- Home

- »

- Pharmaceuticals

- »

-

Insomnia Therapeutics Market Size & Share Report, 2030GVR Report cover

![Insomnia Therapeutics Market Size, Share & Trends Report]()

Insomnia Therapeutics Market Size, Share & Trends Analysis Report By Type (Benzodiazepines, Nonbenzodiazepines, Antidepressants), By Sales Channel (Prescription, OTC), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-213-6

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Insomnia Therapeutics Market Size & Trends

The global insomnia therapeutics market size was valued at USD 2.79 billion in 2023 and is projected to grow at a CAGR of 4.4% from 2024 to 2030. The rising incidence of insomnia and other sleep-related disorders globally have been a significant driving factor in the insomnia therapeutics market. The development of effective and safer drugs and the growing adoption of non-pharmacological treatments such as cognitive behavioral therapy (CBT) are further adding to the market growth.

Various companies have launched new products and services, thereby surging the market growth. For instance, according to a report published by the Translational and Clinical Pharmacology in 2024, Somryst, a digital prescription therapy, which is a smartphone app-based CBT-I showed meaningful responses in patients having insomnia and was approved by U.S. FDA in 2024. In addition, the report also stated dual orexin receptor antagonists, which include daridorexant, suvorexant had also been approved by the U.S. Food and Drug Administration (U.S. FDA) as a novel pharmacotherapeutic alternative for insomnia.

According to the National Council of Aging, About 30% of adults have symptoms of insomnia. American Academy of Sleep Medicine stated that about 12% of Americans have been diagnosed with insomnia (chronic) in by June 2024. The increasing geriatric population, increasing demand for treatment options and rising awareness regarding insomnia are likely to foster further growth in the market.

Cognitive behavioral therapy is the first-line treatment for chronic insomnia. When CBT is not effective, then a pharmacological intervention can be offered. For instance, in December 2022, Zydus received U.S. FDA approval for Triazolam, which is used to treat short-term basis to treat insomnia. The Australian government funded permanent telehealth arrangements under the Medicare Benefits Schedule (MBS which was introduced on 1st January 2022. It provides patient rebates for a wide range of telephone and video services by medical specialists and supports safe and equitable telehealth services. All these factors have contributed to the advancement of insomnia therapeutics, and awareness regarding this has helped the market to surge in the forecast period.

Type Insights

Benzodiazepines dominated the market and accounted for a market share of 28.9% in 2023. Benzodiazepines are useful for insomnia associated with acute stress. It increases sleep duration by 30-90 minutes, decreases sleep latency, and suppresses slow-wave sleep. The higher acceptability of drugs among physicians due to their quick results and easy availability are driving segmental growth. For instance, according to a report published in the National Center for Biotechnology Information (NCBI) in 2024, the U.S. FDA has approved a few of the BZDs such as alprazolam, clobazam, chlordiazepoxide, and others for the effective treatment of insomnia.

The antidepressants segment is expected to grow at a significant CAGR during the forecast period. Drugs such as nefazodone, trazodone, and mirtazapine may also improve subjective sleep ratings compared to placebo or other antidepressants in patients with depression and suffering from insomnia. For instance, the European Medicines Agency (EMA) and Food and Drug Administration (FDA) approved daridorexant has demonstrated sustained efficacy, improving nocturnal sleep parameters, with a favorable safety and tolerability profile. Thus, this segment has been positively increasing with growing awareness among people and acceptance of such antidepressants in treating insomnia.

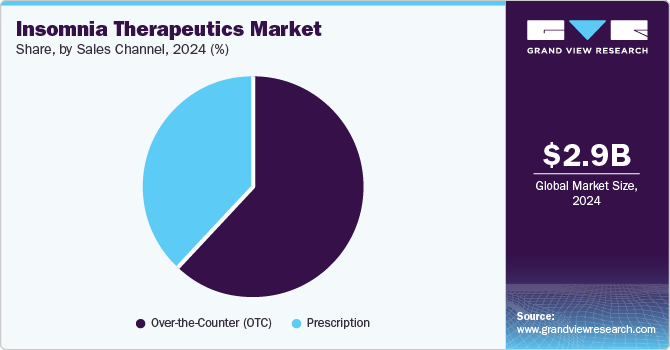

Sales Channel Insights

Over-the-counter accounted for the largest market revenue share of 61.4% in 2023, owing to the increasing number of patients with insomnia. OTC drugs do not require a prescription and are easily available to patients suffering from acute insomnia. For instance, the FDA approved the first OTC sleep-wake cycle regulator, melatonin, in 2021, providing a new OTC option for consumers. The emergence of combination therapies that pair OTC medications with prescription drugs or non-pharmacological interventions helps in providing more effective and personalized treatment options for patients with insomnia, thereby increasing the market growth of this segment in the forecast period.

Prescription is expected to register the fastest CAGR during the forecast period. This can be attributed to the increasing awareness regarding drugs and their consumption amongst people. Physicians prescribe the prescription drugs after evaluating sleep disturbance patterns and a patient’s history; thereby, its reliance level is higher, and the chances of adverse effects are also less. These factors are likely to help in fostering the market growth of this segment over the forecast period.

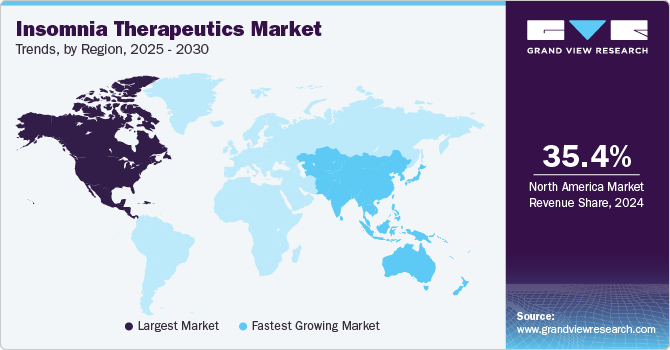

Regional Insights

The North America insomnia therapeutics market dominated the market in 2023 with a market share of 35.4%. This can be attributed to the rising incidence of insomnia disorders, the increase in awareness levels, and high healthcare spending in this region. The governments in North America have been involved in creating awareness about the importance of treating insomnia and the available treatment options. For instance, the American Academy of Sleep Medicine's Sleep Prioritization Survey in 2020 highlighted concerns about adults' sleep quality, which can help drive demand for insomnia therapeutics.

U.S. Insomnia Therapeutics Market Trends

The insomnia therapeutics market in the U.S. accounted for a 29.4% share of the global market in 2023 owing to the rising awareness programs and R&D facilities for new drug development. For instance, in June 2021, the American Academy of Sleep Medicine and the Society for Behavioral Sleep Medicine (SBSM) held the annual Insomnia Awareness Night to drive awareness regarding chronic insomnia and its treatments. In addition, favorable reimbursement policies, rising stress levels, and a strong clinical pipeline are expected to drive the market growth over the forecast period.

Asia Pacific Insomnia Therapeutics Market Trends

Asia Pacific insomnia therapeutics market is anticipated to witness significant growth in the insomnia therapeutics market. Increased stress levels and shift-work sleep disorders are expected to expand the patient base in Asia Pacific. It also contributes to the growing demand for drugs in these economies. Constantly improving healthcare reimbursement policies and FDA approvals have also impacted the market growth in this region. For instance, SUSMED Med CBT-I App developed by SUSMED, Inc. received regulatory approval from the Ministry of Health, Labour and Welfare for treating insomnia patients in Japan.

Europe Insomnia Therapeutics Market Trends

Europe insomnia therapeutics market was identified as a lucrative region in this industry. The increasing awareness, advancements in drug discovery, and development of new drugs by key players in the market are expected to drive growth in the region. For instance- in 2022, a Switzerland-based company, Indorsia, received approval for Quviviq from the Food and Drug Administration (FDA) to treat adult insomnia patients.

MEA Insomnia Therapeutics Market Trends

The MEA insomnia therapeutics market is anticipated to grow over the forecast period. The increasing demand due to growing public awareness of demographic shifts in the Middle East and Africa, such as urbanization and lifestyle changes, may also contribute to the increasing market growth in this region.

Key Insomnia Therapeutics Company Insights

Some of the key companies operating in the insomnia therapeutics include Takeda Pharmaceutical Company Ltd., Vanda Pharmaceuticals, Merck & Co., Inc., Pfizer Inc. These companies are growing their market presence by launching new products, collaborations, and adopting various other strategies.

-

Takeda Pharmaceutical Company Ltd. is a Japan-based company that works for the development of insomnia therapeutics products. It also announced a co-promotion agreement with Meiji Seika Pharma Co., Ltd. for their insomnia treatment drug "ROZEREM" in Japan. Thus, using such strategies, it has been able to expand its market revenue share and its presence not only in Japan but also in other countries.

-

Merck & Co., Inc. is a U.S.-based company which works for the development of insomnia therapeutics products. It launched its insomnia treatment drug Belsomra (suvorexant), which was the first in a new class of medications called orexin receptor antagonists. This is expected to help it in expanding its portfolio of insomnia treatments and contributing to the growth of the overall insomnia therapeutics market.

Key Insomnia Therapeutics Companies:

The following are the leading companies in the insomnia therapeutics market. These companies collectively hold the largest market share and dictate industry trends.

- Takeda Pharmaceutical Company Ltd.

- Vanda Pharmaceuticals

- Merck & Co., Inc.

- Pfizer Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Sumitomo Dainippon Pharma Co., Ltd

- Sanofi

- Paratek Pharmaceuticals Inc.

- Ebb Therapeutics

Recent Developments

-

In March 2024, Vanda Pharmaceuticals announced FDA approval for supplemental NDA for HETLIOZ in the treatment of insomnia.

-

In September 2020, Ebb Therapeutics announced the launch of the CoolDrift Versa, which utilizes cooling technology to target the root cause of sleeplessness (insomnia).

-

In December 2019, Eisai Inc. announced U.S. FDA approval for its insomnia drug, Dayvigo, in doses of 5 mg and 10 mg.

Insomnia Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.89 billion

Revenue forecast in 2030

USD 3.74 billion

Growth rate

CAGR of 4.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Sales Channel, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, KSA, UAE, South Africa and Kuwait.

Key companies profiled

Takeda Pharmaceutical Company Ltd., Vanda Pharmaceuticals, Merck & Co., Inc., Pfizer Inc., Teva Pharmaceutical Industries Ltd., Mylan N.V., Sumitomo Dainippon Pharma Co., Ltd, Sanofi, Paratek Pharmaceuticals Inc., Ebb Therapeutics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Insomnia Therapeutics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the insomnia therapeutics market report based on type, sales channel, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Benzodiazepines

-

Nonbenzodiazepines

-

Antidepressants

-

Orexin Antagonists

-

Melatonin Antagonists

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Prescription

-

Over-the Counter (OTC)

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

APAC

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."