- Home

- »

- Homecare & Decor

- »

-

Insect Repellent Market Size & Share, Industry Report, 2030GVR Report cover

![Insect Repellent Market Size, Share & Trends Report]()

Insect Repellent Market (2025 - 2030) Size, Share & Trends Analysis Report By Insect Type (Mosquito Repellent, Bugs Repellent), By Product Type (Vaporisers, Spray, Cream), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-993-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Insect Repellent Market Summary

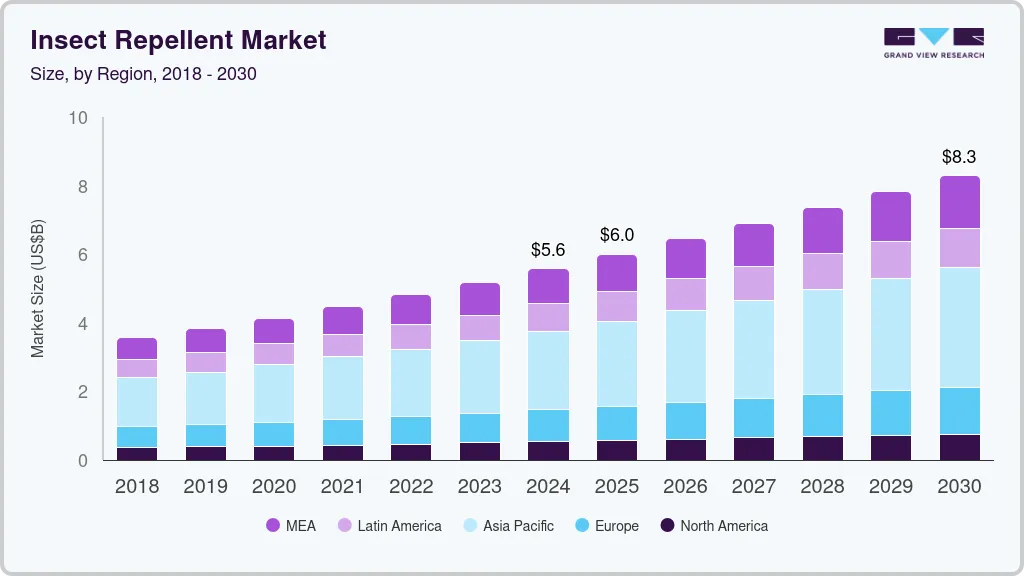

The global insect repellent market size was estimated at USD 5.57 billion in 2024 and is projected to reach USD 8.28 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The growing prevalence of vector-borne diseases such as malaria, dengue fever, Zika virus, and Lyme disease fuels the demand for insect repellents.

Key Market Trends & Insights

- The North America insect repellent market accounted for a share of 9.5% of the global market revenue in 2024.

- The U.S. insect repellent market is expected to grow at a CAGR of 6.0% from 2025 to 2030.

- The Asia Pacific insect repellent market dominated the industry with a revenue share of 41% in 2024.

- Based on insect type, mosquito repellents accounted for a revenue share of over 50.7% in 2024.

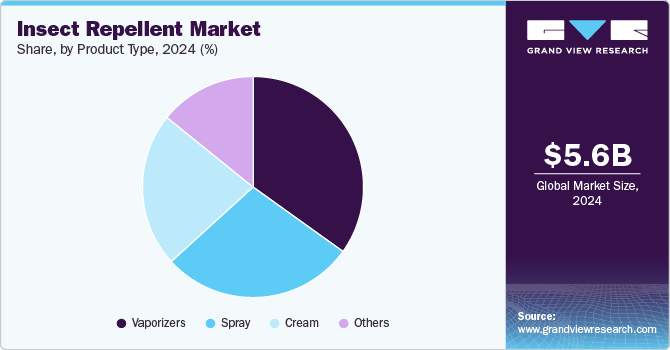

- In terms of product type, vaporizers accounted for a revenue share of over 35% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.57 billion

- 2030 Projected Market Size: USD 8.28 billion

- CAGR (2025-2030): 6.7%

- Asia Pacific: Largest market in 2024

These illnesses, transmitted by insects like mosquitoes and ticks, pose significant health risks in many parts of the world. As awareness of these diseases rises, both in endemic regions and areas where these diseases are spreading due to changing climatic conditions, more individuals and communities are prioritizing preventive measures like insect repellents.The growing adoption of landscaping items like plants, water fountains, and gazebos is anticipated to propel the demand for different home and garden pesticides. In addition, the increasing trend of renovating commercial and residential outdoor spaces into attractive features like lawns, outdoor kitchens, and entertainment zones is fostering industry expansion. Outdoor areas across various sectors are redesigned to integrate natural beauty into structures and enhance their value.

Growing number of insects across the globe has led to an increase in the number of diseases. Mosquitos are the major reason for diseases such as malaria, dengue, West Nile Virus, and yellow fever. They also transmit lymphatic filariasis and Japanese encephalitis. Also, other insects such as tsetse fly cause sleeping sickness, leishmaniasis group of diseases caused by sandflies, Onchocerciasis, or river blindness by blackflies, and plague by fleas.

Furthermore, consumer trends and preferences in the insect repellent industry are continuously evolving due to changing lifestyles, environmental concerns, and health considerations. Consumers are increasingly seeking insect repellents that utilize natural ingredients, as they are perceived as safer for personal use and the environment. Ingredients like citronella, lavender, and eucalyptus are popular due to their natural origins and pleasant scents. This trend aligns with the broader movement towards cleaner, greener living and a desire to avoid potentially harmful chemicals.

Consumers are increasingly opting for insect repellents in the form of creams and lotions with skin-hydrating and nourishing properties. Avon is one of the leading manufacturers of cosmetic-based insect repellents. For instance, Avon offers Avon Skin So Soft Bug Guard Collection in spray and lotion formats. These products are DEET-free and water-resistant and provide SPF 30 protection.

Insect Type Insights

Mosquito repellents accounted for a revenue share of over 50.7% in 2024. The rising threat of mosquito-borne diseases such as malaria, dengue, and Zika virus drives the market demand. As these diseases continue to impact millions globally, the need for effective preventive measures has intensified. Climate change has also expanded mosquito habitats, leading to the spread of these diseases into previously unaffected regions, further heightening the demand for mosquito repellents. In addition, advancements in repellent formulations, offering longer-lasting and safer options, have made these products more attractive to a wider consumer base, ensuring their continued growth in the market.

Bugs repellent are projected to grow at a CAGR of 6.6% from 2025 to 2030. Beyond mosquitoes, various types of bugs, including ticks, fleas, ants, and bedbugs, are carriers of diseases like Lyme disease, plague, and allergies. As people become more concerned about these health threats, particularly in outdoor environments and during travel, the demand for effective bug repellents rises. As the market diversifies with natural and eco-friendly repellent options, consumer preference for safe, long-lasting, and multi-purpose products also contributes to the growing demand in this segment. In March 2023, Zevo, a leading pest control brand, introduced its new On-Body Mosquito + Tick Repellents, offering odorless and non-sticky protection against mosquitoes and ticks for up to 8 hours. It is available in aerosol, pump spray, and lotion forms. This new launch aligns with consumer preferences for non-sticky and odorless formulas.

Product Type Insights

Vaporizers accounted for a revenue share of over 35% in 2024. Vaporizers provide long-lasting protection by emitting repellent vapors continuously, making them a hassle-free solution for households, especially in areas with high insect activity. Unlike sprays or lotions, which need frequent reapplication, vaporizers ensure consistent protection, appealing to consumers seeking ease of use. In addition, the growing preference for non-toxic and environmentally friendly products has boosted the popularity of vaporizers, as many newer models use natural ingredients that are safe for families and pets.

Sprays are projected to grow at a CAGR of 7.6% from 2025 to 2030. Sprays offer quick and targeted protection, making them ideal for people on the go or those engaging in outdoor activities such as camping, hiking, or gardening. They are easy to apply to both skin and clothing, providing instant relief from insects like mosquitoes, ticks, and other bugs. As more consumers seek convenient, portable, and fast-acting solutions for insect protection, sprays are gaining popularity. In addition, the growing trend of outdoor recreational activities and increased awareness of insect-borne diseases are fueling the demand for sprays, as they provide a practical option for preventing bites and stings.

Regional Insights

The North America insect repellent market accounted for a share of 9.5% of the global market revenue in 2024. Climate change significantly drives the demand for insect repellents in North America. Rising temperatures, extended warm seasons, and unpredictable weather patterns have led to an expansion of insect populations, particularly mosquitoes and ticks, into regions that were historically less affected. As a result, areas that were previously not major hotspots for insect-borne diseases are now seeing increased risks, prompting residents to adopt insect-repellent products more frequently.

U.S. Insect Repellent Market Trends

The U.S. insect repellent market is expected to grow at a CAGR of 6.0% from 2025 to 2030. The growing popularity of outdoor activities like picnics, sports, and festivals is pushing demand for insect repellents. As people spend more time outdoors, the likelihood of encountering insects increases, leading to higher usage of repellents for comfort and protection. Furthermore, the surge in domestic travel and outdoor tourism has fueled the demand for convenient and portable insect-repellent products. Furthermore, the rise of e-commerce and online shopping has also contributed to the increased demand, making insect repellents more accessible to a broader range of consumers.

Europe Insect Repellent Market Trends

The insect repellent market in Europe accounted for a share of over 16.79% of the global market revenue in 2024. As more people travel to areas with higher risks of mosquito and tick-borne illnesses, particularly in Southern and Eastern Europe, the demand for repellents has risen as a preventive measure. In addition, the rise in eco-tourism and outdoor festivals, which involve large gatherings in natural settings, has also led to more frequent use of insect repellents to ensure comfort and safety in these environments.

Asia Pacific Insect Repellent Market Trends

The Asia Pacific insect repellent market dominated the industry with a revenue share of 41% in 2024 and is expected to grow at a CAGR of 7.1% from 2025 to 2030. Technological advancements in the insect repellent industry contribute to growth. New formulations, such as electronic and wearable repellents, offer a more convenient and effective alternative to traditional sprays and lotions, appealing to consumers looking for innovative solutions. These innovations, along with an increasing focus on consumer education about insect-borne diseases, are pushing the demand for insect repellents higher across the Asia Pacific region. For instance, in June 2022, Japan-based Kao Corporation launched its Bioré GUARD Mos Block Serum in Thailand. The insect repellent product uses Kao's original, ground-breaking technology, contains natural citronella oil, and is N, N-diethyl-meta-toluamide (DEET)-free.

Key Insect Repellent Company Insights

The industry includes both international and domestic participants. Key market players focus on strategies, such as mergers, acquisitions, and new operating establishments, in different regions to enhance their portfolio offerings in the industry.

Key Insect Repellent Companies:

The following are the leading companies in the insect repellent market. These companies collectively hold the largest market share and dictate industry trends.

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Ltd

- Dabur India Limited

- Coghlan's Ltd.

- S.C. Johnson & Sons Inc

- Johnson & Johnson

- Spectrum Brands, Inc.

- Sawyer Products

- Henkel AG & Co. KGaA

- Jyothy Laboratories Ltd.

Recent Developments

-

In May 2023, the Spectrum Brands, Inc.subsidiary brand, Hot Shot, introduced its newly formulated Ant, Roach & Spider Killer aerosols, featuring newly developed spray scents including Crisp Linen, Fresh Floral, and Lemon. These fragrances were crafted in direct response to consumer feedback, addressing their concerns about the distinct and strong chemical odor commonly associated with traditional insect control products.

-

In April 2023, S.C. Johnson & Sons Inc. in collaboration with the government of Kenya, unveiled a public-private alliance in the battle against malaria. In pursuit of this endeavor, S.C. Johnson & Son Inc. and Kenya jointly embarked on a mission to provide the company's mosquito repellents, Mosquito Shield and Guardian, to vulnerable populations through worldwide public health partners, all without any charges.

Insect Repellent Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 6.00 billion

Revenue forecast in 2030

USD 8.28 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Insect type, product type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; Saudi Arabia

Key companies profiled

Reckitt Benckiser Group PLC; Godrej Consumer Products Ltd; Dabur India Limited; Coghlan's Ltd.; S.C. Johnson & Sons Inc; Johnson & Johnson; Spectrum Brands, Inc.; Sawyer Products; Henkel AG & Co. KGaA; Jyothy Laboratories Ltd.

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insect Repellent Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global insect repellent market report based on the insect type, product type, and region.

-

Insect Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Mosquito Repellent

-

Bugs Repellent

-

Fly Repellent

-

Others

-

-

Product Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vaporizers

-

Spray

-

Cream

-

Others

-

-

Regional Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global insect repellent market was estimated at USD 5.57 billion in 2024 and is expected to reach USD 6.00 billion in 2025.

b. The insect repellent market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 8.28 billion by 2030.

b. Asia Pacific dominated the insect repellent market with a share of around 40.98% in 2024. The technological advancements in the insect repellent industry contribute to growth.

b. Some of the key players operating in the insect repellent market include b " Reckitt Benckiser Group, The Godrej Company, Dabur International, Coghlans Ltd., S.C Jhonson & Son., Johnson and Johnson, Spectrum Brands, Sawyer Products, Inc., Himalaya Herbals, and Jyothy Labs.

b. Key factors that are driving the insect repellent market growth are due to an increase in vector-borne diseases are spreading across the globe especially in under-developed countries due to less sanitation awareness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.