- Home

- »

- Advanced Interior Materials

- »

-

Inorganic Scintillators Market Size, Industry Report, 2030GVR Report cover

![Inorganic Scintillators Market Size, Share & Trends Report]()

Inorganic Scintillators Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Alkali Halides, Oxide Compounds, Rare Earth Metals), By Material (Sodium Iodide), By End-use, By Region And Segment Forecasts

- Report ID: GVR-1-68038-191-7

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Inorganic Scintillators Market Size & Trends

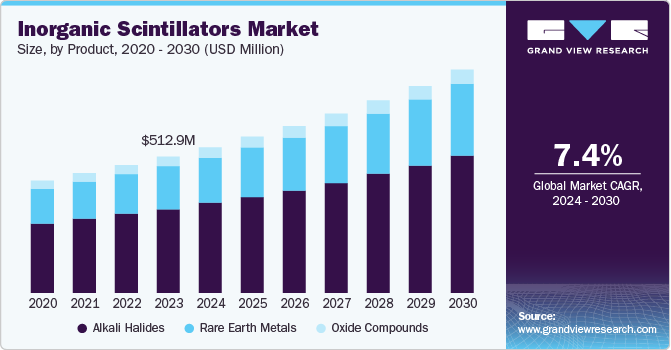

The global inorganic scintillators market size was valued at USD 512.9 million in 2023 and is anticipated to grow at a CAGR of 7.4% from 2024 to 2030. The market growth is driven by the increasing demand for radiation detection across various sectors, particularly in medical imaging, nuclear power plants, and homeland security. Inorganic scintillators, such as sodium iodide and cesium iodide, are essential for converting high-energy radiation into visible light, making them critical for applications such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT) in healthcare. Moreover, advancements in scintillator technology have improved their performance, sensitivity, and durability, further enhancing their adoption.

Regulations play a crucial role in shaping the global inorganic scintillators market, particularly by influencing the development, production, and usage of these materials in various industries. One significant regulation is the Euratom Treaty in the European Union, which mandates strict safety and radiation protection standards for nuclear materials, thereby driving the demand for high-quality inorganic scintillators in medical imaging and radiation detection. Similarly, the U.S. Nuclear Regulatory Commission (NRC) imposes stringent radiation safety guidelines, directly impacting the market by requiring advanced scintillation materials in nuclear power plants and research facilities. Furthermore, initiatives such as the International Atomic Energy Agency’s (IAEA) Nuclear Security Plan promote using scintillators in global security applications, enhancing market growth. Environmental regulations, such as the Restriction of Hazardous Substances (RoHS) Directive in electronics, also impact the market by limiting the use of hazardous materials in scintillator production, pushing manufacturers towards safer alternatives. These regulations collectively shape the innovation, production, and adoption of inorganic scintillators worldwide.

The rising awareness of safety regulations related to radiation exposure also propels the need for reliable radiation detection systems, thereby fostering market growth. Additionally, the expansion of nuclear facilities and the increasing focus on security measures post-nuclear incidents contribute to the heightened demand for inorganic scintillators in various applications.

Product Insights

The alkali halides segment accounted for 62.0% of the market revenue in 2023 attributed to the widespread use of alkali halides in various applications, including medical imaging, radiation detection, and nuclear physics. Alkali halides, such as sodium iodide and cesium iodide, are preferred for their high light yield and efficient energy resolution, making them ideal for detecting and measuring ionizing radiation.

The rare earth metals segment is expected to grow at a CAGR of 7.6% from 2024 to 2030. Rare earth metals, including materials such as lutetium oxyorthosilicate (LSO) and gadolinium oxyorthosilicate (GSO), are gaining traction due to their superior performance characteristics, such as higher density and better energy resolution compared to traditional scintillators. These properties make rare earth metals highly suitable for advanced medical imaging techniques and high-energy physics experiments.

Material Insights

The sodium iodide segment dominated the market in 2023 attributed to its extensive application in various fields, such as medical imaging, environmental monitoring, and radiation detection. Sodium Iodide (NaI) scintillators are highly valued for their excellent light yield and energy resolution, which make them particularly effective in detecting gamma rays and other forms of ionizing radiation. The widespread adoption of sodium iodide in both commercial and research settings is driving revenue growth.

The cesium iodide segment is expected to grow fastest from 2024 to 2030. Cesium Iodide (CsI) scintillators are known for their high density and effective atomic number, which enhance their performance in high-energy physics experiments and advanced medical imaging techniques. Additionally, CsI scintillators offer better resolution and efficiency compared to some traditional materials, making them increasingly attractive for new and emerging technologies. The anticipated growth is indicative of the broader trend towards more advanced and efficient scintillation materials, catering to the evolving demands of various high-tech industries.

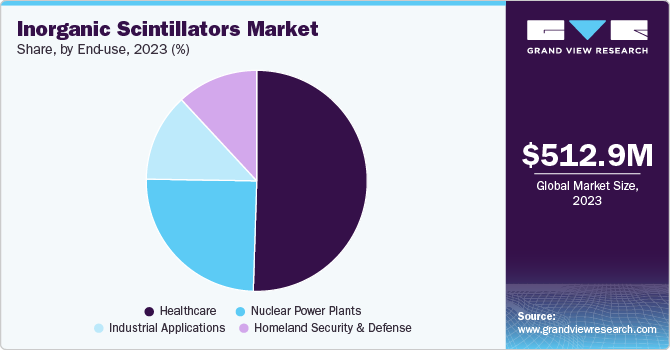

End-use Insights

The healthcare segment held the largest revenue share in 2023 primarily driven by the extensive use of inorganic scintillators in medical imaging technologies such as X-ray imaging, computed tomography (CT) scans, and PET scans. The high demand for accurate and efficient diagnostic tools in the healthcare sector, coupled with the increasing prevalence of chronic diseases and the aging population, has significantly contributed to the substantial revenue generated by this segment.

The industrial applications segment is expected to grow fastest over the forecast period. This segment encompasses a wide range of applications, including environmental monitoring, security, and defense. The growing need for radiation detection and measurement in these industries is driving the demand for inorganic scintillators. For instance, in environmental monitoring, scintillators are used to detect and measure radiation levels to ensure safety and compliance with regulatory standards. In the security and defense sector, they are employed in radiation detection equipment to prevent illicit trafficking of radioactive materials.

Regional Insights

North America dominated the global inorganic scintillators market with a revenue share of 40.8% in 2023 pertaining to the region's advanced healthcare infrastructure, substantial research and development investments, and the presence of major industry players. The high adoption rate of advanced medical imaging technologies and radiation detection systems in various industries has boosted the market’s growth in this region.

U.S. Inorganic Scintillators Market Trends

The U.S. held a significant market share of the North America inorganic scintillators market in 2023. This substantial market share can be attributed to the country’s robust healthcare sector, extensive use of scintillators in medical diagnostics, and strong focus on nuclear safety and security. The U.S. government’s support for scientific research and technological advancements further propels the market.

Europe Inorganic Scintillators Market Trends

Europe accounted for a significant share of the global inorganic scintillators market revenue in 2023. The region’s well-established healthcare systems and stringent regulatory standards for radiation safety have driven the demand for inorganic scintillators. Europe’s focus on environmental monitoring and nuclear energy has also contributed to the market’s growth.

The UK is a significant player in the European inorganic scintillators market, benefiting from its advanced medical infrastructure and active research community. The country’s emphasis on early disease detection and treatment and its commitment to nuclear safety support the demand for high-quality scintillation materials.

Asia Pacific Inorganic Scintillators Market Trends

The Asia Pacific inorganic scintillators market is expected to grow at a CAGR of 7.7% from 2024 to 2030. Rapid industrialization, increasing healthcare investments, and growing awareness of radiation safety are key factors driving this growth. Countries in the region are increasingly adopting advanced scintillation technologies for medical imaging and industrial applications.

China, as a major contributor to the APAC market, is experiencing significant growth in the inorganic scintillators sector. The country’s expanding healthcare infrastructure, rising investments in nuclear energy, and focus on technological innovation are propelling the demand for scintillation materials. China’s commitment to enhancing its radiation detection capabilities further boosts the market.

Middle East & Africa (MEA)Inorganic Scintillators Market Trends

The MEA region is projected to experience the fastest growth in the inorganic scintillators market over the forecast period. This growth is driven by increasing investments in healthcare infrastructure, rising awareness of radiation safety, and the region’s efforts to develop its nuclear energy sector. The adoption of advanced scintillation technologies in various applications is expected to accelerate market expansion in MEA.

Key Inorganic Scintillators Company Insights

Some of the major companies in the global inorganic scintillators market include Saint-Gobain S.A., Hamamatsu Photonics K.K., Dynasil Corporation, Hitachi Metals, Ltd., and others.

-

Saint-Gobain S.A. offers advanced scintillation materials and comprehensive range of products, including scintillation crystals, detectors, and radiation measurement solutions.

-

Dynasil Corporation designs and manufactures scintillation materials and detection systems. The company’s product portfolio includes innovative solutions for medical imaging, industrial non-destructive testing, and environmental monitoring.

Key Inorganic Scintillators Companies:

The following are the leading companies in the inorganic scintillators market. These companies collectively hold the largest market share and dictate industry trends.

- Dynasil Corporation of America

- Hamamatsu Photonics K.K.

- Hitachi Metals Group

- Detec

- Rexon Components, Inc.

- Saint-Gobain S.A.

- Scintaco

- Toshiba Materials Co., Ltd.

- EPIC Crystal Co., Ltd.

- Amcrys

- Shanghai Siccas High Technology Corporation

- Alpha Spectra, Inc

- Nihon Kessho Kogaku Co., Ltd.

Recent Developments

-

In November 2023, Tibidabo Scientific Industries, a leading provider of advanced scientific solutions, announced the acquisition of LLA Instruments. This strategic move expands Tibidabo's portfolio to include innovative products for material detection and identification, catering to a diverse range of applications.

-

In October 2023, Hitachi Group announced that its Healthcare Business Division would be transferred to Hitachi High-Tech, a wholly owned subsidiary. This strategic move aims to enhance the group's healthcare capabilities and drive innovation in diagnostic, treatment, and digital solutions.

Inorganic Scintillators Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 547.8 million

Revenue forecast in 2030

USD 838.8 million

Growth rate

CAGR of 7.4% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, material, end-use, region

Key companies profiled

Dynasil Corporation of America; Hamamatsu Photonics K.K.; Hitachi Metals Group; Detec; Rexon Components, Inc.; Saint-Gobain S.A.; Scintacor; Toshiba Materials Co., Ltd.; EPIC Crystal Co., Ltd.; Amcrys; Shanghai Siccas High Technology Corporation; Alpha Spectra, Inc; Nihon Kessho Kogaku Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inorganic Scintillators Market Report Segmentation

This report forecasts revenue & volume growth of the inorganic scintillators market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global agrochemicals market report based on product, material, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Alkali Halides

-

Oxide Compounds

-

Rare Earth Metals

-

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Sodium Iodide

-

Cesium Iodide

-

Lutetium Oxyorthosilicate & Lutetium-Yttrium Oxyorthosilicate

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare

-

Homeland Security & Defense

-

Nuclear Power Plants

-

Industrial Applications

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.