are expected to drive the demand. Additionally, increased risks of seasonal flu particularly among small children, the elderly, pregnant women, and health workers have led to the rising demand for treatment of influenza in the region. Seasonal flu is one of the most common health conditions in the region generally occurring between December and February, which further propels the need for effective therapeutics. Moreover, key players operating in the market are focusing on developing novel therapeutics to deal with the rising prevalence of the condition. For instance, in August 2022, Genentech received supplemental New Drug Application approval for Xofluza used for the treatment of uncomplicated acute influenza.

Asia Pacific is expected to show the fastest growth over the forecast period. The growth of the market in the region is attributed to the increased elderly population prone to respiratory conditions in Asian countries aided by increased influenza surveillance, which has led to regional growth. Besides, developing healthcare infrastructure, the strong presence of pharmaceutical companies, increased requirements for influenza drugs and improved control strategies to have positively impacted the growth. Furthermore, regional players are trying to introduce novel treatment options in the market. For instance, in March 2023, TaiGen Biotechnology Co., Ltd. entered into a licensing agreement with Joincare Pharmaceutical Group Industry Co., Ltd. for the development and commercialization of TG-1000 in China for the treatment of infection caused by influenza-B, influenza-A, avian flu H7N9, and Tamiflu-resistant viruses.

Key Companies & Market Share Insights

The key players operating in the influenza treatment market are constantly focusing on improving existing therapeutics and introducing novel formulations that help improve patient outcomes and considerably increase healthcare efficiency and effectiveness. Furthermore, several players are focusing on the development of new drug products, thereby boosting the demand

-

In July 2023, Shionogi & Co., Ltd. announced the filing of sNDA of Xofluza which is indicated for post-exposure prophylaxis and treatment of influenza virus infection in the pediatric population (5-under 12 years)

-

In April 2023, Nanjing Zenshine Pharmaceuticals announced positive phase II results for ZX-7101A, formulated for treating acute uncomplicated influenza in the adult population.

Key Influenza Treatment Companies:

- NATCO Pharma Limited

- Novartis AG

- F. Hoffmann-La Roche Ltd

- BioCryst Pharmaceuticals, Inc.

- Sanofi

- GSK plc.

- Viatris Inc. (MYLAN)

- Teva Pharmaceutical Industries Ltd.

- Daiichi Sankyo Company, Limited.

- AstraZeneca

Influenza Treatment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.01 billion

Revenue forecast in 2030

USD 6.44 billion

Growth rate

CAGR of 1.18% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2021

Forecast period

2024 - 2030

Quantitative units

Revenue in (USD billion/million) and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Treatment,route of administration, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; Denmark; Norway; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

NATCO Pharma Limited; Novartis AG; F. Hoffmann-La Roche Ltd; BioCryst Pharmaceuticals, Inc.; Sanofi; GSK plc.; Viatris Inc. (MYLAN); Teva Pharmaceutical Industries Ltd.; Daiichi Sankyo Company, Ltd.; AstraZeneca

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Influenza Treatment Market Report Segmentation

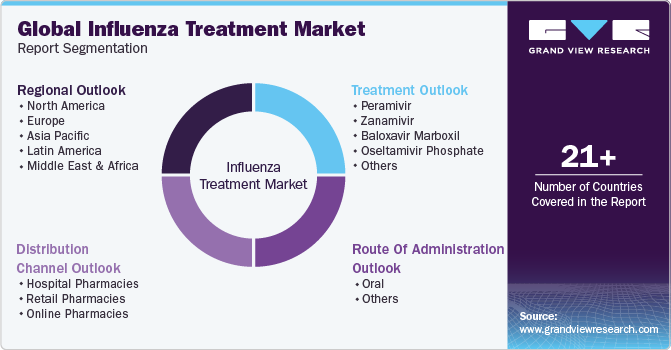

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global influenza treatment market based on thetreatment, route of administration, distribution channel, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Peramivir

-

Zanamivir

-

Baloxavir Marboxil

-

Oseltamivir Phosphate

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Online Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global influenza treatment market size was estimated at USD 5.91 billion in 2023 and is expected to reach USD 6.01 billion in 2024

b. The global influenza treatment market is expected to grow at a compound annual growth rate (CAGR) of 1.18% from 2024 to 2030 to reach USD 6.44 billion by 2030

b. In 2023, the oseltamivir phosphate segment held the largest share, accounting for about 27.60% of the influenza treatment market. Oseltamivir Phosphate is an antiviral drug used to treat acute influenza in patients who are 2 weeks of age and older and is approved for the treatment of Type A and B influenza. This medication may also be used to prevent the flu or outbreak in the community.

b. Some key players operating in the influenza treatment market include NATCO Pharma Limited, Novartis AG, F. Hoffmann-La Roche Ltd, BioCryst Pharmaceuticals, Inc., Sanofi, GSK plc., Viatris Inc. (MYLAN), Teva Pharmaceutical Industries Ltd., DAIICHI SANKYO COMPANY, LIMITED., AstraZeneca

b. Key factors that are driving the market growth include emerging seasonal flu, increased prevalence of contagious respiratory illness, and growing patient populations at greater risk for seasonal flu-related complications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."