- Home

- »

- Medical Devices

- »

-

Inhaled Nitric Oxide Delivery Systems Market Report, 2030GVR Report cover

![Inhaled Nitric Oxide Delivery Systems Market Size, Share & Trends Report]()

Inhaled Nitric Oxide Delivery Systems Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Pediatric, Adult), By Application (HRF, AHRF), By Product (Disposables, Systems), By End-use, And Segment Forecasts

- Report ID: GVR-4-68039-562-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inhaled Nitric Oxide Delivery Systems Market Summary

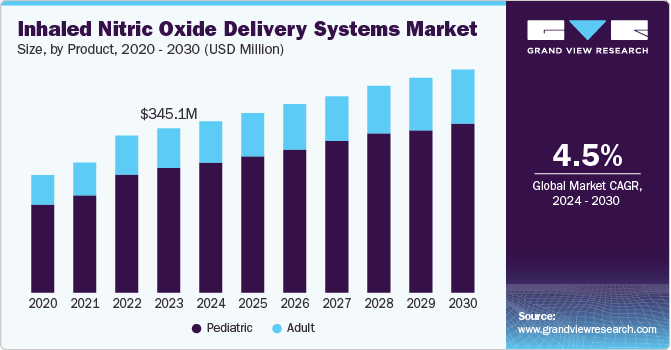

The global inhaled nitric oxide delivery systems market was estimated at USD 345.1 million in 2023 and is projected to reach USD 469.8 million by 2030, growing at a CAGR of 4.5% from 2024 to 2030. This growth is driven by the increasing prevalence of respiratory diseases such as chronic obstructive pulmonary disease (COPD) and neonatal respiratory distress syndrome (RDS), which is increasing the demand for effective treatment options.

Key Market Trends & Insights

- North America dominated the global inhaled nitric oxide delivery systems market with the largest revenue share of 36% in 2023.

- By type, the pediatric segment led the market, holding the largest revenue share in 2023.

- By application, the Hypoxic Respiratory Failure (HRF)segment dominated the market with the largest revenue share in 2023.

- By product, the system segment is expected to grow at a significant CAGR from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 345.1 Million

- 2030 Projected Market Size: USD 469.8 Million

- CAGR (2024-2030): 7.80%

- North America: Largest market in 2023

Moreover, advancements in medical technology and the development of portable and user-friendly delivery systems are making inhaled nitric oxide therapy more accessible and convenient for patients. Additionally, the rise in healthcare expenditure and increased awareness about the benefits of inhaled nitric oxide therapy are encouraging its adoption.

Supportive government initiatives and favorable reimbursement policies are also playing a crucial role in propelling market growth. Government regulations too significantly impact the market. For instance, in the U.S., the Food and Drug Administration (FDA) has stringent guidelines for approving and using inhaled nitric oxide systems, including rigorous clinical trials and post-market surveillance. The Comprehensive Environmental Response, Compensation, and Liability Act (CERCLA) also designates nitric oxide as hazardous, necessitating careful handling and disposal. These regulations extend globally, adding layers of complexity for market participants operating across borders.

The European Medicines Agency (EMA) also enforces strict regulations under the Medical Device Regulation (MDR), which mandates comprehensive safety and performance evaluations. Additionally, initiatives such as the Global Initiative for Chronic Obstructive Lung Disease (GOLD) provide guidelines that influence the adoption and usage of these systems.

Type Insights

The pediatric segment accounted for 75.8% of the revenue share in 2023 attributed to the high prevalence of neonatal respiratory conditions such as Hypoxic Respiratory Failure (HRF) and Persistent Pulmonary Hypertension of the Newborn (PPHN), which are effectively treated with inhaled nitric oxide therapy. The therapy’s proven efficacy in improving oxygenation and reducing the need for extracorporeal membrane oxygenation (ECMO) in neonates has led to its widespread adoption in pediatric care. Additionally, favorable reimbursement policies and government initiatives aimed at improving neonatal healthcare further support the growth of this segment. The high cost of therapy underscores the significant revenue contribution from this segment.

The adult segment is projected to grow at a CAGR of 4.7% from 2024 to 2030 driven by the increasing incidence of adult respiratory conditions such as Acute Respiratory Distress Syndrome (ARDS) and COPD. Moreover, rising awareness about the benefits of inhaled nitric oxide therapy and ongoing clinical trials exploring its efficacy in treating other adult respiratory conditions are expected to further boost the market growth. The adult segment’s steady growth reflects the expanding therapeutic applications and increasing acceptance of inhaled nitric oxide therapy among healthcare providers and patients alike.

Application Insights

The Hypoxic Respiratory Failure (HRF) segment dominated the global inhaled nitric oxide delivery systems market in 2023 due to the high incidence of neonatal respiratory conditions, such as HRF and PPHN, which are effectively treated with inhaled nitric oxide therapy. The therapy’s ability to improve oxygenation and reduce the need for more invasive treatments such as ECMO has made it a critical intervention in neonatal intensive care units (NICUs) worldwide.

The Adult Respiratory Distress Syndrome (ARDS) segment is projected to grow at a CAGR of 4.5% from 2024 to 2030. This growth is driven by the increasing prevalence of ARDS, particularly among patients with severe respiratory infections and critical illnesses. Advances in medical technology have led to the development of more portable and user-friendly delivery systems, making inhaled nitric oxide therapy more accessible for adult patients in various healthcare settings.

Product Insights

The disposables segment held the largest revenue share in the global inhaled nitric oxide delivery systems market in 2023. This segment’s dominance is primarily due to the high usage frequency and the necessity for single-use components to ensure patient safety and prevent cross-contamination. Disposables include items such as delivery masks, tubing, and cartridges, which are essential for each therapy session. The high cost associated with these single-use items also plays a significant role in the overall revenue generation of this segment.

The system segment is projected to grow steadily over the forecast period from 2024 to 2030. Modern systems are increasingly being designed to be more compact and easier to use, making them suitable for a wider range of healthcare settings, including hospitals, clinics, and home care. Furthermore, the integration of advanced features such as real-time monitoring and automated dosage adjustments in these systems enhances their appeal and adoption among healthcare providers.

End Use Insights

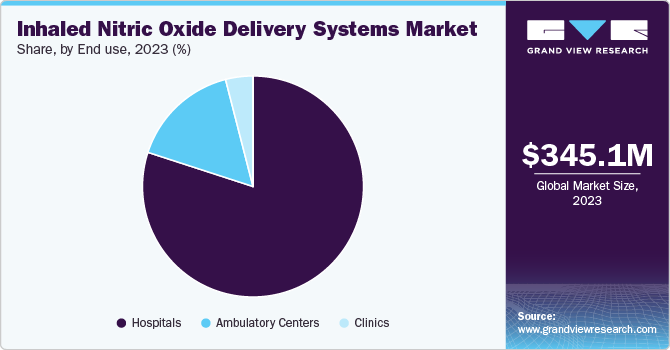

The hospitals segment held a dominant 80.2% revenue share in the global inhaled nitric oxide delivery systems market in 2023. This significant share is primarily due to the high volume of patients requiring critical care and specialized respiratory treatments that hospitals provide. Hospitals are equipped with advanced medical infrastructure and skilled healthcare professionals, making them the primary choice for administering inhaled nitric oxide therapy. Additionally, hospitals often have the necessary facilities for continuous monitoring and immediate intervention, which are crucial for patients undergoing inhaled nitric oxide therapy. The high cost of therapy and the comprehensive care provided in hospital settings contribute to the substantial revenue generated from this segment.

The ambulatory centers segment is projected to grow at the fastest rate over the forecast period from 2024 to 2030. This growth is driven by the increasing shift towards outpatient care and the rising demand for cost-effective and convenient treatment options. Ambulatory centers offer several advantages, including reduced hospital stays, lower treatment costs, and greater accessibility for patients. Advances in portable and user-friendly inhaled nitric oxide delivery systems have made it feasible to administer this therapy in ambulatory settings, thereby expanding its reach. Moreover, the growing awareness about the benefits of early and preventive care is encouraging more patients to seek treatment in ambulatory centers.

Regional Insights

North America inhaled nitric oxide delivery systems market held a significant 36.0% revenue share in the global market largely driven by the U.S., which benefits from advanced healthcare infrastructure, substantial healthcare expenditure, and a strong focus on research and development. The presence of major medical device manufacturers and a robust regulatory framework further supports market growth.

U.S. Inhaled Nitric Oxide Delivery Systems Market Trends

The U.S. Inhaled Nitric Oxide Delivery Systems held a significant revenue share of the North American market in 2023 attributed to the country's advanced healthcare infrastructure, high healthcare expenditures, and a strong focus on research and development. In addition, the presence of major medical device manufacturers and a robust regulatory framework further support market growth in the U.S.

Europe Inhaled Nitric Oxide Delivery Systems Market Trends

The Europe inhaled nitric oxide delivery systems market is anticipated to grow steadily over the forecast period. This steady growth can be attributed to the region’s well-established healthcare systems, increasing awareness about respiratory therapies, and supportive government policies. European countries are also investing in healthcare innovations and expanding their medical device industries, which are expected to contribute to the market’s growth.

The UK emerged as a lucrative region within the European inhaled nitric oxide delivery systems market in 2023. The UK's well-established healthcare system, combined with increasing investments in medical research and development, has driven the adoption of advanced respiratory therapies. The UK's focus on improving patient outcomes and enhancing the quality of care has made it a key player in the European market.

Asia Pacific Inhaled Nitric Oxide Delivery Systems Market Trends

Asia Pacific inhaled nitric oxide delivery systems market is projected to experience the fastest growth from 2024 to 2030 driven by several factors, including the increasing prevalence of respiratory diseases, rising healthcare expenditure, and improving healthcare infrastructure in emerging economies such as China and India. Additionally, the growing focus on healthcare access and quality in these countries is likely to boost the adoption of advanced medical treatments and technologies, further propelling the market’s expansion in the region.

China inhaled nitric oxide delivery systems market dominated the Asia Pacific market in 2023 and is projected to continue its rapid growth from 2024 to 2030. The country's large population, rising healthcare expenditure, and significant medical technology advancements have fueled market expansion. China's focus on improving healthcare access and quality, along with government initiatives to modernize healthcare infrastructure, has led to increased adoption of inhaled nitric oxide delivery systems.

Key Inhaled Nitric Oxide Delivery Systems Company Insights

Some of the major companies in the global inhaled nitric oxide delivery systems market include Mallinckrodt Pharmaceuticals, Getinge AB, VERO Biotech, Linde plc, Beyond Air, Inc., SLE Ltd., Bellerophon Therapeutics, Air Liquide Healthcare, Circassia Pharmaceuticals, and International Biomedical. These companies are focusing on expanding their product portfolios through technological advancements, strategic collaborations, mergers, and acquisitions. Additionally, companies are emphasizing the development of more efficient and user-friendly delivery systems to enhance patient care.

-

Mallinckrodt Pharmaceuticals is a specialty pharmaceuticals company that produces and distributes various products, including inhaled nitric oxide delivery systems. The company focuses on areas such as respiratory health, autoimmune and rare diseases, and pain management.

-

VERO Biotech specializes in developing and commercializing nitric oxide delivery systems. The company offers products designed to treat respiratory conditions, particularly neonatal and pediatric care patients.

Key Inhaled Nitric Oxide Delivery Systems Companies:

The following are the leading companies in the inhaled nitric oxide delivery systems market. These companies collectively hold the largest market share and dictate industry trends.

- Mallinckrodt Pharmaceuticals

- Getinge AB

- VERO Biotech

- Linde plc

- Beyond Air, Inc.

- SLE Ltd.

- Bellerophon Therapeutics

- Air Liquide Healthcare

- Circassia Pharmaceuticals

- International Biomedical

Recent Developments

-

In December 2023, Mallinckrodt plc announced that the U.S. FDA granted clearance for its INOmax EVOLVE DS delivery system, which is designed to deliver INOmax (nitric oxide) gas for inhalation. This system offers a specialized injector module that tracks gas delivery waveforms and ensures synchronized, proportional dosing of NO. The system is compatible with a range of ventilators and respiratory care devices that have been validated for use with the INOmax EVOLVE DS.

-

In January 2023, VERO Biotech Inc. successfully closed a USD 30 million funding round with Petrichor. The investment will accelerate the development and commercialization of the company's GENOSYL Delivery System (DS), a tankless inhaled nitric oxide (iNO) solution.

Inhaled Nitric Oxide Delivery Systems Market Scope

Report Attribute

Details

Market size value in 2024

USD 361.3 million

Revenue forecast in 2030

USD 469.8 million

Growth rate

CAGR of 4.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type. application, product, end use, region

Key companies profiled

Mallinckrodt Pharmaceuticals, Getinge AB, VERO Biotech, Linde plc, Beyond Air, Inc., SLE Ltd., Bellerophon Therapeutics, Air Liquide Healthcare, Circassia Pharmaceuticals, International Biomedical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inhaled Nitric Oxide Delivery Systems Market Report Segmentation

This report forecasts revenue & volume growth of the global inhaled nitric oxide delivery systems market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global inhaled nitric oxide delivery systems market report based on type, application, product, end use and region:

-

Type Outlook (Revenue, USD Million, 2016 - 2028)

-

Pediatric

-

Adult

-

-

Application Outlook (Revenue, USD Million, 2016 - 2028)

-

Hypoxic Respiratory Failure (HRF)

-

Acute Hypoxemic Respiratory Failure (AHRF)

-

Others

-

-

Product Outlook (Revenue, USD Million, 2016 - 2028)

-

Disposables

-

System

-

-

End-user Outlook (Revenue, USD Million, 2016 - 2028)

-

Hospitals

-

Ambulatory Centers

-

Clinics

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2028)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.