- Home

- »

- Medical Devices

- »

-

Inhaled And Intranasal Products Contract Service Providers Market Report, 2030GVR Report cover

![Inhaled And Intranasal Products Contract Service Providers Market Size, Share & Trends Report]()

Inhaled And Intranasal Products Contract Service Providers Market Size, Share & Trends Analysis Report By Drug Delivery Product (Metered-dose inhalers, Dry powder inhalers, Nebulizers), By Services, By Region And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-001-3

- Number of Report Pages: 275

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global inhaled and intranasal products contract service providers market size was valued at USD 2.4 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 8.5% from 2023 to 2030. The rising chronic respiratory diseases and advancement in the technology for the manufacturing of inhaled and intranasal products are the key driving factors for the growth of the market.

The COVID-19 restrictions fully halted research-based operations and interrupted the medical device supply chain, which had a significant effect on the development of novel medical devices. However, the market for inhaled and intranasal products contract service providers is anticipated to grow profitably over the projection period due to the relaxation of restrictions in the second half of 2020 and the significant economic recovery. The COVID-19 infection has significantly surged the prevalence of respiratory conditions thus boosting demand for inhaled products and thereby supporting the growth of the market. For instance, in May 2020, Covis Pharma B.V. announced the initiation of phase 3 clinical trial of its asthma-inhaled drug Alvesco in non-hospitalized patients with COVID-19. Hence, such factors significantly spiked the growth of the market in 2020. Furthermore, the increasing respiratory conditions across the globe post-COVID-19 pandemic has led to the rising demand for inhaled and intranasal products, thus witnessing stable growth across the market.

Drug delivery products such as nebulizers are in high demand owing to the significant usage of nebulizers in hospitals and home care settings. The increasing launch of the latest technology-based nebulizers such as jet nebulizers is one of the major factors propelling the demand for market. Nebulizers are products that combine drugs and devices. As a result, the aerosol characteristics, targeting, and efficacy are directly influenced by the interactions between the inhaled formulation and the nebulizer device. Nebulizers generate the aerosol independently of the patient's force of inspiration. As a result, they are successfully applied to specific patient populations, including newborns, children, the elderly, and those with advanced lung illness.

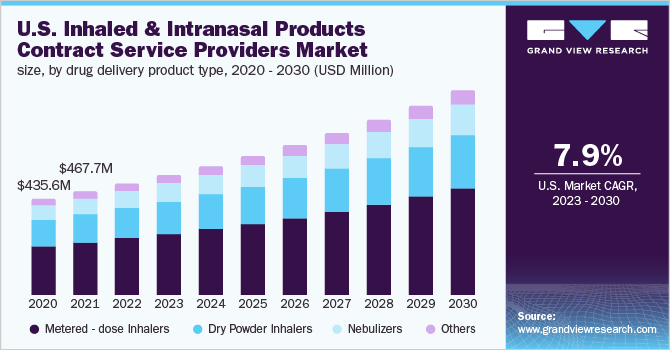

Drug Delivery Product Insights

Metered-dose inhalers (MDIs) accounted for the largest market share of 50.6% in 2022. It is also projected to register the fastest CAGR growth of 8.9% during the forecast period. It is typically used to treat respiratory conditions including COPD and asthma. They are portable, pocket-sized medicine delivery systems that generate aerosols using compressed propellants. Also, there is no requirement for drug preparation, and also the dose-dose reproducibility is also high. Examples of metered dose inhalers include atrovent inhalers, salamol inhalers, and Flixotide inhaler.

Dry Powder Inhalers accounted for the second-highest market share of 27.3% in 2022. It is a type of inhaler widely used to deliver the drug into the lungs, such as inhaled corticosteroids. DPIs have the potential to be efficient and simple to use, and they do not require expensive and hazardous propellants like CFCs that can pollute the environment. They can be single, multiple unit dosage, or multi-dose, with the latter requiring a bulk container and a suitable powder measuring method that the patient needs to use. DPIs can administer far larger doses than MDIs. Examples of dry powder inhalers include Advair Diskus, Asmanex, and Pulmicort flexhaler.

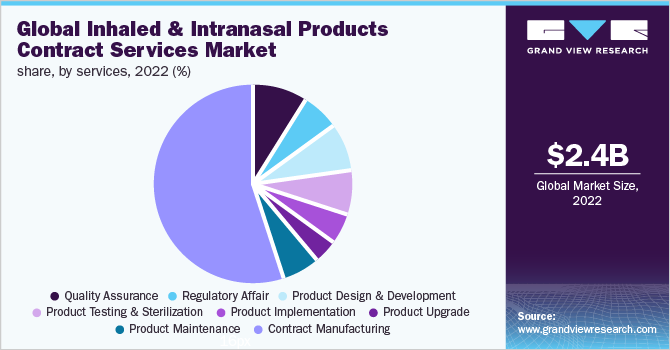

Services Insights

Contract manufacturing accounted for the maximum revenue share of 54.8% in 2022. The focus of manufacturers on lowering the cost of medical devices and the complexity of manufacturing have significantly boosted the demand for outsourcing services, which has driven the growth of the market. Furthermore, companies are using shift work to save fixed costs. Additionally, small and medium-sized companies lack the technical resources and skilled labor to complete the task. The above problems can be resolved by contract manufacturing.

-

Product Maintenance

-

Contract Manufacturing

Quality Assurance Services is anticipated to register the fastest growth of CAGR 10.8% during the forecast period. Quality assurance services include strategy, implementation, quality system assessments, and identification of quality metrics to ensure continuous improvement. It is performed regularly throughout the manufacturing process and is frequently done by a team of individuals. Maintenance of an effective quality management system is an integral part of the production of every medical device. One such quality management system is ISO 13485 which involves the development, implementation, and maintenance of products intended for use by medical device manufacturers and suppliers. Hence, these regulatory factors contribute to the growth of the market.

Regional Insights

Asia Pacific accounted for the largest market share of 41.7% in 2022. The presence of a large population base, increasing government support, and rising incidence of respiratory disorders are the key factors driving the growth of the market in the region. For instance, according to an article published in 2021 by the National Library of Medicine (NIH) the prevalence of COPD in the Asia-Pacific countries are as follows 5.6% in Indonesia, 14.5% in Australia, 6.7% in China, 8.6% in Japan and 13.4% in Korea.

North America accounted to be the second highest market share of 24.7% for the market. This is due to ease of regulatory compliance, the presence of a large number of contract manufacturers, and increasing respiratory diseases such as COPD. For instance, according to research by the centers for disease control and prevention (CDC), COPD affected over 15 million people in the U.S. in 2021.

Key Companies & Market Share Insights

Key market players in the inhaled and intranasal products contract service providers market are adopting a variety of strategic activities, such as the signing of a new partnership agreement, collaborations, mergers & acquisitions, and geographic expansion, to strengthen their products and gain a competitive advantage. For instance, In March 2022, Lonza announced its membership in the International Pharmaceutical Aerosol Consortium on Regulation & Science (IPAC-RS) of inhalation products. With this membership, Lonza's inhalation-related companies will benefit a lot from this, including the opportunity to participate in collaborative research projects, make use of market benchmarking, gather and analyze data, and interact with regulators. Some prominent players in the global inhaled and intranasal products contract service providers market include:

-

Lonza

-

Catalent Inc.

-

Kindeva Drug Delivery

-

Recipharm

-

Quotient Services

-

Hovione

-

Colep

-

Beximo Pharmaceuticals

-

DPT Laboratories

-

Orion

Inhaled And Intranasal Products Contract Service Providers Market Report Scope

Report Attribute

Details

Market Size value in 2023

USD 2.6 billion

Revenue forecast in 2030

USD 4.5 billion

Growth rate

CAGR 8.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug delivery product, services, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Rest of EU; India; Japan; China; Australia; Thailand; South Korea; Rest of APAC; Brazil; Mexico; Argentina; Rest of LATAM; South Africa; Saudi Arabia; UAE; Kuwait; Rest of MEA

Key companies profiled

Lonza; Catalent Inc. ; Kindeva Drug Delivery; Recipharm; Quotient Services; Hovione; Colep; Beximo Pharmaceuticals; DPT Laboratories; Orion

15% free customization scope (equivalent to 5 analysts working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inhaled And Intranasal Products Contract Service Providers Market Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018-2030. For this study, Grand View Research has segmented the global inhaled and intranasal products contract service providers market based on drug delivery product, services, and region:

-

Drug Delivery Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Metered - dose Inhalers

-

Dry Powder Inhalers

-

Nebulizers

-

Others

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Quality Assurance

-

Regulatory Affair Services

-

Product Design & Development

-

Product Testing & Sterilization

-

Product Implementation

-

Product Upgrade

-

Product Maintenance

-

Contract Manufacturing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of EU

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

Rest of APAC

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Rest of LATAM

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Rest of MEA

-

-

Frequently Asked Questions About This Report

b. The global inhaled and intranasal products contract service providers market size was estimated at USD 2.4 billion in 2022 and is expected to reach USD 2.6 billion in 2023.

b. The global inhaled and intranasal products contract service providers market is expected to grow at a compound annual growth rate of 8.5% from 2023 to 2030 to reach USD 4.5 billion by 2030.

b. By services, the Contract Manufacturing segment held a market share of 54.8% in 2022. The increasing rate of medical device contract manufacturing is one of the prominent factors supporting the segment's growth.

b. Some key players operating in the inhaled and intranasal products contract service providers market include Lonza, Catalent Inc., Kindeva Drug Delivery, Recipharm, Quotient Services, Hovione, Colep, and a few others.

b. Increasing R&D of inhaled medical products, the growing rate of outsourcing services, and rising FDA approvals pertaining to inhaled and intranasal medical products are a few of the major factors supporting the inhaled and intranasal products contract service providers market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."