- Home

- »

- Pharmaceuticals

- »

-

Inhalable Drugs Market Size, Share & Growth Report, 2030GVR Report cover

![Inhalable Drugs Market Size, Share & Trends Report]()

Inhalable Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Aerosol, Dry Powder Formulation, Spray), By Application (Respiratory & Non-Respiratory Diseases), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-767-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inhalable Drugs Market Summary

The global inhalable drugs market was valued at USD 22.76 billion in 2024 and is projected to reach USD 32.04 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The increasing prevalence of respiratory diseases such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and cystic fibrosis is anticipated to boost the market growth.

Key Market Trends & Insights

- North America dominated the market in 2022 with a 49.1% revenue share.

- The Asia Pacific region is expected to experience the fastest growth with a CAGR of 7.3% over the forecast period.

- By drug class, The dry powder formulation segment accounted for the largest revenue share in 2022 and is expected to grow at the fastest CAGR during the forecast period.

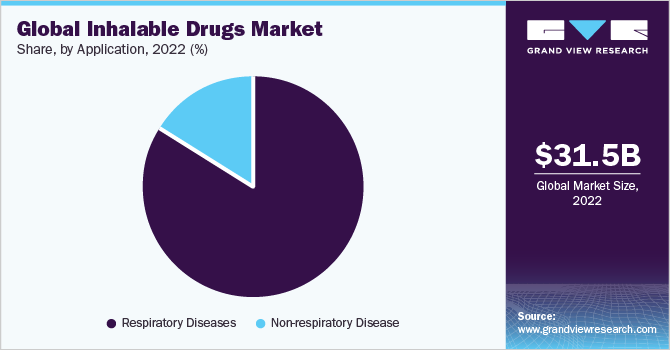

- By application, the respiratory diseases segment accounted for the largest revenue share of 84.1% in 2022.

Market Size & Forecast

- 2024 Market Size: USD 22.76 Billion

- 2030 Projected Market Size: USD 32.04 Billion

- CAGR (2025-2030): 5.9%

- North America: Largest Market in 2022

According to the Centers for Disease Control and Prevention (CDC), more than 25 million people had asthma in the U.S. in 2021, accounting for approximately 8.0% of adults and 6.5% of children. The increasing prevalence of non-respiratory diseases such as diabetes and Parkinson’s disease is a key factor expected to fuel the market for inhalable drugs. Parkinson’s disease is widely reported in people aged 60 years and above. The prevalence rate of this disease increases with age.

According to an article released by the World Health Organization in October 2022, globally, the percentage of individuals aged 60 years and above is likely to increase twofold from 12% in 2015 to 22% by 2050. Therefore, manufacturers are developing inhalable drugs for ease of administration in the geriatric population. For instance, in December 2018, INBRIJA, a prescription medicine containing levodopa, was approved by the U.S. Food and Drug Association (FDA) for adults.

Advancements in inhalable drugs are expected to propel market growth. Advanced inhalation therapy involves using surfactant carriers, nanocrystals, and micro and nanoparticles. Therefore, research is conducted on small molecules to develop innovative inhalable drugs. These advancements in inhalation therapies offer increased systemic availability of drugs, convenience over invasive methods, improved drug interactions, and minimal toxicities. Reformulation of existing non-inhaled molecules into inhaled molecules for enhanced delivery of the drug is providing new growth opportunities to market players. For instance, the reformulation of dihydroergotamine (intravenous drug) into mesylate salt breath-actuated MDI device (Tempo) to treat migraine.

The strong presence of leading players in the field will continue to benefit the global market. These companies focus on unmet market needs, geographic expansion objectives, developing innovative products, and mergers and acquisitions to capitalize on their market share. These companies also provide services to various entities to improve the quality of drug delivery systems and patient compliance. Moreover, the need for efficient therapies and competition among new market players is expected to provide growth potential in inhalable drugs. Furthermore, these players focus on personnel training and R&D investments to capture a larger market share.

Drug Class Insights

The market has been segmented based on products into aerosols, dry powder formulations, and spray. The dry powder formulation segment accounted for the largest revenue share in 2022 and is expected to grow at the fastest CAGR during the forecast period. The segment's growth is attributed to its higher efficacy and better results compared with other forms. Furthermore, a wide range of products and a strong pipeline for this formulation are factors responsible for its dominant market share. In June 2022, United Therapeutics Corporation announced that the FDA had approved Tyvaso DPI, an inhalation powder for treating pulmonary arterial hypertension and pulmonary hypertension linked with interstitial lung diseases.

The focus of manufacturers on developing small-sized particle products has increased, which is expected to fuel the market growth during the forecast period. For instance, in April 2019, Cipla launched Niveoli-the first extra-fine particle inhaler developed in India. The inhaler comprises beclomethasone-formoterol and hydrofluoroalkane (HFA), which ensures targeted delivery to small airways in asthma and COPD patients.

Aerosols are expected to witness steady growth over the forecast period owing to their user-friendliness. Players are constantly looking to manufacture inhalable products that are easy to use and effective without being too complicated. For instance, in February 2018, Teva Pharmaceuticals launched the QVAR RediHaler inhalation aerosol in the U.S. as a tool for asthma management.

Application Insights

The respiratory diseases segment accounted for the largest revenue share of 84.1% in 2022. Inhalable drugs are widely used to treat chronic respiratory diseases such as asthma, COPD, bronchospasm, and non-respiratory diseases such as diabetes and Parkinson’s. Combination therapy of Inhaled Corticosteroid (ICS), Long-Acting Muscarinic Antagonist (LAMA), and Long-Acting β2 Adrenoceptor Agonist (LABA) are extensively used for the treatment of COPDs and asthma due to their effectiveness, ability to reduce inflammation of lungs, and less need for hospitalization.

The effectiveness of these drugs has driven many manufacturers to develop combination therapies. For instance, in September 2020, GlaxoSmithKline plc and Innoviva, Inc. announced that the FDA had approved a new indication for combination therapy Trelegy Ellipta for the treatment of asthma in patients aged 18 years and above, expanding on its existing license to treat COPD patients.

The non-respiratory diseases material segment is estimated to register the fastest CAGR of 8.4% over the forecast period. Due to the rising prevalence of diabetes and the high cost of medications, manufacturers have devised an inhaler as an alternative therapy with reduced cost. For instance, in January 2019, MannKind Corporation developed and commercialized Afrezza for patients with diabetes. The company started a direct purchase program for inhalable insulin Afrezza for as little as USD 4 per day.

Regional Insights

North America dominated the market and accounted for the largest revenue share of 49.1% in 2022, followed by Europe. Both the markets for inhalable drugs are fueled by various awareness programs conducted by governments, organizations, and companies to improve treatment options for COPD. For instance, in November 2021, the Emphysema Foundation of America launched COPD Awareness Campaign. The campaign aims to educate and equip those with COPD, their families, and carers to recognize and lessen the effects of the disease.

Asia Pacific is expected to grow at the fastest CAGR of 7.3% during the forecast period. This growth can be attributed to improving healthcare infrastructure, rising patient awareness, and increasing disposable income. Moreover, new market entrants are expected to play an important role in providing a growth platform to this regional market over the next few years. Growing medical tourism in several Asian countries is also attracting the attention of leading global players to set up numerous emerging economies with significant growth potential.

Key Companies & Market Share Insights

The key players operating in the inhalable drugs market are involved in developing and launching novel products and undertaking strategic initiatives to gain a competitive edge. More than 220 projects regarding inhalable medicines are currently in progress worldwide. For instance, Breath Therapeutics’ Boston Program focusing on developing Cyclosporine A for Inhalation to treat Bronchiolitis Obliterans Syndrome is in Phase III clinical trial. It is expected to be launched during the forecast period. They also engage in joint ventures, collaborative development, mergers, and acquisitions.

In January 2023, AstraZeneca received approval from the U.S. Food and Drug Administration for Airsupra (albuterol and budesonide) inhalation aerosol. Airsupra aims to reduce the risk of asthma exacerbations in individuals aged 18 years and older. The inhalable drug is co-developed by AstraZeneca and Avillion. In addition, in March 2022, Viatris Inc. and Kindeva Drug Delivery L.P. received FDA approval for Breyna, a drug-device combination therapy recommended for patients with asthma or chronic obstructive pulmonary disease (COPD). Furthermore, in August 2018, Glenmark Pharmaceuticals entered a licensing agreement to commercialize Tiotropium Bromide dry powder inhaler to treat COPD in Europe. The following are some of the major participants in the global inhalable drugs market:

-

AstraZeneca

-

Sanofi

-

Vectura Group Ltd

-

Viatris Inc.

-

GSK plc.

-

Mundipharma International.

-

Boehringer Ingelheim International GmbH.

-

Cipla Inc.

Inhalable Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 24.10 billion

Revenue forecast in 2030

USD 32.04 billion

Growth rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug Class, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AstraZeneca; Sanofi; Vectura Group Ltd; Viatris Inc.; GSK plc.; Mundipharma International.; Boehringer Ingelheim International GmbH.; Cipla Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inhalable Drugs Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inhalable drugs market based on drug class, application, and region:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Aerosol

-

Dry powder formulation

-

Spray

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory diseases

-

Non-respiratory disease

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global inhalable drugs market size was estimated to be USD 31.4 billion in 2022 and is expected to reach USD 33.4 billion in 2023.

b. The global inhalable drugs market is estimated to grow at a compound annual growth rate of 6.6% from 2023 to 2030 to reach USD 52.3 billion by 2030.

b. Dry powder formulation held the largest share of 54.9% in 2022 owing to higher efficacy & better results in comparison with other forms, the presence of a wide range of products, and a strong pipeline for this formulation.

b. Key players in this industry include companies such as GlaxoSmithKline, AstraZeneca, Vectura, Cipla Inc., Novartis, Mundipharma, Boehringer Ingelheim International GmbH, and Mylan

b. Rising geriatric population, increasing prevalence of respiratory & non-respiratory diseases, advancements in therapies are key factors expected to drive the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.